By Dominick Stephens*

It is fair to say there is a bit of confusion around the New Zealand interest rate outlook at the moment.

The Reserve Bank acknowledged the economy is getting better, but in the same breath issued a dovish Monetary Policy Statement and signalled lower interest rates for longer. The confusion may have arisen from the fact that the RBNZ’s current thinking does not lie anywhere along the usual simple continuum of views on interest rates.

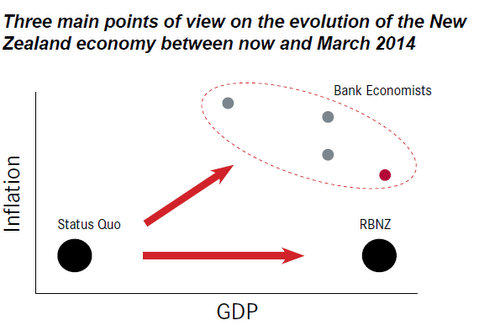

The RBNZ’s view forms the third point of a triangle. And that fact throws up fascinating possibilities about the year ahead. At one end of the conventional continuum is what we call the “status quo” view. It is frequently expressed by financial market participants and the business community, and is probably priced into interest rate markets at present.

It basically says that the global outlook is poor, inflation is well contained, the New Zealand economy is in a debt-reduction funk, and any meaningful stimulus from post-earthquake rebuilding in Christchurch is either years away or will fizzle. This view says the economic status quo will persist and therefore interest rates will remain low for a long while yet.

Most New Zealand-based bank economists, including Westpac, are towards the other end of the conventional continuum. They are cautious on the global economy but expect stronger New Zealand GDP growth over the next couple of years, as the Christchurch rebuild ramps up.

The “bank economists” view says that stronger GDP growth will provoke inflation pressure in the normal way, and the RBNZ will respond with OCR hikes.

Economists at all four main banks project that by March 2014 New Zealand will have higher GDP growth and higher inflation than it has today. All are forecasting at least 150 basis points of OCR hikes by that time. And all expect a persistently high exchange rate.

Naturally, not everybody fits neatly into either category. Some are between the two views so far described, and some are more extreme. But by and large, those who anticipate the strongest NZ growth are usually the ones with the highest inflation forecasts or the most hawkish OCR expectations. The Reserve Bank’s view falls nowhere on the usual continuum. The RBNZ broadly agrees with the local economists that GDP will accelerate.

In fact, the RBNZ’s GDP forecast is stronger than any of the local banks, as it expects almost 30% per annum growth in house building for two years running. But unlike the local bank economists, the RBNZ believes that the coming construction boom will not translate into higher inflation. The RBNZ believes that economies of scale make the Christchurch rebuild different from previous construction booms, so more work can get done with less cost pressure.

The RBNZ also emphasises the inflation-dampening effect that a persistently high exchange rate will have. Essentially, the RBNZ is forecasting growth without inflation pressure, and therefore sees little need for OCR hikes.

The contrast between the RBNZ’s view and the market’s “status quo” view throws up interesting possibilities for the year ahead:

1. If we are correct and GDP accelerates, markets could be quite surprised. Interest rates would tend to rise. But the RBNZ would regard accelerating GDP as unsurprising and might continue sending dovish signals.

2. Conversely, if growth remains low markets will be unsurprised and interest rate pricing will not necessarily change. But the RBNZ may well shift in an even more dovish direction.

3. The RBNZ will react strongly to changes in the exchange rate. That might make its responses to global events seem counter-intuitive to markets. Suppose some global event causes a spike in risk aversion. The NZD would tumble. But the RBNZ might see the lower exchange rate as inflationary and adopt a surprisingly hawkish stance. (Pretty-much the converse of the past three months).

Signs of inflation, or lack thereof, will continue to have a strong influence on RBNZ behaviour. RBNZ-watchers would do well to watch price gauges carefully. Focusing single-mindedly on activity indicators could prove misleading.

Our own view is that growth will accelerate along the lines that the RBNZ expects, but inflation will remain low this year.

Hence we firmly regard the OCR as “on hold” until December. But we expect to see signs of cost pressures emerging from the Christchurch rebuild in 2013.

That’s why we expect more OCR hikes next year than either the RBNZ’s projections or current market pricing suggests.

Why we suggest fixing is better value

If Westpac expects the OCR will remain on hold until December, why are we suggesting that fixed mortgage rates are better value? Floating mortgage rates may not rise until December, but fixed rates could rise earlier. Today’s fixed rates are barely higher than the floating rate.

