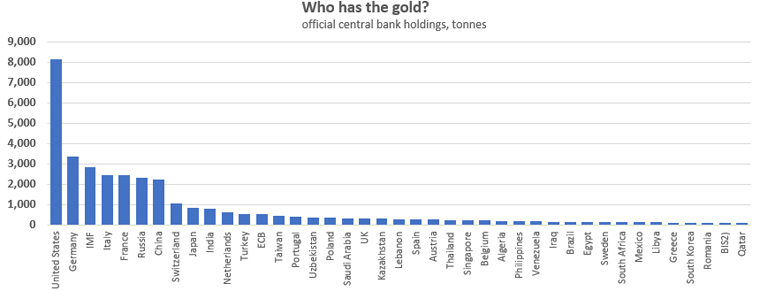

There is nothing much more to this update than the chart below. It is here as a marker of record.

The World Gold Council compiles central bank data from the IMF and other sources to build a picture of which countries have what in gold reserves.

New Zealand never figures in their list - we have virtually none.

Their tally found 35,927 tonnes as at December 2023. At that time the gold price was US$2,078.40/oz. So these official holdings had an overall market value of just under US$2.4 tln - so long as none of them tried to sell substantial volumes of any of it into open gold markets. If they did, obviously the price would fall.

To put that in perspective, the 2023 global GDP is estimated to have reached US$105 tln in overall net economic activity for the year. So total gold holdings would have powered it for eight days and six hours.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

Precious metals

Select chart tabs

35 Comments

Interesting to note that the IMF holds so much gold. Remember that during the 1997 East Asia financial crisis, the South Korean govt collected gold from citizens to shore up its short-term and long-term debt obligations. It's my understanding that the IMF took custody of the gold in exchange for funding liquidity and it's unclear if it was ever returned.

https://www.forbes.com/sites/greatspeculations/2016/09/27/how-gold-rode…

Going by the headline of this article, a couple of questions come to mind.

First, if gold is mostly used by rogue states to insulate themselves, then why do most western states still have so much of it in their coffers?

Second, the fact that rogue states are able to insulate themselves using gold points to the power which gold still has in modern business transactions does it not?

I would have loved to read more on this topic. Unfortunately most respectful business news outlets shy away from discussing gold for obvious reasons. I don't blame them.

Central banks bought more gold in 2022 than in any year since 1967, according to the World Gold Council. In Q3 2022, global central banks bought nearly 400 metric tons of gold, almost doubling the previous record. However, it's unclear where most of the buying came from, according to WSJ and a gold consulting firm.

Emerging-market central banks have long bought gold to diversify their foreign-exchange reserves, which are dominated by dollar assets over which the U.S. exercises ultimate control. The scale and speed of the recent purchases, though, suggests one or more major developing economies were behind the buying spree.

One reason a country may purchase such large volumes is because it feels uncomfortable holding dollar assets given tensions with the U.S., said Dominic Schnider, global head commodities and forex at Swiss investment bank

Another reason may be that a country could have seen excess returns from sectors like energy in the third quarter and wanted to add more physical assets to their reserves, which may point to oil-rich Middle Eastern countries like Saudi Arabia as well as Russia.

https://www.wsj.com/articles/central-banks-have-binged-on-gold-this-yea…

Singapore boosted its gold reserves by about 30% in January, joining central banks from China to Turkey in building up holdings of the precious metal.

The Monetary Authority of Singapore’s bullion reserves rose to 6.4 million fine troy ounces, or 199 tons, at the end of January, up from 4.9 million ounces a month earlier, a spokesperson for the central bank said in response to emailed questions. The total value of its bullion was $4.5 billion at the end of the period, the authority said.

https://www.bloomberg.com/news/articles/2023-03-10/gold-xauusd-gets-rin…

Most countries don't own any gold for good reason - it's a terrible investment. Since QE gold hasn't managed to go anywhere, in fact in inflation-adjusted terms it's declined in value since 2019. Canada sold all theirs because they found better uses for the money.

