By Gareth Vaughan

The deleveraging undertaken by bank customers over the past couple of years is likely to continue for up to another two years with the post earthquake Christchurch rebuild offering the best prospects for banks to ramp up their lending, KPMG says.

John Kensington, KPMG's Head of Financial Services told interest.co.nz in a Double Shot interview on the release of the audit, tax and financial advisory firm's 2011 annual Financial Institutions Performance Survey that an economic uplift, and rising consumer and business confidence, were the key ingredients for borrowing to start rising above anaemic levels.

"One thing that will cause that (economic uplift) is the Christchurch rebuild," Kensington said. "When that comes online just the sheer amount of money that companies will spend rebuilding properties, and the way that will filter through the entire economy, will cause buoyancy which will make people a little more confident."

The rebuild would be a "very significant" factor in credit demand.

"There's enormous amounts of proceeds here in New Zealand ready to be spent. You're going to see that money spent rebuilding the CBD in Christchurch, a build the likes of which we have never seen. It'll probably carry on over five to 15 years and will have an enormous impact on the economy. Those dollars that go in the top of the economy to start that building process will go around many times with the builder paying subbies, the subbies having to live and all those sort of things. So I think it'll be an enormous impact when it finally does start."

On top of this the rural sector needed to perform better and confidence needed to return.

"Really it is around confidence. I think people will only start to spend again and stop deleveraging when they are confident. It (deleveraging) has gone on for two years. How long might it go on? I would say at least another year, if not maybe another two," said Kensington.

The Reserve Bank estimates there will be about NZ$20 billion worth of rebuild in Christchurch, equivalent to about 10% of Gross Domestic Product.

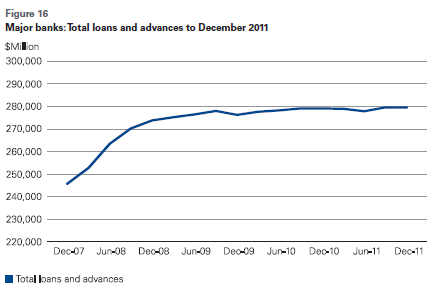

Banks' lending growth has largely flat lined since 2009 (see chart below), with overall gross loans and advances rising just 1.2% to NZ$300.79 billion last year.

"During the global financial crisis people in New Zealand, like all around the world, got a fright financially and some of them were faced with losing their homes or businesses and maybe had to sell assets in order to repay debt," Kensington said. "So they've had a large fright. Others unfortunately lost investments and were hurt that way."

"So what it has meant is people were very much more cautious with the money they have. They don't chase yield so much, security is very important to them now. They're prepared to put their money into a bank deposit instead of into some other form of investment because that bank deposit gives them security."

Deleveraging is people saying "I've borrowed too much, I need to stop borrowing, I need to only spend on the things I need to and I need to be more cautious," Kensington added.

In contrast to the weak lending growth, bank deposits rose by 7.6% to NZ$203.1 billion in 2011.

Fattish profits predicted

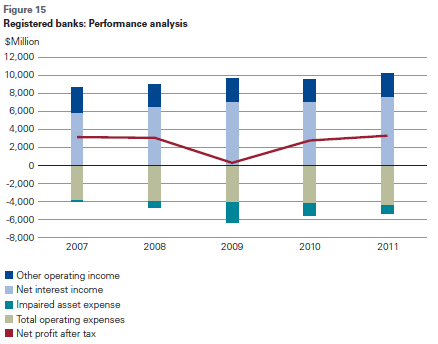

Despite the stagnant nature of their core business of lending money, the banks delivered combined record gross net profit after tax last year, up 19.2% to NZ$3.306 billion. See more on this here. The profit increase was driven by rising net interest margins, increasing non-interest income, and a drop in impaired asset expense. However, return on equity across the sector rose to 14.37% from 13.26%, below the 18.5% seen from 2005-2008. That said, ASB, which reported half-year financial results in February, disclosed a return on equity of 21.2%.

Kensington predicted bank profits would hold at levels near where they are now over the next year or two, as long as the banks can manage their debt impairments.

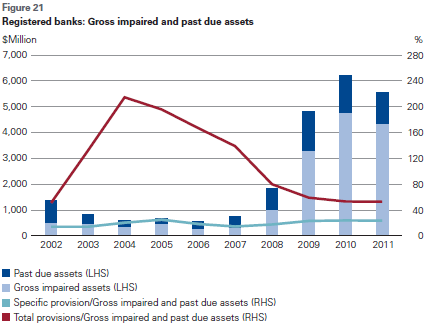

"The banks have done a tremendous job over the period since the global financial crisis managing their problematic loans," Kensington said. "They've done it very carefully and in a very orderly manner. That has seen them take more time to work out some problem loans. Impairments are still at a high and there is still room for them to come down further. Hopefully that will happen."

