This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

Claims that our current inflation is due to government spending are nonsensical. There is a mantra which goes: if the economy is expanding, cut back public spending; if the economy is contracting, cut back public spending; if the economy is inflating, cut back public spending; if the economy is deflating, cut back public spending. Recognise a pattern?

The 1989 Reserve Bank Act places the responsibility for inflation in New Zealand almost entirely on the Governor of the Reserve Bank. I disagreed with the neoliberal analysis at the time and said so. Other economists thought much the same but, wisely, were not so vocal. The commentariat sided with the neoliberals and that was the way inflation was explained to the public. The political trick was that the Government was not responsible for general price rises; blame the Governor.

But times do alter, and now the commentariat (and the political Opposition) has abandoned their earlier views and are blaming the Government for the current price rises. Fashions change but the analysis remains superficial.

In fact, the professional analysis was more subtle than the statute or the commentariat. The Policy Targets Agreement between the Minister of Finance and the Governor, which sets out the consumer price range which the Reserve Bank is expected to aim for, recognises that there could be inflationary pressures with which monetary interventions could not reasonably deal. If the government were to increase GST the Reserve Bank is not expected to take action despite the price rise. If world inflation results in rising import prices, the Reserve Bank is not to blame. However, in each case the Bank is expected to take measures to prevent such events triggering an inflationary spiral.

Nobody is demanding the incarceration of the Governor for failing to restrain the current price rises. But someone ‘ought to do something about it’, so we are all demanding that the Government should. No analysis, just blind panic.

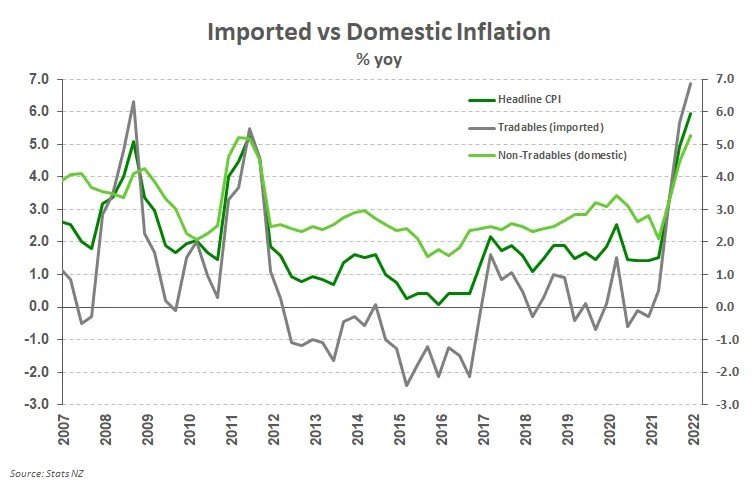

What strikes me for this bout of inflation is the turnaround in the relativity between tradable and non-tradables prices in the Consumer Price Index. To explain the distinction:

- Tradables are those items which are imported or exported (and also consumed in New Zealand). Their prices are set by international conditions – the exchange rate aside.

- Non-tradables are those items which are not internationally traded and so their prices are set here.

In the decade to the end of 2020 non-tradable prices increased twice as fast as all consumer prices whereas tradable prices actually fell. A major reason for the difference is that non-tradables include a lot of services which do not experience the same productivity increases as goods, although there is a view that our local markets are not competitive enough – a view increasingly appearing to be held by the Commerce Commission.

While non-tradable prices usually rise faster than tradable prices, the relativity has changed over the last year. As the chart below shows, tradable prices are currently rising faster than non-tradable prices so we are importing more inflation than we are producing locally. (The chart comes from a very useful article by Kiwibank economist Mary Jo Vergara.)

The two main reasons for the tradable price increase are the disruption of international supply chains caused by the Covid pandemic and the commodity price hikes which have been caused by Russia’s invasion of Ukraine. It is these influences which drove last year’s inflation. Had international prices risen the same as they did in the previous decade, then overall consumer prices would have risen at less than half the rate they did, and below the top of the Reserve Bank’s target range.

