Credit bureau Centrix is providing further evidence that Kiwis are taking the Level 4 lockdown more in their stride than they did a year ago.

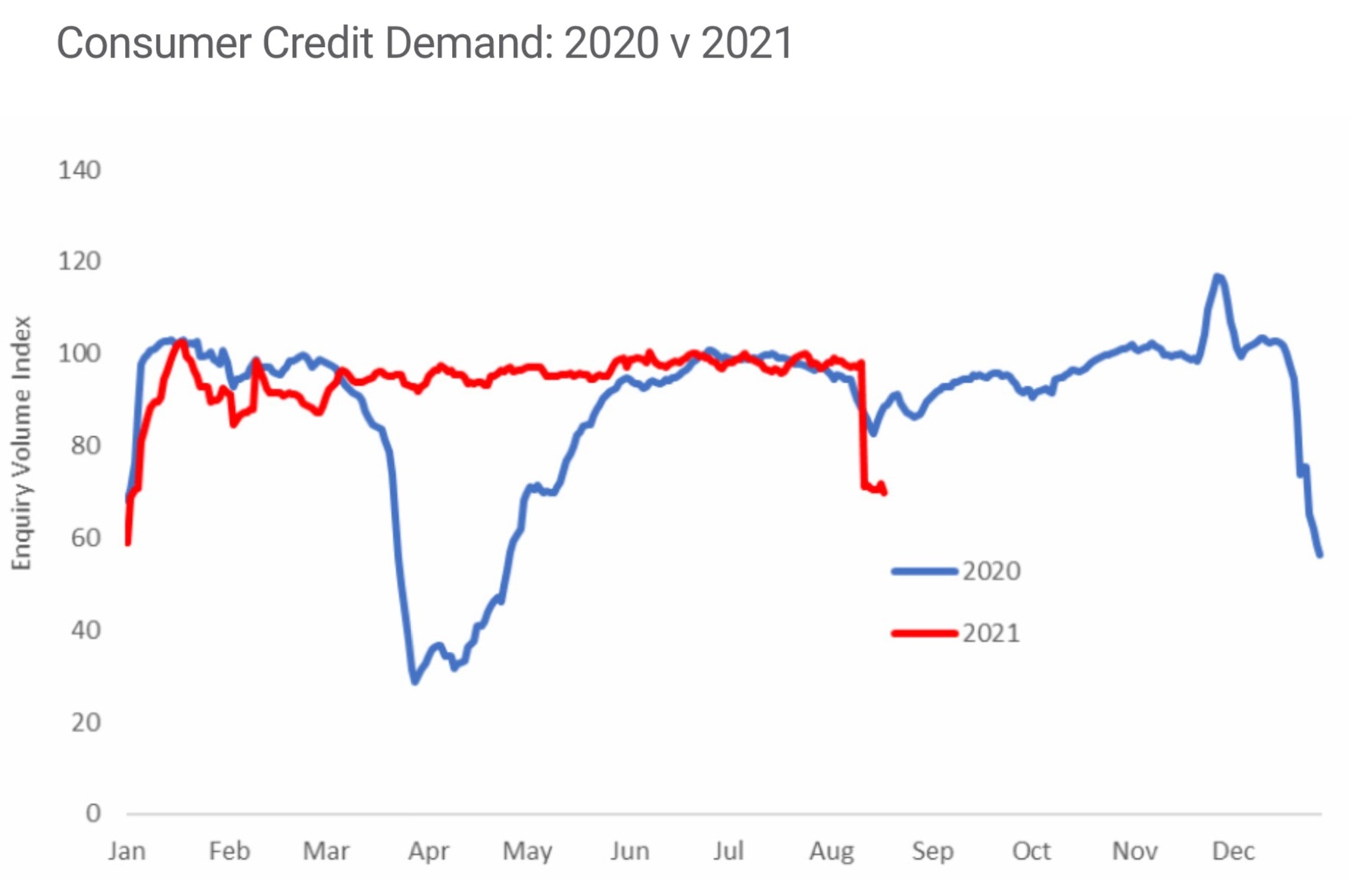

Following on from reports of spending, yes, falling sharply - but nowhere near as sharply as at Level 4 last year, Centrix reports that while credit demand dropped 30% in response to the latest lockdown - a year ago it plummeted 70%.

In Centrix's August Outlook Managing Director Keith McLaughlin said while the shift in Alert Levels is a shock for the economy, "it doesn’t appear to be as severe as last year’s move to Alert Level 4".

"It is still early days but credit scores, arrears levels and financial hardship cases remain stable across all levels, while the fall in credit demand isn’t as nearly as deep as last year’s 70% fall."

It was likely New Zealanders entered this lockdown with more confidence, "remembering the strong economic rebound that followed last year’s lockdown", McLaughlin said.

"But a long lockdown in Auckland might change this, putting pressure on businesses and households and requiring the introduction of further monetary and fiscal support," he said.

