They've got the cash and they are grabbing it.

The amount withdrawn from KiwiSaver accounts by the over-65s has comfortably more than doubled over the past two years at a time when bank term deposit rates have risen from interest rate levels that made them nearly defunct to much higher levels that are now seeing money pouring in.

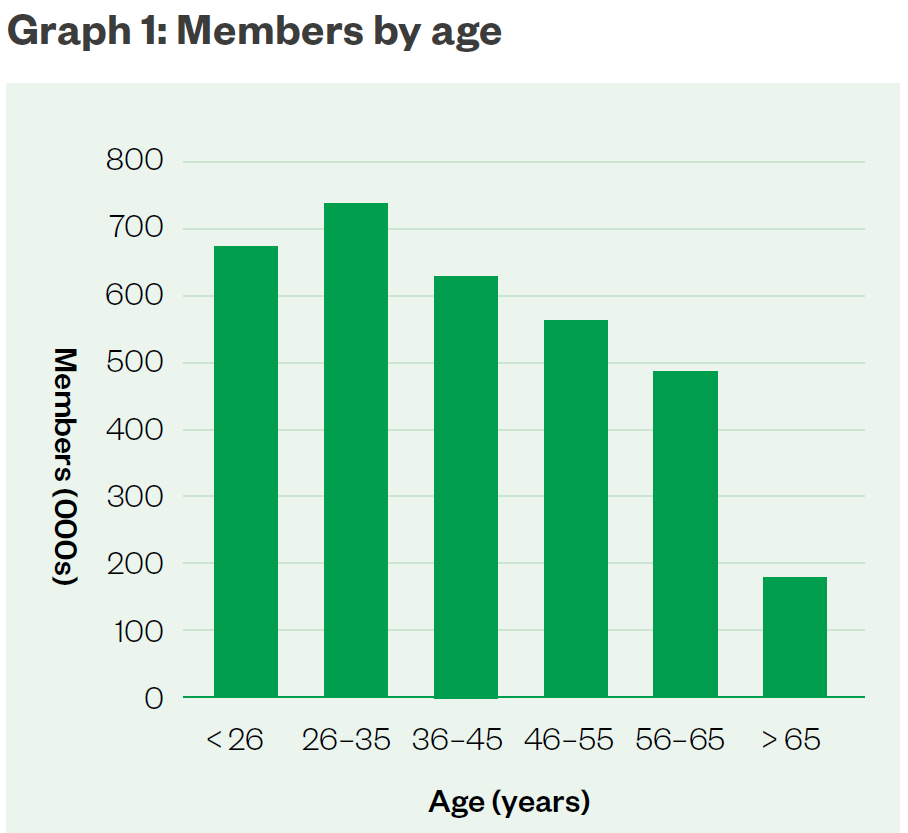

The Financial Markets Authority (FMA) KiwiSaver 2023 annual report shows that in the year to March 2023 the over-65s collectively withdrew more than $2.8 billion, which made up the lion's share of the total $4.2 billion withdrawn by all KiwiSaver members during the year. (As previously reported, the report also showed a sharp rise in the amount of financial hardship withdrawals and savings suspension.)

The amount withdrawn by the over-65s was up some 46.3% on the $1.95 billion that was withdrawn by this age grouping in the year to March 2022. And the $1.95 billion withdrawn in that year was itself up some 59.5% on the $1.22 billion withdrawn by that grouping in 2021.

So, the withdrawals by the over-65s have gone from $1.22 billion to over $2.8 billion in the space of two years.

The FMA said in 2023 a total of 36,121 retirees fully exited KiwiSaver, "which is up 68.3% year-on-year, and the highest number ever".

"Typically, such exits have totalled around 20,000, with the previous highest being 23,458 in the year to March 2019. While this year’s number may be an anomaly, it is still only around one-fifth of all members aged 65-plus which indicates the four-fifths are comfortable leaving at least some savings in their KiwiSaver scheme."

The FMA said it is important to note that over-65s are not required to withdraw their full balance and some providers now enable regular (e.g. fortnightly) drawdowns to supplement retirement incomes. It said that more than 170,000 over-65s remain KiwiSaver members and more are joining. The proportion of new KiwiSaver joiners in this age group has risen in the past three years – from 1.44% in 2020 to 3.71% in 2022 – according to Inland Revenue data.

