By Daniel Hynes and Soni Kumari*

Highlights

-

Gold prices started the year with a bang, advancing by 3.5% in the first two weeks. We hold a constructive view for gold over the next 12months, but a short-term correction looks likely if a hawkish Fed surprises the market.

-

Investment and physical demand are supportive for 2023. China’s reopening sets the stage for resilience in the buying of physical gold.

-

Technically, bullish momentum is still intact, with prices breaking USD1,878/oz. Nevertheless, a rising wedge formation signals a trend reversal, and if that materialises prices could fall back to USD1,730/oz.

Outlook

We expect gold to remain in favour as inflation retreats and interest rates near their peak. Prices have rebounded strongly after the past year’s correction, amidst the Federal Reserve’s most aggressive monetary tightening since 1980. We see the following drivers supporting the precious metal:

•A potential pause in the Fed’s interest rate cycle in Q2

•Rising recession risks

•Potential downside in the USD

•Geopolitical risks remaining high

•Strong physical demand

The recent rally never the less looks vulnerable to a price correction as it was largely driven by expectations that the Fed will turn dovish. Any disappointment on the monetary policy front could see prices correcting in the short term. We keep our 12-month price target unchanged at USD1,900/oz.

Several factors favour gold in 2023

A halt in interest rate hikes

We expect the Fed’s interest rate hiking cycle to halt in Q1 2023, as there are encouraging signs of inflation being past its peak. At its December meeting, the central bank increased the target policy range by 50bp taking the top end to 4.5%. This was a modest rise following four successive 75bp hikes.

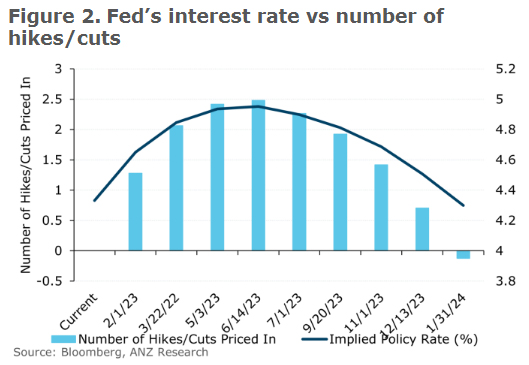

Headline inflation eased from a peak of 9.1% y/y in June to 7.1% y/y in November. We expect goods inflation to drop this year due to base effects and an improved supply of commodities. However, the Fed is likely to struggle to get inflation back to its target range of 2%. Services inflation is stubbornly high and will take some time to subside. We believe the Fed will not abandon its efforts to control inflation expectations, so it should be holding its interest rate steady at 5% (including 25bp hikes in February and March) into 2024. This is against market expectations of rate cuts in late 2023 (Figure 2)and leaves room for a price correction. We believe a synchronised easing cycle will begin from 2024.

