By Alison Brook*

Prices are rising quickly across much of the developed world with inflation in OECD countries increasing at the highest rate since 2008.

In the US, core consumer inflation has surged at a pace not seen since 1992. Central banks have so far maintained the inflationary pressures are temporary and will abate on their own, although US Fed officials acknowledged on Wednesday that price rises may last longer than they expected.

There are growing concerns that central banks and policymakers have misjudged the resilience of the inflationary pressures and we may be in for a period of sustained inflation not seen in the developed world for many decades. The risks are high if their consensus view is wrong. Deutsche Bank chief economist David Folkerts-Landau said in a recent report the global economy is heading for a “devastating rise in inflation:

“We worry that the painful lessons of an inflationary past are being ignored by central bankers, either because they really believe that this time is different, or they have bought into a new paradigm that low-interest rates are here to stay, or they are protecting their institutions by not trying to hold back a political steam-roller.”

Mohamed El-Erian president of Queens College, Cambridge agrees, believing the Fed is moving too slowly in terms of keeping inflation in check. He argues if central banks wait, they will have to “slam on the breaks” by raising interest rates quickly. This creates a real risk of sending the economy into a recession.

The reasons for the surge

A lot of the reasons for the surge in inflation can be attributed to transitory factors which support the official line. A year ago, much of the world was in lockdown, and demand for many goods and services plummeted. However, there is now a lot of pent-up demand and as many countries begin opening their economies, demand is surging.

The demand pressures have been exacerbated by disruptions to global supply chains. Shipping containers in the wrong geographic location and the lack of availability of container ships have made it difficult for producers to access raw materials leading to a rise in commodity prices like lumber, copper, wheat and iron ore.

On top of this, border closures have led shortage of workers, which has been driving up wages in some industries and increasing the likelihood that prices will continue to rise.

Underlying inflation

The difficulty of measuring inflation through measures like the CPI and durable goods is that it can be affected by “noise” such as transient supply shocks (i.e. acts of nature).

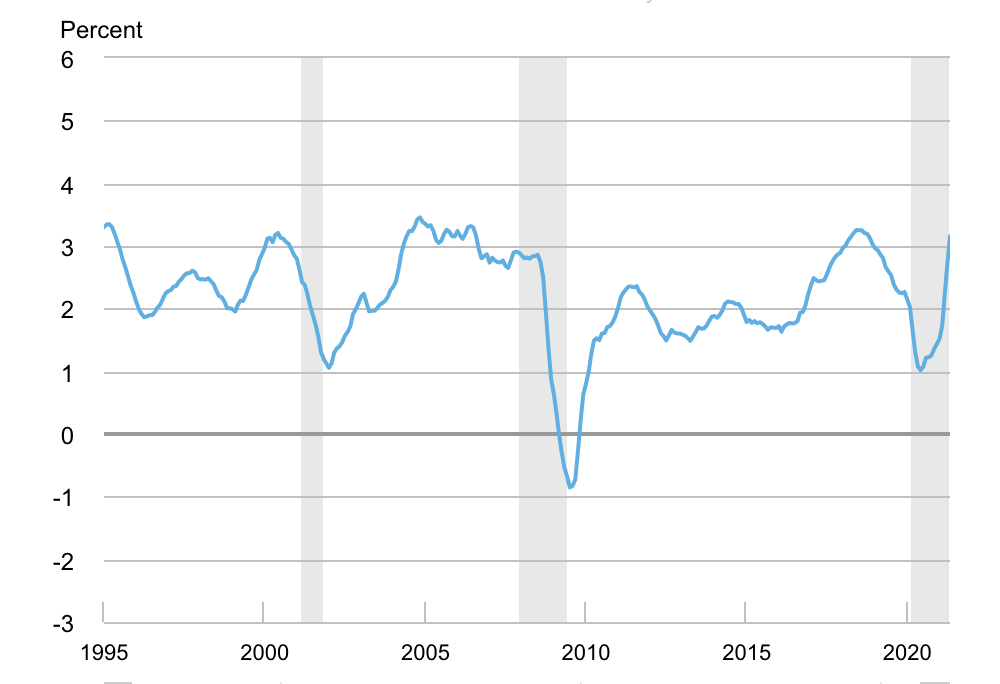

The Underlying Inflation Gauge (UIG) was developed by the Federal Reserve Bank of New York as a way to counter this and to capture the “persistent part” of monthly inflation.

The UIG has outperformed measures of core inflation and predicted the downturn in 2008, peaking from 2004-2006. It has recently spiked 3.2% and is “flashing yellow” according to Eddy Vataru of Osterweis Capital Management. Vataru argues that money printing plus the addition of significant fiscal stimulus will lead to persistent inflation.

