The Reserve Bank's increased its house price forecast for next year and now sees prices rising by just over 7% in 2025.

In data prepared for its latest Monetary Policy Statement (MPS) the RBNZ sees house price growth of -0.2% for 2024, but then sees prices picking up in the second half of next year, with the annual price rise seen as increasing from 2.8% for the year to June 2025, to 5.5% for the year to September 2025 and then 7.1% for the year to December 2025.

The RBNZ sees house price growth peaking at 7.4% in March 2026 before gradually declining.

Compared with the RBNZ's last MPS in August, the latest forecasts show near-term prices as quite a bit firmer. In the August forecasts the RBNZ saw house prices rising 0.1% in the year to December 2024 and then rising 4.8% in the year to December 2025. The forecast peak then was lower too - with a pick of 5.9% for the year to June 2026.

Since August the RBNZ has begun to drop the OCR, from 5.5% to 4.25%. Banks have been dropping mortgage rates quickly as well.

Latest monthly mortgages figures from the RBNZ for October show a seasonally-adjusted increase of 3.3% in the amount of committed mortgage money. This follows a 6.9% seasonally adjusted increase in September.

The total of mortgage money committed to in October 2024 was $7.534 billion, which is the highest monthly total since December 2021.

Investors took $1.709 billion, which is this grouping's highest total since December 2021 also. It compared with just $1.021 billion taken by this group in October 2023.

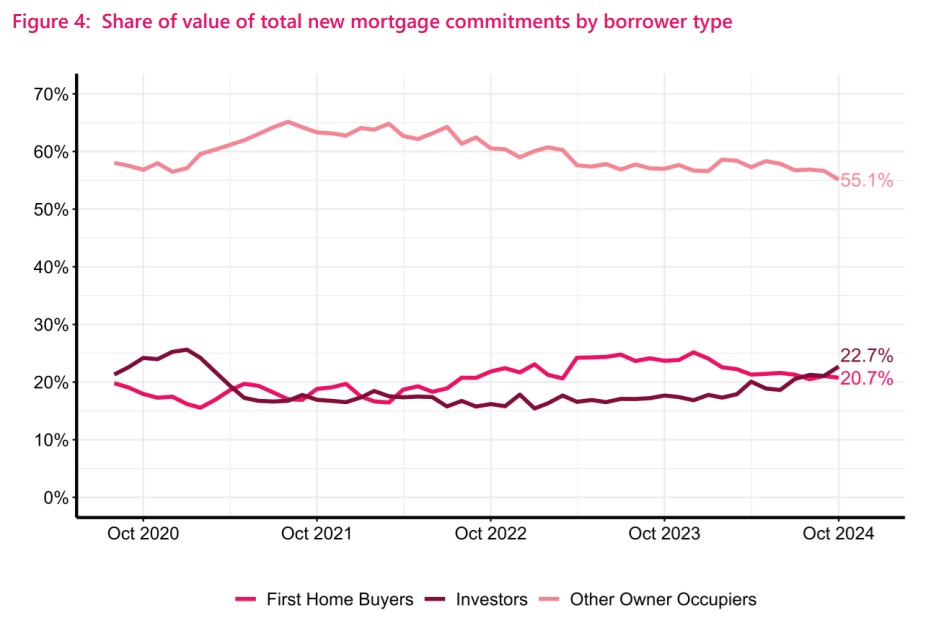

The share of the total mortgage money taken by the investors rose to 22.7% in October from 21.1% in September. It's the biggest share the investors have taken since February 2021 and compares with a share of just 17.7% in October 2023.

The investors' share of the mortgage money really started surging in August, with the grouping that month overtaking the amount borrowed by first home buyers (FHBs) for the first time in two and a half years.

In September the FHBs and the investors actually borrowed exactly the same amount, but in October the investors' tally easily outstripped the $1.563 billion borrowed by FHBs.

The FHBs hit a high water mark in terms of share of 25.2% in December last year and since then the proportion has gradually generally been falling.

In October the FHB share was 20.7%, down from 21.1% in September.

In terms of mortgage numbers the total number of 19,273 loan commitments in October was the biggest in a single month since December 2021.

The 3,068 commitments by investors in October 2024 was this grouping's largest number since July 2021.

The 2,765 commitments by FHBs was this grouping's largest number since November of last year.

159 Comments

So we up the ocr to control inflation but don't give a s##t when the most essential item is inflating even further beyond the reach of our young people.

What an absolutely f##d up system.

