Mortgage rates have been coming down for about a year now, but that's not been fast enough for some.

Latest monthly loans by asset quality figures from the Reserve Bank (RBNZ) show that the amount of mortgage money classified by the banks as non-performing rose by $28 million in May (1.2%) to $2.448 billion.

Within this figure, the amount specifically designated as 'impaired' increased by $30 million (6%) in May to $534 million.

Since the start of the 2025 calendar year the impaired figure has risen by just under a quarter, by $104 million, from the $430 million as of December 2024.

The overall non-performing figure has since the end of 2024 risen by $285 million, or 13.2%, from the $2.163 billion figure as at December.

And all this, of course has been as mortgage rates have been coming down significantly.

What's been going up though is the unemployment level, which rose during 2024 from 4% to 5.1%. It stayed at 5.1% in the March quarter, but high frequency data is suggesting the June quarter figures will likely show a further rise to 5.2% or even slightly higher.

The non-performing housing loans figure currently represents a little under 0.7% of the over $372 billion worth of outstanding bank mortgage loans. That percentage is well down on the 1.2% figures seen in the aftermath of the Global Financial Crisis, but is well above the 0.2% level seen as recently as in late 2022.

In the RBNZ's most recent six-monthly Financial Stability Report issued in May, the central bank had forecasts of likely non-performing housing loan ratios based on projections from the big five banks towards the end of last year.

These projections did indeed point to non-performing loans hitting the 0.7% level, but this was tipped as the peak and with the figure then seen as falling from the final quarter of this year onwards. We shall see.

Meanwhile, on those mortgage rates - as we've talked about a lot, from pretty much the start of last year those with mortgages started to migrate to shorter and shorter fixed mortgage terms in the anticipation that rates would start to come down and they would therefore be able to feel the benefit more quickly.

The plan's definitely worked, but we are now at an interesting stage where some people still seem to be waiting for further meaningful falls while others are now deciding it is time to 'go longer'