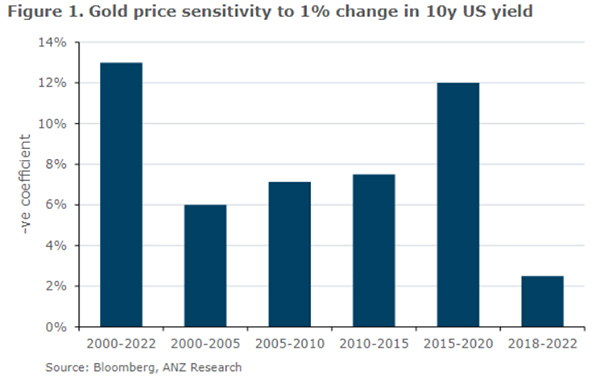

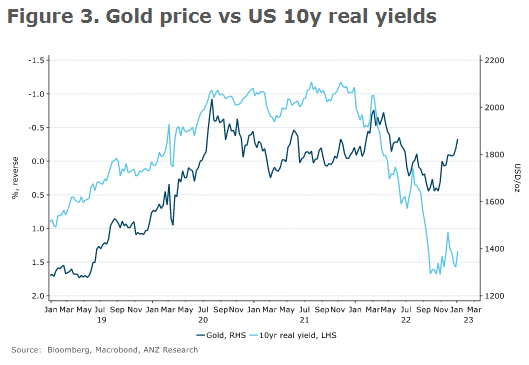

With elevated interest rates and falling inflation, real rates are likely to rise in the short term, but we don’t see this being a strong headwind for gold prices. The inverse relationship of gold with real rates has been weakening over the past year (Figure3). We calculate that since 2000, gold prices have fallen 13% for every100bp increase in US 10y real yields. This sensitivity has reduced to 3% and 1% for a 100bp change in 10y real yield since 2018 and 2020,respectively.In 2022, the 10y real yield rose by 260bp, while gold was largely unchanged. This can be explained by various shocks like the US-China trade war, the pandemic and the Russia-Ukraine war.

Growing recession risk

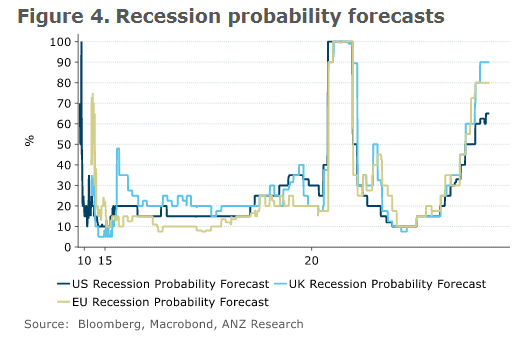

There is a consensus view that a recession is coming, with global economic growth falling to 2.4% in 2023. This would be the lowest level of the last four decades, excluding the GFC and the first year of COVID-19. The 10y/3m US treasury yield curve inverted further and is at its most negative since the early1980s, signalling impending recession. Expectations of a recession in developed markets have increased to 60–90%(Figure 4). There is also a rising risk of stagflation as inflation remains high. In such a scenario, equities are likely to suffer and there will be greater support for haven assets as investors diversify portfolios. We see more strategic positioning building in gold this year.

Gold normally outperforms equities before and during a crisis, delivering nearly 16% average return.

Weakening USD

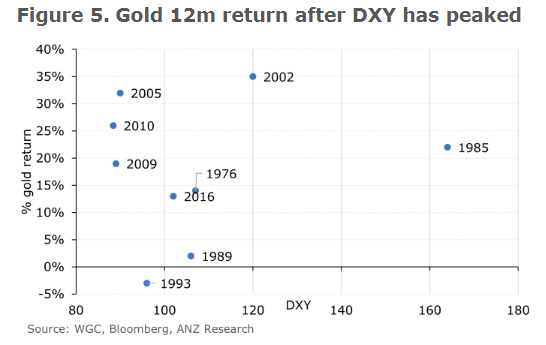

The pace and size of interest rate increases have driven the velocity of the USD’s rise. After rising 29% since its low inmid-2021, we believe the USD peaked near 114 in Q4 2022 and recently fell below the 200-day moving average. Gold has tended to deliver an average 12-month return of 18% after USD peaks (Figure5).

We believe other currencies are likely to strengthen against the USD in 2023. Support for the euro is likely to increase if and when the energy crisis eases. The GBP is finding support as the UK’s fiscal stance is in a more stable position. The JPY also appears to be on a strong footing as Japan’s central bank works to improve the functioning of the economy’s bond markets. China’s reopening is likely to boost investment inflows, with the Northbound Stock Connect scheme seeing net inflows of USD5 bln in December and USD4.1 bln over the first five trading days of 2023, which should support the CNY. On the other hand, as lower growth sets in and inflation retreats in the US, we expect the USD’s rise to reverse in 2023.