You can be sure the youth never voted for this, but they sure are lumped with it.

Thanks to labours complete mishandling of the economy during covid

Incorrect, they had bugger all to do with house prices bar, lockdowns and closed borders. This is due to 30 years of lowering real interest rates coupled with tax free capital gains that have lead to a cultural and economic reliance and obsession with the cost of housing always increasing, currently to the long term detriment of our country. the same 30 years of lowering real interest rates will not be repeated again. The RBNZ's ridiculously low OCR coupled with removal of LVR limits and the FLP can also be noted as fuelling the fire so to speak.

They had everything to do with the massive spike in house prices by flooding the economy with government funds and paying exorbitant prices for land for their KO housing (when they already own under-utilised properties)

I think you are both right.

The "Great Wealth Transfer" continues .... and it won't stop.

Unsuspecting FHB's needing 2 above average incomes ....to buy that crappily built box, without parking

Banks extracting as much cash as they can .....because they can.

Landlords expecting to raise rents anytime .......while their prospective tenants head across the ditch

"Vested interests" in the great PPP lamenting the downturn in the market ....without another arrow in their arsenal to create another income

Needing two adults working full time to pay a mortgage will help to keep birthrates down. Fewer people means the planet will last a bit longer.

PDK will be thrilled at this.

Who needs birth rates when we can invite the already irresponsibly overpopulated areas of the globe to come do same with us.

That's an interesting observation. But it may not hold up much longer ...

As women's education has improved in countries that used to have high birth rates - now they're falling. (One notes that some Islamic countries are bucking this trend.)

(FYI: women's education is obviously a euphemism for much more than their 'education'. Long may it continue. We've got to keep PDK happy.)

Some people insist on their energy-blindness.

Education arrives in lockstep with energy-use - infrastructure build and consumption of shyte. So there's a distraction, and a reduced apparent need to procreate (better health/medicine, less attrition).

The problem comes when the energy-stream leaves - one gets regression to fundamental beliefs, abandonment of education (it didn't work) and increased procreation - who knows how many will survive a down-turn?

Starting from a proven, real baseline, is the better way to go.

"Education arrives in lockstep with energy-use"

Really? Prove it. (Good god man! You're so full of shit.)

https://www.youtube.com/watch?v=T19tHn_LA80

I've put that in front of you before - I'm guessing arrogance? made you not look. As I'm guessing with all the links I've put up. Starting from the assumption that you know best????

Surplus energy = freed-up time (from food production, which is all about energy harvesting).

What sort of engineering are you in? Financial?

Sorry. Written words please. Rewinding videos to join the dots is vastly time consuming. (Far harder to b.s. in written material too.)

Stands to reason that there would be a link between education and energy use, but .....

"Access to affordable, clean, and safe sources of energy is essential to achieving universal and equitable access to education. Energy access directly and indirectly improves educational outcomes. Electrification of the classroom enables longer studying or classroom hours at schools, deepens the use of information and communications technology, and strengthens teacher recruitment and retention.3 The indirect effects on education are tied to how energy improves other aspects of well-being that affect education: better nutrition, access to vaccines, higher household incomes, improved indoor air quality, and reduced time spent by women collecting firewood." .....

"There are clear diminishing returns to educational outcomes from increases in energy use per capita. At very low levels of energy use per capita, small increases in energy use are associated with large increases in expected years of schooling. But above 30 to 40 GJ per capita, advances in schooling start to slow quickly.".....

(What is the relationship between energy use and education? - Cutler Cleveland)

It is the relativity of how how much energy is consumed in education - that can't be generated from renewable sources - that's the issue. For example, a 747 flying uses energy - all of that energy is non-renewable as it comes from fossil fuels. A class room? Almost all can be renewable electricity. PDK's arguments lump all 'energy' into a single group and then uses sweeping but nonsensical generalizations, and meaningless references to physics, to pretend we're all doomed. The non-renewable energy consumed in education is miniscule - if not zero - if we do it right. Or put another way, we need to change. PDK arguments pretends they'll be no change - ever. It's a nonsense. We change how we behave all the friggin' time.

It was the choice of the people to pile into property.

Ultimately it was RBNZ monetary policy that fuelled it.

It's 30 years of inept government and central bank policy, fully captured by banks and the financial system.

Ignorance is bliss.

I don't think so. It's a multifactor thing. Immigration and tax also has a lot to do with it.

Which is government economic policy.

Designed to keep people competing for jobs to keep labour costs down, especially at the lower end of the "labour market".