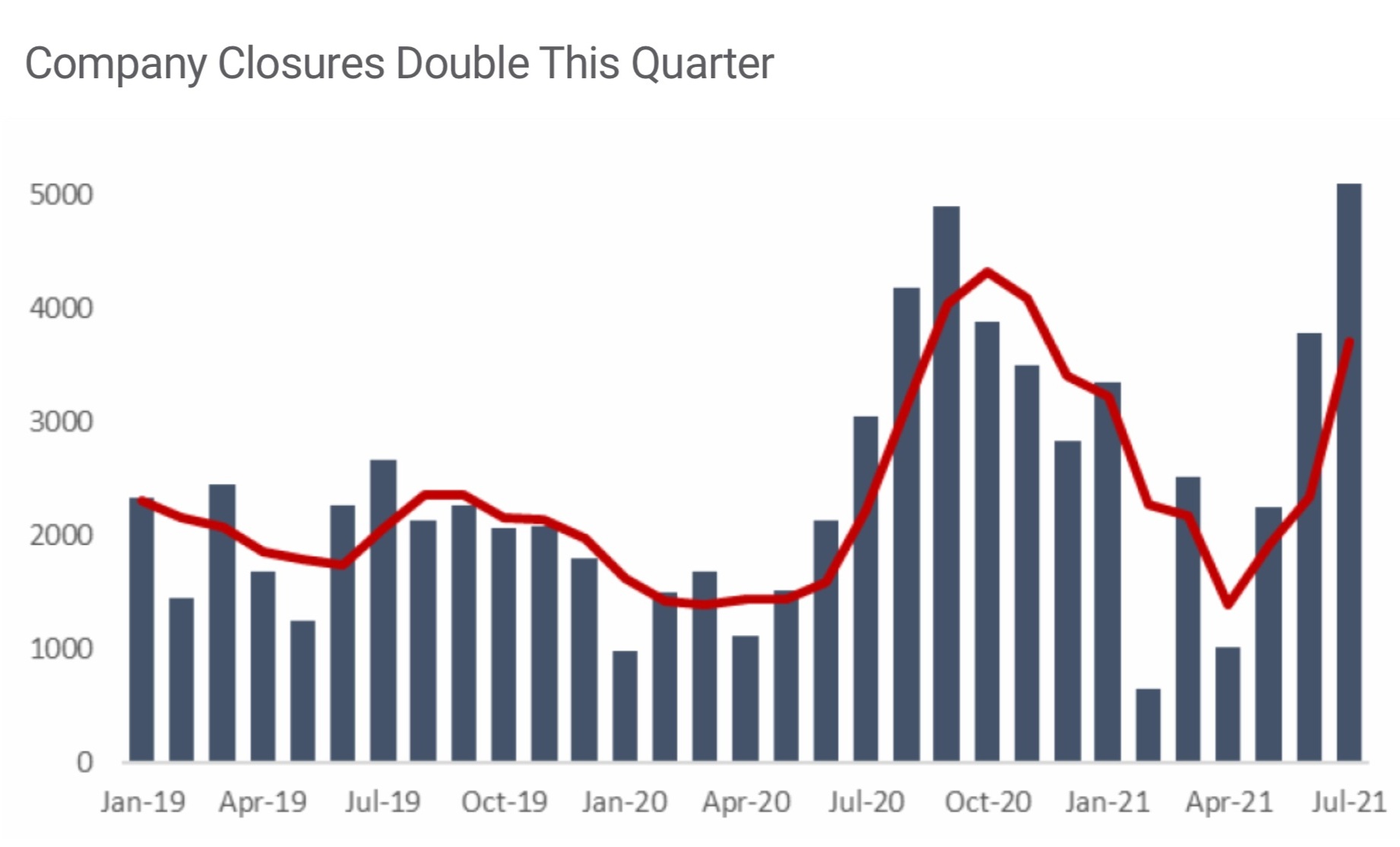

"Business closures and credit defaults were already rising as smaller firms increasingly experienced cashflow stress."

He wondered If greater numbers of households also started experiencing cashflow issues, "we might even see the reintroduction of the Mortgage Deferral Scheme", that was put in place last year.

At this stage there's been no indications the scheme will be returned.

"Whatever intervention is planned in the coming weeks, it is comforting that credit demand is holding up better than the first Alert Level 4 lockdown, at least for now," McLaughlin said.