In the short term, there is scope for USD consolidation or strengthening. We expect it to receive haven attention as recession fear rises, and there is also room for hawkish surprises from the Fed that are not currently reflected in the price. This goes well with our view of a short-term price correction.

Geopolitical risk continues to loom

The ongoing war in Ukraine and the strategic rivalry between China and the US and its allies will keep geopolitical risks elevated. Western support for Ukraine appears to be strengthening, with military aid stepping up in recent weeks. However, this may ebb and flow over the course of the year amid a series of messy negotiations and ceasefires, which could undermine some safe haven buying.

Growing tension between the US and China over Taiwan is another source of geopolitical tension. Although neither the US nor China wants or is prepared for a war over Taiwan in 2023, the risk of a crisis short of a premeditated attack cannot be ruled out this year. Iran’s nuclear program remains concerning, and how the US and other western powers will respond could come more sharply into focus in 2023.

North Korea continues to capitalise on Western distractions, with an unprecedented level of missile testing in 2022, including the resumption of Intercontinental Ballistic Missile testing.

These looming geopolitical disturbances are potentially major sources of economic and financial risks. Such a backdrop lends support to haven asset investment. Even central banks continue to build their gold reserves to diversify their foreign reserves. A higher geopolitical risk premium has kept gold prices steady.

Strong physical demand offsets soft institutional demand

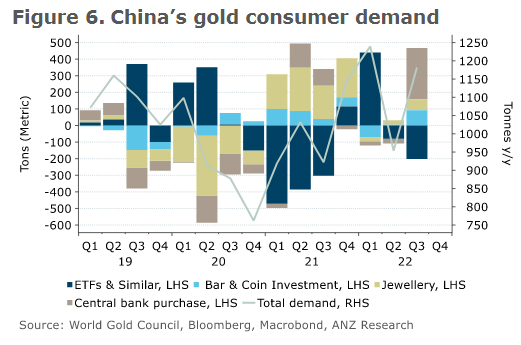

Strong physical demand has been mitigating the impact of an institutional sell-off for the past two years (Figure 6). Retail investments(bar and coins) are strong, as stagflation and geopolitical risks encouraged retail investors to buy. We estimate this will reach a multiyear high of more than 1,200t in 2022.

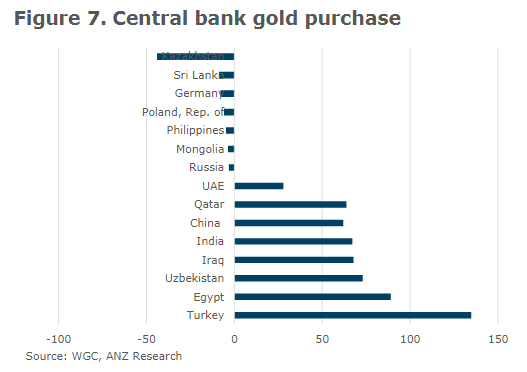

Exceptional buying by the central banks of some emerging market economies supported the offtake of physical gold. They took up 399t in Q3 2022, which was a record quarterly purchase. Turkey, Egypt, Uzbekistan, India and China were major buyers. Depreciating domestic currencies, geopolitical risks and debt defaults were common driving factors leading them to diversify their foreign reserves. China announced purchases of 32t in November and another 30t in December, raising its gold reserve to 2,010t in 2022. Emerging market central bank purchases are likely to continue in 2023, though volumes will not be as high as the 750t in 2022.

Jewellery demand is estimated to come off in 2022 from its high base in 2021.We see this growing by 4% to 2,165t in 2023 as China reopens. China’s jewellery demand will be a main source of incremental growth this year.

China

We expect China’s reopening and supportive measures for the property market to help economic growth to rebound by 2.4–5.4% in 2023. This sets a favourable backdrop for physical gold demand to revive this year.

Lockdowns reduced jewellery and retail investment demand by 15%y/y in the first three quarters of 2022. We saw a modest recovery in Q3, as lockdowns and restrictions eased. Retail investors bought to hedge economic risk amid depreciating currencies and falling equity markets.