UIG: Full data set measure

The case against a long-term rise in inflation

Those who believe the inflationary surge in the US is transitory argue that a “v-shaped” recovery was always on the cards as economies re-opened and experienced a bump in demand. The largest price rises have been seen in areas which were hit the hardest by the pandemic such as petrol (up 56.2%) and used cars (up 29.7%) or tied to the economic reopening, such as airline and hotel prices. This may mean that the growth in demand and prices will start to normalise once countries have fully opened up and supply issues are resolved.

Today’s economy is also very different from the 1970s when rapidly rising inflation created havoc:

- Unionisation levels were higher and workers in the 1970s were in a much stronger position to demand higher wages.

- Demographic trends in the 1970s and 1980s also saw a huge rise in working-age people, providing a tailwind for demand.

- Globalisation today is a much bigger factor despite the recent slowdown so there is significantly more international competition holding prices down.

- The massive technological advances since the 1970s are also inherently deflationary, tending to reduce costs while increasing competition.

All these factors support the view that the current inflationary pressures are transitory and are likely to dissipate over time.

New Zealand quiet for now

The Reserve Bank of New Zealand is forecasting inflation to move to the upper half of its 1% to 3% band this year and then to slow in 2022. New Zealand won’t be immune to international inflationary pressures if they blow through though, and interest rates are expected to rise, which could ultimately cause problems for households with ever-increasing levels of debt.

We won’t know for a few more months whether inflation is short-lived or more permanent. However, there is a growing chorus of voices encouraging early action on inflationary pressures. This includes outgoing Bank of England Chief Economist Andy Haldane who recently warned in the New Statesman that the stakes were high, not just for central banks and governments, but also financial markets, businesses, and consumers. “The inflation tiger is never dead,” he wrote. “While nothing is assured, acting early as inflation risks grow is the best way of heading off future threat. This is monetary policy 101.”

*Alison Brook is from the Knowledge Exchange Hub at the Massey University campus at Albany, Auckland. She is on the GDPLive team. This article is a post from the GDPLive blog, and is here with permission. The New Zealand GDPLive resource can also be accessed here.

61 Comments

Usual conformity to official narrative

See Wolf today

Im reading this kind of thing all the time now - 'Covid-19 related disruptions to global supply chains

for equipment and increased freight costs have had a substantial impact, including restricting the number of

suppliers willing to meet the technical requirements to supply the Project. Additionally, rapidly increasing costs

in Western Australia for labour, equipment, and services due to the strong resource industry has increased

costs for engineering, construction, bulk materials, and services. These pressures have resulted in final pricing

for many packages and services being above that indicated when setting the original Project budget.'

Everything seems to be inflating in price - even houses.

TTP

If only we had an expert in price fixing around to sort it out.

"Today’s economy is also very different from the 1970s when rapidly rising inflation created havoc." Well yes. No oil shocks for a start. NZ's terms of trade dropped by 43% in 1974. Never mind the collapse of the wool price, Britain joining the EEC and the cost of Vietnam ricocheting through the world's economies. Oh and the Iranian Revolution in 79. Not pretty.

https://www.interest.co.nz/charts/commodities/anz-commodity-price-index

(Finally found the charts section at interest.co.nz after only 10 years....)

Has anyone got examples of products or services now that are less cost than pre Covid?

The charts you link show a strong increase in crude and fuel prices since the onset of Covid so why do you suggest fuel has not gone up?

So a quick decline and now pricing has reverted to the prior levels, and possibly going above that as the world reopens. So expect inflationary impact...

My internet went from $15 a week to $14 a week

My car insurances went down....

Nice. What about your house insurance?

I know our families weekly household spending budget, which we increased a couple of years back, is no longer sufficient & we aint buying any more avocado's than we used too.

I think our balanced system was thrown into turmoil and remains out of sync. How long before we see new structures and balance - maybe a couple of years away.

The cost structure of supply chains tend to be heavily weighted to fixed costs. These take longer to flex and move overtime.

I think it's been in 'turmoil' since 2008. Covid has been a convenient thing to blame, but Limits to Growth are (collectively: is) the problem.

Competition for rapidly dwindling NRR's (non-renewable resources) and for degrading RR's (renewable resources) is increasing, but the energy going into the system isn't. So we'll see inflation but with no ability to increase interest-rates; a 'first' as we hit the Limits. I suspect deflation (or collapse) beyond that. The likely trend will be price relativity-changes; food will go up and up, discretionary items down and down, stores of 'wealth' will be increasingly exposed as wishful thinking.

Another instance of Wolf is coming. There is another Wolf on the rampage already, Covid. It won't allow any competition. So this inflation stoking is simply a Central Banks Play to make themselves relevant in the new economic scene. They won't succeed or they may screw up the world economies more.

