Some "late winter confidence" came into the housing market last month, with sales numbers increasing and days to sell reducing, according to the Real Estate Institute of New Zealand (REINZ) in its August report.

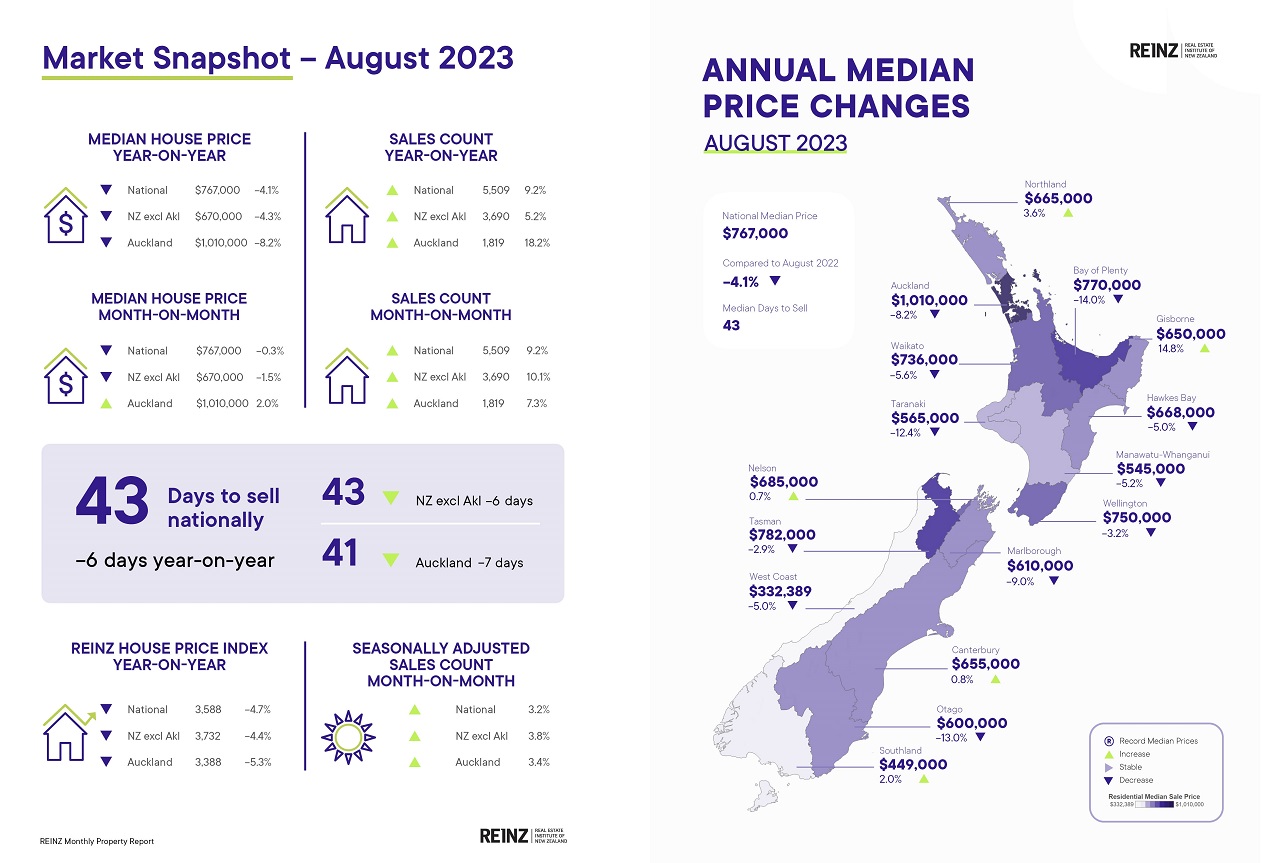

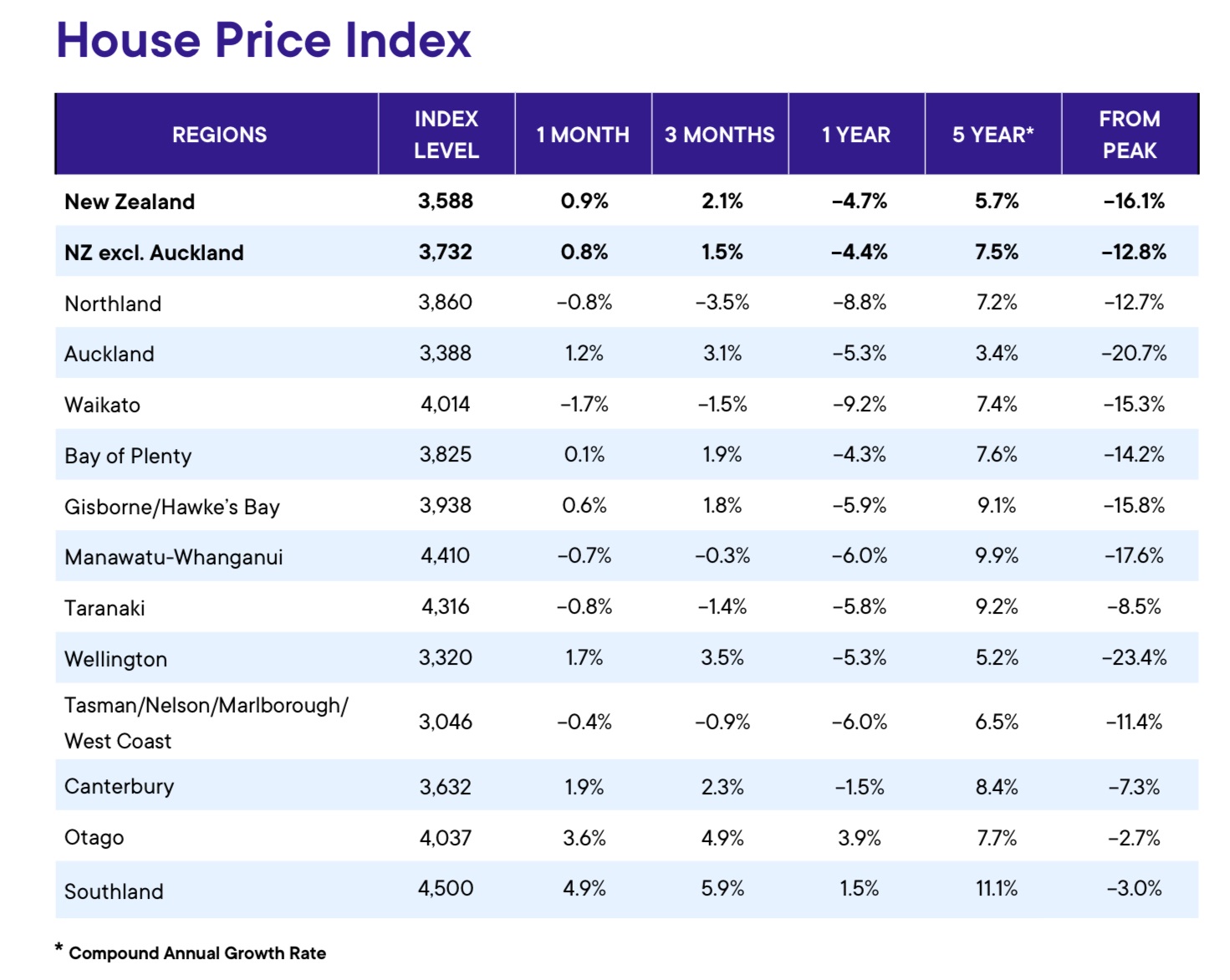

As well, the REINZ House Price Index, which adjusts for differences in the mix of properties sold each month, showed a national increase of 0.9% in the month, following on from a 0.7% increase in July. And it is now up 2.1% in the past three months - though still down 4.7% year-on-year.

ANZ economist Andre Castaing and senior economist Miles Workman said the housing market "has now convincingly turned a corner and has returned to its usual upwards trend".

"The big question now is how long will that last?

"We’re still forecasting house prices to rise 3% over the second half of this year, before growth moderates in 2024 due to deteriorating job security and high-for-longer mortgage rates. However, upside risks to our forecast are becoming harder to downplay, particularly in the near term. Yesterday’s migration data showed an annual net gain in migration of 96,200, all of whom need somewhere to live, increasing pressure on housing demand and therefore rents and house prices," the ANZ economists said.

Westpac senior economist Satish Ranchhod said the housing market has "clearly found a base" and, if anything, "it is looking a bit perkier than we’ve been expecting".

"With interest rates at relatively high levels, we’ve been expecting that house price growth will remain modest over the next few months, before taking a step higher next year. However, the gains seen over the past few months suggest that the market may be heating up even sooner than we had expected," Ranchhod said.

"We’re forecasting that house prices will rise by close to 8% next year. Today’s firm housing market report, along with yesterday’s stronger than expected migration figures gives us confidence in forecasting that acceleration."

The national median price dipped down to $767,000 in August from $770,000 in July and it is down 4.1% on the $800,000 it stood at a year ago.

