First Home Buyer Report - June 2021

By Greg Ninness

First home buyers’ share of the housing market was at elevated levels for the second month in a row in June, according to analysis by interest.co.nz.

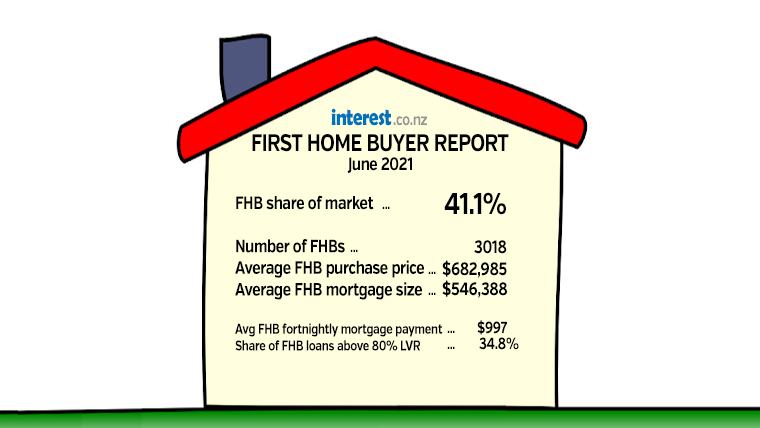

It estimates first home buyers accounted for 41.1% of the 7345 sales reported by the Real Estate Institute (REINZ) of New Zealand in June, down very slightly from the 41.5% market share in May.

Our report estimates the market share of first home buyers each month going back to August 2014, based on Reserve Bank’s figures for new mortgage approvals, which are matched with sales data from the REINZ.

This shows that the only other months when first home buyers’ share of the housing market rose above 40% during that seven year period were in either December or January, when overall sales activity is very low, and for the three months from April to June last year which were badly affected by COVID lockdowns.

But as far as normal real estate trading months are concerned, first home buyers made up a bigger proportion of housing sales in May and June than at any other time covered by our report (see the graph below for the monthly trends).

Not only has first home buyers’ share of the housing market been increasing, the total numbers of first home buyers getting into their own homes has also been setting new records.

The number of home loans approved for first home buyers in a single month passed the 3000 mark for the first time in September last year and remained above 3000 in November and December and also in March, May and June of this year.

The 3018 home loans approved for first home buyers in June this year was up by 48% compared to June 2018 (June 2019’s figures were still being affected by the aftermath of the COVID lockdowns).

So on the face of it, many first home buyers have benefited significantly from falling interest rates, which have undoubtedly helped many of them into a home of their own.

But the downside is that they have also been paying record prices and taking on record amounts of debt to achieve their dream of home ownership and many will struggle to raise a sufficient deposit due to the sky high prices.

The report estimates that the average price first home buyers paid for a home was almost $683,000 in June, down just slightly from the record $685,000 in May (see the second graph below for the monthly trend).

And the average mortgage taken out by first home buyers in June was $546,388, down by just over $2000, compared to the record $685,257 set in May, but up by almost $129,000 compared to June 2019.

More than a third (34.8%) of the mortgages approved for first home buyers in June were for more than 80% of the property’s value.

To service a mortgage at the June average of $546,388, the payments would be just $3 shy of $1000 a fortnight, not enough change for a decent cup of coffee (assuming a 20% deposit and a 30-year term at the average two-year fixed rate).

Those figures suggest many recent first home buyers could become financially stretched if mortgage rates start rising, as many commentators expect them to over the next few months.

For a regional/city breakdown of the main affordability measures for first home buyers, refer to interest.co.nz's Home Loan Affordability Report.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, go to our email sign up page, scroll down to option 6 to select the Property Newsletter, enter your email address and hit the Sign Me Up button.

48 Comments

Increase in First home buyer is always the answer we get when the question (55% house price increase from 2017) is asked by media from JA.

If that is the version of house affordability which labour have promised, than for god sake we don't want these cheaters to rule the nation again.

Raise interest rate to pre Covid level & see how many FHB will lose smile...

Thanks for editing.

Well I'm happy for all those FHB's that are getting on with their lives.

All of them who raised a mortgage have had to jump through hoops to pass the banks acid test of 5-6% interest rate to qualify for a 2.5-3% mortgage.

All of them who raised a mortgage have had to jump through hoops to pass the banks acid test of 5-6% interest rate to qualify for a 2.5-3% mortgage.

Have they now. According to the back of the envelope in Greg's piece, that would mean the banks' 'stress tests' allow for a weekly mortgage servicing cost of approx $800. What kind of trade offs are the banks assuming? That the property can accommodate a turnip plantation? Boarders? Dealing P or weed?

That's always been my question. Lots of comments from banks and elsewhere refer to the mythical stress testing but the figures never seem to gel with reality as pointed out J.C.

Those hoops you're talking about have not been placed high enough to educate those buyers that the price they are paying in the first place is insane. FTBs are just placing an expensive bet on the poker table that interest rates won't rise and the ponzi game of pass-the-parcel (for an easy profit) will continue.

Banks talk about their stress tests - but I frankly doubt that they actually apply it! Banks profit by lending - not by making it difficult for people to borrow. Perhaps age is making me cynical?

Buy the house and pray to god that interest rates don't rise significantly.

Ah yes, major beneficiaries...

What's paying a few hundred thousand more for the same house if weekly payments stay the same*?

(*Assuming interest rates will never go up again. They never will, right Mr. Orr?)

edit: Looks like the original title was changed. I much prefer the current one.