The FMA said the large amount withdrawn by the over-65s this year "might be attributed in part to the higher term deposit rates banks now offer".

According to compiled Reserve Bank information on deposit rates, the average one-year bank term deposit rate as of March 2022 was just a little over 2.4%, while by March 2023 this had shot up to nearly 5.6%. So, this means during the year under review by the KiwiSaver annual report, the average interest rates available for one-year term deposits - to use but one example - more than doubled.

And it's worth noting that separate RBNZ data on deposits shows that as of March 2022 households held just $85.4 billion in term deposits - but this shot up by $25 billion during the course of the next 12 months to $110.4 billion. And the figure has continued to rise, reaching $118.6 billion as of the end of July - the latest month available - as interest rates have continued to edge up, to now over 6%.

When reporting on the withdrawals by the over-65s in its annual report a year ago, the FMA had referred to the then 59.5% increase as a "big surprise".

The FMA had then pointed to the move as "a sign of KiwiSaver’s maturity and that is working as designed", meeting its original purpose of providing income in retirement.

"We expect the amount withdrawn by over-65s will continue to increase in years to come," the FMA said then.

Clearly, the FMA was right, presumably with some help from bank term deposit rates.

110 Comments

Maybe not just TD's?

"My, what a big bank balance you have Grandma!"

"All the better to buy a Rental, Little Red!"

"My, what a big bank balance you have Grandma!"

"All the better to buy a Rental, Little Red!"

I would suspect that financial advisors would have been herding the old farts towards REITs and commercial property.

I am one of them. Starting last year took about 20% out of managed funds into term deposits. Quite a chunk. Not out of KS actually this time.

I don't expect markets to collapse, but they might. It feels jittery.

So it's a flight to conservative. With minor diversification.

Done the same with some of my shares, sharemarket not exactly moving upwards. So putting a larger portion into TD's. Did the same with a Retirement scheme which seems to yoyo and not moving anywhere, but fees keep on coming out, so TD's much more attractive at the moment. Pitty I can't touch the KS or I would put a chunk in TD's as well.

If you move your KS to a cash or conservative option then it will have a sig contribution from bonds.

Yep, it's shocking that returns from TDs are higher than from cash funds in KS.

Presumably the KS returns are backwards-looking and include bonds/deposits made at lower interest rates? Hopefully the forward looking returns are similar

Not necessarily, my provider offers a cash option that has not much in Bonds, the conservative option has a big chunk of bonds. The former is performing OK, the latter poorly, as you'd expect.

It's a shame there isn't a detailed analysis of providers and their options and how they're performing, past performance, %'s, charts, etc, as I'd like to time my entry back into a higher risk option. It all seems opaque, hard to compare. It should be open and transparent so we can make informed decisions about our money.

Gosh the boomers continue to have it good. Everything just seems to align for them. Others than blips in 87 and 08 they saw steady moderate growth throughout their careers. Most of them have never been drafted to fight in a war - something unusual in human history. I could go on. I don't begrudge them at all but I hope they appreciate the blessings of being born when they did.

There are plenty on both govt super and national super. I know a few and its quite upsetting knowing how hard they didn't work and the large income they continue to pull form the workers pockets. Retired teachers as a couple a prime example. 4 x supers between them. No outgoings, the cash just keeps building.

But the 6.5% salary deduction for Govt super was not small.....

"don't begrudge them at all but I hope they appreciate the blessings of being born when they did". Sure you don't begrudge them Baptist. If you didn't, you wouldn't have made the comment. And by the way, I am a boomer and have had no more or less blessings than anyone else, so don't feel any appreciation that you seem to think I should.

I am a boomer and have had no more or less blessings than anyone else, so don't feel any appreciation that you seem to think I should.

Wilful blindness.

Got a chip on his shoulder. Don't sweat it. What he/she/they won't acknowledge is his/her/their position in life is more than likely what they deserve, especially if born in a western democracy.

Be like me Baptist. I don't have a supermodel wife because I'm not particularly attractive. Crossed teeth, balding. Don't have million(s) in the bank because I wasn't smart enough or worked diligently in life. Didn't get the gold medals because I didn't put in the effort or have enough natural talent. Never blamed a soul.

Born in '66. God bless us.

