Personal Finance

/ analysis

World Gold Council analysis shows that gold can help mitigate key risks by providing diversification that works, protection against high and extreme inflation, and enhancing risk-adjusted returns

24th Apr 22, 10:00am

by

The traditional Defined Contribution (DC) investment portfolio made up of equities and bonds has worked well for investors for a long time. For much of the last 15 years, the environment that has afforded this success has been driven by central bank actions such as ultra-low interest rates and quantitative easing.

But with geopolitical and inflation risks rising, the economic backdrop so uncertain, and bond yields low, it makes sense that investors should reconsider traditional thinking. They should question whether to expand the range of assets that can act as “safe havens” in their portfolios to include assets such as gold.

Shortcomings of government bonds as a diversifier

For many DC investors, high quality government bonds, such as UK Gilts, have long fulfilled the traditional role of diversification in investment portfolios, offering protection during periods when risk assets have come under pressure.

Moreover, investors have been unusually well compensated for protecting balanced portfolios by the generous legacy coupons on government bonds and the sheer strength of the bull market in sovereign bonds over the last 15 years. Today’s meagre yield, however, means government bonds’ long-term ability to function as a “shock absorber” has greatly diminished.

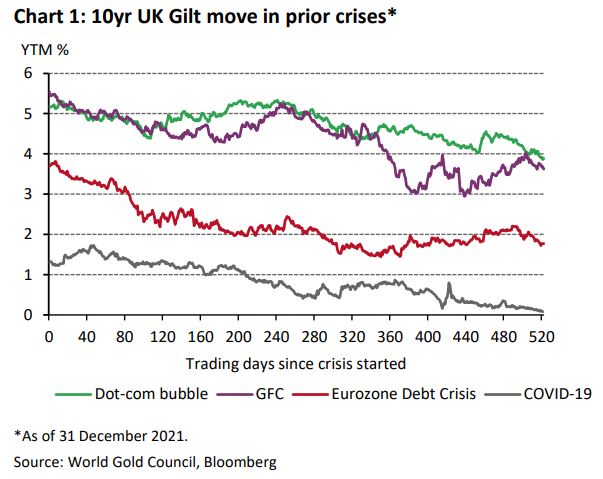

Chart 1: 10yr UK Gilt move in prior crises*

At current yields, the scope is, broadly speaking, limited for yields to be able to move down circa 2% and replicate moves of past crises such as during the global financial crisis (GFC) or the COVID-19 induced crisis (Chart 1).

In addition, high quality government bonds were also favoured as a safe-haven asset during the last 20 years because inflation was subdued and quantitative easing distorted bond markets. But risks invariably exist. Having benefitted from enormous fiscal and monetary policy stimulus in 2020 and 2021, the world economy will have to adjust to a new policy reality going forward. And with the inflationary flare-up proving far more intense and persistent than predicted, major central banks have turned decidedly more hawkish. The Bank of England, for example, hiked again in February and is poised for additional rate increases this year.

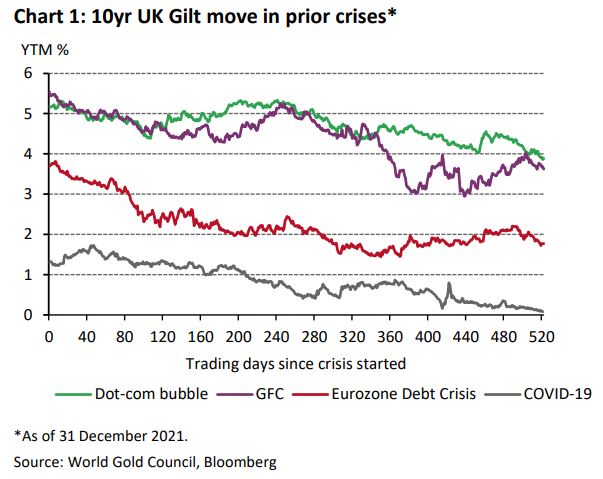

As Chart 2 shows, higher inflation weakens the appeal of government bonds as a diversifier. At inflation levels below 2%, the correlation between global equities and global treasuries has been negative, providing diversification. At levels above 2%, this relationship has historically started to break down.

