ANZ economists say rising business and household confidence levels could "grease the wheels", allowing a more persistent lift in inflation to potentially get established.

And the notion that the Reserve Bank "might be overcooking things" may well gain some traction in the months ahead, they say.

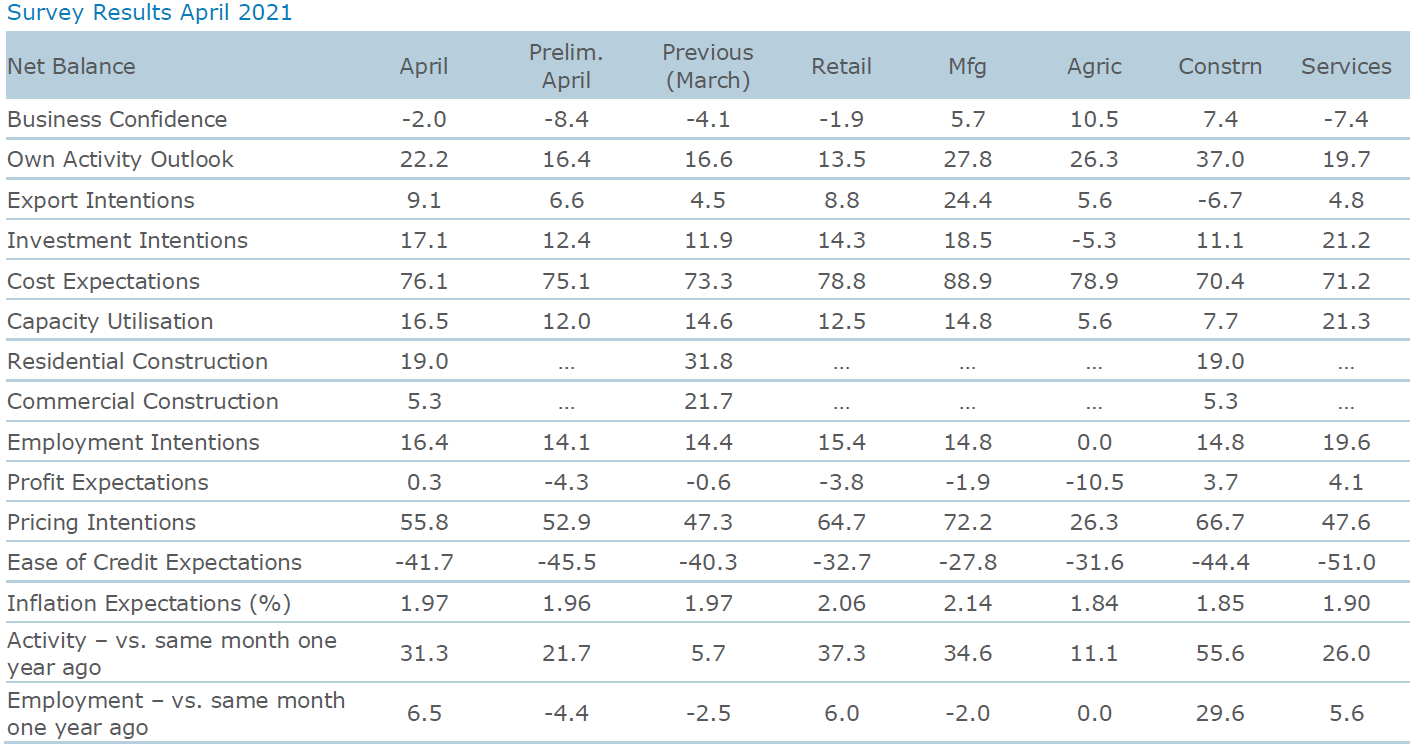

Results from the April ANZ Business Outlook Survey show business confidence has jumped, while cost pressures remain high. Pricing intentions - IE firms expecting to raise prices - were at the highest level in this survey, which dates back to 1993.

One notable negative is a drop-off in the sentiment in both residential and commercial construction, from high levels.

ANZ chief economist Sharon Zollner says the results that came in later in the month were much stronger than those in the preliminary read of the survey released in the first half of April.

