Content sourced from the World Gold Council. The original is here.

The current global economic landscape indicates improving economic conditions, higher inflation and rates expectations, as well as commodity supply shortages which are likely to support commodity performance. This is reinforced by the fact that investors are increasing their allocation to commodities.1 While broad-based commodity investments are often used as a source of returns and diversification, the benefits tend to be tactical.

Our analysis suggests that gold is still the most effective commodity investment in a portfolio as it continues to stand apart from the commodities complex. It deserves to be seen as a differentiated asset as it has historically benefited from six key characteristics:

• It has delivered superior absolute and risk-adjusted returns to other commodities over multiple time horizons

• It is a more effective diversifier than other commodities

• It outperforms commodities in low inflation periods

• It has lower volatility

• It is a proven store of value

• It is highly liquid.

2021 key developments

Gold is a commodity that has always stood apart, but there have been recent market developments that build on its existing differentiators while illustrating the importance of its role in a portfolio.

• The commodity reflation trade is in full effect, which can negatively impact risk-on assets and could suggest a larger allocation to gold

• Gold’s weight in commodity indices is increasing, and should continue to increase for a strategic allocation

• Gold’s volatility has been stable despite the variability in equities, bonds, and alternative assets.

Commodities can be tactically relevant investments, but a strategic gold allocation on its own can supplement or replace a broad-based commodities investment.

Real assets have tended to do well in reflationary periods

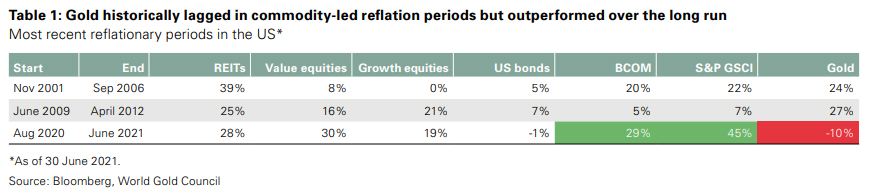

Understanding historical asset performance during reflationary periods is relevant for understanding how assets could perform during the current period. We examine the performance of various assets during the last two periods of reflation, i.e. Consumer Price Index (CPI) trough to peak, and compare this to the current environment.2

The results confirm the idea that assets like Real Estate Investment Trusts (REITs) and Treasury Inflation-Protected Securities (TIPS) were solid performers, with commodities and gold performing well. Additionally, it confirms gold’s meaningful outperformance over equities and bonds.

But what it also suggests is the potential upside in gold compared to how broad commodities have performed during the recent reflationary period. In the previous two periods, gold outperformed broad commodities. However, in the current environment, gold is down 10% compared to commodities, which are up substantially.3

Gold lagged other commodities beginning in May 2020, and has continued through the first half of 2021, but this is not unusual in commodity-led reflationary periods historically, as we addressed in our recent publication, Gold, commodities and reflation. Historically, gold lags initially, but catches up to most major commodity groups by the second and third years of a reflationary period.

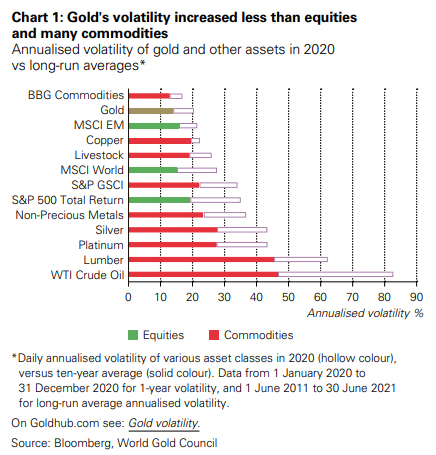

Volatility has increased globally, but less so for gold

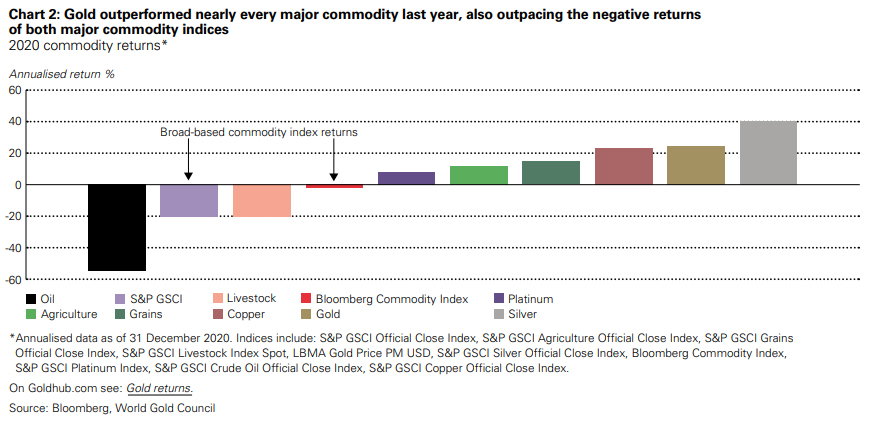

Volatility increased across major assets and commodities in 2020, driven by COVID-19-induced uncertainty, but less so for gold comparatively (Chart 1). A key reason for gold’s relative stability stems from its role as a diversifier in turbulent markets, as well as stronger left-tail correlation between many other commodities and risk-on assets.

