Consensus forecasts for real GDP growth, % y/y*

The following is a re-post from the World Gold Council. The original is here.

Gold had a strong 2023, defying expectations amid a high interest rate environment, and outperforming commodities, bonds and most stock markets.1 As we look forward to 2024 investors will likely see one of three scenarios (Table 1). Market consensus anticipates a ‘soft landing’ in the US, which should also positively affect the global economy. Historically, soft landing environments have not been particularly attractive for gold, resulting in flat to slightly negative returns.

That said, every cycle is different. This time around, heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying could provide additional support for gold.

Further, the likelihood of the Fed steering the US economy to a safe landing with interest rates above five percent is by no means certain. And a global recession is still on the cards. This should encourage many investors to hold effective hedges, such as gold, in their portfolios.

Table 1: The global economy faces three likely scenarios in 2024

Economic scenarios, probability of occurrence and key gold drivers*

*Based on market consensus and other indicators. Size of gold drivers represents relative importance within each scenario. Impact on gold performance based on average annual prices as implied by the Gold Valuation Framework. For more details on variables used as proxies for each driver, see Table 2.

Source: World Gold Council

All eyes on the Fed

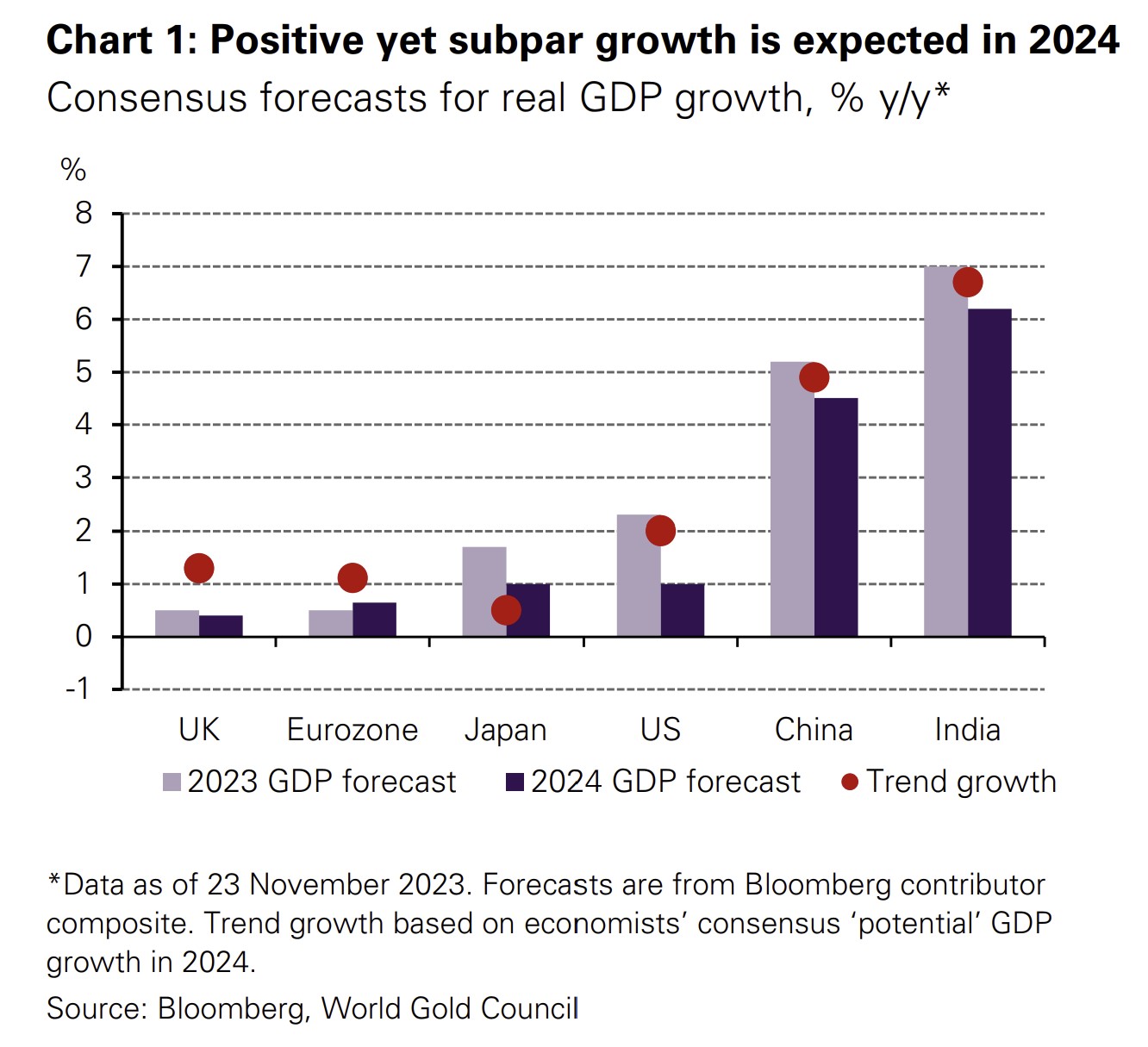

Despite some bumps along the way, the global economy proved remarkably resilient in 2023 and talks of an impending recession diminished as the year progressed. Now, market consensus for 2024 points to a ‘soft landing' given the expectation of positive, albeit subpar, growth ahead (Chart 1). Alongside an economic deceleration, market participants also expect inflation to cool sufficiently for central banks to begin cutting rates.2 Such a soft-landing scenario would be a welcome outcome for many investors. But its execution requires razor-sharp precision by policy makers and also relies on many factors outside of their direct control falling into place.

Chart 1: Positive yet subpar growth is expected in 2024

Consensus forecasts for real GDP growth, % y/y*

Composite PMIs remain in expansion, and manufacturing PMIs are higher than they were mid-2023.3 Real earnings have been rising for the last six months,4 resulting in healthy balance sheets. Household excess savings are not yet depleted,5and unemployment remains historically low. Fiscal stimulus plans for 2024, should they materialise, will also offer support.

Although these factors will not prevent a slowdown in growth, when combined with adequate monetary policy they could help to avert a contraction in the economy.

