By Bernard Doyle*

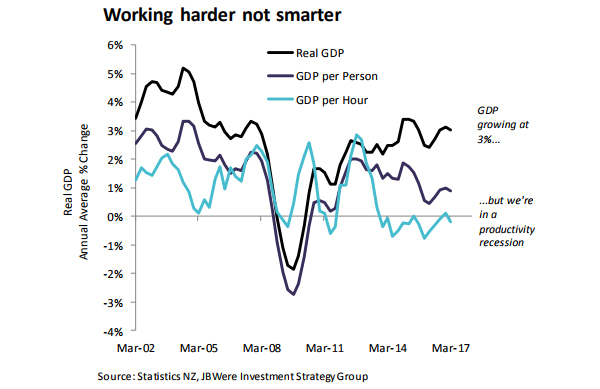

New Zealand has been in a productivity recession since 2012. Not that you’d notice from headline GDP numbers, which continue to print impressively. However GDP per hour worked has flat-lined for five years. Our per capita GDP growth is similar to Japan.

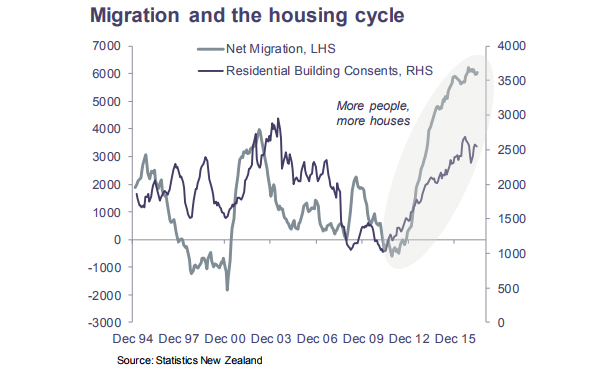

In the absence of productivity gains, our economy has relied on more people, working more hours. Net migration provides a conveyor belt of fresh labour, but it comes with attendant bottlenecks in housing and infrastructure. The profitability windfall for these sectors has not arrived, with earnings warnings from all the major listed construction companies this year.

An economic growth model that is reliant on pushing the capacity envelope can be prone to mishap. Against that, our key sources of demand: agricultural commodities, tourism and net migration, are volatile and have a habit of evaporating at short notice. Moreover asset prices have become a vulnerability: both housing and equity markets in New Zealand are priced for perfection.

It is election season in New Zealand but from an asset allocation perspective we are voting with our feet ahead of the big day. Irrespective of election outcome, we are recommending clients reduce their exposure to the NZ equity market by about a quarter.

A Capacity Hungry Growth Model…

GDP per hour is in recession...

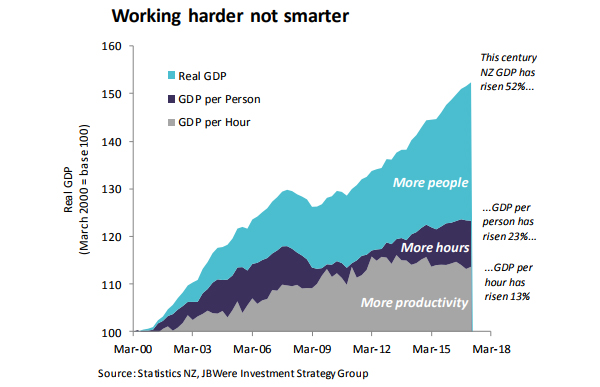

The New Zealand economy appears locked in a volume game. Since the turn of the century, the economy has grown in size by around 50%. However most of the growth has come from more workers, working harder (population growth and hours worked, previous page, left). The holy grail of prosperity, GDP per hour worked, has grown at a far less impressive 13%. In other words, only about a quarter of our growth has come from working smarter. More worryingly, GDP per hour stalled in 2012. So, for the past five years, all of our economic growth has relied on more people, working more hours.1

…growth is reliant on population expansion

Of course, productivity growth has proven elusive in many advanced economies – it is not to suggest New Zealand is failing. However equally, it would be disingenuous to suggest our top quartile OECD growth rate is a mark of success. It really reflects a choice to utilise population to drive growth in a way most of our trading partners are not prepared to. Japan for example, which has similar per capita GDP growth to New Zealand, could conceivably achieve similar headline GDP growth if it chose to loosen its immigration policy.