It is interesting to note that the increase in the volatility of the broader Bloomberg Commodity Index (BCOM) in 2020 was not as substantial as one may have expected. This is largely a function of the significant dispersion of commodity performance, particularly with oil performing so poorly, and other commodities like gold performing so well, evidenced by overall commodities returns of -24% and -3%, compared to a gold return of 25%.4 Simply put, commodities as a whole exhibited lower volatility than gold, but they did not protect the portfolio as well as gold (Chart 2).

Focus 1: Commodity index providers have increased their gold weightings

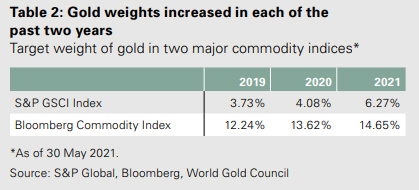

In November 2020, we noted that major commodity indices would increase gold weightings for a second year in a row, which is an indication that index providers are, perhaps, acknowledging a greater importance for gold within a portfolio and broad-based commodity index.

Our 2019 report discussed our belief that gold’s weighting in the broader commodity indices was underrepresented. Some of the reasons for this include:

• the diversity of gold’s liquidity

• the lack of understanding of overall gold trading volume

• capped weights in specific sub-sectors

• gold’s economic significance

• the size of the gold market

• its diversification benefits.

Since then, gold’s weight in both the S&P GSCI and BCOM has increased two years in a row, with 2021 highlighting gold as the largest individual commodity weight increase in the S&P GSCI, as well as its highest weight ever in the BCOM.5 This also took the precious metals weight of the index to an all-time high. The weight increase in both indices is broadly a function of increasing production and trading volumes. Focus 3 provides specific details on the index target weight methodology for both indices.

While our analysis suggests the ideal weight of gold in an optimised commodity portfolio should range from 20% to 35%, we feel the continued increases are a step in the right direction.6

Notes:

1. “Rethink, Rebalance, Reset: Institutional Portfolio Strategies for the Post-Pandemic Period”, July 2021, Coalition Greenwich (formerly Greenwich Associates).

2. Using National Bureau of Economic Research (NBER) recession index (USRINDEX) via Bloomberg to determine analysis starting points. In our analysis, a reflation begins during the last month of the NBER recession and is loosely characterised as an environment of resurgent economic growth twinned with rising inflation and interest rates.

3. 31 August 2020 to 30 June 2021.

4. Total returns for the S&P GSCI and Bloomberg Commodity Index for 2020, respectively.

5. S&P GSCI is a world production-weighted commodity index based on the average of the previous five years.

6. Analysis based on New Frontier Advisors Resampled Efficiency, including individual and sub-index commodities. For more information see Efficient Asset Management: A Practical Guide to Stock Portfolio Optimization and Asset Allocation, Oxford University Press, January 2008.

This is part of a World Gold Council publication, Gold: the most effective commodity investment, which is available here.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

23 Comments

I’ve been reading and hearing about the benefits of gold for years but the returns have been terrible compared to other investments. I’m open to being convinced otherwise though.

You only need 2 things to make a fortune out of gold ... one , being excellent timing at when to enter & to exit the market .... simple huh !

... the other being a means of leverage to juice up potential returns ... there's no shortage of choices there .... a personal favourite is options on junior Australian gold explorers listed on the ASX .. .

Easy peasy , right !

Absolutely right GBH.

Here's the evidence - pretty steep inclines if you pick your entry and exits right!

Yeah Gold has been pretty much the price it is today for as long as I can remember, all the smart money has gone into houses.

Some of the smart money has gone into pharmaceutical companies .... given the current covid pandemic ... CSL in Australia , manufacturing Astra Zenica at 1 million doses per week .... also Merck .... 'cos , the stupid money has gone into buying ivermectin , which Merck makes ...

... perhaps private clinics or hospitals too ... better than gold .... fixing up all the mad hooas who've wrecked themselves on ivermectin ....

No patent coverage on ivermectin, it's been around since the 60s. Nobody makes money from it.

I wish I knew where the smart money was going. I personally invest mostly in realestate, but I own a little gold, British American tobacco, Japan tobacco, and imperial brands, some tech stocks, apple tesla dlocal wise, some oil companies, some mining stocks. esg fanboys can put that in their pipe and smoke it.

A real ethical stand up investor...well done leaving the planet in a worse place once you pass on.

