It's supposed to be about business confidence and outlook - but at the moment it's all about the prices.

The latest ANZ Business Outlook Survey preliminary findings for June show no let up at all in the surging cost pressures our businesses are facing.

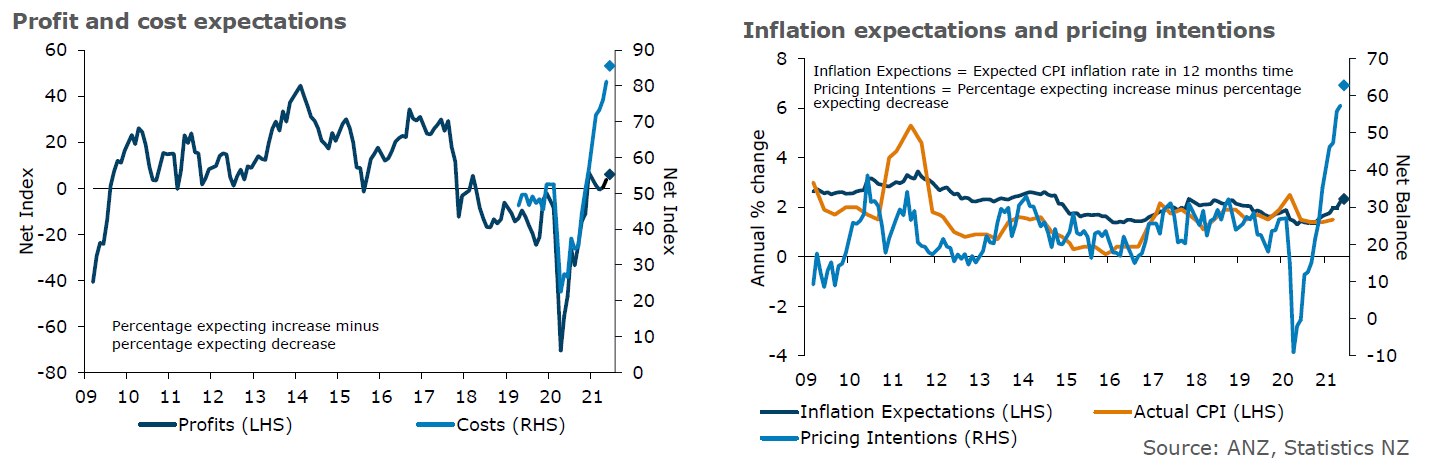

New all time highs in terms of numbers expecting cost increases, plus those expecting to raise their own prices were again reached.

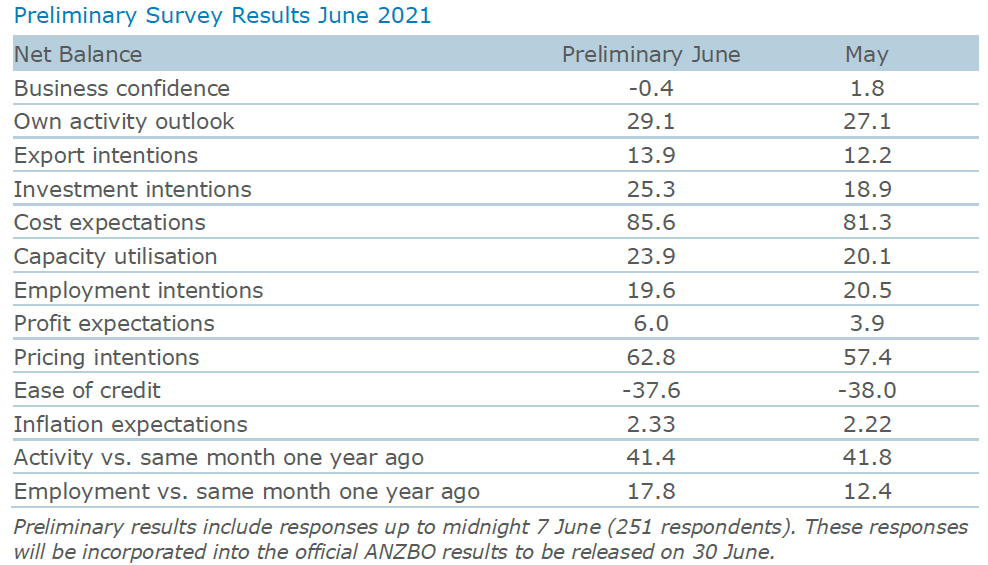

ANZ chief economist Sharon Zollner said among survey respondents those expecting higher costs rose another 5 points to a net 85.6% expecting higher costs ahead. A net 62.8% of respondents intend to raise their prices, up 6 points, another record in data that goes back to 1992.