I agree to some point, however while contributory, KO purchases would only be a drop in the bucket compared to the level of private debt taken on to purchase the majority of sold property over Labours term at ever increasing prices. Not defending Labour, they were hopeless in many many ways with an enduring legacy of shite that will be remembered for generations, but one has to look objectively at the big picture.

Can you draw a line between "flooding the economy with government funds" and "house price inflation"? I get the KO overpaying for land bit, that in itself won't drive wider market movements for existing dwellings, but how does the flood of government funds make house prices go up?

Did these funds translate into wage increases, resulting in increased borrowing power? Just want to know your thoughts behind the comment.

I was referring to the massive increase in public sector employees, the cheap government loans that were dished out (many of the SME businesses that I see didn't really need those funds and they ultimately used for personal use), the massive funding of school and hospital development (which was needed but could have been managed better) and the open chequebook of KO which flowed through to tradies and the like and saw private sector employers having to pay high prices to get/retain staff. Yes the stimulus was needed post covid but it was poorly managed

Good points, thank you.

They had a majority they could have done something to tax property speculation more and productivity less.

Please see: ring-fencing, interest deductibility, and bright line extension. 2 of 3 have now been rolled back but the ring-fencing change could well be the one we look back on as a demarcation point that made the (savvy) investors rethinking strategy.

No point rearranging the deck chairs to bring in the same tax haul re lowering other taxes intune

That's a long time ago now. What is our current government doing to ensure that housing is affordable for future generations?

Streamlining the RMA process and opening up land for more buildings (which I don't actually agree with) are a couple of steps in the right direction

No, they're not.

Widening your scope of enquiry - both by width and by time - might help.

Cheaper houses can indeed be built, but not while everyone wants to clip the ticket, and live on the clippings at NZ levels of consumption. That ticket-clipping can be partially traced to the massed panic reaction to leaky homes (how dare someone devalue moi?) which demanded ass-covering at every level. But there is more involved - the trend to go for the best-first, leaves a sequence of ever-worse options; often showing up as 'ever more costly'.

Nact were guilty of fanning this fire before the last Govt; as were all from 2000 on. There is no other receptacle for growth of issued proxy, big enough to continue the Ponzi, and hasn't been for some time.

Lol bold and patronising comment there mate - maybe it's that I don't have the time to spend all day making heavily opinionated comments on websites?

PDK has some strong views, but inevitably viewing the world through the lens of energy and resources will lead to the same conclusions.

It wont make a difference if a 2 bedroom unit costs $1mil.

Thats true...

I don't think that is their goal. The question is, what are they doing to ensure that housing is affordable for landlords/investors/older well-off home owners/their friends? (plenty, so in their view - mission accomplished)

House prices were rising faster than weekly wages for long periods before the peak…but not deemed to be a problem by those in charge of financial stability. 7% inflation of housing for decades but this wasn’t viewed as a problem…even when the wages that are used to pay for these houses are targeted (by the RBNZ) to rise at half the amount! (anyone else see the problem here?!!!) (there is a huge financial hole here..the only solution is for interest rates to never stop falling let alone rise..otherwise that system/model of running the economy falls apart..even with flat interest rates our economy will stagnate..it always needs cheaper debt in the future to allow house prices to rise at 7%..and if that doesn’t happen the economy starts imploding).

But imagine if the CPI basket was increasing in price at a level higher than average weekly wage? And yet housing costs make up the largest proportion of peoples weekly outgoings, and when the price of that housing was going up faster than people could earn money via labour/wages, many viewed this as a good problem to have (as you know, I vehemently disagreed with this as I could see the long term consequences it was going to have on our social ad financial stability as a nation as a whole).

As you mention, the current model for controlling the economy is f%%kd. All it does it promote asset bubbles and inequality.

A number of us on here have been calling this system as BS for eternity. Mr key celebrating the rises was a particularly revolting moment. We wonder why social problems are increasing - main cause is housing, be it rents, mortgages or quality - driven by poor policy and tax systems.

The crazy thing is, it is because of high house prices (sucking discretionary cash out of the economy) that the economy is broken, so how do they fix it, by increasing house prices. It's nuts.

Not forgetting Arderns comments about house prices rising - the whole system is wrong regardless of who is in power

Orr has the DTI lever that he long advocated for. Lower the threshold for investors, I mean specuvestors.

Yes, but it'll never be used in a meaningful way, as it will prevent asset growth - as per Indep_Obser post above.

