Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. Is financial globalisation in reverse?

In 2008 after the bout of financial contagion, cross-border capital flows abruptly collapsed. Almost five years later, they remain 60% below their pre-crisis peak.

Global financial assets have grown by just 1.9% annually since the crisis, down from 7.9% average annual growth from 1990 to 2007.

Martin Baily and Susan Lund wonder if financial globalisation is reversing itself. They don't think the reversal is all that healthy. More from their article in Project Syndicate:

Current trends seem to be leading toward a more fragmented global financial system in which countries rely primarily on domestic capital formation.

Sharper regional disparities in the availability and cost of capital could emerge, particularly for smaller businesses and consumers, constraining investment and growth in some countries.

And, while a more balkanized financial system does reduce the likelihood of global shocks creating volatility in far-flung markets, it may also concentrate risks within local banking systems and increase the chance of domestic financial crises.

So, is it possible to “reset” financial globalization while avoiding the excesses of the past?

2. Soros's alchemy: Eurobonds

George Soros has a 'miraculous' solution for Europe but his plan is vehemently opposed by Germany. However he says the Germans have no right to prevent others from banding together and issued Eurobonds - and if they are still opposed, he suggests they quit the eurozone. His idea is set out in Project Syndicate and Spiegel Online:

The causes of the crisis cannot be properly understood without recognizing the euro’s fatal flaw: By creating an independent central bank, member countries have become indebted in a currency that they do not control.

At first, both the authorities and market participants treated all government bonds as if they were riskless, creating a perverse incentive for banks to load up on the weaker bonds. When the Greek crisis raised the specter of default, financial markets reacted with a vengeance, relegating all heavily indebted eurozone members to the status of a Third World country over-extended in a foreign currency.

Subsequently, the heavily indebted member countries were treated as if they were solely responsible for their misfortunes, and the structural defect of the euro remained uncorrected.

Once this is understood, the solution practically suggests itself. It can be summed up in one word: Eurobonds.

If countries that abide by the EU’s new Fiscal Compact were allowed to convert their entire stock of government debt into Eurobonds, the positive impact would be little short of the miraculous. The danger of default would disappear, as would risk premiums. Banks’ balance sheets would receive an immediate boost, as would the heavily indebted countries’ budgets.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. Don't call it a currency war

But the rhetoric shows signs of heating up again, amid forceful moves by major central banks to pump up their economies through the creation of new money.

The US Treasury Department said Friday in a report that China’s currency is “significantly undervalued” and that it would “closely monitor” Japan’s aggressive new monetary policy to ensure the goal was economic growth, not a weaker yen. The world’s finance ministers and central bankers will gather in Washington this week for the semi-annual meeting of the IMF. Currencies are sure to be a hot topic. The Globe and Mail reports:

Foreign exchange markets are shifting. Currencies such as the Canadian dollar are suddenly havens for investors and currencies such as the Thai baht are a play for yield. The primary reason is the growth-seeking, zero-interest, money-creating policies of the United States, Europe and Japan.

Canada, Thailand and others are suffering as a result. If that isn’t war, what is it?

It is more accurately a game of survival in the post-crisis global economy where old formalities no longer apply. The policies of the US. Federal Reserve, the Bank of Japan, the Bank of England and others look aggressive because they appear to break the rules. These central banks have created the equivalent of trillions of dollars. What else could this be but a blatant attempt to debase their currencies to give their exporters an advantage in international markets?

If you accept that view, then you think most every policy maker on the planet is a liar, and you deny the validity of an overwhelming body of evidence that concludes that the policies of the Fed and others are doing more good than harm. Even the central bank of Brazil has concluded that its exporters benefit more from stronger growth in the United States than they are hurt by a stronger currency.

The world economy is stuck in purgatory between recession and recovery. The objective of each player is to escape, but none knows quite how to do it. This isn’t a state of war: Nothing is gained by attacking an opponent outright.

But there is an element of survival of the fittest. Countries will do what they can to revive their economies. The contest is complicated by the fact that a handful of players are considerably stronger than the others. But countries have no choice but to play the game.