That makes nonsensical the claims that our current inflation is due to government spending. It is international inflation which is booming away and cuts will do nothing about that.

So who is to pay the international economy for their higher prices? Someone has to. Advocates of cutting government spending are saying that the young, the old, the sick, the environment and (possibly) public servants should pay. I leave you judge whether this is acceptable.

If you think those groups should not bear the burden, then who? The current convention is that we may not raise taxes on those on higher incomes, so it looks to me that your choice is between the workers and future generations. We’ll see what the Government thinks (and the Opposition, if it gets round to thinking).

At the moment the international inflation is seen as temporary by many, but not all, serious overseas economists. But even they worry that the blip may trigger more permanent inflation if everybody tries to compensate for their reductions in real incomes by hiking their prices and wages.

There is not a lot evidence of the spiral starting overseas or here – yet. This is despite many economies being near too fully employing their productive capacity. Many economists are optimistic that the supply chain snarl-ups and the commodity price booms will soon unwind and so the recent price rises will reverse.

However, there are some New Zealand economists who are more pessimistic, expecting last year’s consumer price rise to repeat itself this year. Their presentation is more headline than analysis but I think what they are saying is that they don’t expect the supply chain jams to unwind soon, while they think the commodity price boom from the invasion of Ukraine will continue and the mechanisms which generate an inflationary spiral may start cutting in. They also point out that interest rates are rising but interest rates are not in the Consumer Price Index.

Whatever, there is much policy activity aimed at restraining the inflationary spiral. The Reserve Bank is likely to continue to raise interest rates; it will have to, because world interest rates are rising and ours cannot get too far out of line. The government has cut taxes on transport fuels and increased subsidies on public transport but only for three months, indicating that it thinks the peak will be temporary. There will be other measures of varying effectiveness. (The Commerce Commission may be a bit slow and clumsy to play an urgent role, but it ought to be vigorous in its promotion of competition.)

It is true that the New Zealand economy is near capacity, but if the inflationary spiral can be restrained, politically harsher measures may not be necessary. It may be necessary to remind workers and others that it is better to have a job and good government services than an exact compensation for falls in their real wage. I doubt their rhetoric will take much notice.

Back to the debate between me and the Reserve Bank in the 1990s. I argued that the management of monetary policy had to take the government’s fiscal deficit into consideration. The Bank was reluctant to admit this in public, possibly because it might mean that they would have to criticise the government’s fiscal stance, compromising the Bank’s independence. (There was an invisible barrier down the centre of The Terrace between the two institutions’ buildings.)

Currently, the fiscal deficit is large, so one is uneasy. Funding the deficit generates additional liquidity which would fuel an inflationary spiral. Both the Reserve Bank and the Treasury will be nervous about the current fiscal stance; so should you be, even if you do not care about future generations.

Notes

The consumer inflation rates used in this column are:

Decade to 2021 2021

Tradables -0.3% p.a. 6.9% p.a.

Non-tradables 2.5% p.a. 5.2% p.a.

All Consumer Prices 1.3% p.a. 5.9% p.a.

I estimate that had tradable prices risen at the same 2021 as they had done in the previous decade, Consumer Prices would have risen less than 2.9% in 2021. I cannot tell exactly how much, because we don’t know how much tradable prices feed into the non-tradeable sector (as when it uses petrol for its transport).

Brian Easton, an independent scholar, is an economist, social statistician, public policy analyst and historian. He was the Listener economic columnist from 1978 to 2014. This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

56 Comments

Certainly cut Government spending. There is lots of cost there with no outputs for the public. Better that cashflow go to something useful.

Grant Robertson's spending is outrageous. Any issue throw cash at it.

"It may be necessary to remind workers and others that it is better to have a job and good government services than an exact compensation for falls in their real wage."

Given the last decade of housing cost increases not captured by inflation, just how much should workers be content to fall further behind in terms of living standards before they ask for a payrise then?