I was born in ' 65, work full time, have TD's, belong to Kiwisaver and I'm not even a Boomer. For some strange reason my pseudonym causes some members to arrive at misguided assumptions and spit venom.

Born in '62, renting and will never be able to retire. So thankful for my priviledge :)

Sorry Rob, you still need to feel the guilt. Ageism is the new socially acceptable target for those frustrated not being able to vent sexism/racism etc. Being a whipping boy for the frustrations of finger pointers is a tough job, but someone has to do it.

> Ageism is the new socially acceptable target for those frustrated not being able to vent sexism/racism etc.

Incorrect. Ever been to a council meeting? As a young person it frustrates me to no end to see a sea of grey pushing for things that benefit themselves with no thought to what might be good for the future of the town and it's younger residents. Selfish AF.

So you are being ageist, grouping old people together and calling them selfish, what do you think discriminating against a group is? Young vs old, male vs female, black vs white. Its all the same just pick your random group you want to assign people to and pick on them.

Having a benefit that is non means tested, only for people over the age of 65. That would be ageist wouldn't it? As the only determining factor is age, not need.

If I apply for govt super, I'd be declined based solely on my age. That's discriminatory.

Declined now, yes, but one day you'll be accepted into our club, hopefully you'll last that long, although it might not be 65 by the time you get there. It'll probably be means tested by then too.

Definitely ageist though. Hopefully it is means tested by then, if not then I hope we have a utopia where all our essential services are not starved of funds while young tax payers are paying through the nose for shelter and their landlord's superannuation payments.

I don't think ageist is the correct term with regard to what you are saying. I think you are ageist though, according to the definition I've just read.

Giving taxpayer handouts to a group of people based on age is not ageist? What if taxpayers gave an extra $200 per week to everyone who was woman? What about an extra $300 per week of tax payers money to people who are English?

Obviously you are yet to feel the physical implications of the creep of time dan. Once you do, come back and tell us how your flipping burgers is going so you can afford your rates.

I'm not against Superannuation, just when it's non-means tested while our core services are run down. If anything, I'd rather see it means tested while keeping the same budget and have more redistributed to those who truly need it. You know, the ones struggling to pay the power bill or as you say their rates.

Due to our highly efficient public sector it will apparently cost more to means test super than pay it as is currently the case and thats why it is not done. It was means tested many years ago, the super surcharge that effectively wiped out your super after a certain level of income was reached.

Why are you on this website if this is the case? You make alot of comments, and from your outcomes clearly dont know very much.

Rob I'm sorry to hear that you are still renting as a boomer. But I am sure your current circumstances have nothing to do with the time you were born in. The same can not be said for many renters in their thirties.

My statement is a generalization. To say that the Boomer generation is privileged is not to say that ALL Boomers are privileged.

Not sure what I said that can be construed as a chip on my shoulder. Or blaming others. I have had plenty of unmerited privilege in my life too that I acknowledge.

Reading the replies I can't understand why so many boomers deny they have had a comparatively sweet run. Privilege is not something to be ashamed of. It's something to be thankful for. It might make us less proud and more compassionate to others.

"I can't understand why so many boomers deny they have had a comparatively sweet run". Because so many have not had a "sweet run" Baptist. That's just your outlook on things. Yours. No more, no less. And on privilege, what utter drivel. Life is what you make of it. And I feel proud about what I have achieved in my life from a beginning that was nothing as luxurious as the people that are considered to be in "poverty" today. I try and be compassionate, but often find myself reading and hearing woe-is-me dross from people that don't stand up, face forward and get moving, and start to lose the compassion. Here's a tip, life is a shit show (with some really great bits intermingled), and no one is owed anything. Get your own house in order before trying to sort everyone else's.

That's on them if they haven't had a good run. If those people didn't have a good run during the economic tail winds, then they better stop sharing "I survived" memes on Facebook because they wouldn't survive if starting out today.

I think the kids would say "check your privilege". It's not the fault of a generation that they had a sweet run, but it is a fact. Failing to acknowledge or understand that is what annoys the younger generations.

Not a boomer but always mistified by this, so someone must acknowledge something happened that they had no control over? It's a mystery to me.

Just as mystified as to why very said people are very happy to attribute outcomes from something they had no control over as "pulling themselves up, boot straps and all". Maybe we just call it for what it actually is, privilege.