A recession is not off the table yet

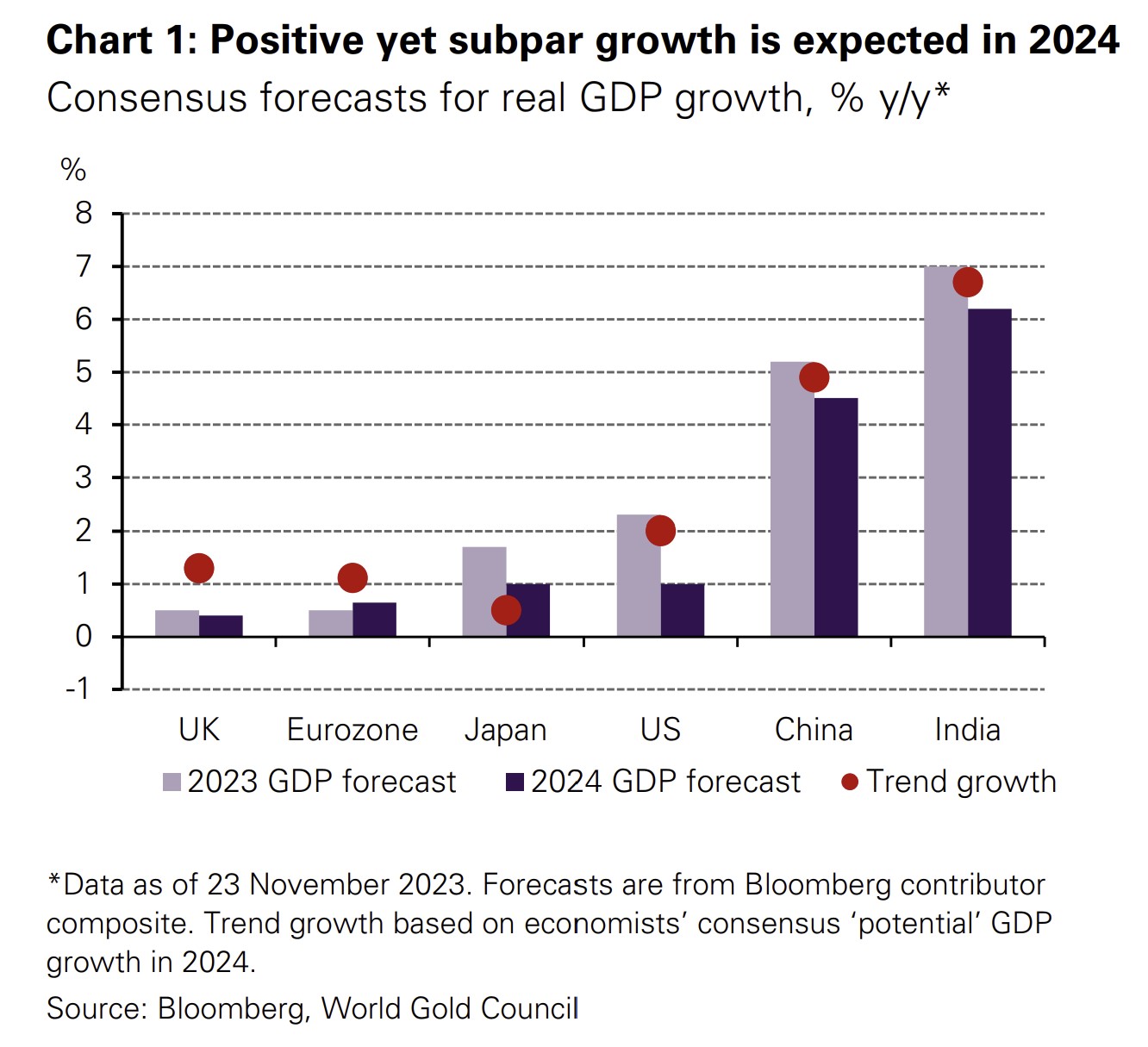

While the market odds favour the Fed pulling off a soft landing, this would be no mean feat. Historically, the Fed has managed a soft landing only twice following nine tightening cycles over the past five decades. The other seven ended in a recession (Chart 2). This is not all that surprising: when interest rates stay higher for longer, pressure on financial markets and the real economy generally builds.

Chart 2: A soft landing is a rarity

Seven out of the past nine hiking cycles resulted in a recession*

A key determinant of whether economic conditions will shift from a soft to a hard landing is the labour market. While unemployment in the US remains low, some of the factors that kept it resilient in 2023 – such as a dearth of labour supply and solid corporate balance sheets aided by a healthy consumer wallet – have not only faded but have a historical tendency to turn quite quickly.

To put things into context, previous recessions in the US started on average between five and 13 months after growth in payrolls reached the same level as today.6 In addition, the so-called Sahm rule, an unemployment indicator developed at the St Louis Fed, is hinting that we are mere months away from a recession.7