However, Auckland saw its median price lift back above the million dollar mark to $1,010,000, up from $990,000 in July - a 2% month-on-month gain. It's still down 8.2% year-on-year though.

The stand-out in Auckland was Auckland city, which (on 481 sales compared with 443 in August 2022) saw its median climb $173,000 or 18.4% from $942,000 in July 2023 to $1,115,000 in August. (It is very much worth noting, however, that the Auckland city median had dropped $140,000 between June 2023 and July 2023 - so, volatility is a thing here.) The August $1,115,000 median compares with $1,121,000 in August 2022. In the whole Auckland region there were 1819 sales in August, up from 1,695 in July and 1,539 in August 2022.

In Wellington, its median rose 2.3% from $733,000 in July to $750,000, though it's still down 3.2% on a year ago. The region saw a month-on-month 16.9% increase in the number of properties sold from 438 in July to 512 in August, though that's still down on the 525 sold in the same month a year ago. Days to sell dropped by 14 days from the 52 average in July 2023 to 38 and were down some 21 days on the figure in August 2022.

In August there were 5,509 properties sold nationally, which was up from 5,047 in August last year and up 9.2% compared with July 2023.

Nationally there were 7,444 new listings in August. That was up 20.9% on the listings in July 2023, but still down by 0.6% from 7,492 in August 2022.

At the end of August, the total number of properties for sale across New Zealand was 22,750, down 10.6% (2,691 properties) from 25,441 year-on-year, and down 1.5% month-on-month.

The national median days to sell number fell to 43, which was down from 48 in July 2023 and 49 in August 2022. In Auckland the number of days to sell dropped to 41 in August 2023 from 44 in July and from 48 in August 2022.

REINZ said 11 regions saw a decrease in the median days to sell compared with July 2023, with the biggest decrease occurring in Nelson, which dropped 18 days from 60 days to 42 days.

REINZ chief executive Jen Baird said local agents are reporting that, as new listing numbers continue to decrease, the demand for entry-level property is holding and fairly strong, and properties are starting to move quicker.