So is our population-dependent growth model working well? We observe that there is a dearth of analysis on the question of the optimal rate of population growth for this country. 2 Immigration is by far our most important source of population growth. Unfortunately the policy debate in New Zealand has deteriorated to trench warfare: immigration is either “good” or “bad”. While we sit on the “good” side of no-mans land, we wonder how much thought has gone into establishing an appropriate rate of inflow to shoot for.

Tight capacity can lead to mishaps

We have a peculiar lens of looking at New Zealand: as investors, who can choose to deploy capital here, or in other markets. In that respect, the balance and sustainability of our economic growth is important to us. Growth that pushes the capacity envelope has a limited shelf life. It is also prone to mishap: housing bubbles, resource misallocation, interest rate volatility and other dangers. We won’t judge whether playing a volume game in this economy is the right thing to do, but as investors, we have some concerns:

• Net migration drives housing demand, but it has a boom-bust history (above left). Unfortunately, our two other important cyclical drivers, tourism and dairy, can also evaporate at short notice.

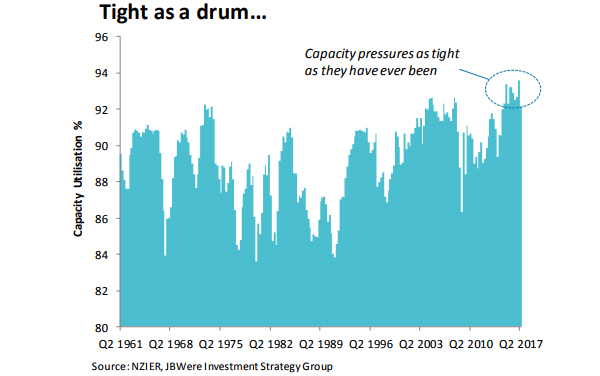

• New Zealand’s capacity pressures are unprecedented (above right). This is not surprising given the economy that has been in a productivity recession since 2012.

• High immigration is touted as a solution to alleviating capacity pressures, but it becomes a game of bop-a-mole. Shortages of labour in specific sectors (agriculture, tourism) may be relieved, but exacerbated in others (housing, infrastructure, education). Why? Migrants, like locals, need accommodation, transport, schools, hospitals and other necessities of life.

• Wage increases to attract talent into successful businesses can be undermined if the solution to input shortages is invariably tapping into the vast global labour pool. Relative prices play a critical role in winnowing the wheat from the chaff in the productive sectors. If a business cannot afford to attract staff from another area of the economy, it can be a signal to adapt. Dampening this will ultimately hamstring productivity growth.

The construction sector epitomises the dilemma we face as investors. After three years of record migrant inflows, which according to some would leave us awash with fresh skilled labour, a senior executive of Fletcher Building described the construction sector thus:

"We must acknowledge the New Zealand industry is absolutely at capacity and you're seeing that reflected in sub-contractor rates and the availability of resources for jobs, etc….It's an unprecedented level of activity, it's ramped up very quickly and if you don't manage it carefully, we can attest it hurts you certainly." Philip King, July 2017

Earnings growth has faded…

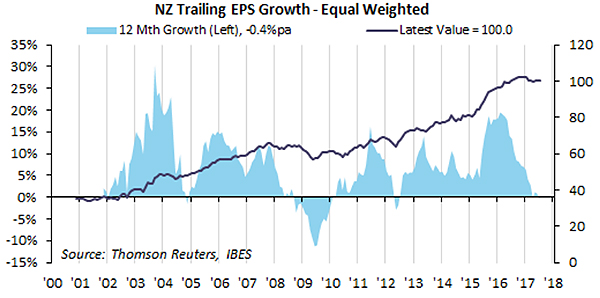

So, in the midst of a building boom, construction has been a tough sector to own, with profit warnings in all of the major listed companies. This underlines the trade-off of an economy that has the needle in the red. Volume growth is impressive, but profitability actually becomes harder to find. Indeed looking at our broad market measures, profit growth has been losing momentum for more than a year (below).