And by what metric is our current level of government services 'good'? Current we seem to be relying on inflating the tax take off wages that may only increase in nominal terms while we fall further and further behind on things like education, crime, healthcare - and that's judging by the few remaining benchmarks, many of which the government cynically scrapped.

"It may be necessary to remind workers and others that it is better to have a job and good government services than an exact compensation for falls in their real wage."

Anyone under 40 has been 'reminded' of that for pretty much their entire working life.

We have pushed so much income from earned income (wages from work) to unearned income (capital gains windfall) and then stubbornly insisted on having the working folk pay for most services. We've taken an austerity approach to healthcare funding for the last decade or so while our population ages.

How unsurprising the results we have gotten are.

So long as we enable freeloading and live by extracting from the working folk they will fall behind on living standards and we all will fall behind on services.

(But come election time many will probably vote for "TAX CUTS!1!" and austerity for services, anyway.)

Maybe the wealthy at a certain income/capital level could take pay cuts and live off their capital whilst we transition to something more equitable? This could be less inflationary or keep the real economy running as asset values correct? Govts would not have to redistribute as much?

Govt has grown far too large.

Carbon / climate change is eating up billions, and a lot of good workers as well. This is going to get significantly worse, for no practical gain.

Education quality is down, but dept of education has over doubled.

And a few large near monopolies (food, fuel, power gen, construction, banks etc) are making hay while the sun shines.

Good job calling out the 'Govt spending to blame for inflation' narrative - it is political opportunism by people with a fetish for austerity.

What I struggle with though is the idea that we have to push interest rates up to keep pace with the rest of the world (given that increased rates will make little difference to imported prices).

Increasing rates, like cutting Govt spending, will lead to reduced aggregate demand in the economy, increases in unemployment (= increased Govt spending!), and reductions in disposable income. The feedback loops between higher imported prices, reduced demand, and increased unemployment create a recipe for a major slump.

There is a growing dissent amongst economists in the US on this issue - with people asking whether, surely, there must be another way. This post is long but worth a read: http://jwmason.org/slackwire/inflation-interest-rates-and-the-fed-a-dis…

Jfoe, if the RB were to fall behind other Central Banks rate rises, the NZD would drop significantly, this will then make all our imports more expensive, hence increase tradable (imported) inflation so yes, raising the OCR has an affect on tradable inflation!

Yes of course, raising the OCR will hamper the NZ economy and possibly lead to a recession but we are (finally) stuck between a rock and a hard place, my view is that a (long overdue) recession is far better (or less bad) than runaway inflation

I don't doubt that a larger spread between NZ interest rates and, say, US interest rates would lead to some reductions in the strength of the NZD - at least in the short-term. Whether those reductions would be significant is debatable (and I would argue would be more influenced by loads of other factors).

But, in any case, does a slightly weaker NZD really matter? Is it worth paying billions in interest payments to foreign bond investors, reducing the disposable income of kiwis, and throwing thousands of people on the dole to keep imported cars and televisions cheap?

We'll need to massively increase intensification around good public transport if we are going to abandon dependence on cheap imported cars.

The market would come to the rescue with innovation and technology to repurpose and preserve our existing stock of vehicles?

Of course! At a certain price point!

Voila......

Why didn't I think of that - so much wasted worry.......

Did you have concerns about central banks pushing interest rates to zero and the associated impacts that would have on inequality and asset/debt bubbles?

Just wondering why you have issues about interest rates going up - but I must have missed your concerns about the reverse when interest rates were being pushed to zero? (based upon the deflationary impacts of globalisation - i.e. nothing to do with the domestic economy). Now that globalisation might be turning a corner, we can no longer rely on cheap imports to fill the basket of measured goods....now what?

It appears that you don't want rates to go up for some reason.....does that mean you have had no issue with rates being pushed down so dramatically to leave us in the situation that we find ourselves?

Just trying to better understand your reasoning...it is ok for the central bank to operate in one direction, but not the other, there is usually a bias.