In NZ look only at housing as has support of reserve bank as well as political class and will never go wrong, specially current current government headed by Jacinda Arden.

https://www.nzherald.co.nz/nz/opinion-government-has-caused-housing-cri…

That statement shows that you misunderstand the role of gold.

"While our analysis suggests the ideal weight of gold in an optimised commodity portfolio should range from 20% to 35%, we feel the continued increases are a step in the right direction."

Missing comparison to BTC ...wonder why that is?

Yes. You are correct. Those who have held gold for >10 years would have been better off switching into Bitcoin. And I am talking about those own gold as a hedge against all the money printing and asset bubble malarkey. I even added to my gold holdings and gold mining holdings in the past 2 years. You could have invested in the NZ Dividend Yield and done better than gold or GDX (gold miners ETF). Here's a few points:

-- If the money supply of USD has increased by 25-30% over the past 12 months, then surely the price of gold should have gone up be an equivalent amount or more. This just adds to the disillusionment with gold.

-- I have come to the conclusion that the ruling elite have let the banks (JPM) continue on their corrupt practices related to gold price manipulation. They're allowed to profit from the gold price because they effectively set it.

-- Central banks and treasuries around the world that still value gold are in a relatively good position if they want to add to their holdings. Conspiratorial or not, there are discussions suggesting that China and Russia will eventually corner the gold market while the West clings to its dirty fiat and not back it with anything.

Wow!

Analysis from the world gold council, suggests we should invest more in gold.

I'm convinced.

Most people don't have 2 sticks to rub together so gold is probably the last place to park money or savings. However, if you own gold tokens like Pax Gold, you can earn 5.5% yield on some respected DeFi platforms. This is probably not going to be of interest to the traditionalists, but better than cash.

Certainly better than what we can expect over the horizon if Germany is considered a relevant forward looking signal.

Good Morning from #Germany where the financial repression intensifies. Real yields (10y Bunds-inflation) plunged to -4.34%, a fresh All-Time low after inflation jumped to 3.9% in August from 3.8% in Jul. Real yields now NEGATIVE for 64 consecutive mths, another historical record. Link

The only problem I have is discerning a liquidity factor in respect of DeFi lending conduits compared to US Treasury Bills for instance - currently considered ultra pristine collateral in the eye of most market professionals.

Yes Audaxes. US Treasury Bills have little relevance to most people anymore. Institutions perhaps and the 1%ers but I don't really see any relevance to the little guy. I would prefer exposure to gold.

Also, while NZD and AUD are relatively strong in the scheme of things, and even though the interest rate differential still exists (kind of), I would not be surprised to see NZD plummet. So this is another benefit of holding gold in the NZ context.

You are not wrong about T Bill use for the majority of citizens.

Their (T Bills) main value is supporting/bolstering leveraged and repo trades gone wrong due to the underlying asset no longer commanding the credit rating it had at the outset - much cheaper to offer pristine collateral to the cash lender than face asset liquidation when buyers have vanished or are waiting to pick at a carcass. That's why 0.00% bids were accepted for 4 week bills at the most recent US Treasury auction. There is something not right in the shadow banking (global eurodollar) system. Hence Gold's recent bid.

I always learn something from your uber-economically literate responses.

This is a reply to the person suggesting property is still the best investment.

If millions are being asked for a garden shed with a view, I would rather leave the buying to you!

Who said anything about "Still" ? Anyone who bought that garden shed for millions a year ago has made a killing. Anyone not already in a house has missed the latest "gold rush". Where the market goes from here is anyone's best guess, but currently it is still going up 2-3% every month. If gold was a true "Store of Wealth" then its value should be going in the opposite direction to the value of the USD. Even if you look at the changes over the last 6 months, Gold should already be over $2000.

According to Martin Armstrong, (if you don't know him - he's worth knowing!), gold won't rocket up (and stay up) because of inflation or geopolitical tensions - it will increase in dollar terms in a manner corresponding to the loss of faith in the fiat monetery system.

You probably wouldn't want to convert it back to dollars at that point anyway, would you!

This is the isurance policy that is gold.

From Bloomie:

Gold and Bitcoin have high potential to continue advancing in price, notably if U.S. Treasury yields resume their enduring downward trajectories, following Japan and most of Europe. We believe the mantra “There is no alternative” — or TINA — that’s been keeping the market afloat may be losing some luster to assets that are more likely to appreciate on the back of entrenched trends amid rising quantitative easing and debt-to-GDP levels. Our graphic depicts the Bitcoin-GoldBond index outperforming the S&P 500 since the end of 2015, notably from the start of 2020, along with the rapidly rising level of G4 central-bank balance sheets.

https://www.bloomberg.com/professional/blog/bitcoin-at-100000-5000-ethe…

Its a bad idea to put Gold and Bitcoin in the same basket. The Bitcoin basket has a big hole in the bottom of it.

Slow clap....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.