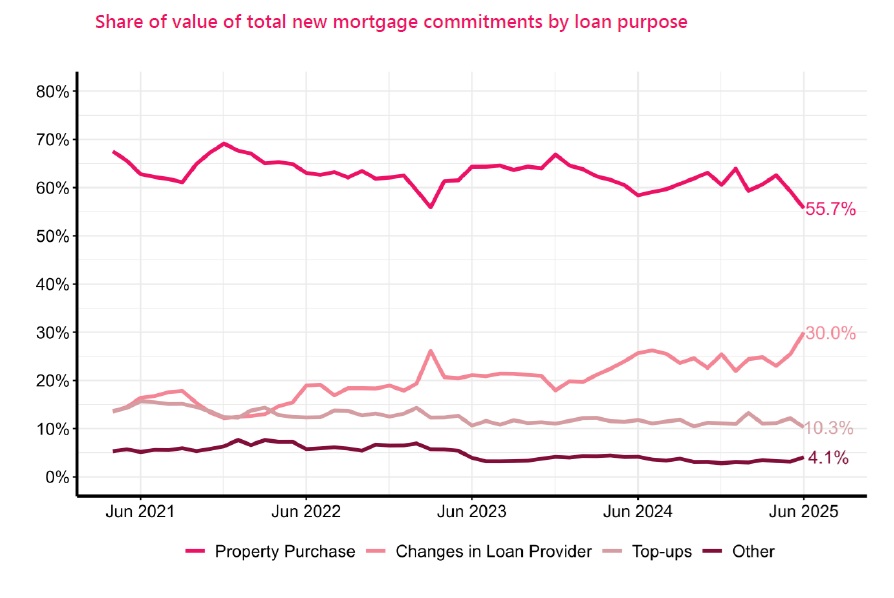

The increasing trend of mortgage customers changing loan providers has hit a new peak.

Latest Reserve Bank figures show that in June $2.475 billion (30%) of the $8.261 billion of 'new' mortgage commitments were people changing loan providers.

This is easily a record level both for the amount and the percentage of the total since the start of this particular data series in 2017.

In addition, by number there were 3,553 'new' mortgages in the month that were changes of loan provider - and that was easily a record too.

All this is likely to keep the banks on their toes and keep pressure on them to provide 'competitive' rates - something the customers are unlikely to complain about.

Changing loan providers has been becoming more and more popular and this may well not be the last record we see broken this year.

The country's mortgage holders have gone shorter and shorter with their fixed mortgage terms in the past year as they have anticipated mortgage rate decreases.

The result is that around $200 million worth of mortgages are either on floating or due to be refixed within the next six months.

Therefore there's plenty of opportunity for further 'shopping around' for loan providers.

The surging level of changes in loan provider saw the percentage of mortgage money actually applied to buying a house hit a new low in this series of 55.7%.

However, that's possibly a somewhat misleading statistic, given that the amount applied to buying a house in the month was $4.6 billion, which was up some $1.3 billion, or just over 40% on the equivalent figure in June 2024.

Still, it will be interesting to see what happens in coming months with the loan provider switching. As said above, we've unlikely seen the last of the records this year.

3 Comments

Would be interesting if RBNZ or a consumer group started reporting turnaround times on these loan switches. Loan admin teams will be under the pump!

30% is a lot. Beginning to look like an actual market. Or will the cartel close ranks.

The credit card switch incentive seems to have moved up to $300 from a few providers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.