…Prone to Asset Price Distortions

…but asset prices are distorted

All of the above would be no more than a bugbear if we could pay the right price for assets in the economy. Unfortunately, this is not the case - we see clear evidence of asset price distortions that either present tail risks to the economy or simply diminish future return potential. The two that concern us are:

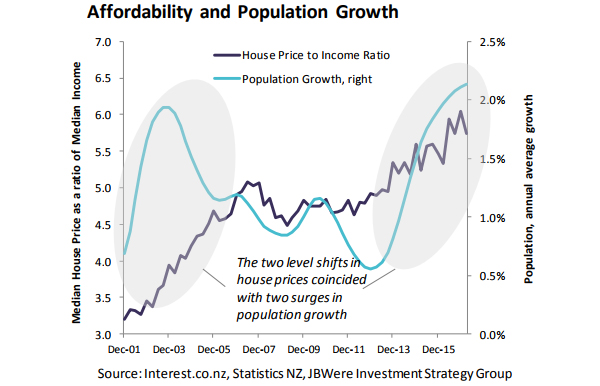

Housing. The popular narrative on the housing shortage in Auckland and other hotspots is all about easing supply-side constraints such as regulation and land use. Of course these are valid debates, but not enough attention is paid to demand. The two level shifts in house price:income coincided with two immigration-led surges in population growth in 2002-04 and 2014-now (below left).

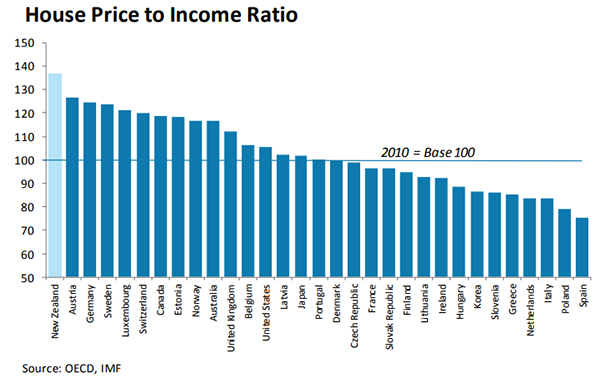

The run-up in our house price ratios since 2010 has left the rest of the OECD in the dust (below). A half glass full interpretation could be that this is yet another indicator of our success. However on that interpretation Ireland and Spain looked world-beaters in 2007, before gravity kicked in. We aren’t directly exposed to house prices in our equity portfolios, but a correction would be a headache as the collateral damage to the rest of the economy is significant. So while we aren’t forecasting a housing crash, elevated price:income ratios are just another source of risk to medium term investors in the New Zealand theme.

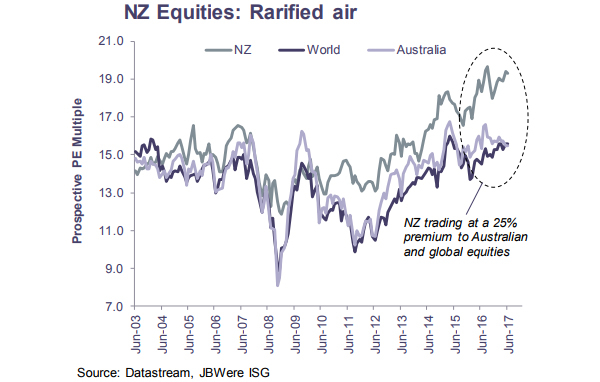

Equities. Valuations in the equity market continue to concern us. At around 20x earnings, New Zealand is one of the most expensive share markets in the world (see chart above). To be clear, we don’t believe NZ equities are a speculative bubble. That said, there has been a clear one-off valuation lift from falling global interest rates. Unless we believe bond yields can again hit the all-time lows of mid-last year, that valuation tailwind has ended. On the contrary we see a better than even chance that yields trend higher as the emergency policies of central banks around the world are progressively wound back.