"The number of properties available for sale over the last three months continues to fall. Listings are still at lower levels compared to August 2022, but only slightly. Month-on-month we have seen a 20.9% increase of stock coming to market, suggesting seller confidence is returning and we can expect a more normal spring ahead for the property market," Baird said.

“Higher interest rates and ongoing cost of living pressures continue to impact the market ahead of the looming election. There is a sense across the country that the market has seen the bottom both in terms of prices and sales volumes, but we are all waiting to see how long it will take to see growth re-emerge."

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

135 Comments

Boom times are returning in Auckland.

Tempted to extend my rugby holiday here in Paris/Villefranche -

Vive le NZ,

Vive le Luxon!

cheers!

We should all be celebrating on the streets - nothing better than higher house prices being brought on by policymakers cramming more people, often desperate migrants, into our creaking infrastructure.

Who cares if our inability to fund critical services from low-wage mass migration into NZ will lead to frequent power cuts, water shortages, long waitlists at hospitals and overcrowded school classrooms - all worthwhile sacrifices to line the pockets of housing investors. The descend into third-world status for NZ in the coming years will only pick up pace!

The housing market is cooked..

More police focused on keeping the poors away from wealthy areas is the answer.

Walled compounds. We are turning into SA.

You're being silly now.

Police ruthlessly focusing on protecting richer suburbs and residents should be enough at this stage.

A banger for the DGM's https://www.youtube.com/watch?v=BfnjX88Va4Y

Let's go Poooonzi.

Probably the best time to get out if you are struggling or not prepared to hold your investment property for the long term.

Pro housing Ponzi is Pro NZ development.

All this is is fear of the Ponzi scheme people are worried we will see house inflation like we did after the GSC.

Young Kiwis need to be very careful what they do this election if they want their own homes and they need to be engaged in the process.

We have just unwound the Ponzi now the blue team want to wind it up again.

Bad,Bad move New Zealand.

Don,t see house prices going any where fast with interest rates so high and house prices so inflated.

The Aussie banks control this cartel how sad.

Need to see about a 20% drop yet.

Young Kiwis need to be very careful what they do this election if they want their own homes and they need to be engaged in the process.

No party has any serious plan to improve housing affordability, there is no one to vote for.

Home ownership probably needs to be under 50% first.

Maybe but National has a serious plan to worsen housing affordability.

Fact: under Labour, the housing market has turned into a veritable Ponzi, reaching utterly unsustainable prices, provoked by ultra-low interest rates caused not just by the incompetence of Orr but also by Labour's government moronic change to the RBNZ's remit.

Yeah... that's awkward.

Underscores the fact there's no one to vote for.

That's true - which makes it even more surprising and disgusting that National are now trying to inflate prices and subsidise landlords even more again.

Best vote beyond these two parties.

I like how the red team unwind the Ponzi only reason I vote for them in the last election as I thought they could achieve this after 50 years of the blue team.

They are Building a heap of housing at the moment which is fantastic.

All they need to do now is control the funding through Kiwi bank and we take back control of housing.

This is how it works in Singapore 90% of there population is in there own homes.

It's mostly leasehold so they're renting a spot from the government their dwelling is on.

They also still have a rather large affordability issue.

Singapore haha. We're looking more like South Africa with each passing day. More wealth being handed by our political overlords to the already wealthy, living standards quickly deteriorating, rising crime and increasing skilled emigration to greener pastures while low-skilled workers are brought into the country in droves.

Sounds a lot like Singapore also.

Pa1nter you have lost the few credibility you might still had here. Have you lived in Singapore? I did. Crime rate is close to 0, streets are so clean you can eat on the bare floor and the city-state attracts highly skilled workers.

And stop citing Singapore in your comparison with NZ, it has nothing to do with it. Contrary to NZ there's no available land to be built there, it has to grow vertically. Population density is 8600/km2, "only" 450 times more than NZ with 19...

I have also lived in Singapore.

I was talking more to advisors' comment about housing and migration than crime and cleanliness. Singapore is falling victim to the same issues seen in many advanced nations; declining birth rates, increasing immigration, and soaring housing costs.

The fact is virtually no advanced economy has managed to escape these problems in a way that's easily resolvable or replicable.

And in the same breath flooding the country with immigrants and handing out residence visa's. 207k thus far.

Only 10k more to get the rubber stamp

https://www.immigration.govt.nz/new-zealand-visas/waiting-for-a-visa/ho…

And of those 207k you cite, all of them have been housed and employed since 2020 or before. So not sure how granting them the right to remain without renewing a visa every 2 years changes anything..

Not so. TOP land tax and investor 100% equity, and immigration control threshold takes the exploiting nature of excessive debt leverage and tax evasion completely out of the equation.

But you already knew that.

Yeah I said "serious" plan. That's just moving tax sliders.

* No serious party has any plan to improve housing affordability *

There, fixed it for you.

That works also, can't really count TOP as anything more than a fringe party.

Explain TOP's immigration policy - it used to be very sensible when Morgan was in charge with population targets and quality over quantity as an aim, now on the TOP website I see lowering minimum wage requirements and dishing out visas in exchange for money.

When you end up in a 14 party multi offer for a basic 4 bedroom house you will learn it is not the banks pumping it up. People want and need a home.

Both Labour and National have had house prices significantly increase under them and not one of them have stated they want the house prices to fall.

None of them will address this, just like none of them will address the retirement age, when even 1 party openly states they want house prices to fall significantly then wake me up.

A good way to stop the ponzi scheme is fear that house prices will fall and the government will do nothing to stop it.