Fair questions - as ever. I think monetary policy is misguided in theory and practice - moving interest rates up or down gives the impression that the central bank is steering the ship somehow, but in our modern global economy, changing the rates just changes how much free money bond holders get from Govt, the inflow / outflow of foreign capital (some impact on exchange rates), how much kiwis can afford to spend on their houses, and the number of people on the dole (via changes in overall demand).

My view would be that RBNZ should set the interest rate at, say, 2% and announce that it will take any action needed to hold rates at that level for the next 5 - 10 years.. then we can get on with the much more important job of transforming our economy so that our kids can grow up in a country that they want to live in.

Yes this makes sense - was thinking 3-4% might be a more historical norm but that would be open to interpretation.

What would/could RBNZ do to ensure that rate is stable? And what might be the consequences of doing that for exchange rates, deficits/debt levels and inflation?

We’d have to remain a hermit kingdom under your scenario!

you think the masses with all their cheap trinkets and gas guzzling cars will be happy when you tank the NZD!

Too simple the Politicians would never go along with it

It isn't price/asset inflation, its currency debasement. The mountain isn't growing higher, we're just falling off it faster. Until people acknowledge this as the problem, we'll keep accepting false narratives and tolerate CB manipulation. Jeff Booth - "The Price of Tomorrow" is a great read.

Interesting post Pacman

Great post Pacman_46. The Price of Tomorrow is a must read, but I also always recommend Debt by David Graeber. (but not so much Graeber’s posthumous book, which is not entirely written by him anyway, as it has some gaping factual holes and logical fallacies). Debt remains a very important read IMO.

I became interested in BTC in 2012, not as an investment, but as a philosophical, technological and economic solution. We could mine our own coins back then with a USB stick tech . Like many, the GFC created curiosity in economics and economic history and BTC seemed like the most elegant and fair solution to our ills. Although back then, I didn’t dare dream it would ever achieve the widespread adoption it has since.

I still believe that demographics is playing a much bigger role than Jeff Booth does. IMI the huge increase in human population size over the last few hundred years has been a key determinant in setting our inflationary mindset and culture. Literally each generation created a bigger generation than the one they belonged to, so each generation created an inflationary environment. This has been substantially true since the Industrial Revolution when the huge technological leap took off. So has been a macro force to counter the deflationary nature of technology. Though as Booth states, knowledge/data is infinite and eventually that knowledge/data has also filtered (via cultural evolution, education, tech and material excess) to where we are simply having less children, are less fertile and so the demographic explosion is self correcting. If certain western cultural trends become the dominant culture globally, then the nightmare dystopian future of a bloated human population fighting to the death over finite resources, might not be quite so bad. People hate the zoomer “woke” culture but fail to see the hand of cultural evolution afoot, or how the cultural trends (and even lower associated fertility and consumption rates) might be helping to ameliorate the impending resource crisis. If the alt-right wins the cultural war though, I imagine we most certainly will see the violent revolutions that Booth warns of, rather than the more gentle adoption of cryptos and deflationary mindsets.

"That makes nonsensical the claims that our current inflation is due to government spending. It is international inflation which is booming away and cuts will do nothing about that."

A somewhat hyperbolic overstatement. The rates of tradable & nontradeable inflation increase are recently similar according to the graph & last time I looked both impacted the NZ economy roughly equally. Its also likely that the increases in public sector staffing & service costs since Labour came to power in 2017 have aggravated nontradeable impact, along with the $50B spent in Covid support.

Always good for a giggle over the 50 years of my working life to hear economists urging wage/salary restraint for the masses to support their macroeconomic theories. They don't feed & house your family whom you have the responsibility to provide for.

Can see the $50B in COVID, but what's the big difference in impact on nontradeable between paying for contractors vs. paying for permanent staff?

The two main reasons for the tradable price increase are the disruption of international supply chains caused by the Covid pandemic and the commodity price hikes which have been caused by Russia’s invasion of Ukraine. It is these influences which drove last year’s inflation.

Anyone else seeing an issue with this statement?