Imagine you are a young adult struggling to save up the $100-200k deposit required to buy a house these days. Now imagine your elders don't empathize, but instead talk about how hard it was for them to save up a fraction of their annual salary to buy a property worth 2-3 times their annual salary.

Understanding how difficult it is for young adults these days will help with inter-generational communication and empathy, if that is something you are interested in. It's not about groveling, just comprehending.

It's the same principle as understanding people in my own generation with tough childhoods have had a harder run than I did, with parents that stayed together and expected me to achieve.

Understand how empathizing with your elders will help with inter-generational communication, instead of saying they don't care, of course they do they are parents, but what can they do? If you have children and not complete jerk you will realize that they are the thing that is most important to you. If this is not the case for most people the we have a much bigger problem than high house prices.

Name calling between groups, and saying they are uncaring, will not encourage inter-generational communication, it will just cause the other group to respond in kind, which escalates things. When I have talked to older people they do seem to care, however I don't go around accusing them of not caring about the younger generation. That is an insult and if you expect anything apart from a defensive response you are fooling yourself.

Question is, how did we get here? Did the voters of the past understand what the salesmen/women of the political classes were bribing them with? All the happy talk about the wonders of comprehensive FTAs that gave huge numbers of foreign property buyers from wealthier countries free reign? Mass immigration policies to fuel exponential economic growthism? A public demanding all the shiniest medical gear, magical pills and other baubles needing paid for with something? Printing free money to keep demand going in a deflationary environment, then doubling down when an inevitable black swan flies in? Inflating away the value of all that cash sloshing around? The path here had so many bad decisions quantifying their complex interactions is nearly impossible. Media, SciFi literature? Fuelling entitlement from the left, fuelling exponential wealth growth from the right?

Going forward all political parties are offering more of the same and voters will give them permission to do more of the same. Parties offering the same. Voters expecting the same. The planet is more crowded, more depleted, more polluted now. The old ideologies of human exceptionalism and rule over nature were never going to work, but we'll keep letting the witch doctors tell us their glittering mythology is the path forward, until this extinction event has run it's course.

Its more using tax policy to hoard all the wealth for themselves - while now to live anywhere you actually want to live you need two working parents and to pay for daycare if you want to have kids.

Noone cares thjat they had it good. The problem is the way they control public policy to favour their generation instead of helping young people get the leg up they had from the great generation.

A nation without children is doomed - we are doing everything we can to discourage people from having kids by making it unaffordable.

Boomers don’t control public policy. Its gen X.

Well as long as the younger generation acknowledge they have a sweet run as well, historically speaking pretty much every one in New Zealand has a sweet run, if you where unemployed you where left to die through most of history.

"It is a fact". Sure mfd. You just saying it doesn't make it so.

Gosh the boomers continue to have it good. Everything just seems to align for them.

Disagree. If the boomers collectively decide to sell equities and funds, who's the buyer? Gen Z? Millennials?

I think you're out of your mind if you think the younger demogs have the capacity and willingness are going to pay silly prices for the boomers' assets.

Pension funds, excess liquidity proudced by governments, the wealthys children. You will own nothing and you will be happy. Asset prices arent going to crash.

I don't get this comment. On the one hand you are saying that asset values are crazy high and on the other hand you are saying the generation that disproportionately owns these assets isn't privileged? Privilege isn't something to be ashamed of so why deny it?

Asset prices being high is irrelevant, if you can't afford to eat, is a person who owned a house 50 years ago any richer REAL terms than a person who owns an equivalent house now, of course not and now if you need to fix something the price is expensive, food is expensive, health care is expensive. You can't sell your house to pay for that because you know that your children will never be able to afford their own house unless they use the equity in yours.

All you have is bunch of people looking at the dollar figure and saying your rich, and being nasty about it, really if you are dirt poor living in a housing NZ house you are more secure that if you live in your own home, at least if something needs fixing the government will pay to fix it, if it get destroyed they will find you another one, your rent is limited to your income, my rates and insurance are more than a person on super pays in rent.

To me privilege when you have more than just a place to live after a working for life time, well of course privilege is relative, just compare yourself to some starving in a third world country, watching their children die, the see how privileged we all actually are. Now start going around apologizing for the fact you are not in the third world.