To me that's the problem with the 2 main parties, they are the same with slightly different rhetoric.

The main difference between the two parties is Labour need grit their teeth to keep the property Ponzi going for enough votes to govern, whereas for Nats blowing bubbles is genetic. The outcome is the same. Perhaps its voters that need to change? Turning the whining Hosk and business lobby media off would be a start.

Your comment is a vibe - besides from the rhetoric, I think the key difference between parties is incompetence vs disguised carelessness (you can guess who's who).

I think NZ is ripe for a new/young party with fresh takes on:

a) affordable housing.

b) focus on the productive economy (instead of the last 10 years' propping up the property market to make it look good).

c) reduced political jibber-jabber on immaterial issues that take up all the media space (conveniently).

d) building some more fkn train tracks.

e) stop bashing farmers (instead of incentivising farms to just grow trees).

f) few policies to reduce wealth inequality

Any other good ideas - let me know.

-SMG

Yep! Build a massive cube in Hamilton.

Agreed, a new party is needed. TOP had promise but it 'ain't it' (I mean Colon Craig's remnants are polling higher in some recent polls, and shouldn't they all be voting for Freedoms NZ or whatever?)

My personal view being that Raf Manji should have rebranded TOP to get away from past associations with the mustachioed cat hater who falsely conflated having lots of money with having valuable insights, as well as narrow its focus to really be about smashing the property investment ponzi even if that means giving up the obsession with an LTV on everything (well not everything ... but let's not go there).

I'd like to see another party pop up that:

- Beats on residential property investors like George Foreman beat on Joe Frazier. Start with:

- Tax on equity release for the purpose of purchasing additional property at say 50%

- If property investors want interest deductibility 'because they're operating a business' then fine you win (I mean I get interest deductibility on the 1% finance on my company vehicle after all) BUT if you are claiming interest deductibility then you are clearly in the business for a profit, so implement a robust CGT on sales of investment property.

- Ceases the current insane immigration system of kowtowing to vested interests to flood the country with cheap labour (while the skilled workers the taxpayer has funded through school and tertiary education disappear off overseas).

- Skill shortage lists restricted to actual critical industries e.g. health - slopping up takeaways, selling vapes at the petrol station etc are not and never will be essential skills.

- For anything outside of these properly skilled jobs, set a minimum income threshold at say 2x median wage. Anything under that, the employer must pay directly to the government as a tax (e.g. if 2x median wage is $120k and you want to bring in some unskilled worker to do it, then if their pay is $60k your business has to cough up an additional $60k PA in tax). Any company director caught forcing the employee to meet this tax out of their wages is liable for serious porridge time and personal financial ruin.

- Fees-free education for important jobs like teachers and nurses but if you want to study post-modern juggling in cinema or the history of feces sculpture then you will pay through the nose. Predict future demand for these critical roles (a bit like they used to for teachers, AFAIK) so there is basically a guaranteed job but we take only the best candidates.

- Makes it a better deal for younger workers to start saving/investing for retirement with a view to 'wind down' universal superannuation and move to a means-tested model.

- E.g. you can contribute up to 10% of your pre-tax income to 'Kiwisaver 2.0', and also employer contribution should be untaxed.

- On issues of tax, introduce a tax free threshold, guaranteed indexing of brackets to inflation, and new higher brackets.

- Prioritizes new infrastructure particularly:

- Healthcare/hospitals

- Climate resilience and alternative energy

- Maintaining current road network in good condition (not the same as building roads everywhere)

- Public transport, particularly trains between cities/regions.

- Balances giving offenders a second chance with protecting the population from delinquent recidivists:

- When someone, especially young, does their first crime throw everything and the kitchen sink at rehabilitation, education etc (this might also mean targeted spending programs for disadvantaged youth, sorry private school kids)

- Once you have your card marked as a recidivist offender or you partake in violent crime, then you'll be locked up for a proper sentence.

Or maybe I'll just vote National and take that extra $50 per week or whatever it is, sure is a lot easier.

Count on 2 ticks for the Dumb Party from me.

I reckon I could get enough signatures from here to form the party.

I could agree with your ideas with a little tweaking. I think there are also many other underlying issues and they're all connected, the toughest challenge here is being able to get it past the self interest, ignorance and illiteracy of the majority.

Whilst we need better policies than the current mob offer there also needs to be a greater element of leadership by example.

I'd start with very simple and few policies that aim to "drain the swamp" first lol. Starting with removing the gravy train from the politicians, conflicts of interest and unjustified perks. We need a better quality of values in our civil servants and public services, more aligned with the needs of the people than the demands of 'the Market'. I'd get the ball rolling on reestablishing the role and purpose of the Government.

Secondly I'd offer to simplify the tax system and laws properly, removing the inequities first before adding extra tweaks.

Instead of offering numerous new policies I'd rather have someone willing to say how it really is.

"Things are really a bit messed up and we need to get a better grip and understanding of the issues, what current policies need changing before offering moonbeams and pipe dreams. Put simply, we can't continue with the same politics and policy making that we've been doing the past 30 odd years. We need to have a better long term vision, we need to think outside the box, remove the dogma and ideology that is holding us back from making real changes, we need more cooperation and ideas that unite rather than divide and it starts here in Parliament. There are no magical fixes, we can't guarantee outcomes and certainty, but we can try to encourage balance, develop trust and an environment that better enables us to respond to ever changing events and conditions. We want to learn from our mistakes and errors of the past and be honest with the public. We ask for the opportunity to start with these smaller but significant policies, and when we've got our heads around the existing structures we can then advise newer policies in 6 - 12 months. We do not believe that having the majority vote gives us an outright mandate to implement divisive, bureaucratic and political BS that only creates more issues and distractions. We want to encourage and enable personal response ability, the coming together of individuals as a community that supports, empowers and values each other to create collective change."