Chart 2: Rolling 3yr correlation of global equity and global treasury bond returns vs. 3yr average G7 core inflation*

The lessons here are twofold:

- the downside to bond prices is now, potentially, much greater than the upside

- there is no guarantee that bonds and equities will remain negatively correlated with one another, particularly considering the inflation outlook.

It is important, therefore, to have assets that can help in these scenarios and not rely solely on government bonds as your diversifier.

Gold as a diversifier and an inflation hedge within DC investment portfolios

We have thus far outlined the issues that represent a challenge for DC investors trying to design well-balanced portfolios. They need to be cautious of the risks of inflation and take account of the low yielding environment.

Our analysis shows gold is a clear complement to equities, bonds, and broad-based portfolios. A store of wealth and a hedge against systemic risk, currency depreciation and inflation, gold has historically improved portfolios’ risk-adjusted returns, delivered positive returns, and provided liquidity to meet liabilities in times of market stress.

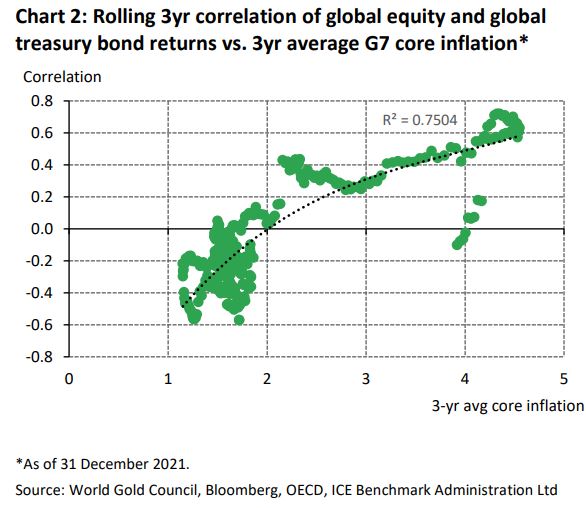

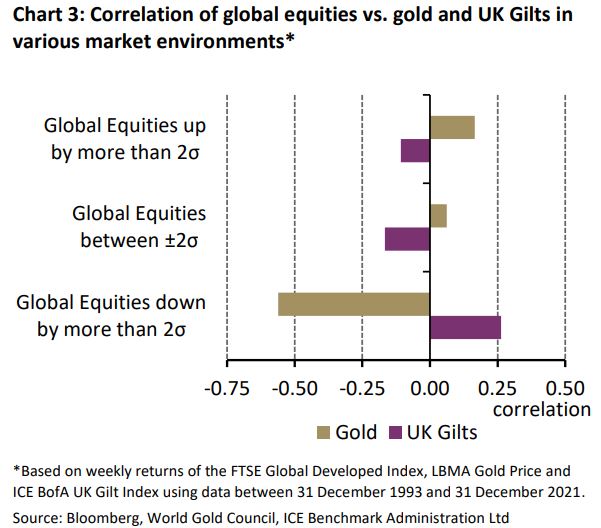

While effective diversifiers are sometimes hard to find, with many assets becoming increasingly correlated as market uncertainty rises, gold is different in that its negative correlation to equities and other risk assets, as seen in Chart 3, increases as these assets sell off.

Chart 3: Correlation of global equities vs. gold and UK Gilts in various market environments*

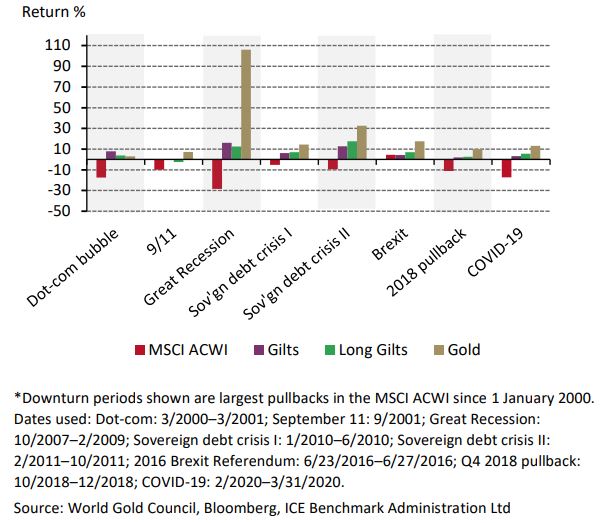

With few exceptions, gold has been particularly effective during times of systemic risk, delivering positive returns and reducing overall portfolio losses (Chart 4).

