By Keith Woodford*

New Zealand reached peak dairy cows at 5.02 million in 2014/15 and numbers are now in slow decline. Peak milk was reached the same year at close to 1.9 billion kg milk solids and has since bounced around a few percent lower.

The dilemma for Fonterra is that its business plans are based on a belief that it needs to grow its milk supply by more than 30 percent over the next seven years. This was a key message Fonterra presented to its non-farmer investors in December 2017, with CEO Theo Spierings referring repeatedly to “çost leadership through scale efficiency” and concluding with the message “Fonterra presents a strong investment opportunity”.

It is notable that Fonterra sees the future world very differently than does the current New Zealand Government. The Government says that the future lies in earning more from less through more value-add activities. Fonterra’s perspective is to agree with the value-add part of that story but not from less production. It wants more production.

To find the specifics of what Fonterra has been thinking about the future, one has to look in detail at what it has been saying in the presentations to its non-farmer investors. These professional investors are the institutions and retail investors who drive the share price through purchase and sale of investor units. They are also the main potential source of additional capital.

These professional investors do not get a vote at the AGM. Indeed, these investors don’t even bother to turn up at the AGM. The AGM event is for the farmer owners, and the messaging of that day reflects that situation.

Fonterra’s most recent professional investor presentation was on 7 December 2017, comprising six hours of presentations and one hour for lunch. All of the Fonterra management heavies were there, led by CEO Theo Spierings.

Compared to farmer shareholder meetings, there is more substance and less spin at the professional investor meetings. These professionals expect and get the real oil as Fonterra sees it, despite it still being loaded with plenty of puffery.

Fonterra’s leaders told the professional investors that Fonterra holds an admirable position but that it would need to grow much bigger. The target for 2025 is 30 billion LMEs (liquid milk equivalents), up from a 2017 global Fonterra supply of 22.4 billion.

This term ‘LME’ will not be familiar to most New Zealanders, but it is becoming a standard international unit to compare milks of different composition. One New Zealand litre equals approximately 1.15 LME, with some variation between seasons of the year, and 1 kg milksolids (fat plus protein) is about 13 LME. So, Fonterra wants another 570 million kg milksolids each year from all around the world.

Fonterra was estimating it could grow its New Zealand milk supply by 1.5 percent per annum, which would provide about 170 million additional kg milksolids per year by 2025. However, this would seem highly optimistic. Some might say it is unrealistic.

Looking ahead, there are strong headwinds relating to New Zealand’s dairy production. First, there is the issue of Fonterra’s forthcoming farmer penalties for milk produced by high feeding of PKE. Those penalties start next spring. Second, some 23,000 ha of land has been retired from dairying in the last two years. More land retirement from dairying seems likely as small farms on marginal dairy country shift to beef. Third, there are increasing pressures to de-intensify as a response to nutrient compliance issues. Fourth, the political winds on greenhouse gas emissions do not give farmers confidence. And fifth, everyone is worried about Mycoplasma.

Fonterra has an additional worry that it has been steadily losing market share to other companies, down from 96 percent at company formation in year 2000 to about 82 percent this year, and almost certainly lower over the next two years with competitors having additional processing capacity coming onstream.

Regardless of whether or not Fonterra gets some growth in New Zealand, or indeed more likely suffers significant declines, it is clear that the volumes Fonterra is talking about can only come from major overseas processing investments.

Fonterra’s recent purchase discussions with Samcor in Argentina are part of this global strategy. However, in recent weeks Fonterra has missed out there, with a local buyer being the winner. Fonterra was also interested in buying Murray Goulburn in Australia. Once again, Fonterra’s discussions went nowhere, with Saputo from Canada about to become the purchaser.

An alternative perspective would be that Fonterra will need to work hard simply to maintain its current overseas supply of milk. In Australia, Fonterra has benefitted greatly in the last two years from Murray Goulburn’s self-destructive behaviour. However, with Saputo in control at Murray Goulburn, there will be a lot more farmgate competition for Australian milk supply.

The reason that Fonterra thinks it needs more milk is primarily but not only because of China. The way Fonterra sees it is that China has minimal capacity to grow its own supply, whereas Chinese consumer demand will increase by eight billion LME by 2025. Filling the gap, if it does occur, will require Chinese imports to increase by more than 75 percent over that time period.

Fonterra sees many opportunities in China, with butter and cream likely to be at the forefront, but these are not the only ones. Apart from the butter category, where Fonterra is clearly number 1, the unstated challenge is whether or not Fonterra has the systems and capability to take advantage of the emerging value-add opportunities. The track record suggests that it does not.