Well if you ask ordinary folk on the street -- they will tell you its not transitory -- and its very real -- house owners looking at 7%+ rates and water costs -- renters at $50 a week rises - electric and gas 5%+ - Builders will tell you they are into the third round of price increases this year alone for many products, fuel heading back to all time highs -

Hard to see how we allow the Reserve Bank and Government to get away with the Transitory narrative -- rates, rents, utilities, raw materials are not going down -- No council is about to reduce its rates - Yes there are some transitory factors -- but the Pandemic is not going away for a few years either - so even those are likely to be several years - some of which will be further increases before any downward pressure begins

Wasnt Japan's deflation and stagnation also transitory ??? for 30 years ....

Can’t think of a single good or service that I purchase that has dropped in price over the past year.

Good. You're probably vice free.

Unless you’re a Buddhist monk, no one is vice free.

ordinary folk on the street have strategies to cope with inflation,they eat mince and sausages instead of steak,hoki instead of snapper,cancel home and contents insurance and have 3rd party instead of comprehensive that should be called apprehensive as like all insurances you never know if they will pay out what you think.move back to mum and dads,share a rental.some houses in our street have five cars parked ,we would be one of the few houses with only two.it may reduce the cost of living but also your standard of living.

Unfortunately, that doesn’t bode well for an economy that relies on retail spending.

Which is probably the point

Shouldn't be eating snapper anyway

Transitory doesn't mean that prices will fall, only that the rate of increase will slow.

There's no better hedge against inflation than real estate.

Postage-stamp sections can't accommodate hedges....

I hear a lot of people talking like this. Maybe correct if your talking ‘normal’ or long-run average inflation, but real estate is hugely exposed to the rapidly rising interest rates that will result from an inflationary shock. Throw in liquidity issues and a recent meteoric rise in prices and no, I don’t think your comment stands up.

OECD appears in the very first line. End of read

There where signs of niche shortages in manufactured goods even before the Covid-19, GPUs for example have been selling over manufacturer RRP for several years now and there was up to a two year wait on newly launched sports cars (e.g. Corvette), EVs (Tesla 3) and off-road vehicles (e.g. Jeep).

I'm actually more hopeful than most about inflation returning. We are at a demographic inflection point in labour markets across the developed world (retire people consume more than they produce), beyond that there are signs food production will decline in major producing nations (e.g. the US) and we will need to build a colossal amount of new generation infrastructure to green our economies.

Can I suggest that's the wrong target?

Who told you 'our economies' were sustainable? They aren't - and by some orders of magnitude. So the first question becomes; What can we fit within the current generating capacity? The second is: What can we maintain long-term that demands energy? The third is: What do we build/triage?

That's a good question, back of an envelope? Looking at the fossil resources we need to convert I make it out to be about 330MJ of energy per person per day on average to live a New Zealand lifestyle which is what...92kWh of electricity equivalent.

The average NZ person uses about 12kWh daily (according to LG) so we just need to generate about 8x more capacity. In truth though we probably need an order of magnitude increase to account for population growth and annual increases in energy consumption.

That's actually much lower than I thought it'd be! Apparently I use twice the electricity of an average New Zealander already.

Are you including the embedded energy in your daily exertions, getting up in the morning, 100 press-ups, 100 sit-ups, consuming breakfast, commuting to and from work, lunch-time latte. Then dinner

Think about ALL the manufacturing processes embedded in producing a slice of toast, then add the butter and jam

That's just based on replacing per-capita fossil fuel consumption at current levels. So, as long as that slice of toast is made in New Zealand, it's accounted for. One of the great things about New Zealand is that we have the geographic and geological resources to do this, it will be much harder in densely populated countries.

Be thankful for this. As hard as it will be for us. Its going to be a shite fest in other places.

Average energy consumption per capita in NZ is around 140kwh per day per person (a bit over 50,000kwh per year). This includes fuel, gas, electricty etc. If we had to meet our current energy needs from electricity alone, we would need to generate at least six times as much electricity. Don't worry though, our ineffective carbon trading scheme, kindness, and the declaration of climate emergencies will see us right.

Interesting, can you share the source of the 140kWh total energy consumption? I just tallied up oil, coal and gas per capita usage and worked out the energy content of each because I couldn't find a direct source of information.

https://ourworldindata.org/grapher/per-capita-energy-use

Based on the BP survey / research etc - check out the energy vs gap graphs etc

Thanks.

Inflation is not coming but has already arrived and now the only question remains, Is it transitory as advused by reserve bank governor or is it that reserve bank governors are screwed and talking about transitory to calm the market as no one can argue with certaninity - the future that reserve banks are talking about, so can get away for time being.

Bigger question Allison, What is the term of transitory, Is it one quarter, two quarter or few years or .........