"Compared to the preliminary read, headline business confidence jumped 6 points in April to a net -2%, and firms own activity lifted 6 points to +22%," she said.

“The jump relative to the early-April read was likely influenced by a fading of the initial reaction to the new housing policies, plus the announcement of the trans-Tasman bubble, a welcome step back towards normality.”

Zollner said the "solid bounce" in the survey indicates that firms are feeling pretty upbeat, and that the recent housing market policy changes are not expected to dent broader activity.

"Overall, the robustness of the data is starting to challenge our view that the economy will go largely sideways this year."

The survey shows that Inflation pressures are continuing to lift.

Cost expectations rose 3 points to a net 76.1% of respondents reporting higher costs.

A net 55.8% of respondents intend to raise their prices. However, general inflation expectations are steady at 1.97% - bearing in mind that 2% is the inflation level explicitly targeted by the Reserve Bank.

“The RBNZ will be keen to look through cost-push inflation as far as possible, because it’s temporary (though it may stick around longer than expected) and not growth-friendly," Zollner said.

The currently "well-anchored" inflation expectations provide room for this strategy for a while yet.

“But there’s clearly plenty of demand and risk-taking out there, amongst both firms and households," she said

"...And that does grease the wheels for a more persistent lift in inflation to potentially get established.

"The notion that the RBNZ might be overcooking things may well gain some traction in the months ahead, especially with headline inflation expected to rise above 2% in mid-2021."

Zollner said that although firms are very busy, they’re not necessarily having an easy time of it, as broad-based cost increases and freight disruptions take their toll.

“Indeed, given supply-side constraints are biting so hard, the confidence and robust employment intentions of firms may represent greater upside to wages and prices than to actual growth. It’s looking like a pretty inflationary soup."

Here's the detail:

- Business confidence rose 2 points to net -2.0% (prelim: -8.4%).

- Firms’ own activity outlook rose 5 points to 22.2% (prelim: 16.4%).

- Investment intentions rose 5 points to 17.1% (prelim: 12.4%).

- Employment intentions lifted 2 points to 16.4% (prelim: 14.1%).

- Capacity utilisation rose 2 points to 16.5% (prelim: 12.0%).

- Inflation pressures continue to lift. Cost expectations rose 3 points to a net 76.1% of respondents reporting higher costs (prelim: 75.1%). A net 55.8% of respondents intend to raise their prices (prelim: 52.9%). General inflation expectations were steady at 1.97% (prelim: 1.96%).

- Firms are evenly split on whether profits will rise or fall from here at 0.3% (prelim: -4.3%).

- Export intentions rose 4 points to +9.1% (prelim: +6.6%).

- A net 41.7% of firms expect credit to be harder to get (prelim: -45.5%).

- Residential construction intentions fell 13 points to 19%. Commercial construction intentions fell 17 points, to net 5%.

- Freight disruptions remain problematic and have worsened for construction and retail, both inward and outward. Disruptions remain significant for manufacturing.

5 Comments

It seems ever more likely that inflation-as measured by the CPI- will cross the 2% boundary and could even test the 3% level. The big question is whether these cost pressures are permanent or temporary. The freight problems will be fixed eventually and I think that the inflation rate will settle back around the 2% level.

I have little doubt that the RB will follow the Federal Reserve's stated policy of being very relaxed about inflation exceeding the 2% level in the medium term and will therefore leave the OCR at its current level.

Compared to the preliminary read, headline business confidence jumped 6 points in April to a net -2%.

Nice spin. He jumped, but he still gained negative height.

March was definitely a grand month to be a bank, and anything remotely connected to , if RBNZ March mortgage data has underlined.

Of course the RB is overstimulating, it seems obvious to all except to A Orr. A simple "we note that the economy is recovering much better than anticipated from the lockdowns, therefore we are going to return the OCR to the pre-Covid level of 1.00% (+0.75% lift) immediately, will sort most problems NZ is facing

Some google suggestions

- stagflation

- feds main lesson learnt post global financial crisis

- does the official cash rate effect more than just house prices.

I think our reserve bank has done a fantastic job and has been one of, if not the best for the last few decades.

We all seem to have very short memories and need to look beyond what will be a temporary reopening price push inflation spike.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.