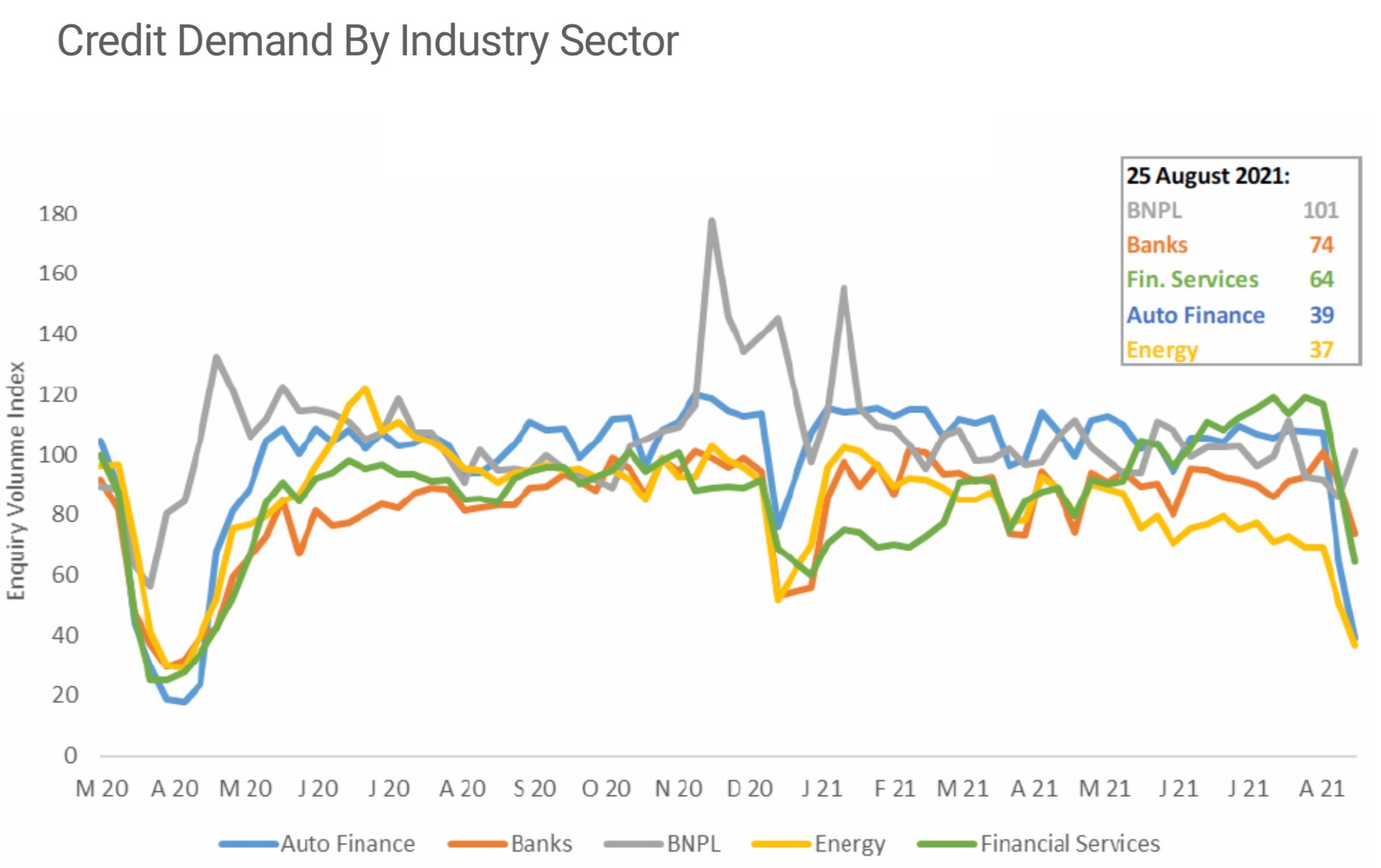

In terms of spending/credit patterns, McLaughlin noted that lockdown supports increased online shopping and as a result there had been an uptick in buy-now-pay-later (BNPL) applications.

"All other sectors have trended down, with auto and energy sectors hardest hit since the transition to Alert Level Four. Mortgage applications also fell to the lowest level we have seen in 2021, alongside auto loans, personal loans and new credit card applications."

McLaughlin said leading into August, the number of accounts reported past due rose by 1.5% in July. The proportion of accounts reported in arrears was up for most account types, with the exception of auto loans and mortgages (held flat). There are 15,250 (1.08%) residential mortgage accounts currently past due. Arrears rates in general are still at an all-time low.

And on the business closures and credit defaults, McLaughlin said as another lockdown challenges business owners again, business closures over the last quarter doubled while new business registrations were down 4% in July.

"Business credit defaults were up 11% over the last quarter. Despite this, business liquidations are also down 34% year-on-year, suggesting the closures are voluntary. Looking at industry credit defaults, we see higher levels of defaults in rental/property, accommodation/food, transport, construction and financial services. It’s clear these industries were the hardest hit by the initial impact of Covid-19 in 2020 and the ongoing recovery."

*Separately, Paymark says payments processed by Paymark through merchants in the core retail sector were down 34% to $975 million in the 14 days ending 31 August 2021, versus the same 14 days in 2020.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.