If success means nothing breaking, Prime Minister Christopher Luxon’s first official visit to the People’s Republic of China has been a triumph.

He spent four days meeting top businesses and political leadership without receiving any obvious rebuke for New Zealand’s subtle shift in foreign policy.

This shift involves speaking more openly about China as a risk to regional security and forming closer defense partnerships with US-aligned countries.

Debate over whether NZ should join AUKUS Pillar II—an undefined technology sharing agreement—has been the most visible issue, but various decisions have moved NZ toward western security partners, such as Australia, NATO, and the Philippines.

Supporters of the policy say it’s an obvious reaction to China’s growing military presence and regional assertiveness, while critics say it is part of an American campaign to halt its competitor’s natural rise in power and influence.

The truth may fall somewhere in between, but it still puts NZ in the uncomfortable position of having China playing a hero in its economic story and a villain in the security story.

Businesses exporting to China are understandably nervous this balancing act could put their market access at risk if New Zealand oversteps or miscalculates. A China-based Fonterra executive told TVNZ he worried tough talk between the two could lead to “trade disruptions”.

Luxon said businesses hadn’t raised that kind of concern with him on the trip. The challenge he heard about was how to win a share of the huge and competitive Chinese market.

“They’re in this market all the time and so they’ve got bigger issues, around how do you make money, who do you partner with, how do you [approach] a country this size,” he said.

This mostly aligns with what members of the business delegation told Interest.co.nz, although they had been coached to not speak freely with travelling journalists.

With that caveat in mind, Kiwi exporters said they saw the trade relationship as stable for now, even if the risk of it deteriorating lingers in the back of their mind.