Yeah might be easier to not vote.

giving up the obsession with an LTV

Never! But otherwise agree with your sentiments.

National MPs have multimillion dollar conflicts of interest preventing them lowering house prices.

You have to laugh at conspiracy theorists B&W. You do realise that despite ups and downs in the market, NZ house prices have been steadily increasing and outpacing inflation since the 1960's? If you look hard enough, you will find an article (and associated graphs to make it easy) by Brian Easton showing this. So, when you say "ponzi scheme", you are clearly unaware what one is, or alternatively, conspiracy theory alert.

Oh, and by the way, latest numbers show first home buyers coming back to market, FOOP has been replaced by FOMO and around 50% of potential buyers are concerned about the lack of listings (which of course drives prices up), up from about 10%. Happy days!

Haha nobody is allowed to call or admit it's become a Ponzi but it does rhyme.

Ponzi:- an investment promising high rates of return with little risk to investors. It generates returns for earlier investors with money from later investors. It eventually unravels when the flood of new investors and money dries up.

For the last 20 years it's effectively been a government/RBNZ backed, bank enabled Ponzi, and we've seen the money dry up a few times only to be flooded again. The banks and earlier investors have made their profits at the expense of later investors.

Only it's worse than a classical Ponzi as it doesn't affect only a few investors. The flood of new debt as 'money' into the system, the financial instability and wider societal and economic consequences it's created, affects everyone.

Waiting for the DGMs to find an incredibly pessimistic way to spin this negatively.

”50% crash incoming”

The people who expect reasonable/affordable house prices in NZ, so the productive economy can flourish are called DGMs? Oh no - I am told they are jealous of the financial success of housing speculators.

If the landlord wants an increase then I'm out of here, will buy a house in Aussie or NZ

The people who expect reasonable/affordable house prices in NZ, so the productive economy can flourish are called DGMs?

Just from observation, people who are really concerned about productivity as a priority, generally aren't constantly baying for some other aspect of the market to fail.

Nobody is saying market failure, that's just hyperbole from a bunch of whiners who want the market to remain dysfunctional so they can profit at the expense of everyone else.

If you berate someone for hoping prices would normalise so a low-income family can put a roof over their heads without paying big chunks out of their pay checks for the next 30 years to a bank, then something is terribly wrong with you.

Market failure, personal failure, however you want to call it, there's a very definite cadre of people eagerly anticipating someone else's demise. I think those are what's being referred to as a DGM.

People rightfully want cheaper housing, this much is obvious.

It's the window dressing put forward of "this is about empathy/productivity" that's mostly a nonsense, and often used fairly cheaply.

"When I said I hoped investors lose their shirt and suffer personal loss, I did so because I love my country. You want the best for your country, right?"

It's the window dressing put forward of "this is about empathy/productivity" that's mostly a nonsense, and often used fairly cheaply.

"When I said I hoped investors lose their shirt and suffer personal loss, I did so because I love my country. You want the best for your country, right?"

Seems like a bit of a strawman argument there don't you think.

Just my personal observation. I know some extremely productive, and extremely empathetic people. None of them make sounds like the dgms here.

It’s not like you’re much different than those you’re whinging about though, you seem just as pessimistic and negative as any other “dgm” here. Most of your comments seem to be along the theme that the problems we face are too hard and we can’t fix them. Which is true to an extent but it isn’t exactly constructive.

Many things we are facing our outside of our (or NZs) control. On that basis, you can only view them as "things that are going on".

There's other things which are controllable, to an extent, but many people's appraisal of the issue, and possible solutions, aren't realistic.

To resolve housing you need a way to produce (and finance) an adequate amount of new dwellings at a price half or less than what is accomplished today. Possible, but no easy feat.

There's other things which are controllable, to an extent, but many people's appraisal of the issue, and possible solutions, aren't realistic.

Who gets to decide what is and isn't realistic though. Someone else may think a potential solution is realistic, which they very well could be wrong but it doesn't make their opinion less valid than yours. And on the contrary could just as well be wrong about something not being realistic.

It just seems somewhat hypocritical that you're accusing other people for being overly negative when you are one of the more doomy commentators here. Most people are aware there isn't one single solution to the housing crisis, that theres a lot of contributing factors both within and out of our control, and that any potential solution will have to come from a variety of actions, but most people aren't going to list those all out in a short mostly meaningless internet comment.

All opinions are equally valid about personal preferences.

Views on the material world are weighted based on things like knowledge, experience and reasoning abilities.

People can be positive or negative, doesn't really make much difference to me (although having a positive outlook is better for you). But people baying for blood, usually aren't people coming up with too many constructive ideas. They usually just end up leading or joining angry mobs.

Views on the material world are weighted based on things like knowledge, experience and reasoning abilities.

This is true, but other people have different sets of knowledge, experience and reasoning abilities which can come to different conclusions. With economics in particular I don't think it's easy to have say whether one position is right or wrong, a lot of the time it seems like there is no right answer at all. I think your generally one of the more insightful posters here, I don't always agree with you but I think you have pretty well reasoned viewpoints on a variety of subjects.

But people baying for blood, usually aren't people coming up with too many constructive ideas. They usually just end up leading or joining angry mobs.