ORR is greenlighting the ponzi, time to fill your boots.

Chuckle - when you and I agree...

:)

That would be one of the best (and easiest) things that could happen

How many young people buy a house with cash?

What matters is the mortgage repayments. House prices up by 7%, interest rates down by much more than that, so houses much more affordable at the end of next year.

Wilfully blind comment.

Cash or not, they need an income. And for the last 15 years or more, incomes have been in lockstep with house prices - a tradie can only afford a house if he's got work building/adding-to houses. If his work dries up, he can't make repayments - multiply that by hundreds (think: all the layoffs this year) and the Ponzi dies. Taking attendant bets with it - like the hairdresser who shore the tradie's hair, until he couldn't afford it and got the missus to cut it. Actually, given the stress of the situation, probably the ex-missus.

The message I was replying to was about house price inflation. I pointed out that the house price is not what FHBs probably care about, it is mortgage repayments. Of course the deposit is relative to the house price, but with Kiwisaver providing most of the deposit I don't see why that is much of an issue.

Yes they need an income, hence why the RBNZ is dropping interest rates to improve the economy now that they have reduced inflation. You are betting it will fail, I reckon it will probably work (eventually).

Unless people are voluntarily putting lots extra into Kiwisaver it is unlikely to be the bulk of a deposit. Also a good proportion of what people get out of Kiwisaver is their own money, so it's still their savings.

Take two people on really good salaries (100k each) aiming to buy a modest house (500k) needing a 100k deposit. After 5 years, the amount over and above their own money that they get from being in kiwisaver is approx $25000 before returns (3% employee contribution minus tax, plus govt contribution). They would need to wait for 8 years and get consistent net returns of 5% before they would even be close to having half their deposit made up of money they wouldnt otherwise have if they werent in kiwisaver. So KS isnt exactly a magic bullet when it comes to a deposit.

Take a look at the Kiwi FHB facebook group.... majority of buyers deposit comes from kiwisaver, especially those buying with a 5% deposit on a $500k home. Obviously there is outliers but for most KS far outweighs savings used as part of their deposits

Interesting, my savings put towards my deposit were 3x what my kiwisaver was. Then again, many aren't good savers out there.

Sure, but I don't think you are taking into account that depending on income, generally about half of what people get out of kiwisaver at the end is their own money that in theory they could have saved elsewhere. This isnt money that kiwisaver is somehow creating for them to save them the burden of saving for a deposit. Its obviously a help in that you get the employer and govt subsidy, and it nudges you to save, but its not a magic bullet that solves the problem of having to save for a deposit.

Totally agree.

Historically house prices were in the CPI in the USA and the politicians removed them. I think NZ followed suit. Houses are the biggest consumer purchase and should be in the CPI. Without a comprehensive CGT its be the only way to manage house prices (ignoring immigration and tight land use policy)

Yep land became "investment" not consumption in the CPI, for the benefit of the financial system.

Simple logic would suggest once you've built on the land, it's "consumed". Even if you change the use, it's the activity that provides a good or service, not the land.

It's the dumbest thinking and the reason land prices are overinflated. It's the historical thinking of land Barons and land Lords. It's the driver of all financial instability, credit creation, etc.

hold your horses a bit. Aussie house prices jumped even higher in pace but young kiwis keep running there. how do you explain that?

It's just a leap of faith. It's shit here for many, it might be shit in Australia too, but out of the frying pan into the unknown is probably better than staying in the frying pan.

the logic does not add up. you leave because house prices increase, to somewhere increases even more?

the only explanation here is that, when economy is good, property prices increase, that's what meant to happen. and when house prices don't increase, that's when everything hit the fans. in short, house prices increase is not a problem, to the most, just a symptom.

Your assumption is that they will sell up here and leave for Oz to buy a house, or intend to buy a house in Oz. I know of a few who went to Oz to save for a house in NZ as the ability to stockpile savings was exponentially better over there. Tahat or, if they don;t intend to buy a house, they can at least bulk their savings over there for a while then make further big life decisions

By focusing on the increase, you're ignoring the starting point.

Many of my new friends here are shocked at what we pay in rent (rents have gone up 80% in 5 years here) - and then I tell them what we were paying in NZ!

As an import, I don't mind paying more than a local would, given it's still far less than I paid in NZ.

Ditto for a house purchase too.

And we're enjoying considerably increased income. My wife, whose income doubled coming here, just got her first raise: 10% -> equal to a 20% raise on her 2023 NZ income! And while my income hasn't increased, I work 1/4 of the hours to achieve it.