The USA own theirs because as Ben Bernanke said it's 'traditional', and they use some of it as a tourist attraction in New York which is booked out months in advance. The US Treasury owned gold might buy a few warships, but that's about it, and the metal can be traded in dozens of different ways in 2024, you don't need to own a 'stack', it can be bought, sold, or sold short from the comfort of home.

Most countries don't own any gold for good reason - it's a terrible investment.

Central banks do not hold gold as an investment. And the question as to whether or not it's a 'terrible investment' depends on a range of factors. In many major currencies like JPY, gold has appreciated approx 100% in past 5 years and 120%+ over the past 10 years.

Against the Kiwi peso, the gold price is up 120%+ in the past 10 years. Last two bull runs in gold have returned 1000%+ and 800%+. Given the money printing going on, quite possibly we're in a new bull run.

The reason the gold has appreciated against the JPY is because the JPY has plunged against the USD. Since the advent of QE gold's gone up and down a few times but the net result is down in inflation-adjusted terms.

Gold has no dividend, it costs to insure and store it, and over the long term is definitely a loser against property and stock markets. I trade gold stocks occasionally. but definitely get out once there's a decent profit. The Aussie stock exchange gold index has been declining for years.

Goldbugs incessantly compare gold with currencies, not dividend producing assets which have slaughtered the gold price.

USDJPY has appreciated approx 40% in the past 10 years.

XAUJPY has appreciated 120%+ over the same time period.

The Japanese holding gold is a clear winner.

Maybe the Japanese, maybe the Russians, which have seen their currency completely crash, but gold..........it's a dud. And it's going to get worse. More is being dug up every year with new technology, and there's dozens of different ways of trading it in 2024.

, but gold..........it's a dud. And it's going to get worse. More is being dug up every year with new technology, and there's dozens of different ways of trading it in 2024.

But the evidence suggests you're wrong. Even against your glorious USD, the price has doubled since 2015.

Possibly doing better than Nu Zillun houses over the same time period.

Gold is often compared to rat poison given its similar properties. Comparatively it's been a dud against ratty. But not against fiat.

Gold is not really an investment, its a physical asset backing fiat and the monetary system to some degree. The USA is holding it for a reason, it adds some credence to the USD being the reserve currency.

In a world where the economic landscape is in a constant state of flux, the idea of a currency backed by tangible assets is gaining traction, particularly outside the Anglosphere. The idea of the gold-backed BRICS currency is a potential game-changer in global finance. If this becomes a reality, it will mark a historic return to the gold standard, whether the English speakers like it or not.

BRICS...you gotta be joking. Failed states tyrants and dictators. Russia, embroiled in a pointless war with a worthless currency. China with a property crash underway, and South Africa....who in their right mind would take a punt there?

Where's this 'BRICS currency' I keep hearing about? You buy it, if it ever turns up. I won't be.

The USA gold is a pittance in the big picture, it might run the military for a few months, but that's it. No one cares about gold in 2024, only goldbugs and those that like to trade it.

Everyone likes the USD because it's liquid, stable and it's being going up for years against other currencies. Would you take a stack of Russian roubles for your next trip abroad? Would you throw a few ounces of gold in your baggage only to be arrested for smuggling?

No one cares about gold in 2024, only goldbugs and those that like to trade it.

The world defined by the water coolers and BBQs that you frequent is an extremely limited profile of gold demand.

I don't frequent water coolers and BBQ's. I've been retired for 10 years. The notion that gold will be a 'currency' is absurd, a posture that isn't supported by a single economist on the planet.

It is supported however, by a plethora of gold salesmen like Peter (gold US$20,000) Schiff who are selling gold to newbys and suckers.

Gold is a murky and obscure subject - and governments and central bankers would prefer it remains that way. It goes without saying the precious metals prices are ‘managed’ to avoid any embarrassing increases in value. 99% of trades on these futures exchanges do not lead to the transfer of any metal.

Supposedly gold demand in eastern countries has increased in the last couple of years after these governments saw that Russia had it’s foreign reserves confiscated after their Ukraine invasion – financial warfare.