What was obvious to all attendees at the professional investor seminar, but left unsaid, was that Fonterra does not have the balance sheet to fund its own transformation. A combination of big growth in volumes combined with transformation to value-add implies a great deal of capital.

Companies have three ways to fund growth. The first is by retained profits. However, Fonterra is under considerable pressure from its farmers that most of the profits should be returned to them, and that is the current practice. Indeed, this year it looks like there will be no profits to distribute and the promised dividends will come from the balance sheet.

The second funding option is to take on more debt. However, Fonterra is in no position to take on a lot more debt if it wishes to retain its current financial ratings (which determine interest rates).

The third option is to take on more equity. The challenge for Fonterra is that only farmers who produce milk can be shareholders.

One way of getting around this would be for Fonterra to take on more farmer shareholders by opening up membership to Australian farmers. There is talk of that, but I see it as a bridge too far.

The other way is that Fonterra could sell units into the so-called Fonterra Shareholders’ Fund. In reality, that means selling units to professional investors, who share in the profits despite not having a formal vote in regard to company policy.

The downside is that further substantial investment by these outside investors would cause considerable grumbling amongst farmer shareholders. Their concern will be that it is yet another step away from co-operative principles and a de facto loss of control.

Perhaps the first step is for Fonterra to scale back its ambitions and focus on working with the New Zealand milk that it already has. It would still be the largest cross-border dairy marketer. Setting up systems to maximise profits from that milk, and finding the necessary capital to fund that transformation, should be more than enough to keep it busy.

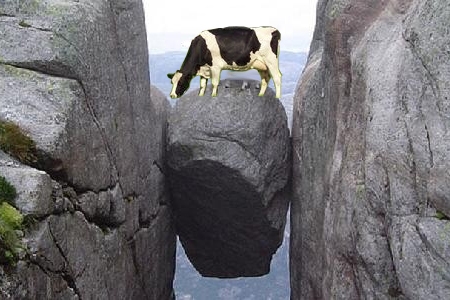

Whatever way one looks at it, Fonterra is caught between a rock and a hard place. It cannot really blame anyone but itself.

*Keith Woodford is an independent consultant who holds honorary positions as Professor of Agri-Food Systems at Lincoln University and Senior Research Fellow at the Contemporary China Research Centre at Victoria University. His articles are archived at http://keithwoodford.wordpress.com. You can contact him directly here.

44 Comments

Fonterra seem to think the future looks like the past... this time it doesn't. Seems like their entire strategy avoids thinking about the big change coming. Ag 2.0.

Good milk won't come from cows any more:

This new technology will have a place in the market, much like processed junk food has a market with a proportion of the population. However, I believe that the largest market share will still be with people who want to eat real and natural food...not a synthetic chemical concoction out of a laboratory.

not a synthetic chemical concoction out of a laboratory.

Considering it's not food produced from chemicals, that doesn't make sense.

Kind of interesting article. But really its a similar argument to the GMO one, theres not much point in us heading down that track as there is no way in hell we can compete on economies of scale in either research or production.

So the picture for me is one where 99% of the population heads to the cities to live the high life dining on yummy fake food while I get to live in a depopulated area eating my own beef, milk and eggs and fishing in a untrawled sea. Oh well.

If thats not the end game, no farming, then what is?

Fonterra's cooperative structure means that any CEO cannot push any strategies that are beyond their 12k odd farmer shareholders' vision, which is, pretty sorry to say, vision-less.

While what you say may be a good simplistic theory it has been sadly very much the other way round. The CEOs and the Boards direction has been very much based on volume over value and farmers have not been happy to see the massive amount of capital sunk into milk powder dryers. They paid a lot and still got a monkey along with peanuts ($3.80).

Nice illustration.

Once you get lots of debt in an industry your options are limited but the banks are winners.

Only up to a point. As interest rates ramp up dramatically in the next 2-3 years there will be a lot of bank collateral - farms, residential property, etc- that will be worth a lot less than it is now. A mere 2% increase in interest rates will see a lot of that collateral worth less than the mortgage, so the banks will be sharing in the pain in a big way. Just don’t be silly enough to have your life savings tucked away in the banks, as you will take a bath when you are called upon to do your duty (involuntarily of course) to recapitalise the banks.

Oh I don't know if there will be any banks left after an industry collapse.

I'm hardly surprised their market share has dropped. The price of their products are always higher than their main competitors in the supermarkets here.

Fonterra (farmers) will eventually have to face the additional costs of a carbon tax.

By market share he means share of the liquid milk of farm production. Fonterra for some reason focus on this rather than profit. Hence Keiths second last paragraph.