Chart 4: Gold provides downside protection

Global equities, UK Gilts and gold returns (in GBP) during periods of systemic risk*

With inflation surging to multi-decade highs, DC scheme members may be most concerned about increases to their cost of living, which are likely to outpace salary growth. Members in the early part of their savings journey will likely continue to focus on growth assets, but those closer to retirement may need guidance about what higher inflation means for their retirement plans and how their investment strategy can protect the real value of their savings.

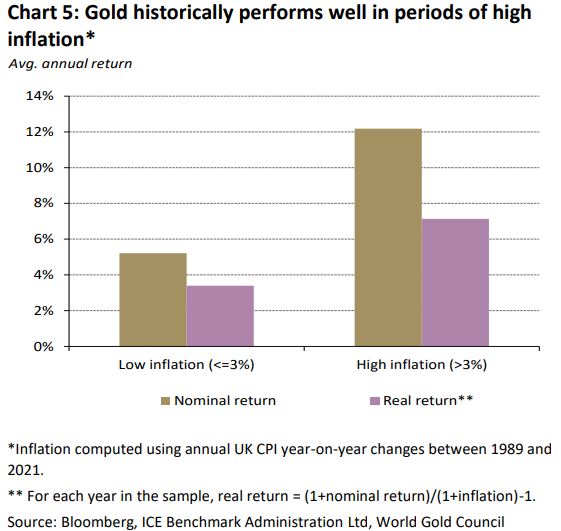

Chart 5: Gold historically performs well in periods of high inflation*

And gold has long been considered a hedge against inflation, with the data confirming this (Chart 5). Also, the annualised return of 9.1% in GBP over the past 50 years has outpaced the UK and world consumer price indices (CPI).

Case Study – The impact of gold within a DC asset allocation

From current levels, a traditional equity/bond portfolio may not deliver the type of diversification and returns achieved historically, as the major central banks have lowered interest rates towards zero over the past 20 years. As a result, we believe DC investors should consider alternatives to high quality government bonds, such as gold.

What is appropriate at different stages of DC investing and where could gold fit?

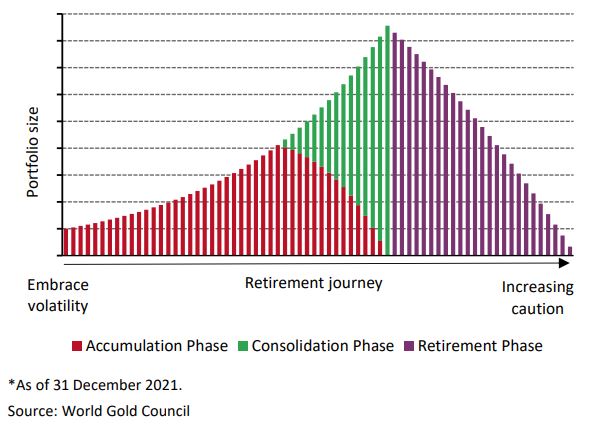

A core belief of the DC pension industry centres around the fact that risk will be rewarded over long horizons, while effective risk management is needed to support good outcomes for those closer to retirement (Chart 6). As such, in the accumulation phase, members are a long way from retirement and have time to ride out the ups and downs of the stock market. In this phase, and despite the fact that gold has delivered some healthy returns over the last 50 years, short-term risk mitigation through diversification of asset classes, and the addition of gold, could be seen as a headwind to potentially higher long-term returns. We are, however, of the opinion that gold has a role to play in consolidation and retirement phases, as protecting against negative returns is important because a member’s outcome could be significantly impacted by a market downturn, with little time left for recovery.