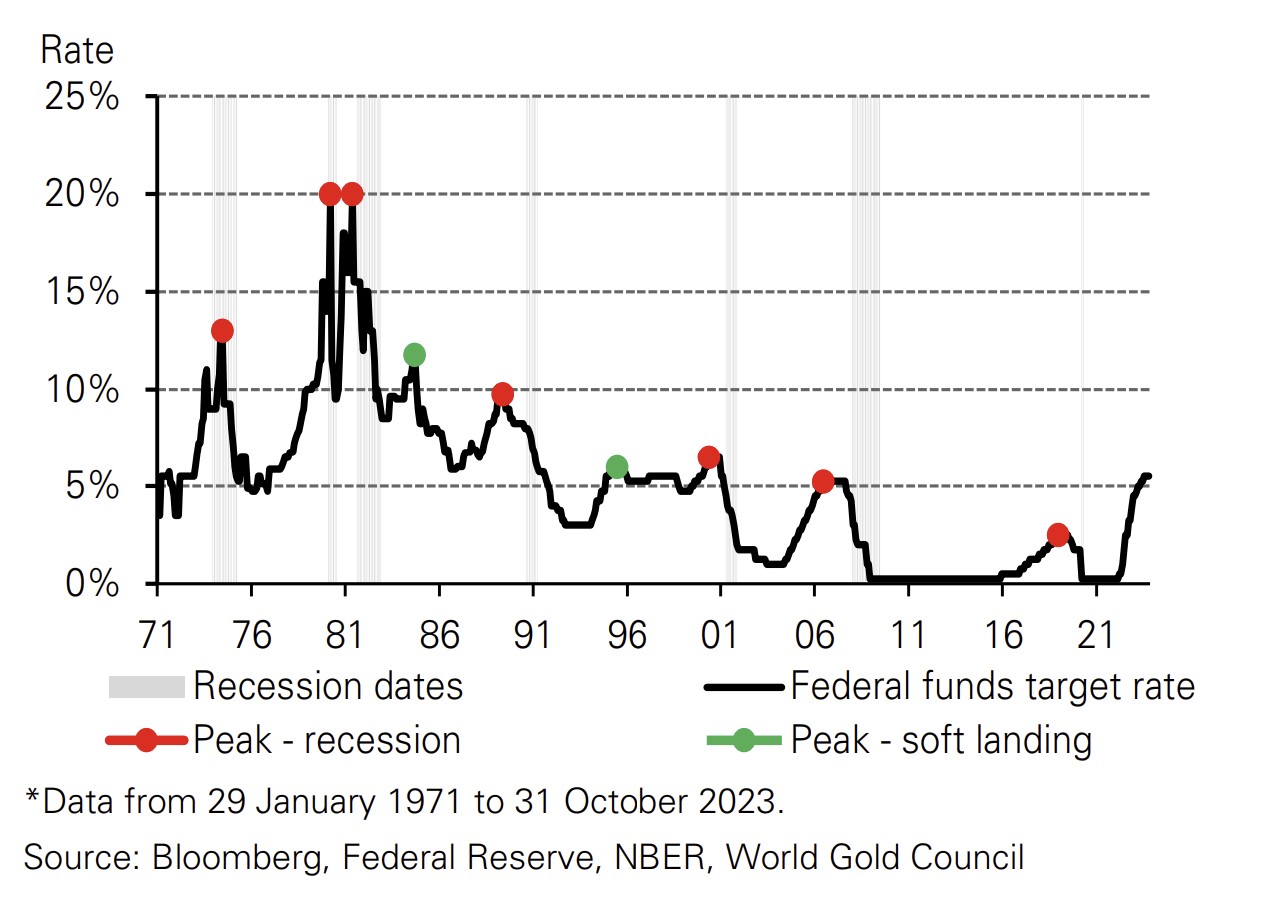

Various commonly followed indicators still point to a moderate to significant chance of a recession (Chart 3). On average, these indicators suggest a recession probability of 45% over the next 12 months.

Chart 3: Estimates of recession probability moderate to significant over the next 12 months

Probability of a recession over the next 12 months based on commonly used indicators*

A (less likely) third option

A soft landing or a recession are not the only outcomes investors could face next year. A 'no landing' is also on the cards.8This scenario is characterised by a reacceleration of inflation and growth. The rebound in US manufacturing and recovery in real wages are two potential drivers of such a scenario.9