Fixing now guarantees a low rate of interest through the difficult years ahead. The risk of waiting is that fixed rates go up, and a less favourable rate of interest is locked in for the 2013 to 2015 period.

Some might point out that an even better strategy is to float until the last possible moment, and then fix just before markets send fixed rates higher.

Sounds good in theory, but in reality it is not possible for the majority of mortgage borrowers to all beat the market. First of all, most people don’t watch the economy and wholesale rates closely enough to anticipate the moment when market sentiment is about to change.

Second, a rush of people attempting to fix their mortgage rate at once would itself send fixed rates higher – if everybody rushes for the door at once, only a lucky few will squeeze through. So our suggestion is to pay a little extra now, sleep easy, and be absolutely sure of beating the crowd.

Of course, our suggestion is based on our economic view. Those on the other two points of the triangle – who believe either that the status quo will persist or that there will be strong growth without inflation – will be roughly indifferent between fixing or floating.

They will believe that the risks on either side of today’s fixed rates are roughly balanced.

* Dominick Stephens is Westpac's Chief Economist. See the full note here on Westpac's website.

See Bernard Hickey's guide to fixed vs floating on our site here. It includes comments from all the main bank economists.

11 Comments

No one see's deflation then....its so far into fear? no one even mentions its "not possible".

Put me down for 5 years of -10% per annum this decade, in the mean time core stays at +2%...

regards

If Dominick saw deflation coming, he would hardly be a bank economist would he. Interesting what he characterises as 'Dovish' behaviour by the reserve bank.

"Cost pressures"...oh he means inflation...now that means fixed will rise...and floating....and both result in less spending...less tax collected...deeper fiscal hole...more borrowing at higher costs...leads to even deeper hole...increased tax theft to fill the hole...less spending...higher unemployment...shops closing for good...people leaving for aus...people deciding building is NOT a good idea...Get the picture!

The next two decades are going to kill off some Kiwi with personal debt mountains...they will see the NZ govts flicked out by voters every three years...the demand for credit regardless of freebees presents and bribes will take a dive...that'll bring down at least two banks...deposits will be lost...pollies will be forewarned....some regional centres will become ghost service centres...empty shops and closed signs aplenty...

Yes it's time to visit your local friendly cheerful credit creator for a boot full of credit to chase after price bloated property....hurry along now..you might miss out...

"Pressure" means they would like to put up prices, but there isnt the money in ppls pockets. If we ever had a recovery prices would go heywire thats pretty certain....

Funny thing is just why there are the "pressures" for instance if a tool costs $400US in the US, why is $1800NZ here....the production unit cost in china is the same in both cases......so some genuine need and some greed I suspect. Another example, So if one venders washing up liquid is $3.00 or $3.49NZ and a NZ made one is $1 a refill or $1.48 a bottle where is the rip off....I cant tell the difference.

Now I agree on the outcomes you see but not becasue its caused by inflation....

Funny that the end results will be similar.

regards

No worries steven...they will say "just borrow the difference"....and I see the UK press is waking up to the farce in the retail area where prices remain pretty fixed but the number of chocolate fish..or the size...drop.

Merv's BS from the BoE about there being low inflation over there is soon to be a sitcom.

The money supply will keep expanding, it has to. This aggregate prices will also keep increasing at a rate that is beyond incomes to keep up. In this environment there is no way they can increase interest rates further, in fact they will keep going down. Money will increasingly be directed towards essentials at the expense of other goods. This will continue until default happens, or someone like Italy defaults and tip everything on its head.

Your name is on the hit list now Scarfie...and sorry mate but you will not get to be the gov of the RBNZ...and you can forget appointments to any of the "working Groups" planned by our brilliant leaders.

Damn, I was just working on my CV......

"What's that Bill"....

Hey Scarfie...you're off the Efficiency Taskforce as well...

The difference in the US market price is almost certainly down to the turn over. The stores are bigger and sell more items so the items cost less. The US business model is more consumertastic than NZ, of course the down side to this is there is much more waste. There are a few more consumers as well, though this would only have an effect if there are fewer stores per capita in the US.

Steve Keen posted a couple of really good lectures on all the problems with supply and demand analysis.

http://www.debtdeflation.com/blogs/2012/03/16/advanced-political-economy-lectures/

You can see the mental dissconnect between the rubbish these economists are talking and the reality of comparing these two.

It's all OK for the banks. No worries, mate.

Just need to put pressure on RBNZ to push those Basel changes out another two years from the two years they screwed the other day.

On the other hand, who is going to be in the chair after Bollard? Will we get another wimp?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.