We've got a target band for inflation, but nothing for immigration.

Low skilled immigration has gotten that bad teenagers can't even get jobs doing the first jobs they used to cut their teeth on before studying and building a career, fastfood and supermarkets are now staffed permanently with low skill immigrant labour.

It's taking a toll on our social fabric.

I think that's a big generalisation re immigration.

Supermarkets just don't employ the same level of staff anymore. Most supermarkets I visit, and I wander around the country a fair bit, are staffed by local residents.

The orchards though are a whole different story. But it's ultimately by demand of the owners.

With the economy tanking and young skilled workers leaving on mass, the idea that one of the primary drivers of the mass exodus (housing cost relative to income) is going to get even more expensive is a scary. Watch as social cohesion deteriorates further and further.

Housing costs alone aren't the reason behind the mass exodus since many expat Kiwis choose to live in places where houses and rents aren't exactly considered cheap, e.g., London, Sydney, etc.

That being said, those economies offer much better job and self-employment opportunities for those with certain skillsets who are willing to put in the hard work. We're a lot more hand-to-mouth here in comparison and significantly more exposed as individuals and households to policy moves made by the government of the day and our central bank.

It was for us. Specifically that reason - we couldn't afford to buy anything. Now I'm overseas.

Wasn't the end of 2023 prediction at +15% for 2024 year?

Haha - exactly.

The smart money does the opposite of what Orr recommends - as he consistently does too much of the wrong thing at the wrong time. [which he will keep doing becuase we reward him for it]

Luxon seems to agree with my strategy as he just sold 3 our of 7 of his houses. Now i think 4houseLuxon definitely doesnt strike me as the sort to sell a appreciating asset - especially if its definitely a safe bet. Then I also ask myself what could he know that we dont - and figue maybe its because he is introducing a bunch of policies that seem designed to smash our economy into the ground and get all the smart kids to leave and eplace them with cheap low skilled immgration- he is probably reinvesting in military tech for the NZ police and private education/healthcare - to protect and serve the elite amongst us as society collapses)

But i am sure they wouldnt do that.

My bet is he is selling to free up cash to invest around the world, now that he has inside information from international politicians on which stocks will pump.

Dumb dumb dumb!

Why is the RB predicting 7% house price increases? I mean, many would say that that would not be healthy for NZ, and presumably the RB has levers it can pull to stop that from happening. I'm thing DTI, LVR etc etc.

Why is the RB predicting 7% house price increases?

In the hope that private debt incresases sufficiently to show or economy as growing again even though it is akin to telling the country on a sunday that they can all have the day of monday, so that they crank the bbq and beers to keep the good times rolling for that short time before reality sets in

Even the Reserve Bank is on the vested interests in housing narrative

I think they have forgotten that there are now Debt to Income ratios in place

The real story is that they are afraid that the market will crater so they are trying to jawbone it into remaining flat.

This.

Meanwhile in Australia

https://stockhead.com.au/news/house-prices-are-falling-in-sydney-and-melbourne/

At least they can now buy houses with only a 2% deposit, what could possibly go wrong?

7% guaranteed, be quick.

Lets continue to drive educated youth to Straya in the name of tax avoided capital gains. Heard yesterday that infometric's are reporting that total population will continue to decline as the next arrivals and departures are published.

@AM - for the love of god - when are you going - your constant moaning and putting the place down is wearing thin

Probably about the same time the requests for lower interest rates by those with debt to save 'the economy' fade.

As such, I expect AM will continue to point out the reality of our taxation system for some time to come. Meanwhile the low interest cheerleaders will tut-tut about the laziness, lack of loyalty to NZ and increase in lawlessness of the young because they find dot joining extremely challenging.

Averageman

i would give the argument that the chance for CGT on the home has gone. house prices do that have room to go up like they did in the last decade.

unless the house price to income ratio keeps going up then the making it harder for the average person.

i do though, disagree with interest deductibility.

if house prices rise but the house price to income ratio remains the same, all you are doing is taxing people of the depreciation of their money.

if you talking about CGT tax on investment properties only (like Staya), that is something i am open to considering.

A commentator was banned from this site for this line of reasoning - but if 7% houses is guaranteed I guess that is ok..but 10% interest rates is not.

Totally different scenario isn't it.

Like comparing one man’s folly to another (but man always believes his folly is right and others is wrong).

No like the RB is suggesting 7% on this very article and just one fool on here thought mortgage rates were going to 10% when everyone else with half a brain knew that 8% max was all the market could take.