Fonterra is governed by legislation according to its market share - DIRA.

Good article Keith

In 12 years Fonterra who had 97% of NZ milk gone to 82% during that period the gross amount of milk produced has almost doubled.It is an indictment on their arrogance and ineptitude.Eight years ago they paid out over $450 million in goodwill for company purchase's i.e. Kapiti Milk$175 million of that $125 million good will.

The stupidity continues .

Frank - what is more important is that they have lost the closest farmers with the lowest transport costs.

By averaging pick up costs they are in placing themselves in a death spiral. Worked when they had 100% share - can't work now.

The new players are well aware of transport costs and even a cursory examination shows they are cherry picking low transport cost farms.

Every time they switch a low transport cost supplier - the average cost of collection goes up and the return goes down making it even more attractive for well placed suppliers to switch.

Eventually Fonterra will be left with a high proportion of suppliers at the back of beyond which are not economic to collect.

Yep, death spiral. Surely that regulatory requirement will be reviewed by this coalition government? It make neither economic nor environmental sense to encourage dairy production in extremely remote areas.

Being biggest has nearly always been a strategy led by management. The bigger the business the bigger the management structure, the bigger the remuneration. There has been constant tension between Fonterra management wanting to build lots of big stainless steel and make it profitable and the farmers wanting to operate their individual businesses as cost effectively as possible. As for being a cooperative - realistically the largest 10-20 suppliers decide our collective fate. I enjoy your columns Prof, don't always agree but usually manage to learn something .

If Fonterra hadn't flushed nearly 1 billion down the Chinese toilet, on what were obviously dodgy companies.(who was advising them here?) They would be in a far better position for an acquisition now.

Can't point out anything dodgy, ever. That would be "racist".

Why oh why won't Fonterra tackle the elephant in the room? If they need capital, they need to split off the value add section of the business (choose where to cut it off) and offer 49% of it to external investors, like the electricity gentailers. It's so elementary, but the farmers won't hear of it.

Sorry to disagree, the reason Tatua suppliers are doing so much better than the rest of us is they hung onto the value add business. The difference is their execution appears somewhat more successful. We let go of the value add and we (farmers) will in time become not much more than peasants living off the goodwill of the processors. Power in negotiations is usually inverse to the number of competitors you have at your point of the supply or demand chain. Oh to be in a supermarket duopoly. sigh.

And what Tatua did as a long term strategy, was to invest in R&D, processing and marketing from retained profits. Fonterra has always paid out too much of its profits as dividends. And now it is very hard to get back on the horse.

Keith W

.. isn't that just typical of large monolithic businesses ... that they don't have an innovative entrepreneurial edge .... that , over time they lose market share to smaller nimbler rivals ....such as A2 .... ooooops ...

No sense crying over spilt milk !

That maybe true Keith but also what Tatua was able to do, was refuse supply by operating a closed door shop, when it chose to. Fonterra to be fair, had to continue to put in stainless steel because the govt, via DIRA, says it couldn't refuse any supply, except under exceptional circumstances. And it still can't. When you can control how much milk you take on, and you don't have to give 50m litres of shareholder milk away to any competitior who wishes to set up against you, you do have an advantage over someone who doesn't have that flexibility.

Casual Observer

Fonterra has always only had to take milk supply from its existing catchment, i.e. from where its tankers were already travelling. And it has always fought hard to get all production that it could, driven by an insatiable growth strategy. And milk sold to new entrants was never given away.

Keith W

I was sloppy with my wording Keith.

Fonterra does have two exceptions to accepting supply: Minimum supply of 10,000kgs and

New co-op may reject an application by a new entrant if the cost of transporting the milk of the new entrant exceeds the highest cost of transporting another shareholding farmer’s milk.

Clause 96 does allow for this exemption to be terminated by the govt.

http://legislation.govt.nz/act/public/2001/0051/69.0/DLM109174.html

Fonterra is unable to consider if new supply is going to be economic for it to pick up or not when accepting supply. i.e. will it require an investment in increased capacity, will it dilute existing shareholder returns etc

I didn't mean to imply that Fonterra literally gave the milk to its competitors though some would say it good as did. It is not a willing seller, willing buyer situation.

Those clauses are disadvantages to Fonterra over its competition especially as Fonterra has now being operating for 18years, and there is competition in both islands, for milk supply.