The sea of grey will just vote for parties that will keep the house prices high at any cost and push local councils to do the same.. That's what they do in general/on avg, make selfish decisions with no care for the future.

You might be right though, I hope you are but I'm not optimistic.

I don't begrudge them, just like I don't begrudge someone on the unemployment benefit. What I would begrudge though, is if someone had a decent free hold house, a few million in the bank, a few rental properties all while collecting the unemployment benefit.

Yet the only difference is when you hit 65 that's okay because you had to pay some tax throughout your life, like it's some loyalty scheme courtesy of today's taxpayers many of whom had no say in the structural changes leading up to today.

Was reminded a couple of days ago of another hardship we had to endure...2 weeks annual leave. Can you imagine young people today accepting that?

Was that alongside the exorbitant daycare costs while the mother also went to work full time to ensure a roof can be put over the family's head?

Anyway, 2 weeks annual leave was pre-1974 so either you're on your deathbed or you're misappropriating your parent's "suffering".

20% interest rates or something in the 1980s.

Maintaining a household all on a single income.

We should all march to remember them & their sacrifices on ANZAC day, and probably add another $1m for their houses as a mark of respect.

They'd never misappropriate their parents suffering.

Boomers were the generation that defeated Hitler and Hirohito, we owe them everything - so do our grandkids who will still be paying for their excesses.

Last I heard it was 23% but it fluctuates with the Bitcoin price. They also courageously took out 3 mortgages at the time because they didn't want to burden the banks with paying out term deposit returns on their savings.

Cmat - lol boomers by definition are the POST- WAR baby boom generation born from 1946 - 1963 or thereabouts. The generation that fought WW2 was called the Silent Generation.

Boomers miss the joke again.

…were the offspring of the generation that defeated Hitler”etc

1974...was it really that long ago? Jeez time flies. Well it was only about 15 years ago it went to 4 weeks, now the Greens want 5.

I guess 4 weeks holiday pay is a nice compromise for those young people who give up their weekend days to ensure you can pick up string for your weed eater on a Sunday morning.

But if you want it put into perspective, that extra 1 week of leave is the equivalent of a 43 cent per hour pay rise on today's minimum wage earner. And since all companies will need to provision an extra week's leave pay per employee, all prices should in theory rise in unison to compensate...including rents!

An extra week means that a firm with 52 people will need to hire one more person, when you only have 15 people it just makes it hard for everyone.

Baby boomers were born between 1946 and 1964. They're currently between 59-77 years old.

Not dead yet.

Average life expectancy in NZ is 82. Average. Some could be on their death bed at 90, some could be on their death bed at 68.

I guess somewhere between 5% for the younger boomers and 30% for the older ones are already dead? Lucky sods those boomers. Buried with all that cash. The kids won't mind getting nothing after rest home fees. They can continue whining about being alive.

I'm not sure you get it. They're not looking for a hand out from their generous parents, just a reasonable chance to make it on their own two feet.

I met with a group including some 30 year old men last night - lives on hold because houses are unaffordable, waiting to have children, already talking about freezing eggs to prolong their timelines. Older generations obsession with property as an investment and retirement vehicle is squarely to blame.

Yes I get it, but I'm not sure intergenerational whiners do. NZ has a finite land area and finite resources. Successive ideologically driven growthist governments have been determined to cram as many humans into the finite pie to satisfy their rent seeking as possible. Having no political choice and a media concentrated on dumbing the populace with stupid memes of boomer theft, as a distraction from the deliberate destruction of NZ quality of life, seems to be working just fine in continuing reality blindness.

The boomer boom was the result of a species faced with a massive energy surge creating the ability to extract natural resources at an increasing rate. That's now in reverse. The downsizing is physics in action. GDP will be foghorned about going up while strangely, individuals get poorer, both financially and in the quality of the living environment.. It wouldn't have mattered which small picture thinkers were alive during the upswing in the energy bell curve, it was just a lucky 150 years to be alive. Whining about who got to burn isn't going to bring back spent energy stores.

And p.s., will those 30year olds be voting Nat? If so, I would suggest those eggs will remain in the freezer in perpetuity.

Except the unemployed can still take up a job. The over 65s are too burnt out.

I begrudge them.

As a block they have continually voted for & backed policies that have stripped from future generations to ensure their cossetted retirement.