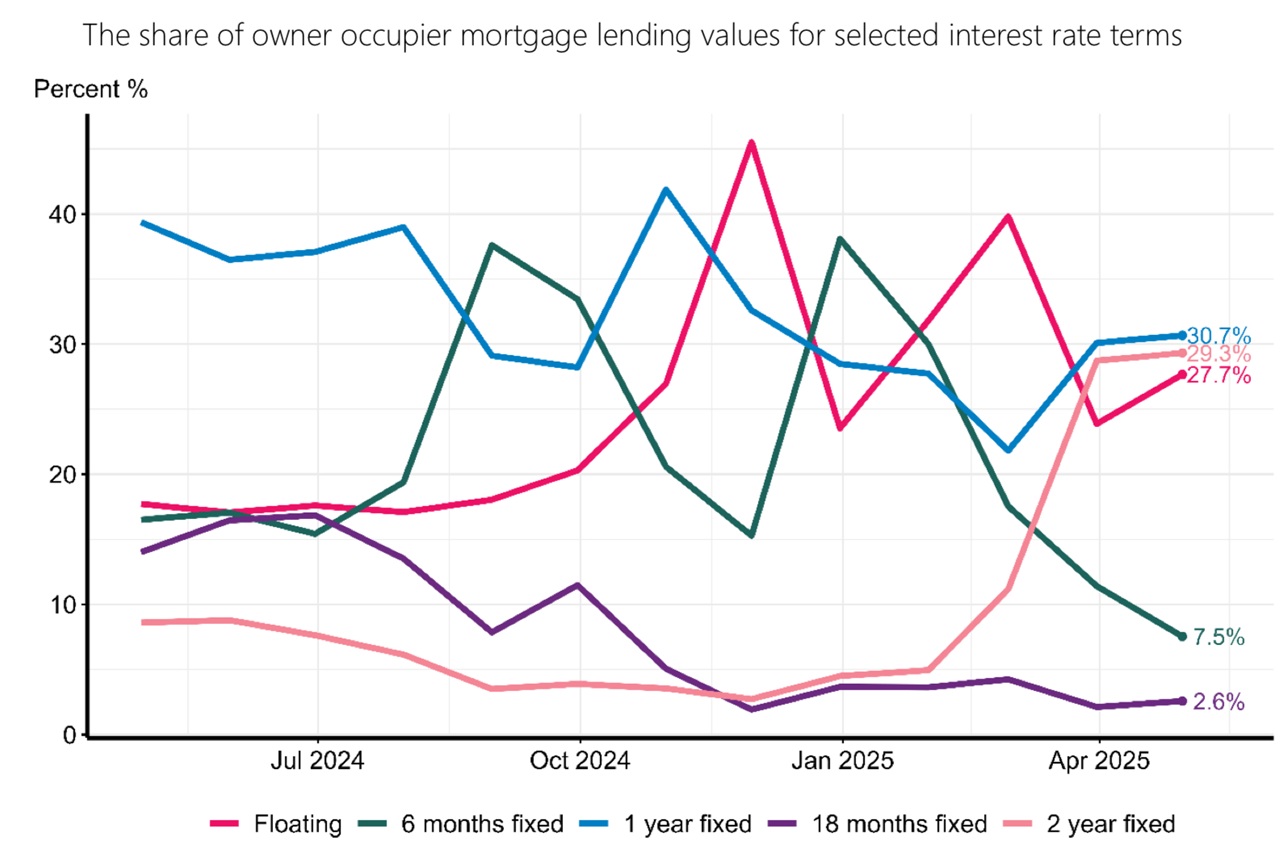

The below graph taken from the RBNZ's monthly C71 data series highlighting what fixed (or indeed floating) terms are being taken up for new mortgages each month, shows how various fixed term rates have enjoyed 'flavour of the month' status in the past year.

At the moment there's still quite a lot of folk happy to hang out on a floating rate to see how much lower rates get - but the swing to longer, particularly two-year rates is very well under way.

