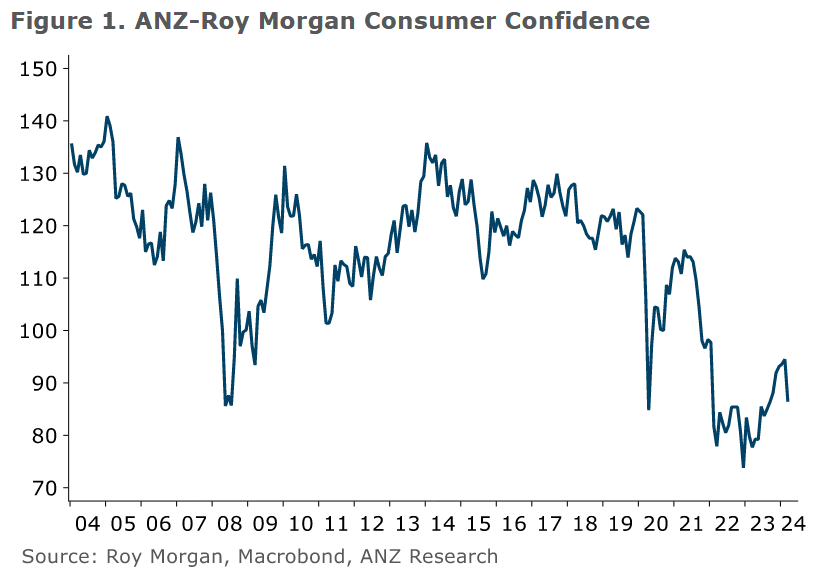

Consumer confidence has taken a big knock, with sentiment "likely affected by recession headlines", according to results of the latest ANZ-Roy Morgan consumer confidence survey for March.

During the period of the latest survey, GDP results for the December quarter were released showing that the NZ economy had contracted by 0.1%, giving two consecutive quarters of negative GDP (after a 0.3% drop in September) and therefore producing what is referred to as a 'technical recession'.

As a result what had been steadily improving consumer confidence took a blow.

"News that the economy re-entered recession in the second half of last year appears to have hit consumer confidence hard," ANZ chief economist Sharon Zollner said.

"Only around half of the week 4 survey responses will have come in after GDP data was released on 21 March, but the responses for that week overall were notably lower. That said, the preceding weeks were also softer than February, so the monthly fall in confidence isn’t just about recession headlines."

Zollner said while the GDP data has likely caused some volatility in surveyed confidence, "in the bigger picture, the economy really struggled in the second half of last year, especially on a per capita basis, and the labour market is increasingly showing the impact of that".

She said even if in GDP terms the economy is now past the worst, "as we expect it is", the labour market will continue to soften for some time yet, given the usual lags in the dynamics between overall activity and the labour market.

Consumers continue to report ongoing extreme wariness about purchasing major household items, Zollner says.

"This perception has been strongly inversely correlated with inflation in recent years, to the extent of breaking the usual reliable relationship with retail sales. To be sure, retail sales have been very weak, ask any shopkeeper, but the fall in this indicator was extreme as inflation took off."

This was the detail of the latest survey results:

• The future conditions index made up of forward-looking questions fell 8 points to 93, while the current conditions index fell 9 points to 76.

• Perceptions of current personal financial situations fell 11 points to -23%, back where it was in September last year.

• A net 19% expect to be better off this time next year, up 1 point.

• A net 24% think it’s a bad time to buy a major household item, down 6 points, bringing to an end a steady run of improvement.

• Perceptions regarding the economic outlook in 12 months’ time dropped a sharp 14 points to -34%. The 5-year-ahead measure dropped 10 points to -5%.

• House price inflation expectations fell from 4.1% to 3.4% y/y. They are strongest in Canterbury (3.9%) and weakest in the rest of the South Island (2.7%).

• Two-year-ahead CPI inflation expectations were unchanged at 4.5%.