Gross impaired bank assets to gross loans and advances fell to 1.85% in 2011 from 2.07% in 2010, with past due assets to gross loans and advances down to 0.40% from 0.47%.

Bank sector facts & figures from the survey

The Big Five banking group’s (ANZ NZ, CBA + ASB, BNZ, Kiwibank and Westpac) saw their total volume of funding increase by NZ$5.680 billion in 2011. This was driven by an increase in funding obtained domestically of NZ$10.960 billion, offset by a decrease in offshore funding of NZ$5.28 billion.

In dollar terms the level of net interest income received by banks increased by NZ$494 million to NZ$7.632 billion in 2011 from NZ$7.138 billion in 2010.

Spending increased by 0.43% over 2010 to NZ$18.719 billion.

When combined with non-interest income of NZ$2.550 billion (2010 NZ$2.339 billion), the registered banks sector achieved an overall net profit after tax (“NPAT”) to average equity ratio of 14.37% (2010 13.26%)

The ratio of NPAT to average total tangible assets increased 12 basis points from 0.74% in 2010 to 0.86% in 2011.

The ratio of operating expenses to operating income fell to 43.8% from 44.5%.

More than 25,000 people work in banks.

The sectors salary bill rose in the year to NZ$2.410 billion from $2.298 billion.

Net profit after tax has increased by 19.2% to NZ$3.306 billion in 2011 from $2.775 billion in 2010 driven by 1) an increase in net interest margin of 11 basis points to 2.20%, which equates to an increase of NZ$494 million; 2) an increase in non-interest income of NZ$211 million (underpinned by trading income and fair value increases); and 3) a decrease in impaired asset expense of NZ$448 million.

Operating expenses rose NZ$247 million and tax paid by banks increased NZ$438 million.

On a percentage basis the most significant individual growth has been at Bank of Tokyo-Mitsubishi, whose gross loans have increased by 30.5% to NZ$1.916 billion. Although Kiwibank grew loans by 10.9% to NZ$11.582 billion, this was its lowest percentage growth since inception in 2002.

Deutsche Bank, principally an investment bank, saw interest margin fall to 0.58% from 3.01% . Deutsche’s net interest income in 2011 was NZ$17 million compared to non-interest income, in the same year, of NZ$71 million.

KPMG's audit clients include ANZ New Zealand, HSBC New Zealand, TSB Bank, SBS Bank, and Heartland NZ.

This article was first published in our email for paid subscribers earlier this morning. See here for more details and to subscribe.

5 Comments

"that an economic uplift, and rising consumer confidence, were the key ingredients for borrowing to start rising above anaemic levels"

"The rebuild would be a "very significant" factor in credit demand"

"Deleveraging is people saying "I've borrowed too much, I need to stop borrowing, I need to only spend on the things I need to and I need to be more cautious"

Is it just the cynic in me but the point being made seems to be that we need to borrow more and spend more on stuff we don't need?

Yes isn't it interesting that in the middle of the largest economic disaster since the great depression banks still link economic success with credit growth.

Mr Kensington may be an expert on the banks in NZ but I don't share his view of the likely economic influences (including on bank lending) of the Christchurch (CBD?) rebuild. Let us distinguish between home building/repairs/rebuilding and the CBD rebuild.

On the home front, new builds are mainly in Selwyn and Waimak districts, where there is more land available, and that land is more affordable, and also perceived as being less vulnerable to EQs.A lot of these builds are being paid for by insurers, EQC and the Crown via Red Zone settlements, some also by insurers where green zoners have opted to rebuild their written off house elsewhere. I don't see that bank lending is playing a big part in this, other than temporary loans such as the banks offered Red Zoners to tide them over until they got their payouts.

As for the CBD rebuild one swallow does not make a summer. For this scenario to play out, critical mass will have to be achieved where the level of activity attracts an increasing level of activity Others may have differing views, but I don't see this occurring in a "strong growth" context, more like a long, slow grind with the eventual outcome bearing little resemblance to the pretty pictures put out in the new media. The eventual CBD will be a scaled down version, to reflect the fact that the CBD was a backwater even before the EQs.

They are trying in this article to portray the repayment of debt that people are undertaking is abnormal and will change back to what the banks like just as soon as we get those silly anxieties out of our heads.

There is no basis for such a prediction. It's just what they want us to do.

Those 'deleveraging' are often finding they like it. It gives you a great decrease in financial costs, thus more personal power and options, better access to material items.

Maybe people will keep this up. Who knows. The banks possibly will have to have to rely on the cognitively challenged, to keep up the bank income stream from the likes of chronically maxed out credit cards.

No KH I was not trying to portray that. I was merely asking if and when something might happen to change the current deleveraging pattern and reporting John Kensington's answers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.