That a month old invasion is apparently driving last years inflation?

Yes indeed

It is absolute nonsense.

You can't have an unprecedented and unhinged spike in the price of financial assets (US equities, real estate, crypto etc) without causing inflation. The people holding that nominal value want to cash it out into tangibles. It's a demand spike exacerbated by supply chain problems.

If the 2020-21 bubble pops, inflation will ease. If it doesn't, inflation will continue.

Economic theory is very clear, interest rates alone control inflation. So this whole imported/global inflation and govt spending must be rubbish.

Or maybe... have the economisseds, finally caught up and realised that the theory was, is, and always will be nonsense.

It is international inflation which is booming away and cuts will do nothing about that.

Yes international (tradable) inflation has risen significantly but NZ (non tradable) inflation has also risen to above 5% and still rising according to the graph provided. That would suggest that an increase in the OCR is justified

I cannot agree with Brian's apparent conclusion that inflation is largely imported.

The tradable sector makes up approximately 40 percent of the overall CPI.

The non-tradable sector, which makes up 60 percent, has been running 'warm' for many years. And currently it is running 'hot' without help from the tradables.

It is flawed to say that overall inflation would have stayed within the upper band of the inflation target if there had been no inflation of tradables. Non-tradables are running at over 5 percent inflation rate and Brian's own data shows that. And it is unrealistic to assume that tradables would continue to carry all of the burden required to keep inflation within the overall band.

I wrote about this here at INTEREST some fifteen months ago, being spurred to write by the total absence at that time of commentary separating out tradable from non-tradable inflation. The headline stated that internal non-tradables inflation was 'well alight' and I provided the data to show that.

Before writing that article 15 months ago I also did my own informal survey among trade contacts which confirmed that charge rates including hourly rates were being ratcheted up independent of imported inputs. Since then the wage-price spiral has been further fueled.

It is also flawed to blame current high commodity prices on the Ukraine situation. Those effects have not yet flowed through into our internal CPI. But they are coming.

It is very difficult to see how the wage-price spiral can now be brought back under control without a significant increase in interest rates to cool the economy. That is going to be painful.

KeithW

Keith, thank you so much for your continued input on Interest.co.nz Personally I think you are spot on most of the time, I really value your comments and occasional articles, please keep them up!

What wage / price spiral Keith? I don't see the wage part of that spiral at all - certainly nothing with a broad enough base.

See David Chaston's 'What Happened Monday' " Average earnings are now +8.1% higher over the year to February, compared with the 12 months before." Given that real per capita GDP is rising at about 1% if we are lucky, then most of this 8.1% feeds straight back into the spiral.

KeithW

Respectfully, taking Feb 2021 monthly data for filled jobs and total earnings and comparing it to Feb 2022 data is terrible practice. The data is very noisy - with seasonal effects almost meaningless in the Covid era.

For example, if you compare March 2021 to February 2022 you would see a reduction in 'average earnings per filled job' - is that wage deflation?!? Of course not - it is just noisy data and February 2021 was just a particularly low baseline.

Also, if David (or infometrics) has used total earnings divided by filled jobs as a measure of 'average earnings' the answer he has got is average earnings per job filled - this is not a measure of wage levels as it is quite possible that lots of people have worked more hours in the same job and earned more for their extra efforts.

interest rates are rising but interest rates are not in the Consumer Price Index.

??? Brian would you please care to elaborate on this sentence

Brian's statement is correct. Housing components and rental costs are included, but interest rates are not included. There are good reasons for this. But it does mean that changes in the CPI under-estimate the effects on those who have mortgages.

KeithW

I don't understand why interest rates should be part of the CPI, they are a tool, a cause that influences the price of goods and services, but they are not a "good" or a "service".

Is debt a product or a service? Interest consumes one's income so why wouldn't it be included? I guess it would make the use of interest as a deflationary/inflationary tool a little more complex, or would it smooth the cycles better?

It is neither. It is a cost of debt capital used to either purchase an asset or consume a good or service.

