The Covid crisis IS changing us.

These changes can be measured by our habits and what we are spending money on. There's good news and bad news. We are eating more healthily. But we're drinking more. And some of us are ramping up the gambling. In the meantime, regardless of what we are buying, we are now doing it much less by using cash.

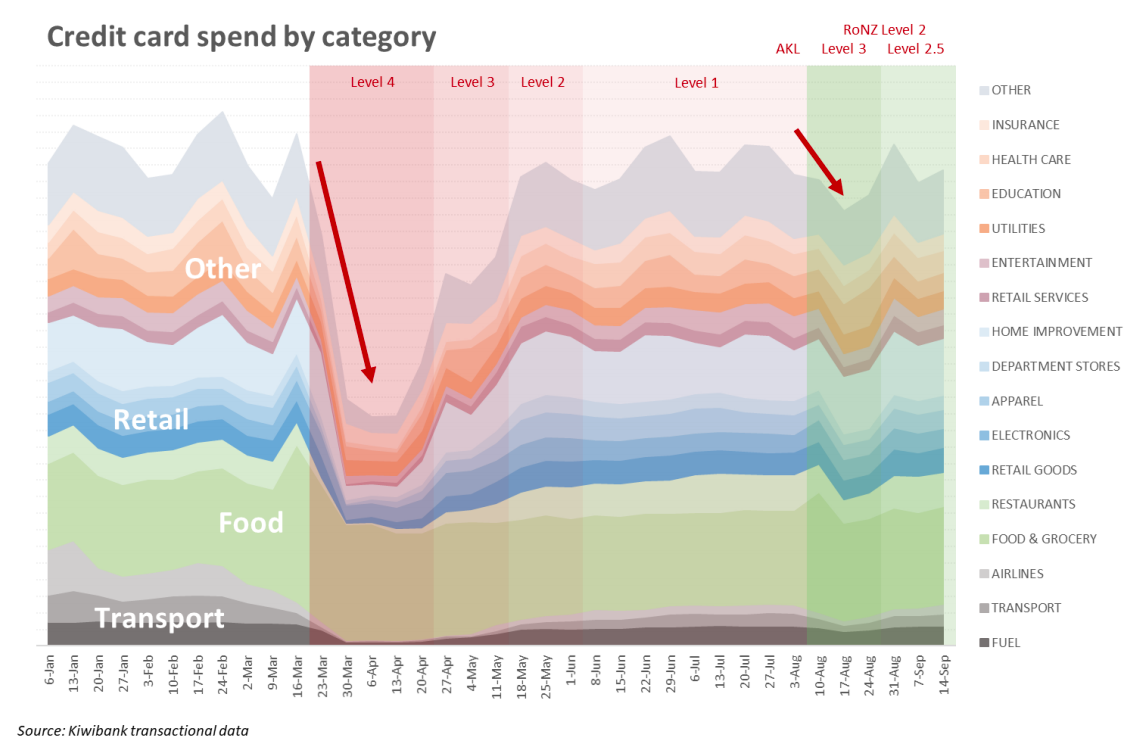

Kiwibank economists have been doing a big crunch on the spending patterns of Kiwi households in their Kiwibank Household Spending Tracker for the September quarter. The data tracks the card spending patterns of Kiwibank customers through the various Covid Alert Levels.

"We’ve picked up some good habits," the economists say.