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8584 | 0.8634 | 0.8237 | 0.8236 |

| NZ$1 = AU$ | 0.8175 | 0.8186 | 0.7949 | 0.7947 |

| TWI | 78.81 | 79.30 | 75.77 | 73.50 |

| Gold, US$/oz | 1,477 | 1,536 | 1,604 | 1,653 |

| Dow | 14,844 | 14,865 | 14,462 | 12,853 |

| Copper, US$/tonne | 7,510 | 7,510 | 7,556 | 8,054 |

| Volatility Index | 12.06 | 12.24 | 13.36 | 19.55 |

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

5. Low risk

Even though the NZ Government has almost NZ$78 billion of securities out there ( 37% of GDP ), the credit markets really like us. Not only do they keep buying the stuff, they price it with among the least-risk premiums of most countries. It is another thing that hurts the exchange rate, along with surging dairy prices and growing credibility that we will be back in surplus next year. Perhaps we only shine in an 'ugly lineup' ? After all, risk is relative.

6. 'Targeting the wrong metric'

New Zealand's monetary policy targets inflation. Sure, that hurts many people, but so does unemployment. But the evidence is that unemployment causes more problems than inflation, or so says a bunch of academics at a Scottish university. They say that unemployment causes four times the hurt that inflation does, so we should actually use monetary policy to target unemployment first.

Higher unemployment and higher inflation correlate with lower levels of reported well-being, their research shows. But the impact of unemployment is much larger. A one percentage point increase in unemployment lowers well-being more than twice as much as an equivalent rise in inflation, the paper says based on US and European data.

We find, conventionally, that both higher unemployment and higher inflation lower happiness. We also discover that unemployment depresses well-being more than inflation. We characterise this wellbeing trade-off between unemployment and inflation using what we describe as the misery ratio. Our estimates with European data imply that a one percentage point increase in the unemployment rate lowers well being by two and a half times as much as a one percentage point increase in the inflation rate.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

7. Read this first-home-buyers and weep

Americans think their houses are still overvalued - and that's after seeing that the multiple between incomes and the mortgage payment for a median house is less than 3x. Median pay is US$52,513 and the median house price is US$157,400 according to Zillow.

At todays exchange rate that is NZ$61,150 in pay and NZ$183,350 for a median house (that is probably spec'd better than a kiwi one). The New Zealand data is NZ$78,700 in household take-home income (~$NZ102,000 pre-tax) and $400,000 for the median priced house. That is a full year's extra income required on a household basis. We don't need Nick Smith and Len Brown arguing.

We believe that current home value appreciation is not sustainable and is due to inventory shortages and more importantly record low mortgage rates. In the future we will see stagnant or depreciating home values and a price-to-income ratio that is more in line with its historical average.

8. Cheap in gold ?

Over the past few days we have seen a sharp fall in the price of gold, news that followed reports of sharp rises in the median price of New Zealand homes (the median hit $400,000 for the first time ever). While the cost of houses in gold has fallen as a result, the shift is not a lot in historical context.

In 1992 when the price of gold was US$350/oz, it took about 170 ounces of gold to buy a median priced house. Before last week's news, the cost in gold was very similar. Today, even after the changes we reported last week, it takes only about 230 ounces of gold to buy a median priced house - not a great difference over more than 20 years.

However, this chart shows that in the intervening period there have been substantial swings and so the price of gold is not well correlated to New Zealand house prices.

9. Job losses

A couple of big job losses reported this week. Sealed Air in Rotorua announced that 112 positions would go over the next 12 months as production is shifted to their major Hamilton facility. And most DHB's announced that they will be outsourcing hospital kitchen work, affecting about 1,300 positions. But real losses in both cases won't be anywhere near these numbers. The Rotorua site is being redeveloped and more than 300 replacement positions have been announced. And the outsourcing contractors for the hospital kitchens will be involved in major hiring.

We are keeping a tally of reported job losses and we are asking readers for help keeping track of them. Let us know when you see some.

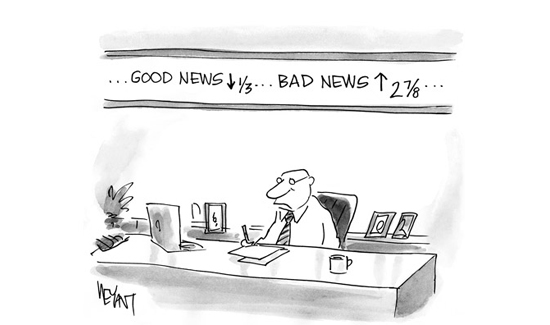

10. Today's quote

"You aren’t wealthy until you have something money can’t buy." Anon

Dairy prices

Select chart tabs

11. New service - Farms For Sale

In case you missed the announcement elsewhere of this website, starting today we are now listing working farms for sale in New Zealand, here »