KW - the 'economy' would be stone cold if it weren't for increasing injections of unrequitable debt. That has to be forgone, forgiven, or inflated away. Trouble is, the train is travelling faster than we're following it - so I'm not sure inflation can ever solve anything; it will merely disenfranchise, starting with the poor.

PDK,

The sovereign debt in NZ is manageable. And one person's debt is another person's asset.

The big questions in NZ relate to population, resources, and inequalities.

KeithW

No - one person's debt is not another person's asset.

If there is no underwrite, then the person who though it was an asset, was mistaken. Simple as that. One of them is going to be the (debt) parcel-holder when the music stops. It's the same with 'cash in the bank'; it's no guarantee that there will be stuff to 'buy', even if someone previously 'earned' said 'cash'. They're only tokens - and if irredeemable, worthless.

That the same mistake David Chaston makes - it's a mantra we can presumably trace to Samuelson-style teaching?

If it's not an asset, what is the debt from the point of view of the lender?

An investment or gift in the well being and empowerment of the other?

It's the tide that lifts the others boat?

Your talking long term PDK so nobody is interested. The current system we have is going to truck along for another 20 years so nobody gives a shit. When the current system crashes it will just be replaced with another monetary system until that crashes. Money supply is unlimited and its still going to take decades before the truly "Limited" resources of this planet come to bear.

No I'm not

No it won't - even if they don't.

No, it won't. There will be no remaining faith.

No, it's happening right now (some call it supply-chain issues - correct in an incorrect sort of way).

Another article on Inflation from other part of the world :

https://m.economictimes.com/markets/stocks/news/every-inflation-is-tran…

Pretty simple

Government spending adds to demand pressures where supply chains are already restrained.

Also the lowering of the OCR out of panic, helped fuel a building boom during a time where the supply issues for materials intensified. The inability to roll back out of that error was just plain dumb. You can say that is Orrs doing but undoubtedly it would have been a joint decision.

It is a good article but the conclusion is wrong. The chart and table makes perfectly clear that our non tradable inflation drives our headline CPI apart from the world wide events like the GFC and the pandemic. It shows that the economy in the rest of the world is far more efficient than the New Zealand one. It also indicates that the rest of the world recovers more quickly than New Zealand from global events. The New Zealand Government is the only responsible for the effectiveness of the economy by making sure markets, labour, food, energy, land and so on, are working efficient by making the appropiate legislation. Obviously this has not been the case as the chart shows.

Wait a sec, I thought the "market" already knows how to operate and allocate resources efficiently.

So who's responsible - the government or the market?

And anyway, in this PC world are you allowed to use 'invisible hands'?

Good post Peter!

Going back to the way interest/business cycles used to happen.

Living beyond ones means will be punished and those that struggle now will be punished even harder.

The interesting point will be what the energy cycle does as all ways of life today rely on that. Will Russia be allowed back into the energy fold? Europe seems to want to move away from them - this will cost.

Renewables - will they really rise now? - it will still cost more than the past. Climate Change?

A painful ride for some coming - some will benefit as well.

Of course, the Government (and other Governments around the world) printing money (you know, inflating the money supply without a commensurate increase in output) had nothing at all to do with raging inflation we have now.

"Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. Of course, we all know the driver of the quantity of money is government spending priorities". So says Milton Friedman.

"Advocates of cutting government spending are saying that the young, the old, the sick, the environment and (possibly) public servants should pay". That seems to be a one size fits all statement. What some say, is that the Government spending we undertake should at the very least, have measurable outcomes. Otherwise it is waste. And why should taxpayers allow a Government to waste what is essentially their money? So cut that spending, and cut it hard.

Means test the pension (perhaps on the value of one's primary residence/s ) immediately? Bit of savings...

Sure Rick, and give back the tax money those people have paid that relates to their annual pension, plus a rate of return commensurate to say, the year on year rise of the NYSE, FTSE, ASX and NZX. That way, those with means won't be subsidising other peoples pensions.

Spot on post.. love the name too

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.