A low return outlook, with risk to the downside

Our judgement is that the risk to New Zealand equities is not a sudden correction, although as we saw in September last year, that can certainly happen. Our concern is that current equity valuations have baked in about all the good news it is possible to see, and then some. Consequently a long period of low returns (0% to +5%) is a plausible scenario. Moreover, if some of the sustainability issues we are seeing in our economy came back to bite us, low returns could become “no returns”, or negative returns.

From Macro to Money: An Easy Asset Allocation Decision = an easy asset allocation decision

Complaining about productivity growth is almost a hobby for the economics profession. The test for us is whether we walk the talk. In the spirit of the election season, from an asset allocation perspective we are voting with our feet ahead of the big day. Irrespective of political outcome, we recommend clients reduce their exposure to the NZ equity market by about a quarter.

Our asset allocation recommendations and their rationale are outlined in our July Investment News here. The link between the economy to the equity market is summarised below:

• Our poor productivity performance is indicative of an economy that is living close to the edge of spare capacity, and reliant on population expansion to grow.

• Our key sources of demand: agricultural commodities, tourism and net migration, are volatile and have a habit of evaporating at short notice.

• Asset prices are either adding risk to financial stability (house prices) or eroding future return prospects (equities).

• Listed companies don’t appear to be thriving in the productivity recession, and marketwide earnings growth has tailed off.

Looking from the macro backdrop, to valuations, to earnings, the decision to reduce our NZ equity holdings is not a difficult one.

*Bernard Doyle is a strategist at JBWere. This is a re-post of a JBWere report. It is used here with permission.

47 Comments

So DEMOGRAPHICS will not save us?

I listened to a discussion on immigration on RNZ. It was Smart Talk at the Auckland Museum (in association with Massey Univerity).

I distinctly heard Paul Spoonley say that immigration was good for the economy, in fact it was good every thing (terrific even).

http://www.radionz.co.nz/national/programmes/smarttalk

A bundle of one-eyed regressive lefties.

So immigration is not good economics. Pity our politicians prefer a values based policy to an evidence based policy.

Excellent analysis. I wonder if any political party would link to this article?

RE : So immigration is not good economics."

Read the article more carefully . The author's statement is (not quite ) the opposite :

"

Unfortunately the policy debate in New Zealand has deteriorated to trench warfare: immigration is either “good” or “bad”. While we sit on the “good” side of no-mans land, we wonder how much thought has gone into establishing an appropriate rate of inflow to shoot for.

"

Seems you stopped reading at that point

Excellent analysis. Fortunately we live in a democracy.

Last two quarters GDP/capita were both negative.

Some people would say this shows we are already in a recession. I can see why the govt need immigration to continue. The Ponzi must be fed.

National's economic policy is actually quite embarrassing when you dig down.

Great read. Thx for sharing interest.co.nz

While most people are fixated on house prices, very little attention is paid to the "price" of NZ equities, particularly the NZX50.

Also, the comparison with Japan is interesting. Imagine if you trimmed all the fat from GDP and only looked at "productive enterprise", I wonder how things would stack up then. I would suspect that Japan would potentially be miles ahead.

It appears the "rock star" economy has been on drugs!

Good article. What many here have been saying for a long time but great to get such a thorough analysis.

P??

Lots of information to digest, good article supported by analysis , which I need to read again, slowly, to properly gather my thoughts and grasp the implications

grasp the implications

Good luck. I bet Hosking thinks it's all smoke and mirrors.

Eco Hoskings response below ;-)

OMG, what a demoralising load of rubbish and a waste of time this article was ... errr

" Complaining about productivity growth is almost a hobby for the economics profession " lol say no more Mr Glass half empty ..

Seeking perfection in an imperfect world , are we?--

Denouncing growth because it is not the ideal text book definition? -

Complaining about productivity when you have loads of losers sitting on the DOL and demanding more benefit for doing NOTHING !?

So we should reduce our share investment because growth is depleted ( down to 0-5%pa) >?? or because property holdings will correct in the near term .... really --??