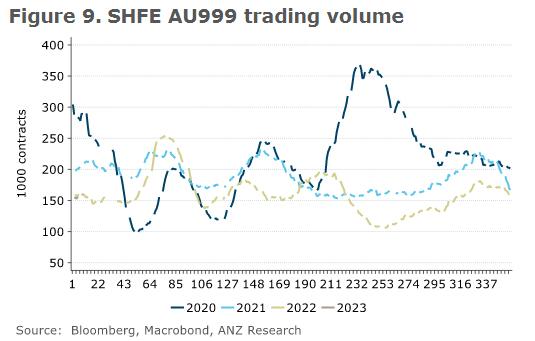

There has been a seasonal rise in trading volume of gold at SHFE due to restocking ahead of the Chinese New Year, though volumes continued to be seasonally lower than recent years. Speculators’ net length increased to a 12-month high. Flows in China looks strong, which is well reflected in the spot premium of USD25–30/oz.

India

India’s gold demand weakened after Diwali in November-December as rural consumers remained cautious on their spending. Higher domestic gold prices are denting new purchases, while enticing gold-to-gold exchange. We see demand remaining muted through January due to higher prices and a smaller number of auspicious days for weddings.

Gold spot is trading at a discount of USD29/oz against the landed cost, due to lacklustre demand and reduced import duties under the India-UAE Comprehensive Economic Partnership Agreement (CEPA).

According to a Metal Focus report, different duty structures under free trade agreements(FTA)are likely to keep spot rates at a discount. Following a hike of the import duty on gold to 15% in July 2022, refiners started importing platinum alloy containing gold, which is subject to4.25%less duty. Although this was corrected by raising the import duty on platinum, industry sources suggest platinum alloy imports are still happening under the India-South Korea FTA at 0-1% duty. Under the India-UAE CEPA, imports of gold are subject to 14% duty, which is 1% less than the normal 15% for 200t.Gold doré imports are available duty free if they are sourced from the ‘least developed countries’(LDC),against normal duty of 14.4%.

These varying duty structures are leading to more unofficial gold imports. The Indian union budget 2023 is worth watching for any change in the import duties. Should the government announce cuts, as urged by the industry, official imports will see a fresh boost.

India’s gold imports fell to 62t in November, down by 13% y/y. Total imports were about 1.3t under the India-UAE CEPA in November, which was nearly 2% of total imports. We expect imports from the UAE to double fromthe72–75t range of 2021.This agreement paves the way for strong exports of gold jewellery from India. From April to December, they increased 21% y/y, and this rise is likely to continue over the 2023 financial year (April 2022 to March 2023).

Silver should not be ignored

Silver prices have risen by 27% since mid-October 2022,as investors rushed to cover their short positions amid strong physical demand and rising gold prices. We expect prices to correct in the short-term after such a price rally, but fundamentals are likely to be supportive over the next 12months.

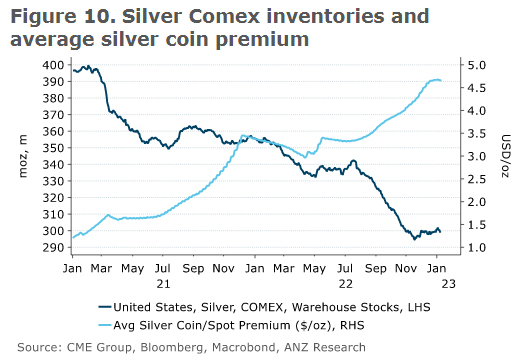

The gold:silver ratio fell to 75x from a high of 96xin September. Exceptionally strong Indian imports to replenish the depleted inventories have been a key support for the market. But imports started weakening in Q4 2022,and domestic silver is now trading at a discount. We believe strong restocking last year leaves limited scope for a sustained rise in imports in 2023. Nevertheless, the supply-demand balance looks strong. The growing adoption of green energy sources continues to favour fabrication demand for silver. Silver stocks are falling at exchanges (Figure 10), suggesting a tighter market. Bar and coin demand continued to be high, and the premium for coins remains elevated. We expect silver to perform well, in tandem with gold, as investors look for cheaper alternatives to gold.