I mostly agree with this but I think you might be reading to much into some peoples comments where they aren't actually baying for blood, more just expressing frustration at the status quo which isn't working great.

If you're talking about yourself, I'd tend to agree.

If you're talking about other posters constantly awaiting 'real pain' or for people to come unstuck, much less so. I find it myopic, because usually the economic path to overleveraged investors going tits up also usually coincides with many more less fortunate people doing it way harder.

It's super rare for falling house prices to coincide with positive outcomes for people that don't have houses. That's not to say the house price situation in NZ is positive, but that if people really want some sort of meaningful improvement, it's not going to be found where they're saying it will be.

It's rock and hard place really, if they go back up that causes harm, if they go down that also causes harm. It's a problem with no clean solution.

I don't see how that's any worse than hoping that a large segment of the population are never able to afford a house for them and their family, instead having to move from rental to rental, many of them in shit condition, spending so much of their income on housing that they have difficulty paying for other necessities, and are doomed to a retirement of poverty. And the people hoping for that don't even have the excuse that it's good for the country.

Who is honestly hoping for that?

Not many, if any.

Not explicitly, no. But hoping for house prices to rise - or even for them just not to fall - is effectively hoping for that, as its hoping for something that would have that as a consequence. So it's the same sort of thing. Not many people explicitly hope for other people to lose their homes or all their retirement savings, but hoping for a price crash so that hard working young people can afford housing again is hoping for something that would have financial devastation for that as a consequence. Point being, either way there is collateral damage, so its unbalanced to only castigate one side for hoping for something that has collateral damage and not the other.

I mean, so many of each of our actions every day has consequences, many negative.

If you want a new phone, are you hoping some poor sap gets paid f all to rip their fingers up on a cheap tool? Or a kid to die in a cobalt mine?

When you buy a burger, are you hoping the cow was as traumatised as possible while standing in the queue for their throat to be slit?

Is there a difference between actions having consequences, and wishing for the downfall of others? It's different to just wanting cheaper houses.

Hmmm, it looks like Tony Alexander and some others weren't that wrong, calling "Green shoots" last month.

I'm sure all the people who made fun of them on this site will now admit they were wrong and apologise.

They will definitely do that, and not some variation of an "it's all rigged" schpeil.

When the evidence is not on your side.. double down on the rhetoric! It worked for Baghdad Bob. :)

Let me guess, your post is in reply to a comment from DGM ?

The user called DGM? No. But in response to a post from a DGM elsewhere on this page, more or less. (Not trying to imply that Pa1nter is a dgm at all)

I'm skeptical that any recovery can be sustained given fundamentals, in particular the relatively low equity that aggressive investors now have.

I suspect the current bump is partly supported by vendors holding off for a change in govt, and buyers trying to get in before a change in govt. If national get in people might be surprised by listings surging whilst buyer interest remains flat at best.

The one thing that might generate a "sustainable" "recovery" is continual high demand from offshore. That would be a disaster for young Kiwis as affordability would be worse than ever in this scenario.

I agree with you HGWR, but my thread is not about the recovery being sustained, it's about admitting that, T Alexander may have gotten it right last month, when seeing "green shoots".

Let’s see another month of data before jumping to any big conclusions.

yes maybe he is right, this time

A broken clock is right twice a day...

ITguy suggested six months of increases before the trend is in place. Although more likely he means 3 months but wants to give himself a headstart ;)

There is so much noise in the data that one month means a bottom is forming , not that the bottom is in and its up from here.... I am in no hurry as I cannot see how you can win here unless you are a builder...... there is to much local and global risk. You need to see 1-2% gains for the next few months, but you are likely to see a flood of listings vs the dearth we have had. I see food went up 8% .... Higher for longer and longer and longer I suspect.

There are 13 listings in Glendowie on trademe, there used to be 40 odd...... people have given up trying to get the price they want yet are not forced to sell, this is known as overhang in trading terms and is a big barrier to any major increase. Known as pent up supply. `

The problem with pumpers is they only think about today, and only at a local level.

Given the extreme circumstances overseas, you’d think these clowns would have a little more foresight.

But of course, they are deliberately stupid as this would poke glaring holes in their garbage.

More pain to come.

I admit that I mocked Mr T Alexander several times, but I always said something along the lines of "he may well be right knowing the NZ property market, but his evidence is lacking".

He was wrong with his peak mortgage rate predictions they have increased quite a bit from then.

...but I admit he was kind of right calling green shoots a month ago?

Maybe there are people who genuinely listen to what he says, believe it and base their decisions on it.

If you have a mouth piece in the industry claiming Bitcoin is about to soar, and people start piling in, what do you think will happen to the price?

This shows a lack of insight. Others changed their perspective on direction months ago Yvil.

This is what I don't get. Our income has increased quite substantially over the last year - and yet our potential purchase price has dropped another 300k (accounting for interest rates and increases in outgoings)

Particularly in the centres, I cannot currently see, aside from an unlikely collapse in interest rates without serious economic carnage, how this is anything other than a dead cat bounce.

The figures coming out of QV, REINZ are starting to look rather massaged, but without access to the raw data, it might just be that I am merely a crank.

Though, another explanation is people trading down: able to push prices up % in the middle while the top drops a lower %.

Significant details missing in this dump of data. Specifically - the last 6 months of listings vs 6 months of withdrawn listings vs 6 month of sales.

Have you ever admitted you were wrong and apologised? Not that I can recall.

Your memory fails you HM, admitting mistakes and apologising when one is wrong, is most important. I have no problem admitting when I'm wrong and I have done so multiple times on Interest.