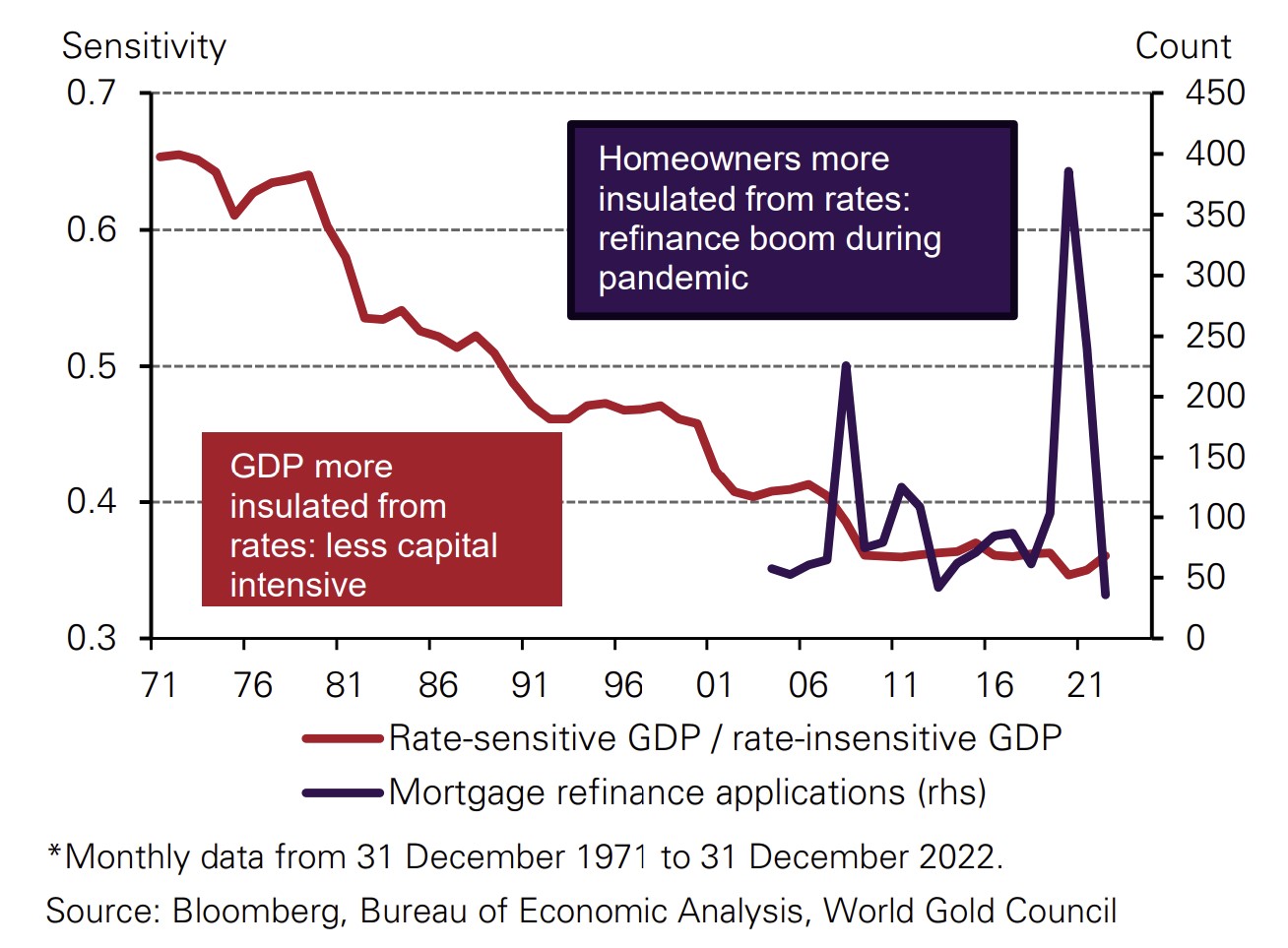

Arguments for this outcome focus on the fact that the US economy has become less capital intensive and thus less interest rate sensitive than in the past. To boot, households have benefited from sizable pandemic refinancing at low rates (Chart 4). 10 And US corporates have somewhat inoculated themselves against the tide of higher rates with a doubling of their duration over the last 30 years.11

Chart 4: US economy and households insulated against rate rises

Rate-sensitive GDP/rate-insensitive GDP and mortgage refinance applications*

Add the prospect of strikes,12 the fact that budget cuts are unlikely in an election year, and spikes in energy prices from a possible continuation of the Israel-Hamas conflict, and the concept of inflation resurgence becomes a real threat.