PGM investment demand to turn positive

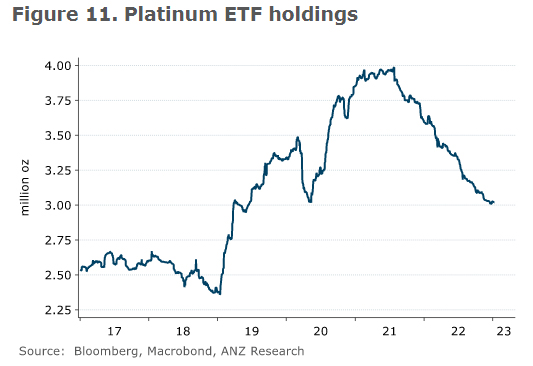

Improving prospects for auto catalyst demand and a constrained supply of primary metals and scrap should keep market balance tight for PGMs. Vehicle production and sales growth slowed towards the end of last year, but improving chip availability and destocking of auto inventories should see auto production faring better than last year. This is despite the prospect of recessions in key markets. Structural switching from palladium to platinum in the auto sector is underway, which bodes well for platinum demand. Chinese platinum jewellery demand should be supported by the reopening of the economy. What could really support the market is the reversing trend in investment demand. Platinum’s tightening fundamentals should see ETF outflows reversing this year. Coin and bar demand is likely to be stronger as well.

We expect palladium prices to average USD2,000/oz before a structural decline due to higher electronic vehicle production and demand substitution to platinum. Russian supply remains at risk, though this is not our base case.

Technical

A trend reversal looks possible

The gold price saw a surprise rally to USD1,1918/oz after breaking the resistance levels of USD1,900/oz and USD1,878/oz. Prices are trading well-above the 200-day moving average, and momentum looks strong until price trades above USD1800/oz level. However, prices need to continue settling above USD1,900/oz to maintain this momentum. We believe the macro environment is not supportive enough to sustain the current price level.

We notice that there is a rising wedge formation in the daily technical chart. The upward trend line broke after prices settled above USD1,900/oz on Friday. Should prices fall from current levels to the USD1,870–1,900/oz range, we expect trend to reverse. Below USD1800/oz gives a confirmation of price falling fall back to USD1,730.

Daniel Hynes and Soni Kumari are commodity strategists at ANZ. This article is a re-post from ANZ and is here with permission.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

30 Comments

The irony of ANZ lackeys pumping gold and silver. Kind of incongruous with their beloved be-all-and-end-all property Ponzi.

Might be time to sell or JP Morgan, etc to wave their magic wand and put gold back in its place.

Precious metals adjusted against inflation, over 5+ years is pretty terrible performance. Now with Bitcoin (digital gold) in the play and access for anyone globally, let's see how gold goes over the next 1-3 years.

Putting my money on a few disappointed boomers starting with Peter Schiff

Precious metals adjusted against inflation, over 5+ years is pretty terrible performance.

It's all relative.The correlation between the gold price and 10-year treasury real rates (US) between 2107-2021 is almost perfect. Real rates have been falling since 2021 and big divergence now.

And look at the gold price in yen. Past year - +17%. Past 5 years - +67%.

Sorry, why are we comparing it to Yen lol?

It's like saying let's price gold against dirt, then dog shi*, doesn't really change the value of the gold at the end of the day?

Gold when zooming out only against USD is pretty poor if we're being honest. I don't really understand why anyone would hold it unless they are betting on societal collapse and fallback to industrial times.

Sorry, why are we comparing it to Yen lol?