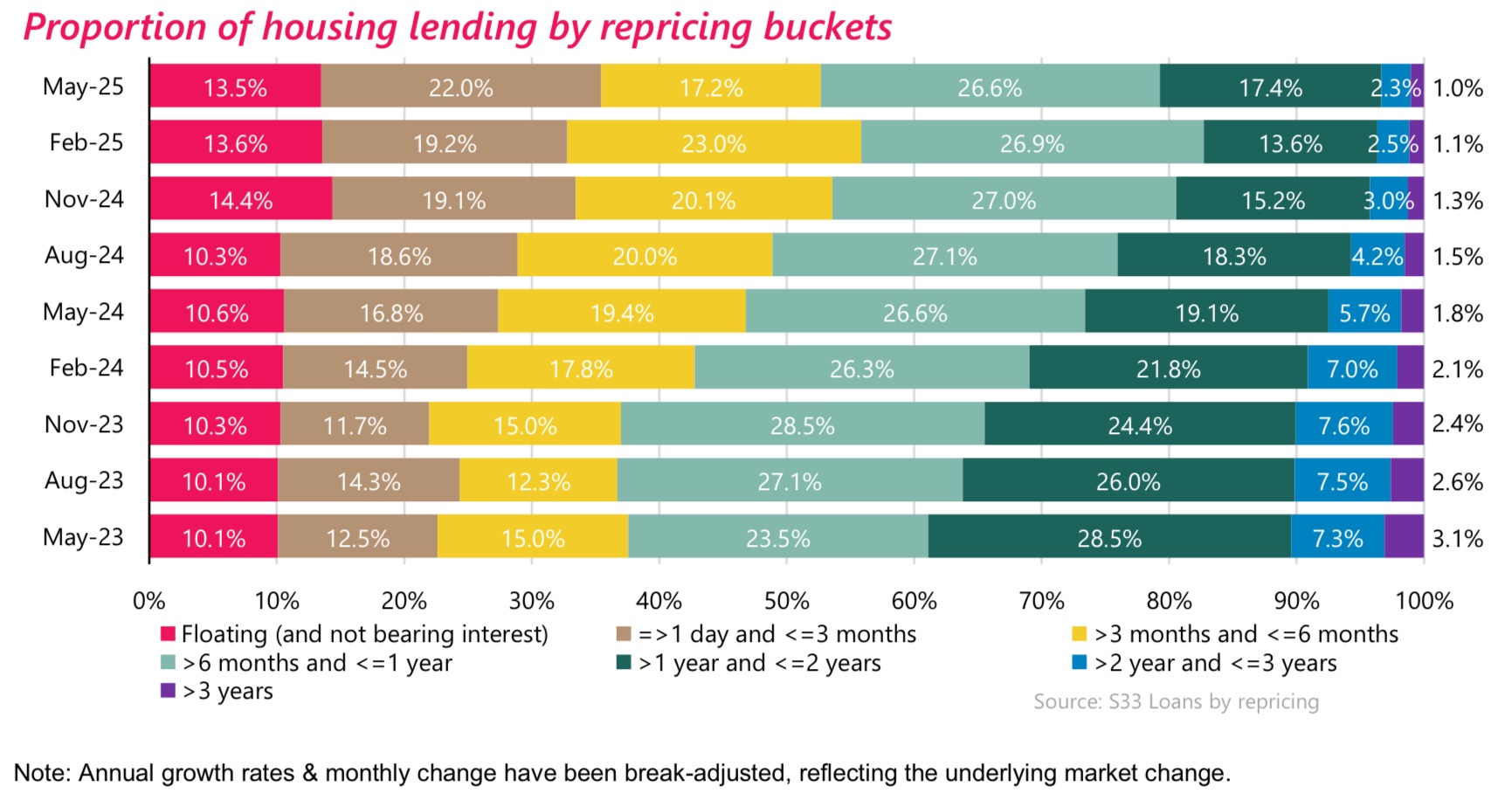

This is demonstrated by the separate S33 data series that shows mortgages by their time until next repricing.

This is not as specific as the C71 series in pinpointing exactly what rates have been taken up by people, since, for example a mortgage that's included in the table as having one year till reset might actually be a mortgage that's been fixed for four years and is on its final year. However, it gives us a reasonable idea.

These figures show us that the peak of the 'go short' strategy for New Zealand mortgage holders was in January of this year.

At that time some 56.9% of the country's entire outstanding mortgage pile - over $200 billion worth - was either on rates fixed for six months and less, or floating. So, that was all up for a reset by the end of this month, representing over $30 billion a month of mortgages to be reset.

Also in January, the total mortgages either floating or due for a refix in a year or less represented some 83.5% of the total. So, over $300 billion worth of mortgages were due to be reset by January 2026.

Well, things are certainly moving on.

The amount of money either on floating or to be refixed within the next six months from May (so, IE by November) is now down to 52.7%, while the 12 month percentage now stands at 79.3%.

Arguably those figures have not dropped quite as much as we might expect and this is because there has definitely been a bit of a division in views between those who've gone even shorter - three months and less, or floating, and those deciding the time is right to go longer.

Doubtless July 9 when the RBNZ has its next review of the Official Cash Rate will be a key point for quite a few people. However, given that economists are suggesting there will be no change to the current OCR of 3.25%, the decision might not be all that helpful in the short term, certainly not when some of the main bank economists are still picking the OCR will ultimately go down to 2.50%. How long do you hold on with a short mortgage term?

Anyway, while the bigger picture of the percentages of how much needs refixing isn't necessarily suggestive of much movement - there has in fact been a lot.

In January the amount of mortgages (NOT including floating) that was due a reset within six months was $164.067 billion. Four months later in May that figure was down to $147.647 billion - a $16.42 billion (10%) drop.

Where did it go? Well, this is certainly not an exact science, but in January the amount of mortgage money that had more than one year and less than or equal to two years to go before reset (so probably mostly two-year fixed mortgages) was $48.182 billion. Four months later in May the comparable figure was $65.421 billion, a $17.239 billion (35.8%) increase.

Interesting times. It will be interesting to see how the Great Mortgage Reset of 2025 pans out. And it will be interesting to see how much longer those holding out on shorter or floating terms continue to do so.

Of course, that really depends on the RBNZ, and inflation, and the ever-unstable global situation. Decisions. Decisions.

6 Comments

Don't lose your job.

Hard for people who work in retail banking right now, but good advice.

Banks are complicit in asset over valuation and today's overall indebebtness. The level of which is sucking the life out of society and fueling the distructive have, have not divide. All the while making super profits on electronically created FIAT.

Ergo can't imagine to many would shed a tear about how tough retail banking is.

This data might be missing/hiding that many people have split mortgages with variable terms, and maturities. The numbers presumably are "smoothed" and illustrate overall picture. Interesting never the less. please confirm thanks David. I enjoy your articles!

It would be interesting to see non performing loans by suburb.

Said the vulture to the carcass XD

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.