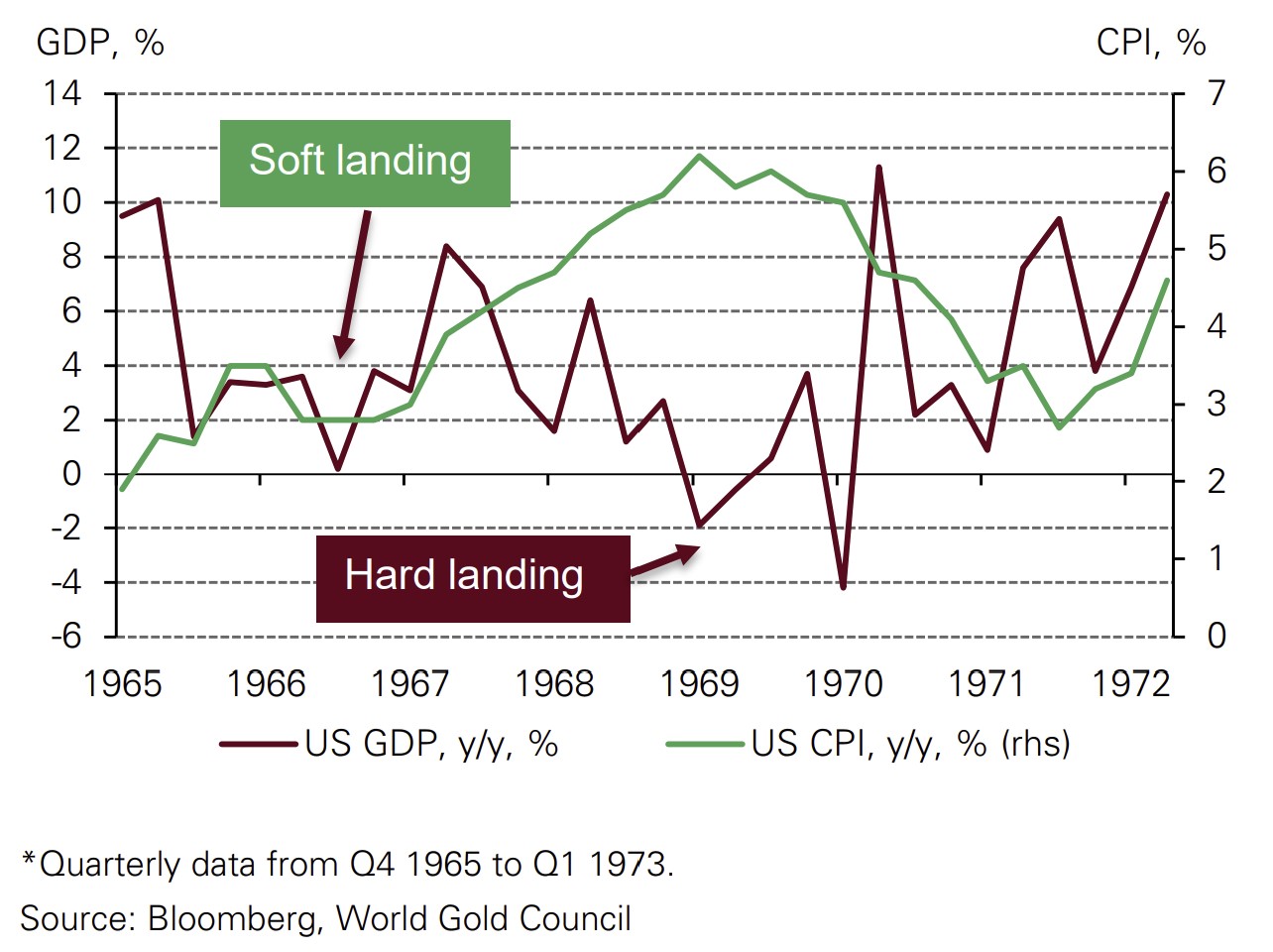

We nonetheless believe a no-landing scenario is an unlikely path: less of an outcome but rather more of an interim state. As Morgan Stanley put it: “A no landing is just a soft or a hard landing waiting to happen”.13 And should the Fed be compelled to hike further, putting more pressure on households and corporations, this would increase the likelihood of a deeper recession down the line, as it did in the late 1960s (Chart 5).

Chart 5: Interest rate hikes following the 1966 soft landing led to a hard landing three years later

US GDP and CPI, y/y during the late ‘60s and early ‘70s*

Can gold break away?

Gold’s performance responds to the interaction of its roles as a consumer good and as an investment asset. It draws not only from investment flows but also from fabrication and central bank demand.14

In this context, we focus on four key drivers to understand its behaviour:15

In practice, these factors are captured by economic variables such as GDP, inflation, interest rates, the US dollar, event risk, and the behaviour of competing financial assets which, in turn, determine a macroeconomic environment (Table 2).