They habitually oppose & vilify new housing that has restricted supply and driven up their own capital values beyond their wildest dreams (let alone wildly beyond anything they could have dreamed of earning in paid employment).

For the last three decades they have continually protested rate increases required to maintain critical infrastructure in our cities.

This underinvestment is now becoming abundantly apparent and the remedies are being funded now with debt that will be left to next generations to repay.

They squabble over minor spend (including moaning about the requirement for more 'needs based' spending) and make this central to election debates but then absolutely see it as an unquestionable entitlement that they receive non-means-tested and unfunded Super. Super which is by far and away the largest single line item of spend on the Government books.

They bemoan beneficiaries when they couldn't run fast enough to the Government to get bail-outs in COVID if & when it was there for the taking.

They are the most cynically self-interested generation to walk the Earth and I totally begrudge them for it.

You may very well think that...

We funded our parents super, as they paid for our grandparents. Hoping you're raising your kids to feel the same way about you.

Boomers were born into large families, so the burden of your parent's super was spread further. Meanwhile today we have to import people from slave wage countries to maintain a respectable ratio of workers to beneficiaries which adds downwards pressure on wages, because the economy was so rooted by previous generations it's not economically viable to have many children (unless you aspire to be a Solo mum).

So boomers would inherit a lot less, being in a large family, than a millenial with only one sibling and two, soon to die,astute hard working hard saving boomer parents who made their own way in life with little if any financial help from their.poverty stricken worn out parents in turn.

I recall getting 60 cents/hr in my first holiday job; boatbuilding.

Later 80-120hr weeks, still 50hrs.

Sure, they could have inherited less from their parents. But they inherited conditions where they could buy a house when the average was 3 x the average annual wage, and then ride a wave of house price appreciation as mortgage rates were slashed from the 27% or whatever number they claim it to be to 2.5% by 2021. Up until recently generous lending and tax rules meant many could just leverage off that into rental properties, to "get in first" on the properties before the next generations are old enough to buy and then claim they're astute and performing the work of Jesus by "providing" something that already existed.

because the economy was so rooted by previous generations it's not economically viable to have many children (unless you aspire to be a Solo mum).

Was in London recently and wandering the streets with a friend and his wife. We saw a husband and wife walk past with 5 kids in tow and the friends wife looked and said to me “5 children, now that’s just showing off!” 😂 How times do change.

The boomer's parent's generation was significantly smaller than the boomers so you had more people paying for a smaller cohort.

The inverse is true now, a smaller working population having to support a larger cohort of retirees, whilst also now having to fund their own retirements. It's not a great setup and is going to continue to become more of a struggle as more people retire with less people working to fund that retirement.

That's true so why isn't the current generation having more children, and devoting the significant time and money in raising them. So the younger generations have more free time while young because the don't have children.

Yes I know we really don't need a larger population, but then again if the population starts to decline house prices should get more affordable.

The problem is we are outsourcing our breading overseas, god forbid GDP goes down. The problem is while GDP goes up most of what produce is useless, and the things we need like housing and food are getting harder to find.

Did you also fund your parents super gold cards, replete with free ferries to Waiheke?

How about Nationals promise to make everyone pay for prescriptions to fund new cancer treatments... Except you of course. You'll keep free prescriptions and you're more likely to need the cancer treatment we're going to pay for.

Don't worry, just plum the endless well that is younger generations for that too.

So let's tally it all up:

- Obscene tax-free cap gains beyond your wildest dreams, gleamed from being a giant boa constrictor on supply

- Not maintaining infrastructure and deferring the costs to the future

- Being the biggest block of beneficiaries but decrying "your" tax dollars [sic, your generation are now beneficiaries, not taxpayers] going to support other beneficiaries

- Super gold card

- Free prescriptions that everyone else pays for

Super cool people your generation.

Remember back in the late 80's when top income tax rates were slashed from 66% to 33%, while introducing GST (a consumption tax). I wonder what block of people were entering their "prime earnings" stage of life, where they'd be more likely to hit the higher bracket? Great that they could keep more of their discretionary income. I wonder how much of that income tax was supposed to go towards Muldoon's promise, where a portion of their income taxes would ensure Govt Super in retirement? Nice little switcheroo.

You should ask Sir Rodger if his GST motivation was protecting an artificial construct that is people born between two arbitrary dates?