Ups and downs

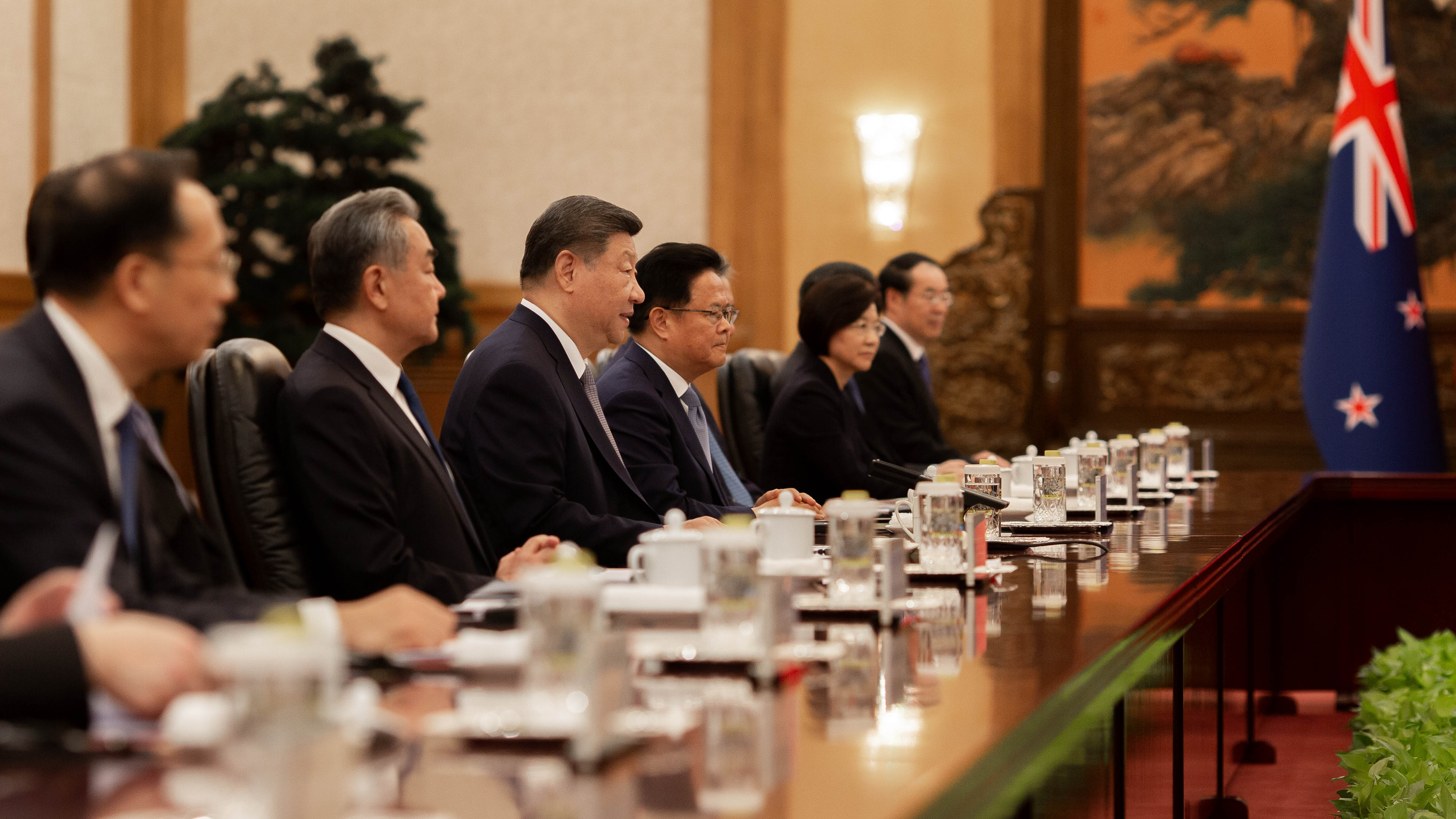

Those anxieties have hopefully eased slightly after smooth meetings between Luxon and President Xi Jinping and Premier Li Qiang. These discussions happen behind closed doors, but NZ officials seemed happy with how they went.

Media are allowed into the room to hear each side give opening remarks and take a few quick photos. These public comments were friendly and respectful, although not as warm as they have been in the past.

Xi complimented Luxon on his “positive attitude” and thanked him for easing visa restrictions for Chinese visitors but also acknowledged some difficulties.

“More than 50 years since the establishment of diplomatic ties, the China-New Zealand relationship has experienced many ups and downs, but we have always respected each other and worked together,” he said.

Similarly, Luxon said the relationship was “longstanding and of great consequence” and that he wanted to grow two-way trade. But he then encouraged China to play a constructive role in regional stability and said they would have open discussions “as partners should do”.

The two sides sounded somewhat wary of each other but willing work through it to maintain the status quo and keep the key trading relationship steady.

Steady as she goes

Wang Xiaolong, Chinese ambassador to New Zealand, told the Global Times the key outcome of the visit was a recommitment to mutually respectful cooperation.

"It is particularly pertinent given the fundamental interests of the two countries and the turbulent times we are going through at the moment,” he said.

Another column published in the state-run newspaper ahead of the political meetings said the US had been pressuring NZ to join “its small circles aimed at containing China”.

“For New Zealand, it is important to see the broader picture and ensure that its choices align with the prevailing trend of history … the "America First" principle means Washington could abandon its partners at any time.”

A later story reporting on the meetings took a positive tone. It said NZ seeks to balance “economic pragmatism” while still talking about Pacific security.

“New Zealand has shown a strong adaptability to balance its relationships with China, the US and Australia. While being a Five Eyes member with deep alliances, New Zealand values its relationship with China and navigates geopolitical complexities with independence and flexibility,” it said.

A quote from Xi said there were no “historical grievances or fundamental conflicts of interests” between the two countries which should respect each other and appropriately address disagreements.

These stories give the impression that China was also happy with the meetings, even though Luxon indicated he raised various concerns including Chinese warships doing live firing drills in the Tasman Sea earlier this year.

Deals and announcements

While the political goal of the trip was to get through unscathed, there were some moderately significant trade announcements. The largest of these related to relaxing visa rules for Chinese visitors.

Chinese tourists with an Australian visa will now be allowed to also visit NZ, an easy-to-get transit visa has been created, and applicants for a regular visitor visa won’t have to provide a costly licensed English translation.

This is aimed at helping bring back Chinese tourists, many of whom have been choosing other holiday destinations, and enabling a Southern Link air route from China to South America via Auckland.

Playing its part, China agreed to a process which allows Kiwi cosmetic companies to sell their products on store shelves despite not meeting a requirement they first be tested on animals.

This was something former Prime Minister Chris Hipkins raised with Premier Li Qiang when he visited China in 2023. It is projected to bring in an extra $200 million in export revenue, as the products will be more visible and allowed to be sold in larger volumes.

New Zealand Trade and Enterprise (NZTE) estimates the various deals signed in China will add $871 million in export value over an unspecified time. Most of these were routine commercial deals between private companies, although some were new or involved the two governments in some way.

New Zealand sold just over $20 billion worth of goods and services to China in 2024, making the collective value of these deals equivalent to about 4.3% of annual exports.

Blowin’ in the headwinds

While Luxon told Xi he had “big ambitions” to grow two-way trade between NZ and China the trend has been heading in the other direction. Export value peaked in calendar year 2022 at $21.2 billion and has flatlined ever since.