Yes and even a fool is correct in his own eyes (see the scrolls).

10% guaranteed interest rates guaranteed stated every day for months by a certain commentator- it became tedious and was pretty much regarded as spam.

Repeating what Mr Orr said about 7%, with a hint of mischief by adding "guaranteed " is totally different!

Imagine if the FMA came out and predicted the NZX50 was going to rise in value by xx% over the next 12 months.

RBNZ predicts 7%+ house price inflation -> drives speculative buying -> house price inflation happens.

RBNZ doing overtime to show they're the banks' good little lapdog

There is a real risk that we have corporate capture of what is meant to be an impartial and independent entity (RBNZ).

That Funding for lending program during/after COVID was highly marginal in my opinion.

Anyone know if there are restrictions on commercial banks hiring RBNZ staff? Ie could Orr move straight from RBNZ to chair ANZ for example?

Yip and imagine if you go out and buy a house now because the RBNZ (economy experts) project 7% increases next year and they turn out to be completely wrong..which is entirely possible given their track record.

I personally think they have no grounds to be giving housing market projections nor should any of the mortgage lending banks - because they are never going to give negative forecasts. So therefore their forecasts are highly misleading and deceptive type behaviour. They only tell you god news stories ie what they want to happen (so you buy their product..a mortgage), not what could happen (both good and bad).

Also, I thought house prices were not part of their primary mandate so why are they entertaining predictions around it? Sure, their policy actions may influence house prices but their commentary should be sticking to their lane.

"Inflation numbers are X, so we need to adjust Y. We forecast that 2 more rounds of Y adjustments will result in Inflation numbers achieving A by Z date."

How dare you try and confine the great Tane Mahuta to a lane.

Tāne Mahuta and our financial system - Reserve Bank of New Zealand - Te Pūtea Matua

I wouldn't expect you to understand with a name like NZDan anyway, you'd need to be an AotearoaDan to pass muster nowadays. Better yet, an ANZDan and move into banking knowing the RBNZ has your back.

@David Chaston, any chance you can rename my profile to AotearoaDan?

Dan is too white male, needs changing as well.

But financial stability is their mandate. They failed this comprehensively once they allowed "to big to fail". They were captured right from the beginning.

We were warned 2000 years ago, again 200 years ago, and again when the Federal Reserve Bank was created.

They've shown their hands in knowing that the level of private debt plays a large role in our economy, even if they don't factor this measure in as JFoe has said.

They measure it, yes, but according to neoclassical economics, only government debt matters as private entities owing each another money have no systemic relevance.

Theory of Reflexivity. Merely thinking something is going to happen brings about that thing happening.

Investor here. Not going to happen. More job losses and population decline to come.

Thank you for your honesty in acknowledging the link between population and housing affordability.

Our dismal current account will weigh on the NZD. This will not bode well for tradable inflation in the longer term.

I suspect/believe Orr is just trying to talk the market. i.e this is no prediction at all, he's doing a Powell.

Thank god there is a few of us that are honest.

The rental market too is abysmal which will push more properties back for sale.

@ spruikers keep saying it’s time to buy ….DGMs keep saying property going down……. My suggestion if you can afford to buy and find a house you like buy it….. no one knows the future

That has always been my philosophy and over 5000 FHB every month agree.

@zwifter - as always I agree with your reasoning

^ this was the advice given by the wealthiest person i know.

Out of interest, how did they make their money? And if they made it from property how long ago did they start buying it?

They were a business shareholder, they also had property but that's not how they made their money. I believe they still have some investment property. 20-30 years would be my guess.

As was pointed out to you a few days ago - it's not 5000 FHB per month. They only make up around a quarter of the monthly sales.

Correct, the actual numbers are between 1200 and 1500 per month according to RBNZ C31. Unless the missing 2/3rds are cash buyer FHB.

Sure... China said the same but there MASSIVE stimulus has done.... nothing.

I think to get 7% OCR would need to be 2

Waits for the Xmas spending spree and following centrikd report that will likely report near half a million Kiwis are in arrears just like last year.. but feel free to think all is well in lil ole NZ..... same wheels turning round and round just a different hype.... I know lets sell houses to each other....theres not much else we can do...lol , Looking forward too seeing how well that plan works this time round.... lets not have any complaining IF the wheels fall off.....fill your boots up....everyones loaded with capital... 'Rockstar' is back....everyone has equity to burn !....OCR is going down.....Is that a Hot Chocolate tune I hear...'Everyones a Winner' baby...lol, Yep get out there and buy em all up lets see if its possible... 7% returns touted but the buy in will cost you...lol

https://www.rnz.co.nz/news/business/510854/half-a-million-nz-consumers-…

I'm forecasting that there will be more forecasts for house prices next year that will be incorrect.