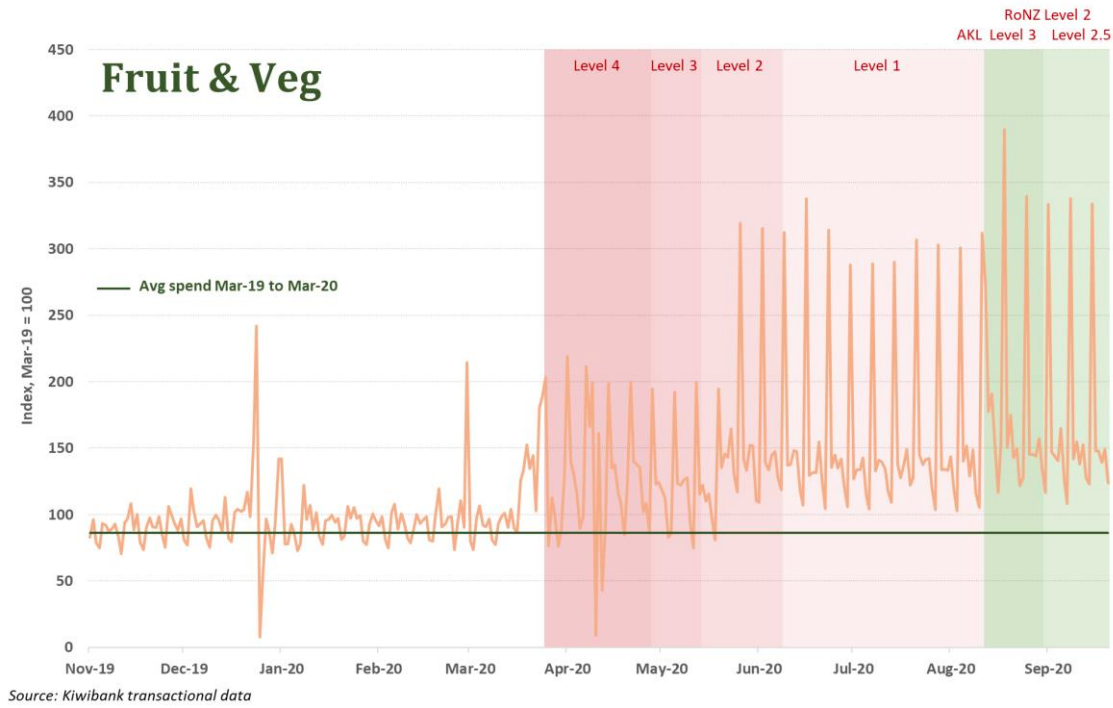

"...Spending a lot more on fruit and veg. A healthy response to a health crisis.

"We’ve also embraced the convenience of shopping online and enjoying entertainment at our fingertips."

But then there's those bad habits that have been creeping in...

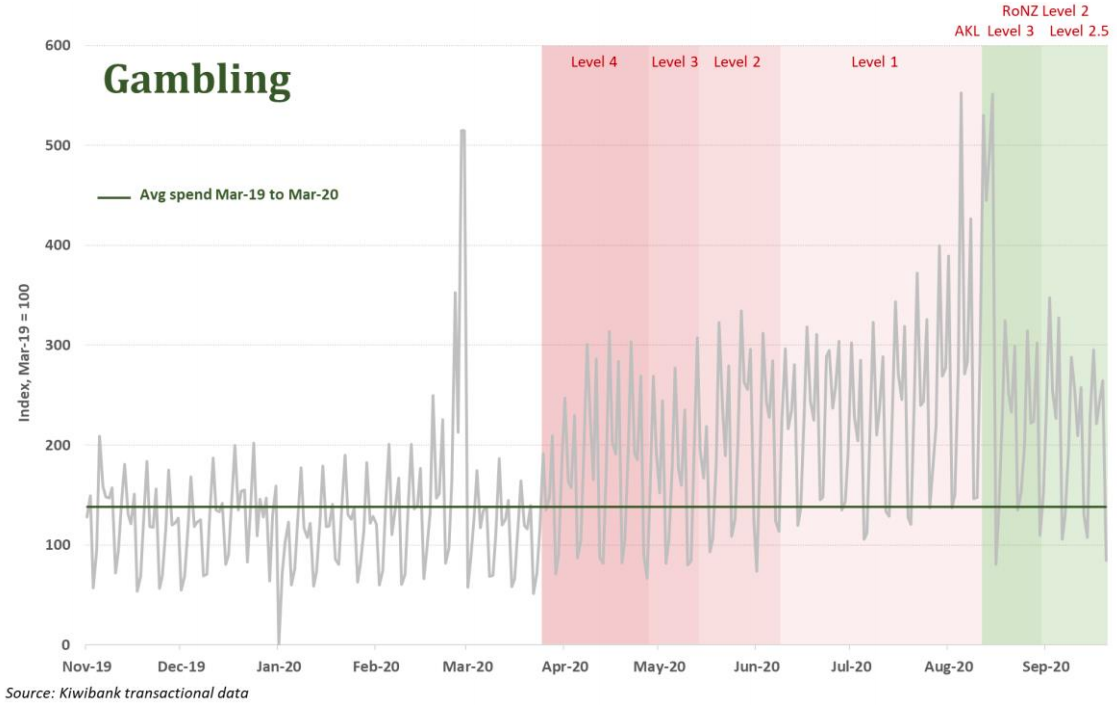

"Gambling and alcohol spending are among categories experiencing a persistent shift higher," the economists say.