Similar interesting discussion / interview on inflation below :

Yep you can call it what you want but it's still inflation.

What happened to rents the last time countries like us saw huge inflation pressures?

Want to guess?

Yep. A freight train of inflation is thundering down upon us. If the Govt does its usual (nothing) the remainder of the retired generation will see the last of their savings crushed. They are truely stuffed unless they own lots of houses.

So its raise interest rates in a vain attempt to hold back inflation, or see the retired generation (all voters) get well screwed and become even more dependent on the tax payer.

Ps. Pretty sure when this sort of happens in the 70s, rates ended up around the 20% mark.

And the young generation with no savings and high debt will also be crushed.

I believe there are very few retirees these days who hold all their savings in cash. They're mostly donkey deep now in rental properties, shares, or property syndicates.

Those that do have that cash mentality are probably at the very old end of the spectrum and are on the way out regardless.

Is high inflation making a comeback?

Daily Treasury Real Yield Curve Rates

A negative real yield means that investors are willing to see safe investments decline in purchasing power.

In other words, investors today are comfortable receiving not even a return of capital in real terms, let alone a real return on capital.

Why would they accept that?

Good question the most likely answer is they expect a downturn with a deflationary outcome.

Indeed.

...you won’t see any real inflation (sustained, broad-based consumer price increases) without serious credit expansion.

If there has been anything more unusual about the past few quarters, the love of safe and liquid assets hasn’t been that thing. Instead, it has been the turning away from loans and lending..

Loans had already been largely avoided in the post-2008 era, but since 2011 had at least been advancing in nominal and absolute terms (though in linear terms, still shrinking).

Apart from the big jump in loans in Q2 2020 as companies all over the place forced banks to standby their existing revolvers, lending has only dropped ever since. No matter the Fed and its variety of puppet show variations, nor Uncle Sam’s overtures into increasingly every corner of the economic sphere. Banks are saying “yes” to safety in a big way and “no” to risk-taking in a bigger way (which is what loans are, especially in the sense of liquidity risks). Link

The price is set not by the free market. If central banks weren't buying government debt hand over fist, you wouldn't have real rates so negative.

Materials price rises in our businesses continue to pour in. Tradies are hoarding stock due to anticipated continuing freight disruption, so much that we are applying a surcharge to paid for but delayed delivery orders. Orr's view that supply chains will sort themselves out over coming months is very optimistic. US ports are hopelessly jammed with some taking 5 days to turn a ship around, compared with under 10 hours for efficient European ports. It's a chronic mess that ain't going to be fixed any time soon.

Once more for those at the back… when people are paying more for something, other people are getting paid more for something. Inflation is simply a redistribution of money. If people are finding the cost of living going up, it is because someone else has managed to increase their share.

Nope

Diminishing returns, resource constraints, scale losses to name a few factors can all increase base cost for no more return to anyone

You are both right, but H&E is righter.

The energy cost of all things is rising, and hitting the exponential-inflection-point around now. So yes, things will 'cost more' with no return to anyone. So that's a sinking lid, but under that, vis-a-vis each other, Jfoe is right.

Essentially, it is all a fight with each other for resources and energy. Complexity theory applies, but the Limits to Growth are the stage upon which it plays out.

I was assuming steady state on productivity, marginal costs, scaling etc - factors that are mostly temporary in nature.

As ever pdk, I recognise that real resources are the real boss.

I think it is transitory. 3-4% CPI is hardly anything to worry about, especially at a time with serious effects from the pandemic.

How long is the ‘transit’

I’d be interested to know thoughts on supply-side inflation possibly ‘transitioning’ into demand side inflation i.e. will buiness resource shortage and cost pressure kick in and continue the inflation party?

P.S. 3-4% inflation is fairly large when bond rates are historically lowest ever

Your statement is only valid if real wages follow suit, which they haven’t for years.

Article failed to mention our very high levels of household debt (mostly mortgage debt) which will constrain the ability of reserve banks to raise interest rates. Or to put that another way, they won’t need to raise interest rates very much to ‘slam on the brakes’ or ‘take the punch bowl away’ should inflation become a problem. I’m of the view that the current inflation is indeed transitory. Also the inflation hawks have been running the show for far too long.

Interesting quote https://www.zerohedge.com/markets/fed-faces-greatest-risk-its-history-e…

...And the greatest risk it now faces in meeting its mandate is an economic crisis accompanied by inflation. Such a crisis would force it to choose between a return to orthodox policy and the consequent defaults that would devastate asset prices, or a currency collapse and runaway inflation that rebalances the value of our assets and liabilities. Without a determined improvement in our politics, it is increasingly likely that we must endure the latter, followed by the former. And this drama will surely play out in the decade ahead...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.