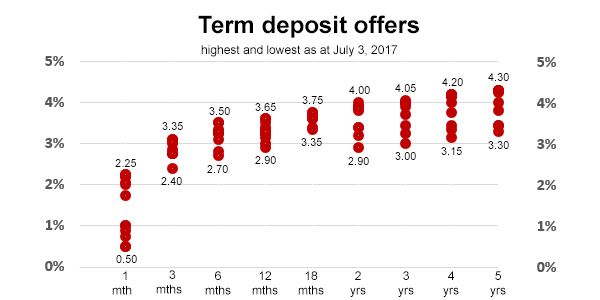

Halfway through 2017 seems like a good time to look at what has been happening to term deposit offer rates.

And sadly you do need to have a longish time scale to see any market movements because they have not been major.

When rates are low, getting the best rate available will mean applying some diligent work to the project - and it may involve shopping around.

Background wholesale rates have not moved much over this period, although the margin retail depositors are getting has improved.

The sweet spot for depositors seems to be the two year TSB Bank offer of 4.00% on this basis. However it might just be that retail offers for longer terms have yet to catch up to the recent steepening of the wholesale rate curve. If that continues, expect to see longer term retail rates rise. Institutions like RaboDirect, which are sensitive to wholesale rates will be the ones to watch and their moves could pressure their rivals.

| for a $20,000 deposit | 3-Jan-17 | Today 3-Jul-17 |

by | change | swap | Retail margin |

| % | % | % | % | % | ||

| 1 month | 2.25 | 2.25 | Coop, Heartland | ... | 1.86 | -0.39 |

| 3 months | 3.10 | 3.35 | RaboDirect | +0.25 | 1.99 | -1.36 |

| 6 months | 3.55 | 3.50 | ASB | -0.05 | 2.04 | -1.46 |

| 12 months | 3.60 | 3.65 | SBS Bank | +0.05 | 2.11 | -1.54 |

| 18 months | 3.70 | 3.75 | ANZ, Coop, SBS, TSB | +0.05 | ||

| 2 years | 3.80 | 4.00 | TSB Bank | +0.20 | 2.37 | -1.63 |

| 3 years | 4.00 | 4.05 | Coop, TSB | +0.05 | 2.59 | -1.46 |

| 5 years | 4.20 | 4.30 | ANZ, ASB, Kiwibank, TSB | +0.10 | 2.92 | -1.38 |

Background rate pressure at the shorter and more popular end of the rate curve is nowhere near as strong.

Among investment grade rated finance companies, the rates from Liberty Finance don't stand out quite as much as they once did.

Don't forget to shop around and ask for better-than-carded rates. Negotiate. We often hear that +0.10% or +0.15% can be added at some banks if you press them. A lot, however, will depend on the size of your business and the term you are prepared to lock it up for.

For higher rates, you need to assess the offers of institutions with a lower credit rating. Rate offers rise significantly from non-bank institutions with sub-investment grade ("junk") credit ratings.

As we have earlier noted, savers may wish to think through the wisdom of locking up funds for longer terms in what seems to be a turning rate environment. This situation should have savers thinking through the risk/reward scenarios.

Using our deposit calculator to figure exactly how much benefit each option is worth you can assess the value of more or less frequent interest payment terms, and the PIE products, comparing two situations side by side.

All carded, or advertised, term deposit rates for all financial institutions for terms of less than one year are here, and for terms of one-to-five years are here.

The latest headline rate offers are in this table.

| for a $25,000 deposit | Rating | 3/4 mths | 5/6/7 mths | 8/9 mths | 1 yr | 18 mths | 2 yrs | 3 yrs |

| Main banks | ||||||||

|

AA- | 3.00 | 3.30 | 3.50 | 3.35 | 3.75 | 3.90 | 4.00 |

|

AA- | 3.00 | 3.50 | 3.35 | 3.25 | 3.65 | 3.90 | 4.00 |

|

AA- | 3.00 | 3.15 | 3.60 | 3.15 | 3.60 | 3.85 | 4.00 |

| Kiwibank | A | 3.00 | 3.55 | 3.30 | 3.30 | 3.85 | 4.00 | |

|

AA- | 3.00 | 3.30 | 3.55 | 3.15 | 3.60 | 3.80 | 3.90 |

| Other banks | ||||||||

|

BBB | 2.95 | 3.35 | 3.55 | 3.60 | 3.75 | 3.85 | 4.05 |

|

BBB | 3.10 | 3.55 | 3.70 | 3.40 | 3.40 | 3.40 | 3.70 |

| HSBC Premier | AA- | 2.50 | 2.80 | 2.90 | 2.90 | 2.90 | 3.00 | |

| ICBC | A | 3.05 | 3.40 | 3.65 | 3.40 | 3.80 | 3.80 | 3.85 |

|

A | 3.35 | 3.35 | 3.35 | 3.40 | 3.70 | 3.85 | 3.95 |

|

BBB | 2.75 | 3.30 | 3.50 | 3.65 | 3.75 | 3.85 | 4.08 |

|

A- | 3.00 | 3.30 | 3.50 | 3.40 | 3.75 | 4.00 | 4.05 |

| Selected fincos | ||||||||

| F&P Finance | BB* | 3.45 | 3.80 | 4.00 | 4.10 | 4.25 | 4.35 | 4.50 |

|

BBB- | 3.60 | 3.95 | 4.25 | 4.30 | 4.35 | 4.40 | 4.45 |

| UDC | BBB | 2.95 | 3.45 | 3.75 | 3.80 | 3.75 | 3.85 | 3.85 |

| * = the only credit rating in this review that is not investment grade. | ||||||||

Rates in this table are the highest offered by each institution for the terms listed. You however will need to check how often interest is credited or paid. That important factor is not filtered in the above table and rates with various interest payment/credit arrangements are mixed here. However, our full tables do disclose the offer basis.

Our unique term deposit calculator can help quantify what each offer will net you.

Term deposit rates

Select chart tabs

6 Comments

All still down from the 4.7% two years ago from the ASB and now less than a year to run, should have gone 5 years at 4.8%. Still there is time left for it to get back up there, anything can happen.

4.39% fixed for 2 years if you use a broker.

The effective rates after tax are still too low to attract new savers. Maybe it is time the government took a sledgehammer on RWT on medium to long-term savings.

David - is your table of "retail margins" right? Are banks making or losing money on term deposits?

Quite right. I had the sign the wrong way around. Banks are paying retail investors more than what they can source wholesale funds for. Thanks. Corrected now.

Now I'm totally confused; what do you mean by Retail Margin exactly??

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.