Does that matter though if enough are convinced to borrow to 'invest'?

Most accurate forecast here.

The new mortgage lending figure for September was 6.5 b. But total mortgage lending only grew by 3.4b for September. So we can assume that a fairly large portion of each month's new lending is just existing debt being refinanced with another bank. Approx 3000 new dwellings consented for the month needed to be sold/funded somehow. Transfer of debt from developers to investors and owner occupiers. Business debt becomes mortgage debt.

I have a number of problems with this.

1) What the hell is the RBNZ doing issuing house price forecasts?

2) On what basis do they see house prices increasing? and where did they pluck the 7% number from?

3) Could it be that they're trying to jumpstart the currently declining economy with positivity - even going as far to say they're going to cut the OCR in Feb

4) Where is their financial sustainability mandate in all this - we've gone from no interest rate to high interest rate heading back down to low interest rate - none of which provides sustainability as you've no idea what they're going to do next.

5) Are they literally just barking to support the banking sector? i.e. the tail wagging the dog.

6) They've literally just gone to bat get DTI measures to reduce borrowing levels, they already have LVRs, and yet they're out here publicly spruiking for house price rises which inevitably will increase borrowing levels - they can't make up thier mind.

7) Don't get me started on immigration. Incoming immigrants probably can't afford housing (last article I saw stated only 2% of incoming immigrants were 'skilled'). Our youth are leaving in droves because they can't afford current housing prices. To come out and spruik 7% rises in 2025 is irresponsible.

It would be bad enough if this was one of those so-called bank 'economists' - but this being put out by RBNZ - which is supposed to be all about financial stability...

"4) Where is their financial sustainability mandate in all this "

Think that got modified to 'immediate financial stability' sometime ago....albeit informally.

Feel exactly the same ..... so irresponsible of the RBNZ.

Latest from the US:

‘The Fed's worst nightmare is officially here:

Today's data confirms ALL 3 inflation metrics are back on the rise.

For the first time since February 2022, Core CPI, PCE and PPI inflation are now rising at the SAME time.

Did the Fed spark a new wave of inflation?’

https://x.com/kobeissiletter/status/1861858357440651714?s=46&t=MUwQeKa7…

As you say I_O - recessions usually follow rate inversions. Methinks the US could spark a really good one if their new government does what they've promised.

They, like us, were due for it to happen before 2020 as a hangover form 2008 right? If so, then like us, they have fudged the numbers and fiddled around with percentages as best they can to delay the inevitable.

Are the MPC required to disclose their personal vested interests? I've long suspected many have significant RE portfolios.

"The Reserve Bank's increased its house price forecast for next year and now sees prices rising by just over 7% in 2025."

The bitter irony is that the RBNZ does not see this as inflation, nor inflationary. (i.e. Employees will demand more to afford a roof over their heads.)

Ah looks like RBNZ is jawboning the housing market now.

I personally think they will join the "you look stupid" column along with the banks that joined this year as their "5 - 15% increases" fizzled to nothing.

'Aussie households are millionaires but still ‘poor’.

Is this the future for us?

“A lot of Aussies have a huge amount of their wealth tied up in illiquid assets,” said Graham Cooke, Finder head of research.

“They’re rich, but their wealth is inaccessible without taking out a loan against their equity – and interest rates are through the roof.

https://www.realestate.com.au/news/aussie-households-are-millionaires-b…

Renters better get cracking and buy.

Renters are currently enjoying the best market for tenants in decades.

Having sold and now renting I must say the weekly rent without the adds on with ownership is quite nice.

Very easy to manage ones finances with such an even outlay and no surprises.

Yet they’re all on here day in day out complaining about how high house prices are. Glad you enjoy renting so much you’re probably in the gifted 1% guess you won’t care where house prices go then.

Not a renter.

I'm like you just not morally broke.

No, the banks won't let them - they know without the rent many landlords would be well under water.

The banks don't care who's paying the mortgage as long as it's being paid. And are in a position where they can pick and choose who those paying 'in name' are.

Haha, imagine it though. FHB applies for mortgage, the bank cross references their mailing address against their loan book for a match, and declines because their landlord is overindebted and needs the tenants to keep making payments.

