The good bits have fallen - but the bad bits have risen.

That might be a quick way of summing up the latest ANZ Business Outlook Survey, which shows a fall in business confidence levels but another sharp rise in inflation expectations for the next 12 months - to a nine-year high.

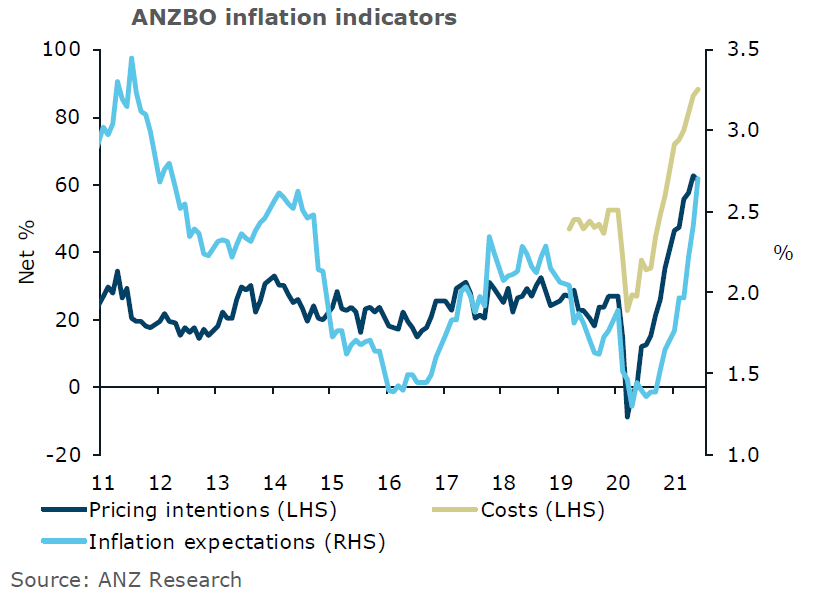

“Inflation expectations at 2.70% are the highest since early 2012 and look likely to go out the top of the [Reserve Bank] RBNZ’s target range of 1-3% for the first time since 2011, given they were 3.33% in the late-month sample. Pricing intentions also remain extremely high," ANZ chief economist Sharon Zollner says.

She says inflation pressures provide "an excellent reason" to raise interest rates now, despite downside risks.

ANZ economists are expecting the RBNZ will raise the Official Cash Rate from the current 0.25% in its next review on August 18.

Zollner says firms continue to report soaring costs and strong demand, "a very inflationary combination".

"While it’s unlikely, allowing high inflation to become truly ingrained could potentially result in the RBNZ facing an extremely unappealing trade-off between stabilising activity or stabilising inflation in the next recession, whatever the cause and timing of that," Zollner says.

She says expected costs for firms continue to lift, with the biggest increase seen in the services sector, where a net 84% of firms expect higher costs.

"This is still the lowest across the economy, but has caught up fast with goods sectors, underlining that there’s a lot more to this than just shipping costs."

Zollner notes that forecasts and market odds on imminent lifts in the OCR have evolved rapidly in the last two months, with a hike in August now "odds-on".

"But Covid risks remain extreme, as events in Sydney attest, and this stark reminder has seen market pricing for OCR hikes back off somewhat.

“The combination of clear upside for the activity and inflation starting point, but downside risks in the (quite possibly not far off) future, do, on the face of it, present a conundrum for the Reserve Bank.

“If they raise rates now, the odds are indeed uncomfortably high that they’ll end up reversing course before long, either because of abrupt trouble related to COVID or global markets, or else because rate hikes turn out to be very potent in terms of their confidence impacts. But counterintuitively, that doesn’t necessarily mean hikes would have been a mistake."

In terms of the Covid risks. Zollner says it is worth noting that lockdowns, if accompanied by aggressive fiscal income support, are not deflationary; "the past 18 months have shown that".

“At least as importantly, super-stimulatory interest rates are encouraging people to pile on debt and take risks they may well regret when trouble strikes.