Exactly right.

The implicit message of this article is beyond ridiculous.

As a first home buyer in 2017, I have definitely been a beneficiary of lowering interest rates, buying at the bottom of the market and riding the wave of home ownership refugees seeking asylum in small town New Zealand. Not sure if I could do it again in 2021 though.

If FHB had any sense they would completely withdraw from the market till it falls to something like sensible prices (at least 50%). Call it a buyers strike, aimed at crushing the market if you like. Or another way of looking at it, preserving their capital and not loose their equity in a falling market.

If that doesn't work, plan B, the only rational thing to do is leave the country (at least until sanity returns).

Would never work, because sellers would simply choose not to sell.

Greed/FEAR

Chris

If that is the level of your thinking and reality then it explains why you are seemingly not one of the current record number of FHBs.

Your landlord will be really loving you, paying off their mortgage while they take the tax free capital gains.

Why be mean?

Mountie

That’s not being mean . . . just reality which Chris is not in touch with.

If anything, a reality check is being kind.

Need a rent strike. That’s would soon sort out the ponzi.

Lockouts are legitimate responses to strikes.

"Many first home buyers have benefited significantly from falling interest rates"

Yes, but also when interest rate goes up, they are the ones get hit badly as they will struggle with cash flow, Investors can sell one or two to improve their cash flow and sit through the tough times, first home buyers? Not much they can do. That's why I always tell people, know your limit and plan for bad times.

Recent FHB will only benefit if rates stay low for the duration of their mortgage. If rates rise they will have paid massively inflated prices, caused by ultra low rates. Little soon to claim FHB's have benefited.

Right now low rates primarily benefit existing property owners - they paid lower prices but reap the benefits of low rates.

Incorrect, its only the first 5 years or so that FHB have to worry about, after that wage inflation and career progression should make even moderate rates increases a non-issue.

Sounds like advice from the 1980s, loan to incomes are such that servicing cost increases of rising interest rates will dwarf any wage inflation.

Is it pent-up FHB demand, released as investors take their foot off the pedal a little this year?

Investors haven't really according to Tony Alexander

dc

. . . and that is based on seperate feedback from those involved - investors, REA and mortgage brokers.

Certainly no abnormal unloading of properties and still some interest in buying albeit at subdued levels.

Interest rates would have to go to 4.5% for me to be paying what a renter would for my house. And I’m currently getting 2.49% for 2 years at least.

Also the capital value whether paper or not has increased almost 200k since we bought at the end of last year.

Very happy to be a FHB and no longer a renter.

Now that you are renting from the bank you are no longer a FHB.

Brock

Stupid comment oozing of envy.

Renters don’t get capital gains of $200k.

Printer

Stupid comment oozing of attention seeking.

He is no longer a FHB.

Did you have something relevant to add?

FHB dont get capital gains either unless they sell. Buying and selling in the same market zero sum game unless you're downsizing.

Yes that’s correct but they also don’t see their deposits diluted either.

It's sunshine and roses if you ignore the likelihood of rates rises across the 30 year term you likely had to take on to get over the line on a huge mortgage.

Exactly. Even weekly rents down here now in Tauranga are what I was paying on my Mortgage 6 years ago in Auckland. So now $600+ rent is pretty normal down here now in all the houses in my street and its what's considered by Tauranga snobs to be the "Poor" part of town.

Yes. Those first home buyers are soooo lucky that low interest rates have pushed house prices into the stratosphere. Will they still be lucky when interest rates normalise and they end up underwater on their mortgage with interest taking an increasingly bigger bite out of their wage?

If FHB under FOMO has borrowed more than they should without DTI, more the reason Mr Orr would be happy as has reason that is forced to not raise OCR.

ANYTHING TO SUPPORT THE PONZI.

AUNTY JACINDA AND UNCLE ORR PUT MEASURES IN PLACE TO CONTAIN SPECULATIVE DEMAND !

The REINZ data and RBNZ mortgage data will relate to different sales/settlements so not sure the simple 'match' you've done really works.

Hi Nick, we did have a look at that to see if there was some sort of lag between the two sets of figures but instead found a high degree of correlation between the two, which gave us additional confidence in the numbers. Remember that the REINZ figutes are compiled at the point that a sale becomes unconditional, not when it settles.

It seems like no price is high enough to be free from landlords.

We can't put a price on freedom.

Swapping one set of leeches (landlords) for another set of leeches (banks) is only the illusion of freedom.

The true price of freedom is a one-way plane ticket.

Be quick.

Off you go then !

Can't wait!

Bad comparison.

Banks won't make you mow the grass.

I rent flats to students. Maybe they should be housed by HNZ somewhere near their school instead? Perhaps in a motel?

I really worry about these first home buyers who are buying old rotten houses in the range of 700-800k. It will take them 15-20 years to pay that off that current interest rates. What happens if interest rate rises?? Will take them 30 years and not much savings for their retirement. But no one is thinking that far.. Right?

When i was first home buyer and prices for a new house was less than half of what it is now for a rotten old house, I was still stressed about how i will be able to pay my debt. But seem like this new generation of first home buyers don't worry about debt.

Sometime you just have to jump in and play or your going to be standing on the sidelines your whole life. If you over analyse or are totally against any risk you would have been one of the big loser's over the last 50 years.

So you are saying ownership of a house and making money is winning? I think that's the problem with the generation and see where it has got us.. Feel so sorry really.

Please provide FHB mortgage amounts in Auckland & Wellington, this has got to be significantly higher?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.