28 Comments

So if it gets really bad one of the things the Govn could do is take your gold off you...hence this seems a really bad idea to me "Keep it safe. Keep it in a New Zealand Mint safety deposit box. "

The biggest danger could end up being our own Govn, so hardly a bright place to store your gold.....JK would just bring a can opener.

regards

What would their OBR staus be Steven....?.... lemmme guess....two bars for you one for me.,

"Wealthy households would face new taxes on property and other assets under German plans to prop up the struggling eurozone."

http://www.telegraph.co.uk/finance/financialcrisis/9993790/Wealth-tax-to-pay-for-EU-bail-outs.html

This is a burning fuse....closer every week to the gunpowder store.....

Is that sneaky little gold add in amongst the 10 a new thing? Or have I just missed it before?

Nah , you have missed it Scarfo....he's slipped it in before this...and rightly so I might add, could have saved a few Gold Bugs from frostbite.

Further south it goes ...glove up .

Top 10 has eleven items today and that pesky little add.

Gold anyone...? We'll keep it safe for you, honest...

Yeah, right!

HGW

#9. The Rotorua Sealed Air site proposed redevelopment is a supermarket complex. If it does go ahead, many of those 300 supposed jobs will probably be part-time checkout staff on youth rates.

New Zealand has become topical over at Zerohedge: http://www.zerohedge.com/news/2013-04-14/which-nations-are-next-credit-market-answers

The comment stream is interesting.

"The People's Utopia of New Zealand is a freaking Socialist nightmare. The mid-2000s brought back the welfare monster that bankrupted the country in the early 1980s. Red Tape suffocates the land.

Yet hiding behind the govt placing the non-productive morons at the top of society, and the productive man at the bottom, is the corporate extraction of product without value added (why make profits in the high tax region?). The whole country is asleep and has never questioned the third-world extraction model that is run in all of NZ's ag and primary production. NZ never made it developed country status. Rio Tinto was recently shaking down the govt for subsidies for an Aluminum plant (white elephant) that uses 15% of the country's electricity.

$28 Billion in govt debt in July 2008, and now $78 Billion -- which country has done worse?"

"Excellent comment, Dry Drunk. I am relieved New Zealand's precarious position is FINALLY starting to come to the surface. It has been below the radar too long. We relocated here from the US and we have smelled a rat since we arrived. I have never seen a populace so over-extended on real estate. The true economy seems non-existent. Everyone is mortgaged into 2, 3, 4 or more houses, but no one has a real income. All the money seems to get sucked out of the country overseas. All the major banks are foreign owned. The people we meet are broke, broke, broke. This is a poor farming country that has pretended to be soemthing else based on credit--borrowed money to get off the tractor and into a Range Rover. but the truth will come out. Talk about a house of cards! I am afraid for New Zealanders."

Good spotting. I like the mention that NZ could be a complex bet on China crashing. Makes ya think....

Smile .. only in new zealand .. a yanqui telling us how it is ..

Rio Tinto shaking down the govt to keep the 40 year old subsidies-teat going for a 40 year old Aluminum plant (white elephant) that uses 15% of the country's electricity

I always read the Tiwai Point news with interest as I worked there for just over a year. I still have a mate from those times working at the smelter.

Nothing like having 96,000 amps pumping through your feet, or through the buzzwork you are walking on. Not a problem though as you can't earth anywhere, just don't take your eftpos cards in. The magnetism attracts your steel caps and makes walking rather interesting.

Really Tiwai Point is responsible for an entire lake, but not many think about that aspect. I suspect that white elephant is right, like most things in this country it was probably built with a 50 year lifespan. I would suspect maintenance costs are creeping up and Rio Tinto are doing the numbers on whether it is worth continuing.

I received interesting news about Invercargill last night but might put that up on the 90@9

"Excellent comment, Dry Drunk. I am relieved New Zealand's precarious position is FINALLY starting to come to the surface. It has been below the radar too long. We relocated here from the US and we have smelled a rat since we arrived. I have never seen a populace so over-extended on real estate. The true economy seems non-existent. Everyone is mortgaged into 2, 3, 4 or more houses, but no one has a real income. All the money seems to get sucked out of the country overseas. All the major banks are foreign owned. The people we meet are broke, broke, broke. This is a poor farming country that has pretended to be something else based on credit--borrowed money to get off the tractor and into a Range Rover. but the truth will come out. Talk about a house of cards! I am afraid for New Zealanders."