A weak Kiwi dollar and strong commodity prices—most notably milk and butter—pushed these export values to a record high in March but it is unclear if that trend will be sustained with Chinese consumers still feeling cautious.

Consumer sentiment took a nosedive in 2022, as covid lockdowns dragged on and a property bubble began to burst, and has never recovered. Chinese citizens are choosing to keep their money in the bank.

This is a problem for Chinese policymakers who are tasked with hitting a 5% annual GDP growth target while facing an average US tariff of 51% (at the time of writing) on 14% of its total exports.

With exports unable to act as the economic growth engine, China is looking to its own citizens to start spending. Most economies become more consumption based as they develop, but China has remained an exporting economy.

In the long term, it wants to develop its own internal market and reroute more exports to other Asian countries to its south, but it is proving hard to get citizens spending.

Core inflation is likely to be -0.01% in 2025, disposable income growth is at an all-time low, and personal debt has climbed to a historical high. These factors are constraining the ability of households to drive a demand-led recovery.

Southward and inward

Economists think Southeast Asia and India will play a proportionally larger role in global growth in the coming years, as China battles these headwinds. It is no surprise or secret that those two regions are also the priorities in New Zealand’s trade policy.

If China was able to reinflate its economy and get consumers shopping, it might be a boon for New Zealand’s sluggish exports. Many Kiwi products are used in fine dining experiences or are consumable luxuries such as natural cosmetics or manuka honey.

That said, NZ products generally fill a tiny niche in their mega-sized Chinese markets and aren’t overly sensitive to shifts in the macro growth rate.

Cultural consumer preferences and the strength of local competition tends to be a bigger problem for Kiwis looking to capture a slice of the market. A survey of 60 businesses in China found increasing domestic competition was the number one problem.

Chinese businesses are fit, competitive, and full of local knowledge. Consumers themselves are increasingly choosing local brands over international ones in response to the trade war.

The nationalist backlash is primarily aimed at US products, but it can have a spillover effect for New Zealand as the preference for Chinese takes hold in the culture more generally.

China remains a vast market, but it is no longer an untapped one. Businesses must fight for their market share, and it is becoming more difficult—whether for economic, cultural, or geopolitical reasons.

2 Comments

'Most economies become more consumption based as they develop,'

No - the dominant countries force others to produce for them... for less. In the primary sense, that sentence is ignorant - in that it ignores. It avoids the fact that 'development' (otherwise known as increased use of energy, coupled with increased material throughput) has global Limits. Which we are hitting now. Not all countries can 'develop', just as not all oil exporting countries can transition to importing.

'Economists think Southeast Asia and India will play a proportionally larger role in global growth in the coming years, as China battles these headwinds.'

The first two words are an oxymoron - economists are too ignorantly trained to properly think. There will be little or no 'global growth' from here on in - although there will relatively-better pockets within the whole.

'and it is becoming more difficult—whether for economic, cultural, or geopolitical reasons.' Well, yes - but how about identifying the reason underlying those 3? A cultural and geopolitical reason could be Zionist-vs-Islamist - but really that is about overpopulation/under-resourcing. Same with US vs China.

To me, his article contains a bewildering array of contradictions and misinformation...

"Consumer sentiment took a nosedive in 2022, as covid lockdowns dragged on and a property bubble began to burst, and has never recovered. Chinese citizens are choosing to keep their money in the bank."

The evidence on the ground does not support this statement. In China, the median per capita disposable income was 34,707 RMB in 2024, up from 33,036 RMB in 2023, and has grown from 15,632.085 RMB in 2013.

And surely when citizens choose to save, this represents a very healthy move into a long-term societal wealth-building phase.

And then this bewildering contradiction...

"Chinese citizens are choosing to keep their money in the bank."

... and then 4 paragraphs later...

"Core inflation is likely to be -0.01% in 2025, disposable income growth is at an all-time low, and personal debt has climbed to a historical high."

Apart from being contradictory, statements like this illustrate that the author has little understanding of a financial system where a country, especially at the central bank level, runs banking as a public utility - where interest is retained locally and offsets revenue that would otherwise need to be collected in the form of taxes.

In a public utility model, interest remains within the local communities, and in the domestic economy at large as capital and liquidity to accommodate the productive economy, rather than being lost as unearned rent to global third-party private monopoly banking corporations.

In a sound money model, which works as a corollary to the PBS (Public Banking Solution) and as technology and productive output increase, deflation is the natural progression.

Money creation under this no-brainer operates as a sustainable wealth-building public utility - NOT AS A COUNTERFEIT PRINTING PRESS FOR THE GLOBAL KLEPTOCRATS.