Why? Because Japan has arguably the lowest inflation among developed nations and illuminates its store of value property among the 3rd largest economy in the world (and a net creditor to boot). F'more, the world revolves around capital flows related to Japan and its currency. Who is the primary holder of U.S. debt among foreign nations? What happens if capital started to repatriate back to Japan?

Gold when zooming out only against USD is pretty poor if we're being honest

Did you read my comment? The correlation between the gold price and 10-year treasury real rates (US) between 2107-2021 is almost perfect. Real rates have been falling since 2021 and big divergence now. So gold has outperformed 10-yr Tsy.

Did read your comment, we're on different levels of thinking in terms of this though, couldn't care less about tsy's?

tsy yields are a suckers investment as far as I can see, Gold still performs ultra-poorly against countless other easy access assets, so my intial comments and thinking stands, who the hell in their right mind is wanting to buy or hold it?

Gold still performs ultra-poorly against countless other easy access assets

Would you like to elaborate and illustrate your point? Do you understand why people might hold gold over other comparable assets such as NZD?

The comparison between gold and 10-yr Tsy real rates is an illustration of how the value of the assets compare as a SoV.

And you're aware that the appreciation of the gold price over the past 5 years is approx 1/3 greater than the appreciation in the NZ 50 Index, right?

I can see why people might hold gold over the NZD, but the NZD isn't an "asset". It's a fiat currency, by design it erodes in value.

Gold (against USD) is just now peaking over its previous values in 2010-2013, without even accounting for inflation, a SoV that for 13 years hasn't really stored a positive value unless you've held out for over 13 years or have got in recently.

Back to my initial statement, it has performed ultra-poorly.

My SoV assets cost me 2.2 ounces of gold in 2019 when I began accumulating, vs 10.9 now.

From a gen z pov, gold is dead and highly unattractive.

I can see why people might hold gold over the NZD, but the NZD isn't an "asset". It's a fiat currency, by design it erodes in value.

My SoV assets cost me 2.2 ounces of gold in 2019 when I began accumulating, vs 10.9 now.

I hear you. But whether you like it or not, gold is perceived by many as 'currency.' I know that's not a fashionable belief, but many around the world and outside the suburbs of NZ think so. You may also think that suppression of the gold price is a conspiracy. And that may be true.

You may have an asset that has increased 4x when priced in gold since 2019. That doesn't discount or reject the hypothesis that gold as a SoV or currency. F'more, it is not a benchmark of any sort.

To add, you seem very caught up in traditional financial thinking which is barely break-even in the realistic grand scheme of economics. tsy, gold, snp500, NZX50, all a joke when you start doing the math.

The gold rush days of those are far gone my friend, younger gens know it and don't want to touch it, gold being the worst. When the wealth transfer from boomers to younger gens really starts to shift those assets will flop hard.

You're far more clued up than me on those but from numbers only perspective, it's not worth my time or money.

To add, you seem very caught up in traditional financial thinking which is barely break-even in the realistic grand scheme of economics. tsy, gold, snp500, NZX50, all a joke when you start doing the math.

I used the NZX 50 Index as a comparison because you said that gold has underperfomed. I used it because it's a broad index that many NZers have exposure to directly or indirectly.

And OK, I understand that "propadee" has probably outperformed gold over the past 5 years.

But the reasons for owning gold can be entirely different to the NZX or propadee.

QUOTE: gold rush days of those are far gone my friend, younger gens know it and don't want to touch it, gold being the worst. When the wealth transfer from boomers to younger gens really starts to shift those assets will flop hard.

Well we were all Young once. I'm sure "Back in the Day" those now long passed had the same sentiment as You.

History shows Gold and Silver around much longer than ALL of Us.

Your comment hints as a naive assumption the World History can ('scuse the pun...) Spin on a Dime.

--------

Disc. purchased my first Physical Gold and Silver last month. It took most of my adult life to get the confidence to diversify into physical Precious Metals.