I wasn't necessarily suggesting there was a conspiracy where tax changes were done solely to benefit those born before a certain time, but just highlighting how convenient it was for that cohort.

Why bring up the politician? Sure they made the decision, but it's the voters of the day that put them there. No different than the rhetoric out there against people who voted Labour today, "you get what you vote for".

But what party could we have voted for back then who would have done anything differently??

Fair point. So the tax switcheroo was unavoidable, so let's back it up slightly. Those who were around in the 70's voted Muldoon into power who had a very clear mandate that he'd scrap Compulsory Super. Even took out a bunch of Hanna-Barbera cartoons on his campaign trail suggesting Labour's compulsory super was Soviet Style communism.

Your bitching on about all boomers and then counter my point by going all the way back to 1970 to get one example, and using Muldoon? What if I voted Labour back then? Am I off your boomer hit list? Seriously you need to focus less on the past and try and sort your future. Who are you going to vote for next month to do that?

I'm probably going to vote for ACT. For all the "bitching" as you call it about Boomers, the only thing I am really focused on is our big black hole which is non-means tested superannuation, that we currently dish out to the generations that screwed the country up. My "bitching" is just explaining why such a generous benefit system should not exist.

For the record, I am extremely comfortable and none of my "bitching" is motivated by seeking a single extra cent in my pocket. Just tired of paying tax to be frittered away.

Don’t forget free education

And me cmat. That's what health insurance is for.

And you've been watching way too many Labour election adds. Somewhere there is a website with the list of lies Labour is telling, go find it. It might enlighten you.

FYI, what infrastructure are you referring to exactly?

"That's what health insurance is for"

Oh really?

Why don't you tell Luxon your generation don't need free prescriptions either, or any public health care for that matter, because that's what health insurance is for you're happy to pay for it?

Why don't you tell Luxon your generation don't need Super because that's what all your tax-free capital gains will cover?

Why don't you tell Luxon your generation don't need Gold cards, you know, who needs free ferries?

You're not going to do that though right. They are your 'entitlements' that you're very 'entitled' to aren't they?

"FYI, what infrastructure are you referring to exactly? "

Sure, allow me to wrench your head out of the sand with just a few examples:

- Water infrastructure in Wellington (ring a bell?)

- Sewerage infrastructure in Auckland (closed beaches sound familiar at all? No?)-

- The small matter of 185 BILLION DOLLARS of water investment required in the next 30 years to address underinvestment

https://www.rnz.co.nz/news/national/443888/new-zealand-water-infrastruc…

I mean, honestly are you that ignorant to issues in this country that you would debate that infrastructure has been underfunded for a generation?

I've been a centre right voter my entire life.

Sure, by all means call us moaners, your generation are the original gangsters of whinging - the absolute personification of the squeaky wheel - and look at where it's got us as a nation?

If another generation was getting all your 'entitlements' we'd never hear the end of it in town halls across the country.

And the fact your generation can't even begin to see it is a national disgrace.

You all need to be told to collectively pull your heads in.

And in reciprocity they gave you debt-free entry to work and affordable housing supply.

That reciprocity went missing.

We pay for the boomers super as they already prepare to lift the ladder up on following generations and there is not going to be many kids to support us as people can't afford many.

What children? Noone can afford it.

So you will say no to an inheritance from your boomer parents. Actually no, you will probably upgrade your EV.

Oh yeah thanks for reminding me, creating a feudal society and thinking that's a good thing.

Your generation instilled a myth that you get what you work for... but oh no, now you're saying you get what you inherit.

Awesome stuff, well done.

You grew up with all the benefits of an egalitarian society, the ideals that this country was founded upon, then tore all that down for your own gain and now have the cheek to tell us we should be grateful for what we inherit.

We'll inherit a nation in tatters - wonder why we have all this crime?

You've ripped up the social fabric of the country and created an underclass that previously didn't exist.

Thanks for the inheritance.

A disgrace.

Its logical to assume that those complaining about the Boomers on here have parents that don't own a dime. You are never going to complain if you had parents like mine that worked, didn't waste money and did well in property then gave me a leg up just when I needed it to get started with a house deposit. Still see it today, friend of mine is helping all his kids into their first house.

My Dad was a partner at one of the largest firms in the country so no, thanks.