Most of us understand that all of you guys ( advisors) are always pessimistic to cover your backside should the proverbial hits the fan - Yes, we know that you call it RISK .. and that you make a living out of these "exciting" reports which you dish out for a handsome subscription - but I think that the writer's claims that we are at capacity and the sky may fall tomorrow is a bit too stretched ! ,,, Is that a warning that whoever cuts immigration will switch the lights off the economy? Does he mean the left Circus??

Unless, the author is pretty damn sure that If the Labour circus resumes power then they will certainly shut off immigration, wreck the economy, and scare the shite out of tourists, investors and the shareholders sending everyone running for the Hills

Talk about productivity and GDP/Hour then sir !!

I will be looking forward to reading your next report in October !!!

Never let the truth get in the way of a good story huh Eco Bird.

OMG Eco Bird you are hilarious! YOU MUST READ THIS!

Auckland property prices could soar in a year or two

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=119…

Differed maintenance - buy and sell. It's extractive. All part of the problem.

Examples:

-worn out asbestos containing decramastic roof tiles

-leaking guttering

-butynol peeling at the edges and needs replacing

-ancient hot water cylinder from the 1970's

-ancient kitchen and bathroom from the 1980's

-worn out and rented for the last 10 years

-cheapest nastiest materials used for repairs

doesn’t matter. Buy it! don’t put any money in it fool, get out ya hot glue gun. Charge max rent and sell for profit.

That's wise financial advice. but it doesn't help the country.

lol, ... Yes I read this last night and had to pour an extra glass of Pinot to wash it down properly !! :) ...

It is all becoming very amusing .. " Catch Animal Spirits in Auction" lol, does that have anything to do with " Animal Instincts" I wonder? --- :)

... who needs comedy or Netflix? few media sites and Interest .co.nz will do really.

Does Pinot come in crates I might have to get some, cheaper the better though, will give it a try cuz.

You missed a few comments.

"irrational exuberance further fuelling house prices."

"Auckland University of Technology lecturer Dr Song Shi co-authored the paper, recently published in Real Estate Economics, which showed as prices remained high, an "irrational exuberance" in the Auckland housing market became apparent."

"Shi said this showed Aucklanders were buying with "overwhelming confidence and unrealistic expectations in term of future price growth and rising prices" - a phenomenon known as "animal spirits" a term coined by a British economist John Maynard Keynes in the 1930s."

"The boom of the housing market is mainly driven by social contagion rather than the knowledge of economic contagion," he wrote in the report."

"Media hype, stories, beliefs and the officially assessed home values for rating purposes also added to the urgency and excitement among homebuyers."

"control the bubbles"

Maybe people will want to buy, but will they have enough money as DTIs are 10 times, and will banks want to lend to them.

lol ... thank you for copying the whole article ... I know what Animal Spirit is in the property market .... unlike the other drinkable spirits, this one happens to make good money! Should try it some time !

Oh, and No ..I dont think they sell Pinot in crates ..

but in 2 years time the value could have dropped 30% from now which means soaring prices are only regaining ground. but in reality the party is over for the next decade

Hilarious! A paper that shows that Auckland house prices are irrational is used as justification by the Herald that house prices will continue to rise. Another classic example of a journalist reaching the exact opposite conclusion of what is actually being said.

I know.....it makes you weep.

Although to be fair to the journalist, quite a few on this site were fooled as well.

Very Hoskingesque. Just need to work on your delivery and flow.

"OMG what a demoralising LOAD OF Rubbish and a waste of time". That sums up your post perfectly.

Do you really believe that per capita growth is irrelevant? If so,why? Are you saying that you would be happy to see NZ's GDP growth to be endlessly maintained through unrestrained immigration?

I won't dignify your thoughts on the P/E of the stockmarket with a response.

Great read... Mr Doyle "gets it" .. Poor governance, Lack of vision, Lazy economics.

"Growth is reliant on population expansion" The very definition of a unsustainable Ponzi.

"A long period of low returns" Agree, all this liquidity is painting equity's into a corner.. and.. that brings us right back to bricks and mortar.

And thanks for the spell check thing its oarsome!

I don't really believe the comparison with the Aussie market as If you strip out the banks and resource stocks in Aus then you find the valuations are almost identical.

