By the Westpac NZ economists*

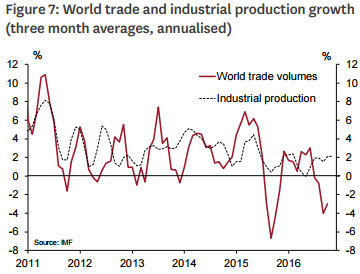

Demand in many economies remains lacklustre, and global trade remains subdued.

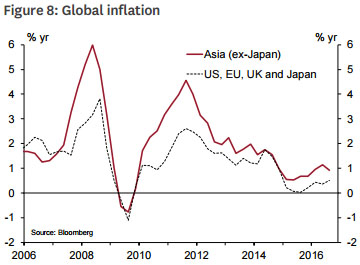

Combined, these conditions have resulted in lingering weakness in global inflation, and mean policy makers are continuing to fight uphill battles.

On top of this, the unexpected result of the US election, as well as other geopolitical events, means that there is the continuing risk of volatility in global financial and economic conditions.

Make America great again…

Since our last Economic Overview, global attention has been squarely focused on the US, where economic conditions have continued to strengthen. This has been underpinned by low interest rates and ongoing improvements in the labour market, which together are supporting household spending and activity in the services sector. Hand-in-hand with this has been a lift in US core inflation to a little above 2%.

However, the unexpected outcome of the US election means that there is heightened uncertainty around its trajectory over the next few years. We’re still waiting for clarity around the details of President Elect Trump’s policies. Some of his early announcements imply a substantial boost to US growth, including reductions in corporate taxes and increases in infrastructure spending. But at the same time, they imply a large amount of pressure on the US fiscal position, and if enacted, could provide a brake on future growth.

Mr Trump’s election has also cast a shadow over global conditions more generally. His protectionist focus, particularly in relation to China, could reinforce what is already a weak environment for global trade. This adds some downside risks to our forecasts.

Importantly, the increased uncertainty around US and global conditions is adding a layer of uncertainty around the outlook for US monetary policy and the possible flow-on effects for financial markets globally. We still expect the Fed to hike rates in December, and to follow this with additional hikes in 2017. However, this is an evolving situation, and we will continue to review the outlook over the coming months as the shape of the Trump presidency comes into sharper focus.

…because conditions in many other regions are still soft

While the recent strengthening of US economic conditions has been positive for global demand, the outlook for global growth remains subdued. Over the coming year, the global economy is projected to grow by 3.5% - up modestly on the past few year, but still well below pre-financial crisis rates. Many advanced economies, including Japan and a number of countries in the euro area, are continuing to operate with some excess capacity, with lingering softness in both domestic demand and investment spending. Furthermore, demand in a number of regions is still being propped up by monetary and fiscal policy.

China's ongoing reorientation

One of the major factors weighing on global growth continues to be the reorientation of Chinese demand. The ongoing shift away from state-led investment and towards private consumption and services ultimately aims to place the Chinese economy on a more sustainable trajectory. However, this refocusing of spending has been a sizeable drag on manufacturing. In addition, much of the lift in Chinese spending that we have seen has been underpinned by increases in government spending, as well as easy monetary policy and rising debt levels. This casts doubt on the sustainability of growth.

China’s rapid growth over the past decade has made it a key global market for many consumer and intermediate goods. And the refocusing of its demand is consequently having reverberations around the globe.

Coming on top of the more general softness in global demand in recent years, the shift in Chinese demand has contributed to a weak environment for global trade. This is having a particularly marked impact on economies in East Asia, where activity is heavily centred around manufacturing, and where growth is expected to remain sub-par over the coming years. Weakness in global demand has also seen investment spending pared back in many regions.

On top of this, subdued global demand has weighed on the prices for many industrial and hard commodities. This has dampened income and spending growth in commodity exporting nations. It is also weighing on inflation more generally around the globe.