"Monetary policy is currently exacerbating, rather than smoothing, the business cycle. And to put it in context – we aren’t even forecasting the OCR to get above neutral over the next two years. But it needs to get off the floor.

“One never has the counterfactual in macroeconomics, and uncertainty is rife, but inaction comes with risks too. It’s time to start normalising monetary conditions, even if trouble might lie closer ahead than we hope.”

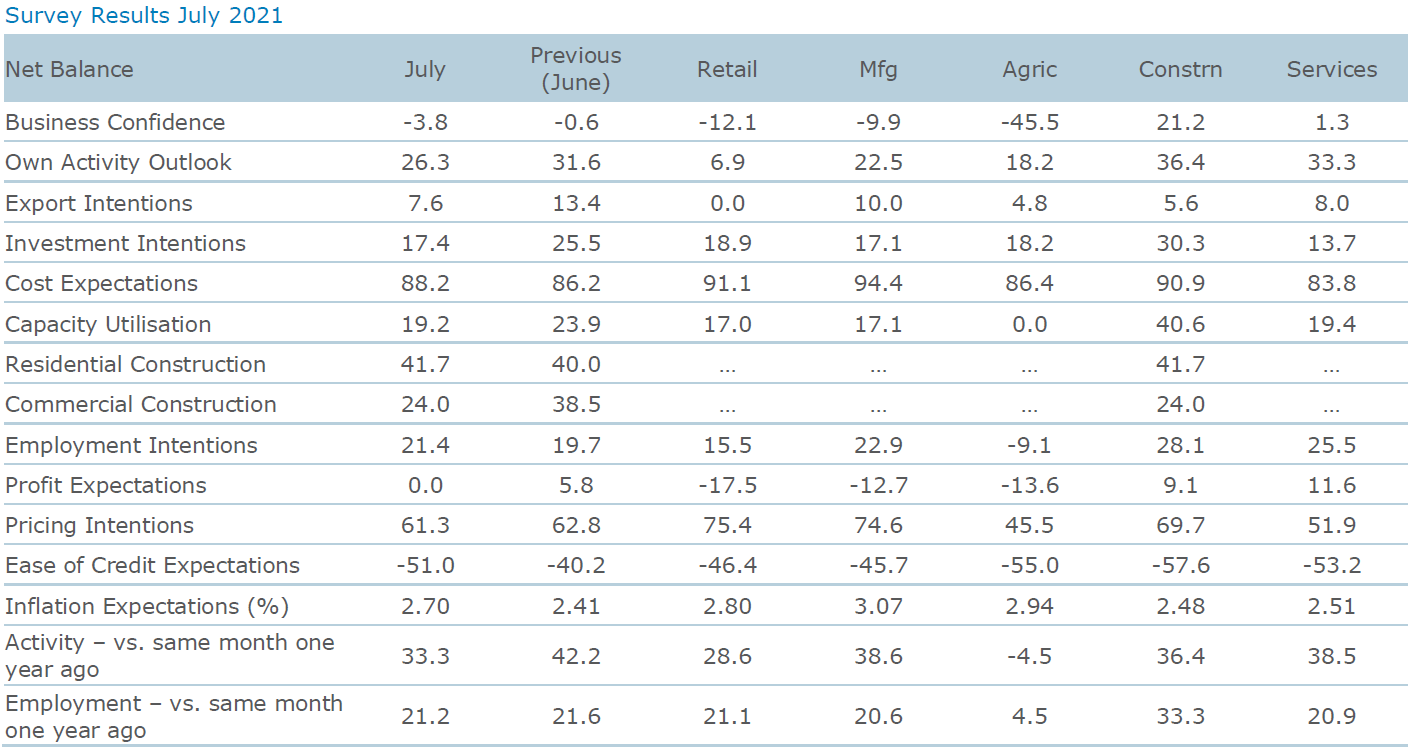

Looking at deeper at the survey, in July, 'headline business confidence' eased 3 points, while firms’ own activity fell 6 points to +26%. Other activity indicators generally eased a little.