Gold is like an insurance policy in case central bankers lose control of their fiat currencies and we have a currency crisis. See linked article if interested.

https://www.zerohedge.com/markets/dutch-central-bank-admits-it-has-prepared-new-gold-standard

I can trade gold in dozens of different ways without taking delivery. The same as I can trade oil, soy beans or cattle without having 100 cattle arrive at my house. Goldbugs waffle on about 'paper gold', but never mention paper cows, paper orange juice or paper steel.

Goldbugs love conspiracy theories. Since the advent of QE, gold's gone nowhere...it's not 'managed', it's just a dud investment that has no dividend.

Gold stock indices have been declining for years.

Since the advent of QE, gold's gone nowhere...it's not 'managed'

It's ok wingman, it's a hard concept to understand.

Gold is like an insurance policy in case central bankers lose control of their fiat currencies and we have a currency crisis.

Last two bull runs in gold saw 10x+ and 8x+ over <10-year periods. So while gold can be considered an insurance policy, it can also be an investment.

An interesting doco on gold. https://www.youtube.com/watch?v=x5kOhJPxAsY

All that glitters is not gold. Market manipulation. Any gold left in Fort Knox?

A few years ago Texas didn't trust the Feds about their stash of gold so had it repatriated back to Texas. German govt also didn't trust the US so had all their gold repatriated in the last ten years or so.

Comex ran out of gold sometime in the last five years when contracts weren't rolled over and the hard stuff was called on for delivery. Had to run around trying to get gold via the UK.

Took Germany a long time to repatriate their gold. While it was held at Fort Knox, they weren't even able to audit it.

https://money.cnn.com/2017/08/23/investing/germany-gold-reserves-new-yo…

Claims on gold ETFs are suspected to be far greater than the underlying physical gold. Of course, the likes of the media and JPM would suggest that's little more than a conspiracy theory.

Most gold ETF's don't own any gold, they're not required to and state as much in their prospectuses. There's all kinds of gold ETF's - short, double short and even triple short.

Youtube......you gotta be joking. Fort Knox is empty is about the nuttiest conspiracy theory on the internet. About 3 years ago a couple of politicians visited Fort Knox and had their photos taken with the 'stack'. But I suppose that won't be good enough for conspiracy cranks.

The COMEX doesn't own any gold. It's a trading company.

I doubt the doco is done by conspiracy theorists.

Comex doesn't have to own gold but is required to deliver it if a contract is not rolled over. There's enough information on the internet about the debacle two or three years ago.

This is very recent. https://www.linkedin.com/pulse/gold-silver-move-excavating-hints-comex-…

who holds Russia's gold? - is it safely deposited in Swiss vaults :-)

Russia.

Russia's gold is effectively worthless because no one will buy it - it's got Russian hallmarks.

New Zealand extracts 10 tonnes of gold a year and there’s plenty more in the ground - it’s safer there than in the bank !

I bought gold at £1131 6 years ago.

It is currently at £1611 so that is 42% up

Is the DJIA up 42% in that time: no.

Did banks deposit rate give that rate of return in that period: no.

Doesn't matter what the increase was its about how much of it you bought. People make a lot of money on houses because they have a lot invested to start with. If you make a few thousand on Gold, so what.

I've traded gold, shorted it, triple shorted it, bought it, sold it and never owned one ounce of the stuff. Why anyone would buy an illiquid chunk of metal is something I can't get my head around.

There is only one period in history gold has beaten the stock market. Stock markets pay a dividend, property pays rent, gold pays n-o-t-h-i-n-g.

Gold has been declining for the last 4 years in real terms.

Gold has been declining for the last 4 years in real terms.

Depends. Gold price up approx 29% in past 4 years so possibly down in real terms.

NZ50 flat over same time period. So waaayyy down in real terms.

Gold is the better performer. It's all about trade offs.

Since May 1980 gold is up 400%. In the same period the DJIA (which doesn't include dividends) is up 3,900%.

Long term gold is complete waste of time, nice to look at, but not for serious investors. More a collectors item like a vintage car or stamps.

The answer - Tucker C. has the gold......

Ask him!!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.