This actually happens. Risk management don't ya know.

Although I don't believe banks will reject a FHB on that basis as they stand to make more profits from two mortgages - even if one drops into arrears. Mind you, the banks that don't get the FHB's mortgage, that the FHB applied too, would take notes.

But just like the recruitment sector - when someone gets a new job - they frequently leave a vacancy behind and the recruiters that placed the leaver into a new job are the first to know and are all over it. Ditto real estate agents, and ..., and ...

Hypothetical scenario.

Lord Orr is offered the title on a median priced Wellington or Auckland house or 10 x BTC with a caveat that he can't sell either for 4 years.

My reckon is that he takes the house.

ABSURD.

NZ is nothing more than a housing ponzi scheme.

I thought these morons said last month that housing sustainability was at the upper range... so they think it's going to be upper upper upper range? It's comical. It just shows.. there is NO maths or logic behind any of their 'predictions'

Theoretically the 'money' is there, unfortunately it is not in the hands of where it needs to be....we appear to be banking on RE owners being willing/able to keep topping up the shortfall (or the gov on their behalf) on their investment until such time as incomes inflate enough to take up the slack(whenever that may be)....all while keeping their fingers crossed that no external event causes an uncontrolled value correction.

The desperation of such a strategy demonstrates how bad things are.

Surely interest rates are a factor in their calculations. So with interest rates going down, housing sustainability may actually be improving next year.

there is NO maths or logic behind any of their 'predictions'

There are plenty of references to the number 7 in the bible re cycles. And it fits in with the 7-10 year theory that is common at the BBQs and water coolers.

Modeling is a secondary consideration in this case.

This prediction will age like milk

Did anyone actually read the Monetary Policy Statement. November 2024?

Do a search on 'house price' and the RBNZ's thinking is crystal clear ... Take this bit:

Private investment is declining

Business and residential investment are declining, but we assume they will recover next year. Business investment has continued to decline, reflecting weak demand and restrictive interest rates. Residential investment has also fallen further, consistent with restrictive interest rates and falling real house prices. We assume that residential and business investment recover from the beginning of 2025, reflecting recent and further decreases in interest rates and stronger economic activity.

See how they conflate 'business investment' with house prices? i.e. we need higher house prices so we get more 'business investment'. Sad, huh?

Probably because the banks don't lend against business, they lend against property (even if the funds are for your business).

So things are declining and they just assume it will change without any data?

Why are so many negative in regards to the housing market..

Went to in house auction today and it was chocker, with people out the door.

Plenty of bidding and very good sell rate.

Actually bought another one as it was good buying as it has the potential that everyone should be looking for .

Interesting though that there was only one other bidder, but then auctions are the place I tend to buy when there is little or no competition.

We are still very cheap and nothing surer the market in many places is on the rise!

Anecdote 2. Work colleague has just pulled house pre auction as NO interest.

Maybe you should look at the reason why.

The housing market is cooked.

its just another anecdote...as per the man. meaningless almost. The point.

The point is that there is always opportunity out there!

I can guarantee that those that continue to moan and groan about the housing market and do not buy, will always be in the same financial position when they retire.

Those that are prepared get on with it and make the decision to buy and imorove will always be light years ahead of those that do not!

Its only one sided on here and not out in the actual market. Interest is just a good place for a rant on how you cannot afford a house.

Interest is also a good place for the underwater to try and pretend they'll be able to breathe again soon.

i would argue the worst place considering the amount of people that rip in to the housing market.

I think 7% is plausible. Personally I would say 3-5%.

It will of course depend on how far and how fast the OCR is cut

The beauty is that the RBNZ can keep cutting the OCR in such a way to make their forecast a self-fulfilling prophecy.

And then look stupid again by going well below their projected OCR endpoint

3 to 5% is probably a given now HM. I made the call of 3 to 4% for this year but the rate cuts came pretty late so it will not quite get there.

Why aren't they referring it to house price inflation and which ultimately makes housing more and more expensive when compared to wages. It is unsustainable. It shouldnt be more than inflation

Because they're all spellbound. House price growth sounds much better than homes inflating at unsustainable rates.

Oh ffs sake will we ever learn. More and more of our young give up on the country by the day, which no one loves - yet people are still delighted at the idea of their house going up in value - never putting the two together! Would Adrian factor in this rise into future inflation expectations - and does it even impact the inflation numbers much at all?

Because the majority milking this will be gone by the time the society in NZ implodes

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.