I can’t recall it. And I certainly can’t recall any apology from you when you - wrongly - abused me about my support for this site.

I sincerely apologise to you HM, for previously saying that you were not contributing to Interest, I was wrong! It's great that you are a contributor and you have my respect for doing so.

Great. I can put that one to bed then

Yvil's respect is like the worlds finest of wines. Its worth waiting a lifetime for every drop from every bottle 🍷😂

And may half the time be corked?

"What storm?"

The likes of TA would be more credible if they simply called the market what it is right now - a low-volume holding pattern - and left it at that. It's the deep and obvious bias that makes them such deserving targets of ridicule.

There is a backlog of both sellers and buyers. Which is larger is anyone's guess at this point, but we'll soon find out.

We won't, since both backlogs are currently throttled by price expectations and that won't change

We might see a trend though. My money is that it'll go wayward for a while until it settles in a certain direction

I presume that direction will be dictated by economics and not sentiment, but, hey, I've been wrong before and market can stay irrational for a long time apparently

Hang about - could it be that TA's commentary is based on actual surveyed data and might actually provide a fair insight into the current state of the market? Yep I'm rather disappointed in Interest's recent article ridiculing those seeing greenshoots as 'smoking hopium'. Looks like that author was popping downers.

He surveys a group with a vested interest namely real estate agents. He himself also has a brokerage in Wellington. Both him and his surveys are hardly an impartial source of data now are they?! This is the guy that last year said house prices would RISE nationally by 5% and that interest rates had peaked 6 months ago.

Indeed. Lets not let facts get in the way of a "not so little" vested interest.

Like what the catholic church taught at marriage guidance class.

Yvil, I am holding your hand now, looking at you sincerely into your eyes and saying "I am sorry"...

Something something, even a broken clock tells the correct time twice a day. Not going to give snaps to him for permanently calling the same narrative until eventually it becomes fulfilled. Same goes for the flip side, the real price of housing in NZ will revert significantly at some point. Is that happening now? In 5 years? 15, 50 or 100 years? If I call it every day as TA has done, then will I expect credit when it eventually does happen? No.

On that note, he also correctly called the peak of interest rates last year around July. They then fell slighly for a month and shot up significantly after that. Though has since called the peak every month.

A friend told me about a plant growth hormone that boosts green shoots. TA is using the same stuff, he is just spruiking the market to make everyone nervous and thereby cause FOMO

I'm guessing that TA was a bit premature: the market had a brief uptick a few months ago; arguably some evidence of it slowing down over the last month.

We may see another bump after the election (assuming National wins), but until interest rates start to fall and/or incomes start to rise significantly, the best bet is that the long-term trend down for NZ house prices will continue. In my view, NACT's proposed property law changes are not enough to offset the negative weight of the fundamentals (interest rates and incomes).

Hmmm, it looks like Tony Alexander and some others weren't that wrong, calling "Green shoots" last month.

A broken clock is accurate twice a day.

It's Global Warming, August is the new first month of Spring.

REINZ claiming the dead horse twitched in response to their flogging .

With the exceptions of Whangerei and New Plymouth every three month entry in the HPI report is positive. Doesn't really lend a lot of support to the "we are crashing" narrative.

Ok, here me out - to stop house prices from going down and all our buddies losing on their investments - why don't we stop building new houses, maximise immigration, reintroduce interest deductability, and only promote media from aligned/vested-interests?

The best part of house prices up is that the NZ economy figures will look amazing and we can continue to be perpetually wealthier on the back of all the communist serfs.

↓↓↓↓ Voting National Chain ↓↓↓↓

- SMG.

I wouldn't stop building new housing completely. Just ensure immigration remains high and credit is readily available to speculators.

I know you're being sarcastic, though a plan is a plan.

Police need to focus more on protecting homeowners. Clearly more prisons are required.

Just build a massive cube in Hamilton

If you're a prospective house buyer you really need to be careful about the comments you read here providing advice... time & time again they get proven wrong, today being another example.

Wellington saw month-on-month rises in median prices

Thank goodness for that, it's been getting tough down there for landlords with tenants failing to understand their place as second-class citizens:

https://www.msn.com/en-nz/news/other/realtor-landlord-tanya-lieven-thre…-

Yikes.

I’m currently going through that as a tenant, though the RE agency is being a lot nicer about it so far. Still sucks having someone want to sell their home while you’re renting from it. We’re 1 year into our 1.5 year lease, and I feel like this will go on for the remaining 5-6 months of our tenancy (private viewings before being publicly marketed in November. I know my/their rights, btw).

Turns out this house was bought 10 years ago, listed for sale near the peak (early 2022), then taken off the market, rented to us, now going back on the market. The homeowner probably could have scored a couple hundred grand more if they never rented to us and probably doesn’t think the market will pick back up again.

The homeowner owner also works for a RE agency, and so if this is really green shoots, then why sell now? Surely they know that tenanted properties don’t usually sell for as much, especially when rental yields are so low. I’m guessing they’re over-leveraged or they think the market will tank further. Meh, we’ll see.

Edit: I live in Wellington, for reference.

Probably didn’t sell 2022 due to the lowering narrative of looming house prices dropping and likely unrealistic seller expectations. Wonder how those expectations will be this time around, place your bets now

They should be nice; they need your consent (which cannot be unreasonably withheld - from memory giving a couple of day/times a week is reasonable at Tenancy Tribunal). Some LL's offer a rent reduction to compensate for the inconvenience too.

“There was really nothing else that I could have done differently in that situation,” she said

She could have given the tenant the 48 hours notice he asked for - it was not an unreasonable request given she tried to issue carte blanch viewing notice.

