They've called it 'revenge travel' - and it's the credit cards of New Zealanders that are paying for it.

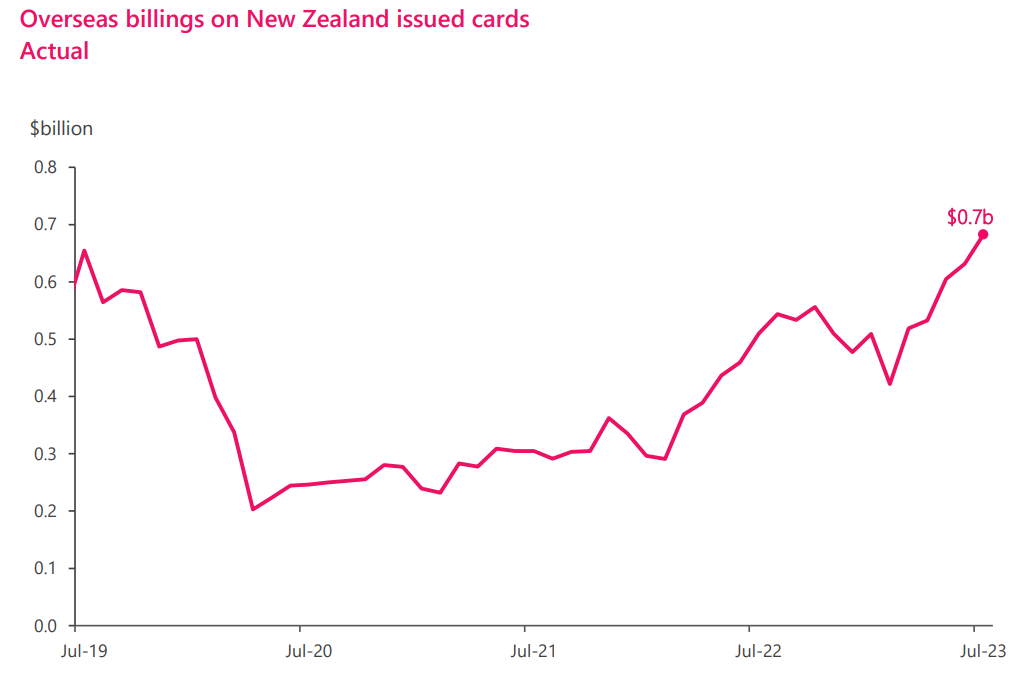

The post-pandemic surge in offshore spending by Kiwis hit a new peak last month - with a record $683 million clocked up on their credit cards during overseas trips. This is according to new Reserve Bank figures.

July tends to be the big month for overseas spending (school holidays) and so it has been in 2023. The new record beats the previous high, in July 2019, of $655 million. These overseas card spending figures are NOT seasonally adjusted.

And, yes, if the immediate answer that comes to mind is - yeah, but what about inflation? Well, fair enough. The RBNZ's inflation calculator suggests that if you apply the rate of inflation since 2019 to that figure then it equates to $775 million. So, people should have spent $775 million, not $683 million in order to maintain equivalent value from the spending.

But remember, all things are not equal.

It's not the same numbers of people travelling as before the pandemic.

Overseas travel by Kiwis is thus far running at only something a little under 80% of the level pre-pandemic.

So that $683 million has been spent by about a fifth less people than the previous record $655 million was.

All of which means overseas travel - and spending - is definitely back in vogue for now, economic slowdown or not.

But the very interesting thing to note is that while the money's there for overseas spending, when it comes to domestic spending that's a flat as a pancake. Seems like the credit card goes straight back in the drawer when folks get home.

On a seasonally adjusted basis there was $3.87 billion put on Kiwis' credit card domestically in July - and that was exactly the same as the previous month. In the past 12 months, monthly spending on cards domestically has been in a very narrow range of between $3.7 million and $4 million.

The FIFA Women's World Cup definitely had an impact, with $492 million of spending in NZ on overseas-sourced cards during July. That was up on the previous month up from $423 million in June and was the first rise in spending from overseas cards in NZ since March.

The RBNZ did this summary on the July card spending figures.

12 Comments

There is a good reason to put your overseas holidays on your credit card, (provided you can pay the card off when it's due of course). Most premium credit cards offer travel insurance when you use the card to purchase the flights. They are very good insurance offers, as I have previously found out.

Four words "balance of payments deficit"

Have you ever thought that it might be a case of someone shopping at K mart in Australia, instead of buying exactly the same item at K mart in NZ. In which case its only the retailer margin that adds to the deficit

I don't understand your point? Two deficits don't make a surplus.

Difficult to comprehend flying to another country to shop at a budget store that exists within a few kms of home. I suppose some people do it? There's oblivious people everywhere.

I didn't say it made a surplus, all I said is that the extra deficit was the retailer margin, I could have just as easily said Costco, or Ikea, yes there are people who shop as part of their travel experience, and yes they spend all that money on an air ticket and an extra bag and yes they buy the same stuff in another country. How do we stop this silliness, dont know, other than perhaps a credit card tax on overseas billings

How do we stop this silliness? Now there's a question? At some point it will stop due to resource depletion, climate stability collapse, or large scale war rooted in the previous two predicaments.

The voluntary way would be to reverse the way we have been trained to consume by the corporate backed marketing industry. Humans are simple creatures. They respond to the dominant message.

They respond to the dominant message.

Yes, and from a young age!!!!! Just booked a school holiday trip with grandchildren from Welly to Q'town. Planned to ferry and bus going south and fly back going north. The little ones are moaning about the bus :-). Oh dear.

Plenty of "cash" still floating around. Spend it now as the NZD depreciates and local inflation still bites.

Those without mortgages will have plenty of cash.

Those with mortgages are doing the suffering for everyone else that can afford to travel.

What a terribly inequitable society we live in.

So another example of how rises in the OCR are creating an "us" and "them" among Kiwis?

I.e. so some people just aren't affected at all?

Or perhaps they are? I.e. those travelling are spending the high interest they're getting on their term deposits.

...when it comes to domestic spending that's a flat as a pancake...

Have you considered that New Zealanders have done all the domestic travel they feel they need to do post Covid?

Now that the world has opened up its time to see something else.

And why not?

Why not? Because climate heating.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.