"For context on just how spectacular that record is, the previous high before this year was 47.4% in 2000," Zollner.

In terms of the business confidence readings and activity outlook, business confidence fell 2 points to -0.4%, while the own activity outlook lifted 2 points to +29.1%.

Zollner said activity indicators were mixed. Investment intentions jumped 6 points, consistent with the 4-point lift in capacity utilisation.

Profit expectations eked out a 2-point gain while export intentions also rose. However, employment intentions eased.

But back to those cost and inflation pressures...

“Inflation expectations continue to lift – at 2.33%, they are close to the 2% RBNZ CPI target midpoint, but they’re still rising”, Zollner said.

“We’ll wait for the full month’s data to report sectoral results, but it’s worth noting that the retail sector’s inflation expectations and pricing intentions outstrip everyone else’s by quite some margin, and retail prices weigh heavily on the consumer price index.

“Shipping disruptions, rising global commodity prices, the higher minimum wage, labour shortages due to both the closed border and uneven sector growth are creating a perfect storm for the supply side of the economy at the same time as demand is holding up much more than firms (or economists!) had anticipated.

“Headline inflation is set to jump over the next six months as a result, but it’s best to focus on wage growth and inflation expectations for clues regarding when the Reserve Bank might conclude they can no longer look through inflation pressure and simply wait for temporary pressures to subside, necessitating a higher [Official Cash Rate].”

12 Comments

Anyone else think central banks and governments have completely overcooked their responses the last 12 months?

And was it really caused by COVID or has COVID been a nice thing to blame, given that all the signs were there that we were heading towards trouble back in 2019 so may have happened with, or without the pandemic - but yet the pandemic has provided the perfect excuse to say, hey look - 'unprecedented event' justifies and 'unprecedented response'.

Totally agree.

If we didn't have the pandemic and instead just experience the loss of confidence in the economy markets, share prices, house prices etc - would there have been the excuse to provide mortgage holidays, putting all these people on IO loans, giving wage subsidies etc....no and we might have actually had some real price discovery in the markets. Now we have fake markets run by zombie companies and house prices elevated way beyond where they should be, being paid for by interest rates of mortgages that reflect an OCR that isn't coupled to real inflation present. And people with handouts from the government speculating on the price of meme stocks and s%#t coins, and houses. Insanity.

S%#t coins had the best returns by a country mile.

Totally agree x 2

Completely agree. I understood the reason why they dropped OCR to 0.25% from 1%. But I was completely lost when they removed LVR. They keep saying housing price is not in consideration in their mandate when they make monetary policies. But what was removing LVR for? They keep saying we need to act fast, the earlier we act, the greater the opportunities.

https://www.rbnz.govt.nz/news/2020/11/sustainable-finance-the-earlier-w…

When the lockdown happened, they removed the LVR straight away. But when they put it back on, they gave months to let it take effect. Now they are saying "We need to be patient... ".

https://www.reuters.com/article/newzealand-economy-rbnz-idUSL1N2KU2SL

I don't know what do you guys see here. To me, their actions are intentionally favoring housing price increases. Correct me if I'm wrong.

Well the old Communist manifesto did say crush the middle class between inflation and taxation. Maybe that's the plan.

Absolutely - they know if house prices start falling the entire economy goes with it. So formally, they have no regard for house prices 'as it not in our mandate' but behind they scenes they're absolutely making sure they do everything in their power to prevent them from falling...

Free market...yeah nah.

I favour cock-up over conspiracy as an explanation.

And we'll never know what would have happened if they *hadn't* undertaken all the extraordinary measures, even though it's obvious now that it's been overdone.

Inflation is off the charts I use the Wendy's Burger meal as a reference, its now up to $18+ for the number 11 angus steakhouse large combo orange juice no ice thanks. The price increases every time I go there.

I use McDonalds as an index. I couldn't believe it they charge $9 for some burgers now! Years back they used to be 95 cents for a basic cheeseburger.

I'd say our grocery bill has stayed about the same over the last 6 months, with prices going up a bit and us tightening our belts and economising where we can to balance it. We are vegos so Burger Meal indices aren't very representative for us.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.