As a realtor, she should have known better, and both tribunals involved have told her so.

Thats why the general advice is to evict the tenant before putting the property on the market. The tenant hassles are just not worth it. Plus you will get a better price selling a vacant property that is clean and professionally staged, rather than one with a disgruntled tenant and his crappy furnishings.

Anyways, you should all be celebrating. This is what you want right - landlords selling up? The tenant should have just made an offer on the property and avoided the drama.

Can't move on a tenant on a fixed term contract - they come with the house.

Also, can't move on a tenant to sell - only purchaser can request vacant possession.

And fixed term tenancies convert to periodic unless otherwise agreed by both parties - so waiting till end of fixed term still doesn't mean you can force the tenant out if they don't agree.

Correct about not being able to terminate a fixed term, but you can terminate a periodic tenancy if you want to sell the house. So what you do if you are thinking of selling is issue the notice of termination 90 days before the fixed term expires, so that it ends on the day the lease rolls over to a periodic lease, or don't renew the fixed term and allow it to roll over to periodic (tenant cant prevent that) and then issue a notice of termination whenever you like.

S.51 of the Residential Tenancies Act

(2) A landlord may terminate a periodic tenancy by giving at least 90 days’ notice if—

(a) the premises are to be put on the market by the owner within 90 days after the termination date for the purposes of sale or other disposition; or

Agree with your interpretation which is why I would like a no cause (no fault of tenant) termination notice to come with $2,000 towards 'moving costs/hassle'. A small disincentive to uproot a 'home'.

I stand corrected.

And yes, I have long agreed with Murray re: landlords paying moving costs for no-fault terminations - pretty sure I put that in my RTA reform submission back in ?2019?.

Thats why the general advice is to evict the tenant before putting the property on the market. The tenant hassles are just not worth it. Plus you will get a better price selling a vacant property

Yes, that's the advice I've heard too. Perhaps she is one of those landlords that does God's work providing much needed shelter in houses built by someone else and selling for capital gain isn't the reason for the investment.

Then again, threatening to sue for lost sale price (lost capital gain?) might suggest otherwise - I wonder if the IRD is looking.

Even Tony felt compelled to make note of China's seriously ailing property sector - https://www.oneroof.co.nz/news/tony-alexander-the-worse-china-looks-the…

Nothing like covering oneself in case of left field wild card that could easily kill the green shoots. Tony wants to be right - and fair enough too. His reputation is at stake.

The bottom is probably close or in, I expect a general flattening in house prices over the course of the next 1-2 years as credit availability remains restricted, and then slowly tick up as rates slowly peel back and national's pro-housing policies start taking effect. We should be back to ATH by 2027.

7% maybe the new normal, I dont think the 2-3% daze will return for many years, if ever. If I'm right, everything is still way overpriced.

"If I'm right..." and what if you are not right about 7% being the new normal?

The desired normal by central banks is still around 2% inflation.

So unless they change their mandate, it's really a game of how long it's going to take them to bash inflation into submission.

And western central banks are going to fail because this inflationary period is not like any recent ones. Russia is organising large energy and commodity producers into cartels to increase the pricing power of groups like the BRICS. Notice for instance that western countries are in a steep economic slow down which would normally depress the price of oil as energy use slows with the economy. But the price of oil has instead been going up, largely because Russia and Saudi Arabia are coordinating production cuts between them. In turn that further depresses economic activity but due to Russia and OPEC+ we are not going to be seeing oil drop back to $40bb to help boost activity back up.

The Saudis are cutting production because they believe demand for oil is going to take a dive. Because of the inflation fighting that's going on.

To be fair I dont really care. Im living on my yacht, currently in Fiji. Back and forth to the land of the big white debt as necessary. Dont own property. Business interest rates are of more concern to me.

Bula

Met a street hobo near the rubbish bins the other day in Hawkes Bay. He said he was a prophet. He was rambling incoherently about a house price apocalypse and something about 10% rates guaranteed...

Who are we to question hobo-nomics?

Oh great news. Also according to the alcohol industry a few drinks a day is actually good for your heart and the tobaccoo industry has advised that vaping is a healthy alternative to tobacco so good times all around really.

Alcohol consumption and rising property price are here to stay.

And you can afford both of those with your untaxed capital gains.

Doesn’t sound too healthy, lucky I don’t drink alcohol saving me plenty of money.

If you take into account inflation house prices are still falling. At the moment we are down 20% but add in inflation over last couple of years it would be down around 33%, house price don’t crash over night it takes time we are not even halfway through process. House price’s throughout history keep in touch with incomes and CPI at the moment there’s still a big difference, if house price stay the same for next 3 year but inflation is 5% each year we be down around 50% when adjusting for inflation from highs. But with rates staying around this level for long I think more price drops will be coming.

And if you price NZ houses in US$ they've devalued even more. 2 years ago the NZ$ was worth 72c now its just 59c.

If you are a immigrant, you'll be thinking NZ property is a good deal at the moment, time to move some cash into NZD, and buy rather than rent..

This might be worthy of further study ....

To cut a longer story shorter ... Was out with about 20 people and almost all work from home. I was surprised there were so many. I asked where they were working prior. The majority said they weren't working before but now are ONLY because they can work from home.

So when economists say the pool of workers is tapped out when unemployment is below 3% (or whatever each economist thinks is the correct figure) ... Have they factored this in? I.e. being able to work from home has actually increased the number of available workers?

Methinks economists may have not adjusted their models for this post-covid phenomenon. Ergo - they're wrong again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.