23 Comments

And as we know by reading the works of Tony Alexander, once consumer confidence gets knocked, House prices go up.

Yes, once anything happens, House prices go up.

How is that Toye?

Your are missing the loaded sarcasm. Implies that Tony is a "it always goes up mate....." kinda guy. Which he is.

reading the works of Tony Alexander

You make it sound as though he has been writing things of substance.

geee, it's almost lower than 2008!

Shows the power of media. The financial situation of those surveyed didn't change from the day before the recession announcement, to the next day, yet negativity has set in following the announcement

It's about confidence in the future. If I got a bad prognosis from the doctor I'm not going to leave feeling confident even if I feel physically fine for the time being.

A "prognosis" from the doctor, as you say, is about the future. But the GDP figures showing a recession, are not about the future, far from it, they are figures for June to December 2023 !

Our new leaders have not been painting an optimistic picture of the NZ economy since they have got into power. You can't really blame the media for reporting what they say.

This metric has a falling wedge pattern over 20 years. Too much of disposable income diverted towards mortgage servicing! Further drop in valuation seems inevitable.

What is inevitable are rate cuts - they will be coming fast.

Only when inflation actually falls.

RbNZ has only one target which is inflation.

I wouldn't bank on inflation falling either.

There is significant potential for a black swan event to result in either oil price rises, or major exchange rate fluctuations. The most likely is the expansion of the war.. drawing in additional players in Europe .

Agreed, higher oil prices help the major oil producers. Hinder the US and Rules based economies more than perhaps the BRICs, it's the use of physical war to inflict economic damage. Look what removing cheap oil and gas from Russia has done to Europe.

Almost every major NZ recession historically has been driven by an offshore event.

There is significant potential for a black swan event

I saw one just last week. Was passing by Pauatahanui Inlet and saw about fifty of them congregating. Struck me as unusual. A definite 'black swan event' in hindsight.

If Luxon and Orr find out they will have the perfect excuse for everything!

Not when you’re pegged to the US$.

When you start a new job and the person sitting next to you is disestablished on the 2nd day..... tends to sharpen the mind.

The sheer number of redundancies starting to hit is starting to really ruffle some feathers.

Anecdotal but personally know of 3 peoples being made redundant (TVNZ, 1 from private events business and MPI), with another unsure currently of their position at NZ Post. This is all people in their late 20s/early 30s, recent FHBs.

Hopefully they'll still be able to find jobs in the next wee while.

Heard they're looking at 25% at the ministry of health from a friend that works there in a pretty senior management role. It seems that the fastest and easiest route to 7.5% savings in the budget isn't changing the way you do things, it's simply cutting staff and hoping for the best.

Should probably add she mentioned that the expectation is that because so many of the MOH staff are front line, that 25% will be concentrated amongst the bureaucrats, so more than 25% there. Sounds brutal.

I love it that commentators are still rolling with 'don't worry, this is a blip, signs are that the economy will be rising Lazarus-like in no time'. Are they crazy?

We are still crushing the economy by pulling billions away from spenders and businesses and stuffing it into the savings of savers (and bank shareholders). The delayed effect of the constraints placed on the economy over the last 6 months will be playing into the economy over the next 12 months. Economists don't understand this because they misunderstand the role of private credit.

It does seem crazy.

Everything points in the opposite direction.

- Effect of higher interest rates still to be felt in full

- Widespread indications of job losses to come (and currently occurring)

- 'Wealth effect' gone

- Cost of living still going up if anything (certainly not falling - as if it ever would)

- Skilled workers with more reason to leave and replacement immigration filling low skill roles for the most part

- Overall population gain leading to higher infrastructure costs (even just maintenance)

- Cancellation of infrastructure projects necessary to support productive activity and employ people through a downturn

On the plus side:

- $20 and possibly some new roads to maintain

"Two-year-ahead CPI inflation expectations were unchanged at 4.5%."

We will be under that at the next CPI release!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.