Data to 31 December 2022.

Highlights

The following is a re-post from the World Gold Council. The original is here.

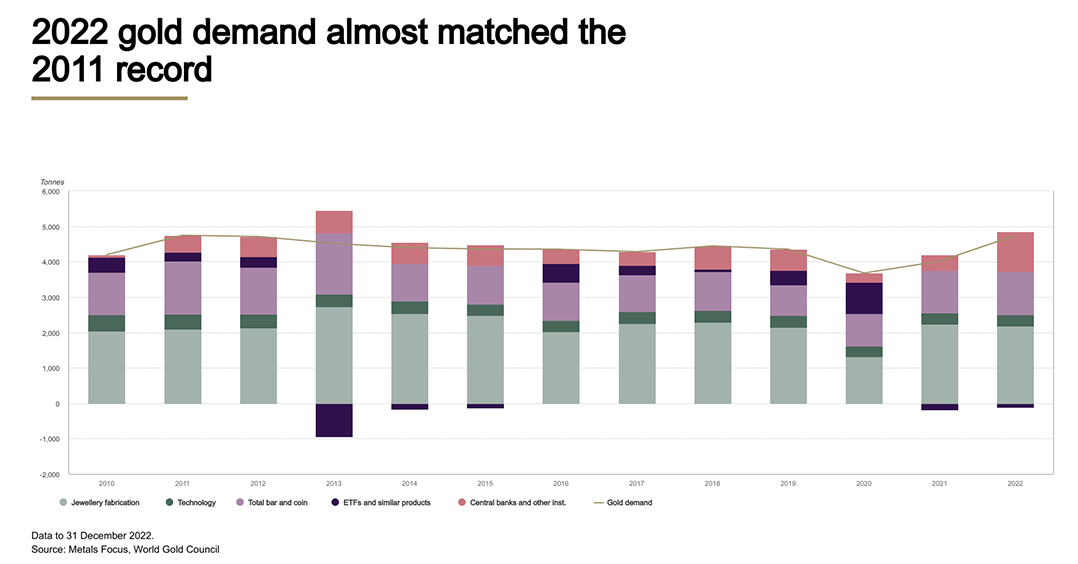

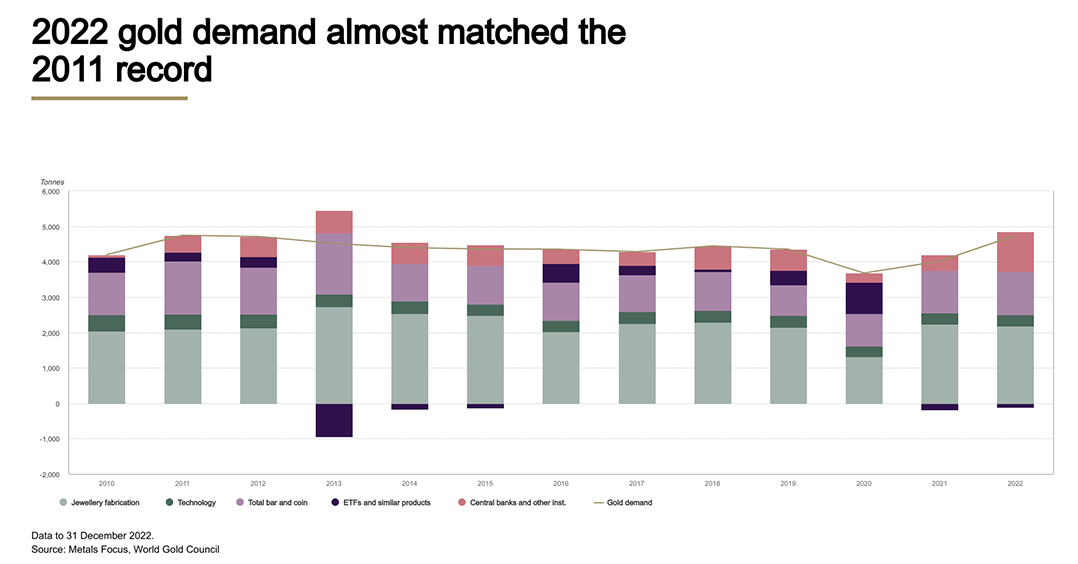

Annual gold demand (excluding OTC) jumped +18% to 4,741 tonnes, almost on a par with 2011 – a time of exceptional investment demand. The strong full-year total was aided by record Q4 demand of 1,337 tonnes.

Jewellery consumption softened a fraction in 2022, down by -3% at 2,086 tonnes. Much of the weakness came through in the fourth quarter as the gold price surged.

Investment demand (excluding OTC) reached 1,107 tonnes (+10%) in 2022. Demand for gold bars and coins grew +2% to 1,217 tonnes, while holdings of gold ETFs fell by a smaller amount than in 2021 (-110 tonnes vs. -189 tonnes), which further contributed to total investment growth. Quarterly fluctuations in OTC demand largely netted out over the year.

A second consecutive quarter of huge central bank demand (417 tonnes) took annual buying in the sector to a 55-year high of 1,136 tonnes, the majority of which was unreported.

Demand for gold in technology saw a sharp Q4 drop, resulting in a full-year decline of -7%. Deteriorating global economic conditions hampered demand for consumer electronics.

Total annual gold supply increased by +2% in 2022, to 4,755 tonnes. Mine production inched up to a four-year high of 3,612 tonnes.

Data to 31 December 2022.

Highlights

2022 saw a record annual average LBMA Gold Price PM of US$1,800/oz. The gold price closed the year with a marginal gain, despite facing notable headwinds from the strong US dollar and rising global interest rates. Although the Q4 average price was slightly weaker both q-o-q and y-o-y, a sharp November rally was followed by continued recovery throughout the closing weeks of the year.

Brisk retail investment lifted bar and coin demand to a nine-year high. Strong growth in Europe, Turkey and the Middle East offset a sharp slowdown in China, where demand was affected throughout the year by COVID-related factors.

Indian gold demand remained robust compared with longer-term pre-pandemic levels. Despite a fairly soft start to the year, Indian consumer demand recovered and only just fell shy of the strong levels of demand seen during 2021. Continued recovery from COVID-19 boosted yearly comparisons, although the sharp local price rally choked off demand in the closing weeks of December.

Total gold supply halted two years of successive declines in 2022, lifted by modest gains in all segments. Full-year mine production grew 1% but failed to match its 2018 peak. Annual recycling supply made only marginal gains, despite strong local currency price rises in many markets.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.