I'm able to separate my privilege from what's good for the country.

You talk about hard work but then talk about having parents with money and growing up with the silver spoon like it's an accomplishment.

Well done bro, getting help with a house deposit. Congratulations to you for your hard work.

Screwed the market, but at least they're "altruistic" by throwing a few bones to their kids to buy a house. Guaranteed their gesture is barely putting a dent in their savings, it'll just be "put up some equity as collateral" and hoping the kids keep up with the payments.

Gosh the Cry babies are commentating again. have a good week-end

Makes a change from politicians holding audience in town halls & bowling clubs filled with wall-to-wall moaning grey hair doesn't it.

This is the most important thing to realise and something that has seemingly been obscured from the 80's onwards. The scolding of those born outside the lucky window has been ever present, with people who struggle financially being labeled as irresponsible profligates. The privileged position of the lucky people is taken a proof of superior qualities. That narrative has been slowly changing over the past 2 decades, especially since 2008 GFC.

My grandfather had a secure position as an architect for the State of New York, something that was a solid career until the Great Depression when he was suddenly made redundant and had to get by as a shoe salesman for JC Penney. He owned his own home and was building a spec home on the adjacent property to sell at some point. He rented out his house and his little family weathered the worst of the Depression in an unfinished house, where snow would drift through cracks and leave stripes on their wool blankets as they slept.

My parents received the post-war boost starting in the 50's, but my grandparents' finances never fully recovered. It is the luck of the draw and it is high time people fully realise that.

Don’t blame them taking it out. The low risk options in many of the funds are heavily weighted toward bonds and could get smashed again with rate rises.

If you want low risk, which most at this age do, best to take the money and self-manage your own TDs.

There is another risk of leaving it in KS. Imagine the government suddenly introduces means testing of super... To then stop people withdrawing and spending it all at once to avoid it being caught by the means test, the government would have to make you buy an annuity with your KS balance. It's happened overseas.

More evidence - if any were needed - that the OCR is a thoroughly inequitable tool.

isnt that what KS is designed for?to enjoy in your retirement.sounds like fund managers remorse about losing that extra easy money.

If you are lucky enough to make it to 65 with your health, you may as well take it out and start spending it. Many people have this weird mindset where they think they are going to live forever and you need to be making money your whole life.

Life expectancy may come into play here. 4/8 of my children's great-grandparents are still alive and approaching 100 in fair health... and none of their grandparents have retired (but do draw down super) and all intend to work till health says otherwise - which family history suggest will be early-mid 80s, so possibly another 15-odd years!

I know it's different for some of the more physical trades, but there are large swathes of people for whom continuing to work after 65 still makes sense.

70s now and just at the beginning of my 20 good summers plan. The ancestors all seem to depart at 94 and healthy until about 90.

My health plan is to keep moving so just spent a week on the chainsaw. Hard yakka that, hanging on to the machine, and tossing rounds. Double benefit of fitness and a warm 2024 winter.

The KS will come in handy. Very pleased to have one.

Watch your back....

haha. I think ACC must have a whole team for dealing with 'old man and ladder'

But not for 'old man,ladder and chainsaw'. Such claims are once and final. Tiny volumes.

Put that "Rust Never Sleeps" vinyl on the LP12 and rock those JBLs; then chill out with a bit of Leonard Cohen.

BOOM BOOM

Recently read that only 40% of us live past 70. Life expectancy is increasing but it is not uniform.

Most younger members are less likely going to get their money back at all when they retire in around 40 years time.

Boomers exit and new members pay. KiwiSaver is an “investment “ with risks involved but many think it is a savings account.

Lots of the boomers I know are in a race between death and running out of money, and running out of money is winning.

I just don't get those that have an ambition to spend their money before they go. I've observed that in people with kids with young families they could help, and when their money is largely inherited.

I am a boomer, and sthink we're a more selfish generation than previous ones.

BTW, KS is probably a better place to stash money money than savings accounts and TDs. What's really catch up with boomer high livers is a decade of inflation. Td rates give a misleading return. When you take inflation and tax off, your going backwards, whereas shares are more likely to give a sustainable 3-4% yield over the 30 years a 65 year old needs to plan to have money for. It's a myth that you spend less when you get older, if you have a house to maintain.

Look at the Dutch, the kings of intergenerational wealth generation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.