The Australian economy is particularly exposed to the shifts in global commodities demand. Although supply disruptions are providing a temporary boost to the prices of some commodity exports, soft demand in recent years has seen the terms of trade fall sharply from its peak earlier in the decade. This has been a considerable drag on nominal income and GDP growth. Export volumes have been more resilient, however, with earlier increases in capacity supporting a 15% gain over the past year. Looking forward, we expect the Australian economy to grow by around 3% per annum over the coming years. Growth is being supported by low interest rates and an improving labour market, both of which are helping to boost household sector activity. In addition, the lower dollar is supporting service exports. On top of this, drags from declining mining investment and public spending have been dissipating. However, growth remains uneven, with mining states still the laggards.

Policy stretched to the limits

Weakness in global demand and the related softness in commodity prices is contributing to an extended period of weak inflation globally. This is a big concern for central banks, many of whom are already struggling to offset soft domestic demand. The longer inflation remains low, the greater the risk that inflation expectations will take a step down. And as expectations play a key role in how businesses adjust wages and prices, that could erode the effectiveness of monetary policy, making it harder for policy makers to boost inflation and activity over the long run.

With lingering weakness in global demand and inflation, the extraordinary degree of stimulus that central banks have introduced in recent years will need to remain in place for some time yet. However, in many regions conventional (and unconventional) policy tools have already reached the edges of their effectiveness. In addition, continued loose monetary policy since the financial crisis has given rise to growing concerns about financial stability.

Concerns about the build-up of debt are particularly acute in many Asian economies in light of the existing challenges for economic activity. There have been large capital inflows into many of these economies. If investor sentiment turns, the resulting changes in currencies and debt servicing burdens could see the headwinds for growth turning into full blown gales. On this front, evolving geopolitical situations, like the negotiations around Brexit, the changing political environment in the US, and ongoing concerns around the European financial system, could all be catalysts for bouts of nervousness and increased volatility in financial markets.

With monetary policy already stretched, some central banks have called for additional fiscal stimulus to bolster demand. However, outside the US, this may not be forthcoming. In many economies, fiscal positions are already stretched and governments remain wary of how increased spending could affect longer-term public debt levels. Furthermore, even in countries where there is scope for increased spending, determining appropriate targeting of stimulus is not simple and can take time to be effective. It appears likely that the burden of supporting activity will continue to fall on monetary policy.

Economic forecasts (calendar years)

| Real GDP % yr | 2013 | 2014 | 2015 | 2016f | 2017f | 2018f |

| % | % | % | % | % | % | |

| New Zealand | 2.4 | 3.8 | 2.5 | 3.4 | 3.3 | 2.9 |

| Australia | 2.0 | 2.7 | 2.4 | 2.9 | 3.0 | 2.8 |

| China | 7.7 | 7.3 | 6.9 | 6.7 | 6.5 | 6.0 |

| United States | 1.5 | 2.4 | 2.6 | 1.5 | 2.1 | 2.1 |

| Japan | 1.4 | 0.0 | 0.5 | 0.6 | 0.6 | 0.7 |

| East Asia ex China | 4.2 | 4.1 | 3.7 | 3.7 | 3.9 | 3.8 |

| India | 6.6 | 7.2 | 7.3 | 7.7 | 7.4 | 6.5 |

| Euro zone | -0.3 | 0.9 | 1.6 | 1.6 | 1.2 | 1.3 |

| United Kingdom | 2.2 | 2.9 | 2.2 | 2.1 | 1.6 | 1.4 |

| NZ trading partners | 3.5 | 3.8 | 3.6 | 3.4 | 3.4 | 3.3 |

| World | 3.3 | 3.4 | 3.1 | 3.3 | 3.5 | 3.4 |

Forecasts finalised 11 November 2016

This article was prepared by the full Westpac New Zealand economics team. Michael Gordon is the acting chief economist at Westpac New Zealand. This is the second chapter of their recent publication "November 2016 Economic Overview", and is here with permission. The first chapter is here. The next three chapters will be re-posted here, in turn.

2 Comments

"This casts doubt on the sustainability of growth"

Nice that they have worked this one out.

Is no-one else seeing this?, that the measures used do not isolate actual production. That the polliticians just want to be able to trumpet a larger number than the previous and insist that it is an improvement and, moreover, that it is their policies which brought it about. Does no-one else see that much of it is just churn generated to satisfy the baying of those special interests who have made it their business to hector and harrass? Beuler?,....Beuler?, .....Beuler?,

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.