There is an awfull lot of truth in tht coment scarfo.......oversimplified encapsulation perhaps, but very near the bone..... omit poor farming from the final paragraph and I think it a fair assessment when applied to Auckland...instead.

Trying to be something...based on credit.

and you want to omit farming why? The aggrecultural sector has been in on the credit bubble game as much as anybody else in the economy if not more so.

Total agriculture debt has risen from $16.6 billion in June 2002 to $48.3 billion in mid-2012. This has coincided with a huge increase in dairy and meat exports from $7.3 billion in 2001/02 to $16.7 billion in the latest 12-month period.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10843146

Note, not everybody agrees with Brian Gaynor that this is harmless,

http://www.interest.co.nz/rural-news/50515/exploring-farm-debt

Yeah, sorry Nic and mist my bad, or bad analogy really.....although I feel it more in Auckland on a day to day exposure....just way way too many people leveraged or living beyond sustainable means.....

But as you rightly point out there's no imunity to I want it all....and I want it now...while the banking industry plays Ricky the Magic Pixie telling them to....... go for it.

Kimy, the obvious question, what if houses go down %30? Never happens?

Does the bank only take %20 of you home as security or the whole thing?

I'd like to take the time to thank Kimy. Every time I read his posts, I am happy to be out of the property market.

Incidentally, renting has proved great the last couple of years. House prices are up 25% in the period but I have negotiated my rent downwards and negotiated renovations (new bathroom, heatpump) at the landlords expense.

No need to worry about me Kimy. I have enough widely-invested savings from not paying a mortgage to buy a house outright. I am not dependent on one type of asset for my future. I also have highly desirable skillset and have worked in NZ, Aus, UK and Europe. Renting allows me the option of moving at short notice should the need arise. When (not if) a housing bust happens, I can choose to buy or not.

My children's futures are safe as they will be taught not to peg their hopes on speculation and to make their incomes as resilient as possible.

Next question is who is the counter party to that unearned 50% Kimy makes? His children? or Grandchildren? Too many people around that don't look past the end of their nose, whats in it for me is the name of the game.

Kimy - your self-description is spot-on.

No growth could go forever, no hypothesis based on growth could either.

So those who assumed it would/could, were indeed DUMB.

Caveat emptor.

oh, and saying "looks academic, yawn", doesn't alter a fact.

:)

http://baobab2050.org/2011/04/02/the-herengracht-canal-perspective/

Don't say you were ignorant that it was possible, Kimy.

Yes they are ....out there..mist.....and such fashioned arrangements do take place as I can testify to.

You are wrong money is energy.

Welcome to the new world.

Its how it is post-peak oil.

NB, estiamte is as much as 50% of china's mircle GDP growth is at the expense of its environment and a lot of the rest is from its mad building spree of empty cities....so its REAL growth could be 3%...v 2% for us....

regards

Look up the Greeenspan "putt"

regards

" theft to bail out failing banks that made stupid loans."

Now ask yourself what the smart savers will be doing right now across the euro zone...stash the cash...buy the gold...the art...the property...spread the deposits...hide the wealth...

Guess which hated groups have already moved their stash?

Why am I not surprised that this fool is surprised!

"The chief executive of the Prudential Regulation Authority (PRA) said that it was a “source of some surprise” to him that authorities had brought cases against junior bankers but not senior directors.

Speaking at a conference in London, Mr Bailey said it was “not the job of the regulator” to say if individuals should go to prison.

But he added: “It is to my mind a very striking observation and difficulty with the crisis that no formal action has been taken against any chief executive or any chairmen of a failed institution. Not because I have a personal vendetta against them but it is more than odd that action has been taken against people lower down institutions but not at the top.”

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/9995972/Andrew-Bailey-its-odd-UK-bank-bosses-have-avoided-formal-charges.html

Also from the Telegraph and the laugh of the day

"The EU and IMF have predicted that Greece can meet budget targets without further austerity and that the Mediterranean country will shrug a GDP contraction of 4.4pc this year to return to growth in 2014."

Wolly... "stash the cash...buy the gold...the art...the property...spread the deposits...hide the wealth..."

Exactly......all good but not on margin....own it and then no worries. How many are adding all those interest charges to the purchase price of the house......you need to be free and clear then the volatility becomes entertaining.

Cheers

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.