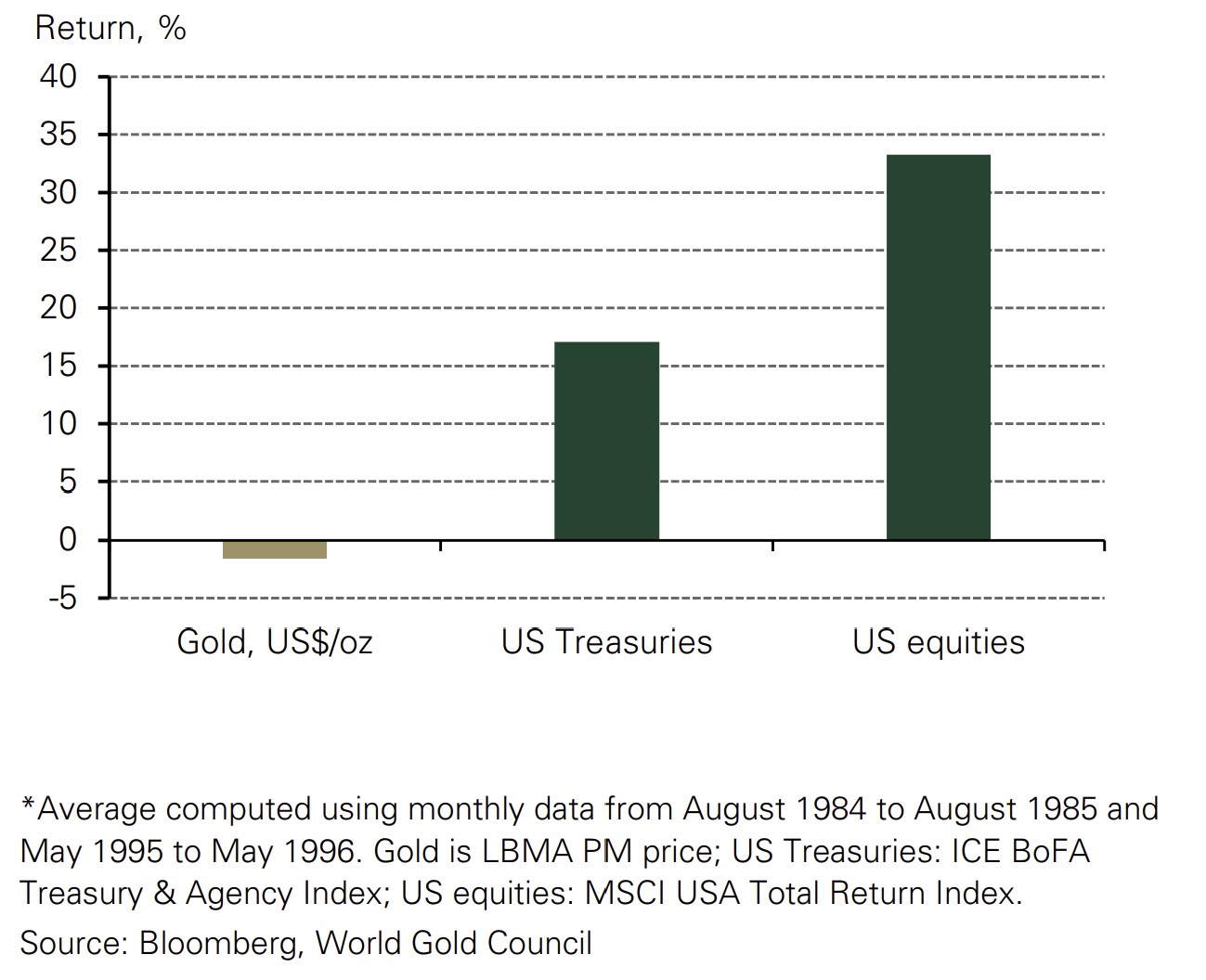

Sidewinding in a soft landing

A soft-landing scenario could benefit bonds and risky assets. Consensus earnings expectations appear optimistic16 and high interest rates would keep bonds attractive. This is consistent with historical evidence, with both bonds and stocks performing well in the two previous soft landings. Gold, however, has not fared as well – increasing slightly in one and decreasing in the other (Chart 6).

Chart 6: On average, the past two soft landings have resulted in flat returns for gold

Average returns for the past two soft landing scenarios*

This is likely the result of two competing forces:

Lower nominal interest rates should bring a respite for gold: 75–100bps of policy rate cuts are likely to translate into no more than about c.40–50bps of longer maturity yield drops. We estimate this response given the bull steepening that has occurred during past soft landings and we also factor in continued term premium pressure, quantitative tightening and high issuance supply in 2024. That drop in longer maturity yields, all else being equal, suggests a gain of about 4% for gold.

Alas, all else is likely not equal. If inflation cools more quickly than rates – as it is largely expected to do – real interest rates will stay elevated. In addition, subpar growth could constrain gold consumer demand. In summary, expected policy rate easing may be less sanguine for gold than it appears on the surface.