My first home in 2000 Valued at NZ$120 K , Gold NZ$500

That home sold in 2009 for NZ$258, Gold NZ$1500 (Property x 2 , Gold x 3)

Home now approx $600 K, Gold 3000 (both doubled from 2009) and Gold outperformed Property since 2000.

Property now Falling and potentially a liability. Gold stores wealth with Genuine History and Geopolitical Clout to move upwards priced in NZ$ through the rest of the 2020's.

Lots of people made fortunes in property, but no one I know of made fortunes buying gold or silver. How many property companies listed on the ASX? Dozens. How many companies that stockpile gold? None that I know of. Property has a return, you can live in it or rent it. You can't rent out a gold or silver bar.

I reckon your young friends should learn a bit from Rick Rule and the art of patience.... https://www.youtube.com/watch?v=YOab7l3jWM4&t=1516s

Rick Rule sells gold. What do you think he's going to say?

China holds 2 million kg of the stuff. Sounds a lot but it only works out to 120 billion usd, so not that much in the grand scheme of things.

Decent chunk of change without counterparty risk

Immaculate timing

China set to win Asia gold pricing race with new exchange

China will launch a gold exchange open to foreign players for the first time on Thursday, putting the world’s top bullion buyer on track to win a race to set the benchmark price in Asia.

A successful take-up could see more gold priced and paid for in yuan rather than the U.S. dollar, challenging the traditional dominance of London and New York in trading.

The long-used pricing benchmark for gold, the so-called London “fix”, has come under regulatory scrutiny due to allegations of manipulation, adding to China’s push to have a bigger influence on global pricing.

https://www.reuters.com/article/us-gold-china-pricing-idUSKBN0HD12J2014…

Silver is off 50% from its all time high.

Gold is off 7% from the promised land.

And the ol' rat posion is down 69%

Was the Silver all-time high in the 80's?

That's a while ago and think of all the currency that has been printed since.

It certainly rockets upward in times of crises, because everybody knows it's more stable and time tested than anything else.

Gold doesn't rust, rot or break down like houses do either.

Was the Silver all-time high in the 80's?

No. 2011. The Hunt bros short squeeze was 79/80.

Got to say I'm surprised ANZ has come out now to tout gold.

Could it be the last game on the table?

The official price is heavily controlled. You can see the price slam-downs, against the trend, on an almost daily basis, so it's a slow grind upwards.

With economic turmoil, the fiat system abused to the max, the world on the brink of a nuclear 3rd world war, the warning of a global cyber attack coming from the WEF, the stage couldn't be better set up for the safety of gold (you would think....).

The official price is heavily controlled. You can see the price slam-downs, against the trend, on an almost daily basis, so it's a slow grind upwards.

China is attempting to stamp out the manipulation. See my post above about the Shanghai exchange.

Why would I buy gold in an economic meltdown? It's illiquid, you can't eat it, and who knows whether it's fake or real? In an economic crash you'll need to be debt-free, own your own house, have a bullet-proof job, and have ready access to food, water, heating materials and transport.

It may take some time, however a slow adoption of getting back to sound money is appearing.

Tennessee Lawmakers Introduce "Tennessee Bullion Depository Act" (soundmoneydefense.org)

The Great Depression was mostly caused by the gold standard, what you call 'sound money'. Central banks were unable to expand the monetary base, and the following colossal crash was the end of the gold standard, which will never return. BTW, gold isn't 'money', it's listed under 'metals' in the Wall Street Journal.

Soni Kumari..A very apt named author for an article on Gold. Well done.

From 5:50 tells the story.... https://www.youtube.com/watch?v=3YWA2calTgQ

Central bank gold purchases and sales are mostly of little consequence, or failed states. The USA has about 8,800 tonnes...no one cares, it's value/GDP is a fraction of what it was decades ago and a large chunk of it is used as a tourist attraction.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.