Great to see something sensible on the subject of the flawed NZ business model that both National and Labour have created between them over the last 50 years. At last the economics types are beginning to think about the right things, ie, GDP per capita, not GDP.

My only major issue is the lack of consideration given to the excess capital brought in with the new arrivals and the way that inflates the exchange rate and asset prices. This cripples the productive and service export sectors, rendering them marginally profitable at best and so unable to generate the capital to grow.

Maybe instead of new arrivals giving their $20,000 plus to their employer to gain the point count for permanent residency they could give it to the government to pay for the new roads, houses and classrooms. That would help absorb the excess capital in a productive way.

Announced today by Education Minister Nikki Kaye: thirty classrooms costing about $18 million will be built at schools around Auckland.

How on earth does a classroom cost $600,000 to build?

They already own the land, so it can't be that.

Who's clipping the ticket on this one?

Gooki welcome to commercial construction. The building code has severe requirements for buildings that aren't simple residential houses. Schools also have a lot of technology in them these days. Not to mention the Ministry's guidelines that also add cost (for good reason).

In reality land, we are headed for a recession and who knows how bad that could be

Secretly Im sure National wont mind losing this election its the perfect time for a hospital pass.to Labour

Perhaps part of the issue is extreme ramping in the labour market supply has kept wages low and taken pressure off companies to automate, innovate and restructure towards a higher levels of productivity.

Inflation is dead !! for now at least ....( Every economist in the world has put the old book on the shelf, for now ... because it does not make any sense with what is happening today - this is new theory!!)

Technology and huge corporations / online selling ( Amazon, AIRbnb, Uber etc) are putting a cap on consumer product prices , low energy prices have squashed production and shipping costs and hence inflation despite high employment rates almost everywhere ..... online selling is becoming a major component of turnover of almost all consumer related supplier, whoever is not in e-commerce will be counting his days !!

As long as there is no significant inflation and Margins remain slim ( pie slices are getting thinner) There wont be much of wage appreciation if any at all going forward ....No one will give away pay rises when they are not making (enough) money !!

The FED is expected to tweak interest rates UP one more time in December, we will then join them in watching the result of that for maybe few quarters.... things will move up very very slowly - No RB wants to rock the boat hard - they are very prudent now !! So we, small fish, Just follow

The countries who have high productivity, also have higher unemployment - not a rocket science! unless you live in an isolated island.

high productivity -> high unemployment. Don't minimum wages and levels of benefits have a significance?

"The countries who have high productivity, also have higher unemployment - not a rocket science!"

Not a science at all, rocket or otherwise. In fact the highest GDP countries have low unemployment. https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_hour_w…

A shortage of cheap and desperate labour is a powerful incentive for higher productivity through incentivising better methods and mechanisation. Sorry.

BTW Brian Fallow with a similar story to the J B Were missive:

"When you compare hours worked from the household labour force survey in the year to March (a period clear of the one-off level shift in employment and hours worked, which resulted from changes to the survey in March last year) with GDP growth over the same period, labour productivity growth was negative 0.4 per cent.

Looking at the paid hours data from the quarterly employment survey -- a survey of firms rather than households -- labour productivity growth also comes in negative, by 0.2 per cent.

And after adjusting for that level shift the year before, the Treasury concludes that average labour productivity over the past four years has been flat.

Zero growth over four years in what has to be foundation of any sustainable gains in living standards is not encouraging.

Nor is it a record the Government can boast about."

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=119…

And Wheeler also commenting on productivity http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=119…

Would someone mind explaining to me, which living standards are we trying to raise and exactly where are we raising them to?

It appears to me that we have all the living standards we need and the real issue one of access by all.

Does anyone dare question whether we are at maximum productivity? How much productivity is there in buying and selling houses to each other?

This still sounds a lot like the slave masters wanting more from their slaves so they can have more for themselves.

thank you David,

GDP/hour worked is an incorrect interpretation of unemployment levels ... in addition, most of the first tear countries in that list are highly loaded nations with resources adding to their wealth - certainly we have tons more in productivity that Qatar, Kuwait, UAE, and some others! .. and we are less productive than Germany and the scandinavian countries.

