The Official Cash Rate should be kept on hold this week, although there is more weight this month for a cut than in April, according to a shadow Reserve Bank board set up by the New Zealand Institute of Economic Research (NZIER).

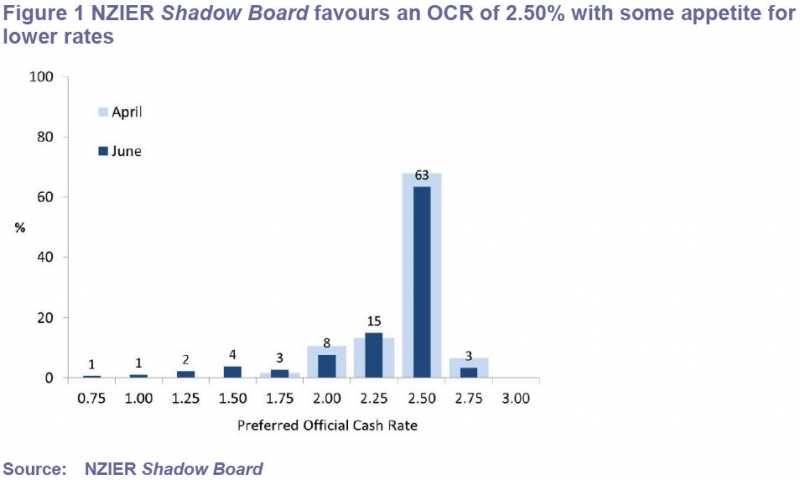

The shadow board of nine academics, economists, and business leaders put a 63% weight on the Reserve Bank keeping the OCR on hold on Thursday, down from 68% in April.

There was just a 3% weight given to raising the OCR (down from 7% in April), and a 34% weight given to settings below the current 2.5% as appropriate.

“The Shadow Board is now more inclined to a lower interest rate being most appropriate for the economic conditions. This shift reflects higher global economic risks, particularly in Europe, the economy moving sideways, fiscal headwinds and low inflation,” NZIER Head of Public Good Research Kirdan Lees said.

In mid-May financial markets gave an 85% chance of a cut in the OCR, although in recent weeks that has retreated back to under 20%. New Zealand bank economists expect the next move in the OCR to be up, in March 2013. Markets are pricing in cuts over the next year, with this oscillating between a cut to 2% or 2.25%.

Reserve Bank Governor Alan Bollard is set to review the OCR at 9am on Thursday, June 14.

Also see article, Reserve Bank to keep OCR at 2.5% next Thursday, bank economists say; Global developments the catalyst for any cut; Markets eye 25% possibility of a cut.

Shadow board

The members of the board are:

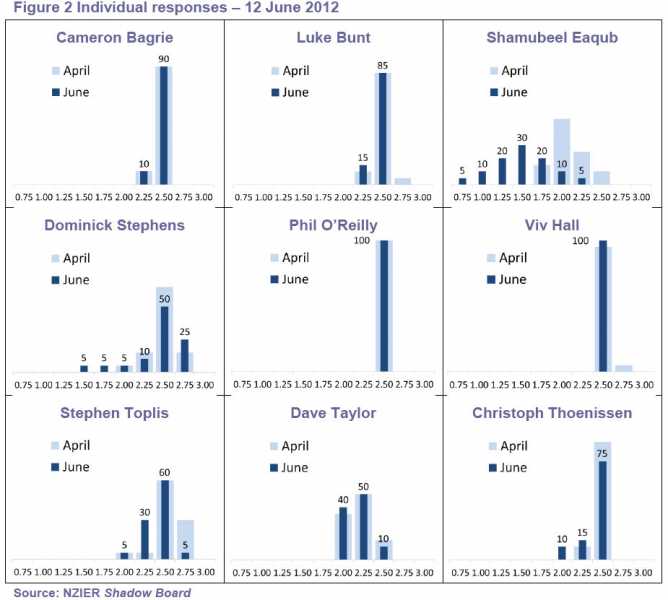

Cameron Bagrie, Chief Economist, ANZ National Bank

Luke Bunt, Chief Financial Officer, The Warehouse

Shamubeel Eaqub, Principal Economist, NZIER

Dominick Stephens, Chief Economist, Westpac

Phil O’Reilly, Chief Executive, Business New Zealand

Dr. Viv Hall, Professor, Victoria University of Wellington

Stephen Toplis, Head of Research, Bank of New Zealand

Dave Taylor, Chief Executive, Steel & Tube

Dr. Christoph Thoenissen, Associate Professor, Victoria University of Wellington

About the NZIER Shadow Board

Lees said the NZIER Shadow Board aimed to achieve three goals:

- to encourage informed debate on each interest rate decision

- to help inform how a board structure might operate relative to New Zealand’s current single decision-maker model, where the Governor is responsible for making each decision

- to explore individual board members using probabilities to express their uncertainty.

"The format closely mirrors the Australia Probabilistic interest rate setting project (PROPOL) run by the Centre for Applied Macroeconomic Analysis at the Australian National University," Lees said.

The Board does not meet but each member is asked to give a percentage value for how much they prefer each interest rate. These values are aggregated to form a collective Board view (see above).

3 Comments

The economy is flatlining, unemployment rising, exports suffering, NZ needs stimulus.

But ... we can't cut - because we need to be able to cut when the bigger disasters hit us shortly.

Oh, and by the way - the OCR is going to rise .... soon .... maybe next year .... you better believe it ..... rises anytime soon ... ok , if not next year then the one after that ...... rises, rises I tell you .... (I used to be right [5 years ago])

I wonder whether this group considers whether the OCR and inflation only targets are in fact optimal. Our interest rates still high by international standards- and so sucking money from elsewhere that is more damaging than the demand for any excess leverage- but are relatively low by our own history, and so will encourage local asset bubbles. This paradigm is heading us from an already disastrous 4% current account deficit, to 7% within 2 years by even Bill English's rosy forecasts.

Only Shamubeel Eaqub of NZIER seems keen to challenge this paradigm with his response. I suspect the bank economists understand what the answer should be- which is lower interest rates, with some capital/lending growth controls, but that answer wouldn't suit their banking paymasters.

I agree, Shamubeel rocks. He's the only one with any common sense among NZ economic commentators....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.