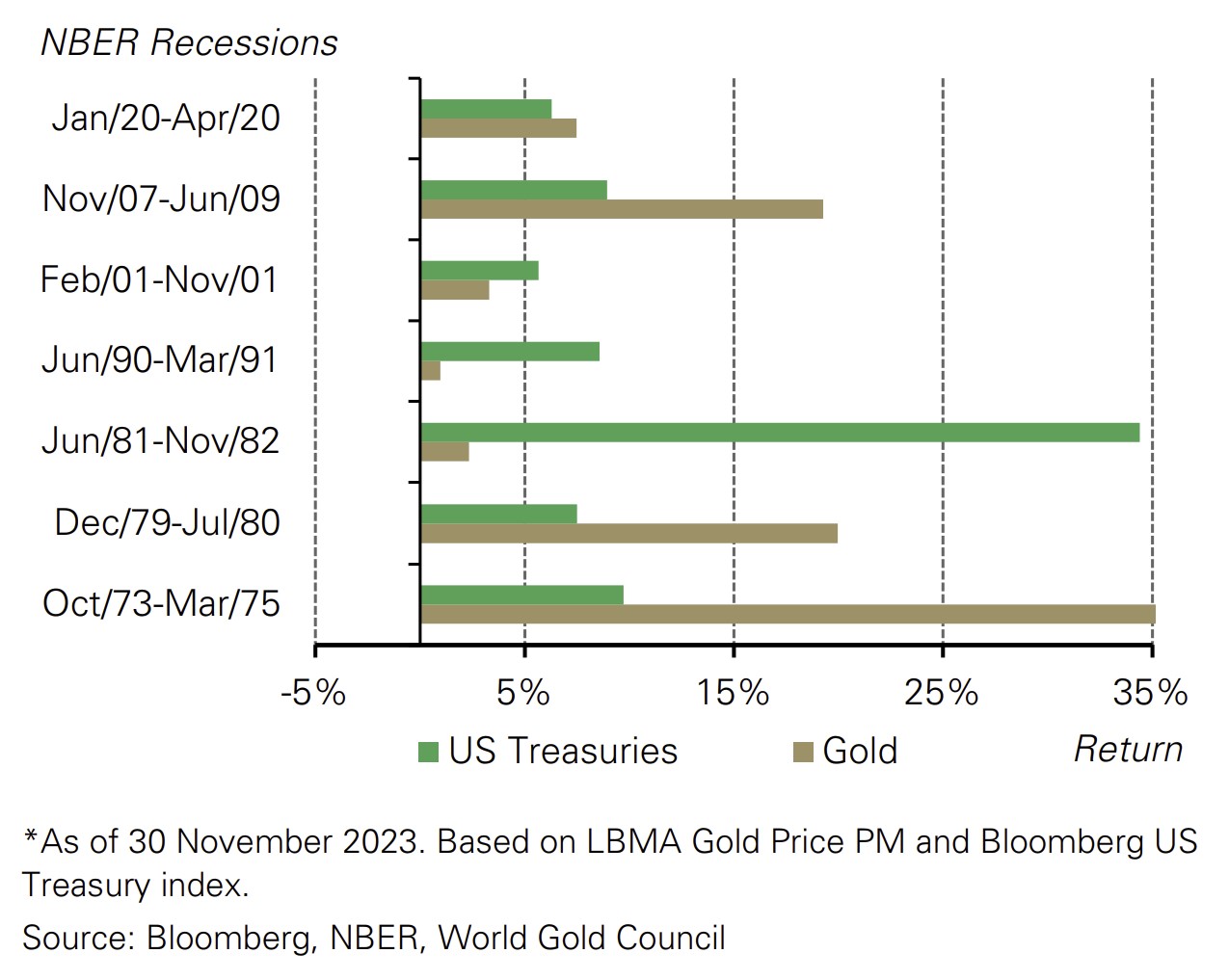

Consistent recessionary outperformer

If a recession becomes a reality, weaker growth will help push inflation back towards central bank targets. Interest rates would eventually be cut in response. Such an environment has historically created a positive environment for high-quality government bonds and gold (Chart 7).

Chart 7: Gold has historically performed well during recessionary periods

Gold and US Treasuries during recessions*

Higher rates may spook

If the no-landing scenario does occur, it could prove initially challenging for gold. While positive economic growth would support consumer demand and higher inflation would increase the need for hedges, it is likely that the combination of higher rates and a stronger US dollar would create a drag, as they did in September 2023. But if inflation surged again it could elicit an even stronger monetary response – leading us back to the spectre of a hard(er) landing further down the line and a strong case for strategic gold allocations.

History may not have the last word

From a historical perspective, a soft-landing or a no-landing scenario could result in a flat to slightly weaker average gold performance next year. However, this time around there are two additional factors in gold’s favour:

Furthermore, the probability of a recession is not insignificant. From a risk-management perspective, this would provide strong support to the case of maintaining a strategic allocation to gold in the portfolio.

Table 2: Gold’s performance in a given economic scenario is driven by the interaction of its four key drivers

Economic scenarios and factors that impact on gold based on key drivers*

*Based on market consensus and other indicators. Size of gold drivers represents relative importance within each scenario. Impact on gold performance based on average annual prices as implied by the Gold Valuation Framework. For relative importance of the various drivers, see Table 1.

Source: World Gold Council

Footnotes

1The LBMA Gold Price PM was nearly 13% higher y-t-d as of 1 December, performing better than the Bloomberg Commodity Index, Bloomberg Global Bond Aggregate, and the MSCI All Country Index excluding the US.