Talk is easy, productivity levels certainly increase with modernisation and technology. Establishing new heavy industry days in NZ are almost gone unless new resource or mining industries are established ( if it passes our strict environmental hurdles) and because of the saturated nature and the location of our markets. Plus, there is not much fat in our economy as yet!

So here is the big question, DOES GDP/hour worked take into account the benefits paid to the unemployed OR their productive hours should they be at work -- ??

If our GDP/hour is low then that would suggest that we are employing too many people to achieve the same output ! well that is good , isn't it? that is why we have 4.8% unemployment - should these be also employed then the GDP/Hour will look even worse (relatively) ..so is that a good thing or Bad?? or we are assuming that these guys are rocket scientists who will thrive the economy??

You said : "A shortage of cheap and desperate labour is a powerful incentive for higher productivity through incentivising better methods and mechanisation"

Sure, but Mechanisation also causes additional unemployment -- recent examples, IRD,Spark, NZ post etc... a new software could be devastating for lots of families !!

Better methods involves changes in laws, culture and work ethics to retrain and upskill etc !

In practice: SMEs are just making enough margins to survive with current wage levels, they will not put up wages to attract more people if they cannot expand their business of sell at higher prices - simple capacity constraints and economics.

New added businesses ( especially in High tech) are numbered so are the potential available candidates to work in these businesses, let alone the feasibility and risks of setting these up in the current worldwide competitive environment. (india has had its share of attracting these using CHEAP LABOUR and enormous highly educated workers) so did Ireland but with added tax incentives (sacrifices) ...

The majority of newly created businesses to absorb and/or increase man hours and employment is in the Service and building industry - these, by nature, are neither high tech nor can sustain higher wages to entice people to join or work.

The other side of the coin, is the balance between wages, inflation and the cost of living - Higher wages' argument often assumes that the cost of living and cost of housing will remain the same - or that workers will produce more within the same working hours to increase overall GDP as a result - hence the improved productivity overall - As i said, That needs Culture and Law changes - wage increase alone does not improve productivity.

we currently have a "certain" balance between wages, population, and cost of living -- this was tipped over lately by the cost of housing ( albeit by external monetary influences including the effect of total migration, QE, and interest rates + available investment choice available for surplus money) ... These effects, just like any anomaly on a stable/ balanced equation will take their toll and time to get dampened by corrections in all aspects of life to accommodate these changes.

Seeking to have high GDP/hours in comparison with other developed nations has to be realistic and in balance with our structure, resource and primary industries capacities. it can also be described as the chicken and egg story. Adding new taxes, production constraints, or environmental restrictions just exacerbates that ...

A big change , in my view, should start in the education system and work ethics and attitude, - that is one of the basic productivity pillars of Germany, Japan and South Korea to name just few

Immigration level is the wrong argument to have. We should debate what is the desired population. Two million is my vote, but I would settle for five million as part of the deal

How exactly would you go about reducing the population to two million?

Kill people? Prevent people who want to have children, from having children? Force people to leave the country? Make life here so terrible that everybody who can, leaves?

And this would make everything better, would it?

isnt that an interesting question.

Put it this way, globally if we dont get to 2 billion with 20 at most 40 years, nature will do so for us (or we'll do it to ourselves violently, that is our choice.

NZ is "lucky" we can probably feed 4 to 5 million without oil when we feed 20million today.

The Q is who feeds then that 16million?

So how do we do it?

A stupid indeed ugly post Ms de Meanour - and plenty of common taters have answered your question before. Get a grip. Simplest answer is that without the artificial population pumping under current policy, the population would balance or drift down.

I've said this in a previous post: this will not be a good election to win. JK made a smart move. Excellent piece by Doyle, fact driven and articulate. But let's not lose sight of our priceless natural advantages - living space and a clean environment. We must protect what we have. So let's agree on population size and protect our freshwater and marine environment. Can someone mention this to English and Smith...

"JK made a smart move"

JK made a self interested move. The only one he knew.

His timing was superb

No politician listens, not one IMHO. All that happens via the ballot box is we get a new set of deaf people, ie the main replacement Labour isnt interested either its all grow for ever economics.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.