Casual Observer

I can assure you that Fonterra's mid level managers were instructed to do everything they could to make sure that milk did not shift from Fonterra to other processors. This included providing options to new farmers such that they did not need to purchase shares for five years ( i.e they chose to take milk without requiring any capital contribution). And they lobbied hard for all of that milk. But in practice, these other companies have always been able to fill their factories. Most of Fonterra's farmers currently have no option to supply another processor because these processors have waiting lists. It is true that Fonterra would prefer supply in places like Canterbury than in some other part of the country but they have never turned down milk unless it was well outside their existing catchment. But the bigger problem is that Fonterra has always paid out too much in dividends. That night have been OK if Fonterra was happy to stay as a mature commodity producer, but has been inconsistent with overall transformation to consumer products.

Keith W

Well, as we all know there are limits to growth, unfortunately the way we have organised things, we rely on it. How about thinking cap on, and we work out how to prosper without it, this dilemma is and should be coming to us all, as the world really is at peak growth, past it, as we are consuming the world's resources as if we have a spare planet just along the road.

They are still saying China is the answer? They've been saying this for what 10 years? And it's never materialised.

But China is still our biggest market despite its challenges. Just think what might happen if we put more effort into understanding China and didn't keep stuffing up.

Keith W

... Keith , if Fonterrible can nut that one out , how to understand China and to garner a deal on an equal footing with them ... then they'd make more money out of teaching their knowledge to other companies than out of dairy products ....

Cos no one else on the planet has figured that one out yet !

Zespri and The a2 Milk Company seem to be able to find a way through the maze. Similarly for Freedom Foods in Australia. And there are others.

I first went to China in 1973 and have been there many times since. For a long time I said that I was simply going to enjoy the experience and never try to understand it as I considered that an impossibility. But over time, as I have been exposed to Chinese culture and its historical roots, and how behaviours are rooted in a culture which is sub-conscious to those who are actually living it, a lot more makes sense. However, if one simply looks in from the outside from a Western perspective, then nothing makes sense. And silly mistakes will continue to be made.

Keith W

... perhaps a Chinese born person ought to be a member of the Fonterrible board of directors then ?

Kind of like having one student designated as the sober one . to drive the others to the booze up .... and safely home again ....

... and , given the way Fonterrible has lost hundreds of $ millions on their investments in China , they have behaved like drunken ya-hoos , in need of someone sober to sharpen them up ...

That will require Fonterra developing special superpowers against bribery and corruption

... hey , cracking idea ... a marvel of primary production , a super hero to take on the baddies of the corporate dairy world ....the new heroes of a milk curdling world of cheesy deals and subterfuge ....

Drum roll , please ... ta-dummm de dummmm ........ arise ....

" Super Milk Man " and his off-sider , " Butter Boy " ...

... can't wait for the movie !

If China is the answer, you are asking the wrong question.

Keith often writes a peice bagging fonterra i believe due to his A2 bias (still a great read). Fonterra is naturally going to have to invest more in value add to get more growth from a stagnating supply of raw milk. Instead of selling off value add branches of the co operative Fonterra should be looking to create joint ventures with other milk processors much like they have recently with the A2 company.

Im one investor who has lost confidence in Fonterra Directors willingness to act for the company rather than suppliers. Beingmate was too much about access to markets rather than investment performance. It shouldn’t be a surprise - farmers have played the volume and farm scale for capital gain game for decades, hence collectively their businesses are geared to the eyeballs, and oversensitive to the commodity price volatility they should expect from their strategy. They probably consider its still game on for volume, gearing and capital gains - the way they built their wealth - so they need Fonterra to play ball on that - hence lack of sufficient supplier price differentiation for A2, distance, quality, increased and peak supply, reward for winter milk. Fsf is no place for a non-farmer to place capital.

I wonder what shape the dairy industry would be in now if farmers had voted against the Fonterra dairy companies merger and stuck with the status quo?

Tatua and Westland appear to be doing quite nicely.

Sadly, too simplistic. You'd need to step back and ask how much better off the industry would have been if NZDC and Kiwi were prepared to ditch the culture that relied on cannibalizing the rest of the milk manufacturing industry to "create growth".

The Waikato Dairy, Bay Milk, Tararua etc would have preferred to go the Tatua route but the big two were never going to step back and let that happen. I understand Bay Milks old plant (over 30 years old) is still running at full capacity even this late in the season as its production is value add, how many Fonterra built plant are still doing the same.

The status quo of a statutory marketing board was not an option. And so the challenge was how to get value from the Dairy Board assets. But yes, it could have been done in other ways.

Keith W

Have you spoken to Westland suppliers lately? 'Doing quite nicely' is not a phrase I hear from those I know.

Really? Westland must have been getting advice from Fonterra directors.

Did you attend the MyConnect conference last week omnologo?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.