Chart 6: Retirement journey*

With member outcomes being a key factor in setting all aspects of DC strategy, we assess how an allocation to gold can impact the future retirement incomes of investors.

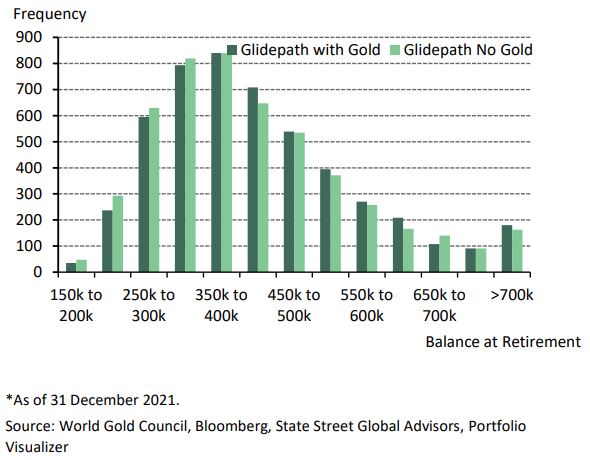

Using long-term asset class forecasts (see Appendix for more details) and assumptions (Table 1) around starting salary, salary increases and contributions, we’ve projected the range of potential pension outcomes for a glidepath with and without gold (see Chart 8 and Chart 9 in the Appendix for details). The glidepath with gold has a modest but meaningful 5% allocation to gold built over the consolidation phase of the retirement journey.

Table 1: Monte Carlo assumptions*

| Assumptions | |

|---|---|

| Starting salary at age 21 | 30k |

| Annual salary increases | 2% |

| Annual pension contributions | 10% |

*As of 31 December 2021.

Source: World Gold Council

These forward-looking projections provide us with a number of key insights (Chart 7):

- the distribution of outcomes at retirement (age 65) for a glidepath with gold is skewed towards the right-hand side, meaning the median portfolio at retirement is higher and the potential worst outcomes are reduced

- a 5% gold allocation throughout retirement can also provide a more secure income in retirement, as a portfolio following a glidepath with gold will exhaust its assets after a portfolio without gold.

Chart 7: Distribution of outcomes at retirement – age 65

Monte Carlo simulation results for 5,000 portfolios using long-term asset class forecasts and historical asset correlations and volatility. The distribution of outcomes suggests portfolios with gold outperform*

Conclusion

In short, there are several advantages to diversifying the sources of safety in an investment portfolio beyond just high quality government bonds. The way gold and government bonds perform going forward is likely to be different from one another. That feature alone should appeal to DC investors.

As demonstrated in the case study, gold can help mitigate the key risks faced by DC investors – investment risk, inflation risk and longevity risk – by providing diversification that works, protection against high and extreme inflation, and enhancing risk-adjusted returns.

This article was first published here. The original also has an Appendix.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

5 Comments

Most NZers would not consider having exposure to precious metals and don't be surprised if the financial advisors would not recommend gold in a portfolio as the commissions are not high enough.

Try selling physical gold without a major commission deduction..

by

Rex Pat

|

25th Apr 22, 12:58pm

Yes, you could drive a bus through the margins for buying and selling coins. I keep some for use if the NZ economy turns to custard. However I see them going to my estate rather than use them. However, head and shoulders above all else for portable value storage is Rolex sports watches. You could get on a plane with $50k on your wrist and sell in any major world city.

... the best exposure to gold is through share ownership on the ASX , some Aussie mining stocks ... a few pay dividends , too ...

But ... gold is not " the best hedge against inflation " as spruikers claim .... property and shares are ...

... gold is a speculative bet that the financial world is going to hell-in-a-handbasket ... and even when we do have a GFC , gold sometimes plunges too ...

I have said previously that I cannot see why this blatant advertising is allowed on this site, irrespective of the merits of gold as an investment.

However, I might point out that over the past 10 years from the charts i have just consulted, while the gold price has risen by a paltry 14%, the NZX50 index-in which i am heavily invested-has risen by 336%. Additionally, the 14% figure takes no account of the costs of purchase or storage.

Those who want to hold it are welcome to it.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.