Turning to the detail, compared to June:

- Business confidence was down 3 points to net -3.8%.

- Firms’ own activity outlook was down 6 points to 26.3%.

- Investment intentions fell 9 points to 17.4%.

- Employment intentions ticked up 1 point to 21.4%.

- Capacity utilisation fell 5 points to 19.2%.

- Inflation pressures continue to lift. Cost expectations rose 2 points to net 88.2%. A net 61.3% of respondents intend to raise their prices, down 2 points. General inflation expectations rose 29bp to 2.70%. In the late-month sample, inflation expectations were 3.33%.

- Profit expectations at 0 were down 6 points on June.

- Export intentions fell 5 points to +7.6%.

- A net 51% of firms expect credit to be harder to get, a deterioration of 11 points.

- Residential construction intentions rose 2 points to 42%. Commercial construction intentions dropped 15 points to net 24%.

14 Comments

How long can the pretense that inflation is not going to be a real risk be kept up ?

It is getting clearer by the week that, unless the RBNZ acts now, and decisively, inflation is going to be a real risk.

The RBNZ must raise rates by at least 50 points next month, and the OCR must be raised to at least 1% by end of the year at the very latest, and to at least 2.5% (up to 3.00% if necessary) by mid next year at the latest.

Not doing it now will create a bigger problem later on, and it will force the RBNZ to raise rates to a even higher level.

Scary! Scary! we shall have to lower interest rates further. Or shall we give ourselves a small scare so that we can justify lowering interest rates further.

The beatings will not stop until the morale improves.

No surprise. Govt and Orr is picking hyperinflation to the absolute ruin of low income earners and non home owners, even though both groups are core Labour voters. Perhaps the plan to to increase all taxes to keep that groups head above water. Anymore GST and cash work will explode. Anymore income tax and in ome earners will fight to stack interest in debt offset with new homes, further driving up prices.

What a legacy.

In 2012 , the last time inflation expectations reached such lofty heights what actually occurred one year later. ANZ own forecasts at the time in early 2012 1 year out were for inflation to reach 2.4 percent one year later and the OCR increased from 2.5 percent to 3.25 percent. Did not happen.

I love that yet another 'interest rate rise imminent' article is sitting right next to the article announcing the latest bond sale results. Yields are DOWN today despite the fact that RBNZ have stopped using LSAP / QE to keep yields (market interest rates) low.

The fundamental issue here is that low interest rates + tax policy + state subsidy of rent + lax rental regulation + political and public commitment to prevent house price falls + easy access to unlimited bank credit + some lack of supply (less of a factor than people think) = huge house price inflation. So, why when we know about all of these contributory factors does everyone focus on interest rates?

Increasing interest rates won't make prices at the fuel pump cheaper, neither will it cheapen the food at the supermarket (the main drivers of the current inflation numbers)- it just makes you buy less.

Love the relentless push by ANZ.

Imagine the meetings in ANZ everyday where they work out how they can continue to keep the 'rate rises are coming' stories flowing so that as many of their customers lock themselves into longer-term profitable mortgages. Shameless.

Higher interest rates cause the exchange rate to rise.

Imports like fuel and a large percentage of our food get cheaper.

You're incorrect.

You're right but only in a free market with healthy competition. You got the country part wrong.

Actually increasing interest rates will make prices at the pump cheaper because the NZD will rise and oil will be cheaper to import.

You're assuming any savings would be passed to consumers.

There is a strong correlation between exchange rate and petrol price in NZ. His assumption would be correct, your statement appears wrong.

Anyone can plot 2 lines on a chart.

Understanding it is a different matter.

https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.eia.go…

And make all our exports more expensive. Can't believe ANZ relentless push and screaming interest rates rising. These are the same economist who predicted a 30% decline in house prices. I really wonder what the Aussie banks are playing at here. Situation across the ditch is dire and all indicators are for no increases in rates there.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.