2Bond derivatives markets are pricing around 75bps of cuts by the Fed and European Central Bank starting in June, with other central banks such as the Bank of England to follow. In addition, the Fed’s dot plot indicates that most FOMC members expect the fund rate to be down from current levels by the end of 2024.

3ISM economy-weighted composite PMI at 51.3. Manufacturing PMI at 46.7. As of October 2023. Source: Bloomberg

4Real average hourly earnings at 0.8% as of October 2023. Source: Bloomberg

5Data Revisions and Pandemic-Era Excess Savings | San Francisco Fed (frbsf.org)

6At the time of writing, US payroll growth was 200,000 per month based on a seasonally smoothed three-month average.

7Sahm Rule Recession Indicator, St. Louis Fed (stlouisfed.org). It is worth noting, however, that Claudia Sahm, author of this indicator, has recently said that the Sahm Rule may break without a recession due to pandemic and post-pandemic economic distortions. Claudia Sahm: ‘We do not need a recession, but we may get one’, FT.com, November 2023

8Some investors are taking an alternative view that Fed funds futures are pricing no landing rather that a soft landing. See: Fed Funds Futures Pricing in "No Landing" - Apollo Academy

9Prospects for a global ‘rebound’ | TS Lombard

10The Great Pandemic Mortgage Refinance Boom - Liberty Street Economics (newyorkfed.org)

11The notorious wall of maturities revisited (ft.com)

12From UAW to WGA, here’s why so many workers are on strike this year (cnbc.com)

13Soft, Hard or No Landings, Ukraine - Time to Have Your Say - Bloomberg

14Gold also responds to supply-side factors: primarily recycling in the medium term, and mine production as the longer-term determinant, based on its scarcity.

15It is common for investors to look at gold’s performance through two factors: real interest rates and the US dollar. While useful in the very short term, these factors alone are not sufficient to explain its behaviour and can lead to inaccurate perspectives.

16S&P 500 2024 consensus earnings growth forecast of 12% y/y.

17“In 2024, countries making up over 50% of global GDP will undergo decisive elections.” Eight Key Elections to Watch in 2024, Brunswick Geopolitical, September 2023.

182023 Central Bank Gold Reserves Survey, May 2023.

19Conversely, slower than expected demand would likely create a drag gold.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.