Under a sound-money/PBS scenario, negative core inflation is a bonus - indeed it should be a goal. It can foster a societal savings mentality which complements the transition from fiat casino money into sound hard-backed money principles.

Within the entrenched status-quo Western Casino narrative, inflation is spun as a requirement - in reality, it is the silent thief that disadvantages the working classes and the real economy, whilst benefiting the wealthy, blows giant asset bubbles, and manifests into a very unhealthy GDP profile.

PGDP

It has been recently revealed that the PGDP (Productive GDP) of China at ~U$15 trillion, was already 300% larger in 2023 than that of the U$, which was only marginally ahead of India at just over $5 trillion.

The US, two years on, is now ranked #3 in the world because India leaves them for dead in real growth - the traditional GDP, and PPP GDP, measures are farcically outdated tools.

They are deployed to disguise how badly a country does, as it insidiously de-industrialises into a financial economy that relies on selling an endless mountain of debt rather than providing goods and services to remain solvent.

I would hazard a guess that the current U$ admin finally saw the looming consequences and panicked when they realised the enormity of their debt trap. When you divide public debt by PGDP, it reveals a shocking home truth.

Let's work it out - according to Mr Grok who I'm quite sure would go to the ends of the earth to avoid exaggerating this debt mountain, said...

"As of May 2025, the total public debt of the United States is approximately $36.2 trillion. This figure includes both debt held by the public ($28.95 trillion) and intragovernmental debt ($7.26 trillion)"

Too easy...

Public Debt:PGDP at $36.2T divided by $5.1T (PGDP) is more than 700%!

THE NIIP NUMBERS TELL A GRIM STORY TOO

In Sept 2023 China had a NIIP (Net International Investment Position) of +$3.81 trillion. A credit position per citizen of +$2,721.

For the Western-facing casino counterparts, their NIIP numbers don't look quite so flashy...

US negative $23.6 trillion = neg $69,005 per citizen

UK negative $1.12 trillion = neg $1,631 " "

NZ negative $132 billion = neg $24,682 " "

Australia negative $403 billion = neg $14,454 " "

The ultimate irony in these numbers is that on realising just how dismal they are in combination, the #47 Admin went into panic mode and declared a trade/tariff war against the entire planet, including those that had been purchasing their debt and allowing the global Western-centric fiat Ponzi scheme to remain alive.

The tariff debacle is a lot like being caught red-handed trying to set fire to your bank manager's house because you can't afford to pay back your mortgage.

Also in their panic, the US is telling China that they need to take instructions from them on how to run their fiscal/monetary policy, when all the while they are the most obscene example of a technically insolvent debtor nation in financial history.

The world's central banks have been net sellers of U$ treasuries since 2014, and when the US began weaponising their reserve currency status things went into overdrive - Trump's policies were the equivalent of supercharging de-dollarisation and running nitrous oxide as well.

THE FOREVER WARS

The US now owns three wars - Ukraine, Gaza, and Iran. The latest debacle just ignited was a pre-emptive act of war, that has ZERO to do with Iran's nuclear ambitions and everything to do with a banker's/MIC war.

Energy and resources are a sideshow too. This attack by the US is about trying to regain control of Iran, because it is the only land-bridge that joins Asia into the Middle East, Africa, and Europe.

The BRICS have already invested trillions on what is effectively a new diplomatic/trade/connectivity/security system.

They had no intent to ruin the reserve currency of US dollar, as they knew full well the effects of the well-documented Triffin Paradox, and as such realised the benefits of a system where reserves are held in an array of many different national currencies and durable commodities that don't carry counterpart and currency shift risks.

The US decided to not join in this initiative and to try to destroy it instead. As such they became the authors of their own destruction. This was already happening anyway, it's just that Trump has vastly sped up the collapse.

Their predatory behaviour will render the US economy, plus its reserve currency status increasingly irrelevant, and also its military/financial hegemonic position where it feeds on the RoW and lives completely beyond its means.

NZ SECURITY IN THE LONG TERM

Perhaps the author should ask the multi-trillion dollar question - how many overseas military bases does China have (1.5) against the US (~850), which begs the question - who is the real threat to global security?

HINT - it's the country that for every single year of my entire life (70 years) has been at war with at least one country - usually concurrently with multiple states, especially when you include the endless string of proxies.

The US is involved in three extremely serious wars at the moment and is trying to start one between India and Pakistan, plus a civil war in China as well. It seems that the Deep State, which runs foreign policy from the shadows, never saw a war they didn't like.

Add in a mathematically inevitable debt death spiral and as the old cliche' goes - "when all else fails they will take you to war".

Regards to all

Col

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.