The other key change in habits has been a fall in the demand for cash, as people embrace payWave and online shopping.

The economists say that the change in habits that started during lockdown are now looking increasingly permanent.

"More of us are embracing the convenience of shopping online and ordering from our favourite eateries on a smartphone."

They note that in a health crisis, healthy eating is something we can control and hence the increased spending on fresh fruit and vegetables has soared.

They say that consuming more fresh produce is partly a replacement for not being able to eat out.

"But even as restaurants have reopened, we still can’t get enough of our greens. A change for good."

However, increased spending on alcohol and gambling "looks like an unwanted hangover".

"Fewer drinks at the pub or casino may be replaced with more around the socially distanced BBQ, and a betting app."

On the move to less cash, the economists say weekly cash withdrawals took a stepdown during lockdown and haven’t recovered.

"Hard currency isn’t needed as much if more shopping is done via payWave or online. But the drop in cash withdrawals can’t explain the entire rebound in spending we’ve seen on cards."

The economists say people "are adaptable creatures", and Kiwibank’s transactions data show Kiwis are adjusting. Auckland’s August lockdown showed a familiar pattern to the initial, national lockdown. Spending fell, with traditional service business most affected. But the overall drop in spending was unlike the first.

"Businesses and households have quickly learnt to trade in a world with limited face to face contact. Many have re jigged their business models to accommodate social distancing and the shift to digital. We’re getting better at living with alert levels."

Worries ahead

The economists say the tourism sector had a good winter, but there’s concern about the summer season.

"We’re wary of the damage done. The drawbridge into NZ won’t be let down anytime soon. Greater domestic tourism goes some way. But foreign tourism is a hard void to fill, especially over Summer. Diverting Kiwis from going overseas, to the slopes of Queenstown worked in the weaker winter period. But the droves of foreign tourism normally seen during the summer months cannot be offset by locals."

Also the economists think the strength in spending may ease as job losses rise.

"The unemployment rate is expected to rise in the coming months. Companies have failed, and more may fail. The wage subsidy has supported many business and households. But that lifeline is coming to an end. More job losses are expected. Consumer confidence could wane (further), with more subdued spending. The pace of our economic recovery may slow as a result."

And they say, not all businesses will survive.

'More needed'

"Defaults to date have been surprisingly low. Government and central bank support have helped many businesses stay open and afloat. We Kiwis are resilient people. But the near term outlook may deteriorate before it’s gets better. Business investment activity is understandably weak given such high uncertainty. More is needed, especially from the Government, to spur activity. The good news is, they are able to deliver. The Covid Response and Recovery fund is still looking rather plump."

With Auckland moving back up to Alert Level 1 as of early Thursday morning, the economists say they are expecting "another bounce" in spending.

"The end of the wage subsidy scheme however will weigh on the strength of the rebound. Unemployment is expected to rise. Consumer confidence could wane, with more subdued spending and investment likely.

"The decline in personal incomes across US households and slowing consumption growth is something to watch out for in NZ. Time will tell," they say.

2 Comments

"The decline in personal incomes across US households and slowing consumption growth is something to watch out for in NZ. Time will tell,"

"Yeah Nah. The wealth effect will pull us through". (Not my words. This is a consensus speaking).

"the change in habits that started during lockdown are now looking increasingly permanent." - this is the money shot for me.

Glass half empty - it's gonna crucify businesses which import, make, retail or repair some of the consumer categories which are now seen to be superfluous. And the domino effects of this - employment, transport and logistics, lenders, etc - the usual 'multiplier' - are essentially unpredictable - there's no "Reverse BOM' for the modellers.

Glass half full - it's the 'Refuse, Reduce, Recycle, Repair' etc cycle starting to work in wider and wider ripples....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.