Content supplied by Rabobank

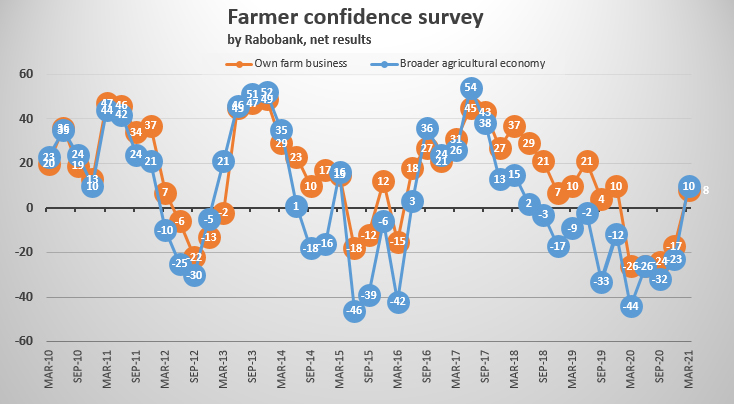

The recent spike in prices for New Zealand dairy commodities has seen the nation’s farmer sentiment rise sharply to now sit at its highest level since early 2018, the first Rabobank Rural Confidence Survey of the year has found.

The second successive lift in farmer sentiment – coming on a rise in the last quarter of 2020 – pushes overall net confidence back into positive territory – with more of the country’s farmers now optimistic than pessimistic about prospects for the wider agri economy. This snaps a run of ten consecutive surveys with net negative results.

The latest survey – completed earlier this month – found net farmer confidence rose sharply to +10 per cent, up from -23 per cent recorded in early December last year.

The survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had risen to 29 per cent (up from 16 per cent last quarter) while there were fewer farmers expecting conditions to worsen (19 per cent from 39 per cent previously).

The number of farmers expecting the performance of the agricultural economy to stay the same rose slightly from 49 per cent (from 44 per cent previously).

Rabobank New Zealand CEO Todd Charteris said farmers across all sector groups were now more buoyant about the outlook for the agri economy, with both dairy farmers and sheep and beef farmers significantly more optimistic than last quarter.

“Rising commodity prices were the key factor cited by farmers now holding an optimistic view of the year ahead with this no surprise given the strong upward movement in dairy commodity prices we’ve seen since our last survey,” he said. “Over the course of the year, dairy commodity prices have shot up over 20 per cent on the GDT platform, with our survey kicking off just after the bumper 15 per cent average price rise in early March. The survey was also conducted after Fonterra lifted the midpoint for its pay-out forecast for the current season to $7.60kg/MS – the second rise in as many months.”

While the improved dairy outlook was undoubtedly the chief contributor to improved expectations for the broader agri economy, Mr Charteris said there had also been encouraging news for sheep and beef sector participants over recent months. “Commodity prices for red meat products haven’t fared as well as dairy prices. But demand from our key markets has held up much better than expected in the first quarter of the year, with Chinese demand in particular leading the charge as our major market continues its post-Covid-19 recovery,” he said.

Among the one in five farmers now expecting the agricultural economy to worsen, the survey found government policies were still the major concern – with this cited by two-thirds of those with a negative outlook.

Own farm business performance

In line with the results for the broader agri economy, the survey found pastoral farmers were significantly more confident about the prospects for their own farm performance over the next 12 months.

“Well over a third of dairy farmers are now expecting their own farm business performance to improve while the number of dairy farmers expecting performance to worsen fell to just eight per cent,” Mr Charteris said.

“Sheep and beef farmers were also far more upbeat about their own operations, rebounding strongly from the historically-low farm business confidence recorded in late 2020.”

Mr Charteris said business confidence among horticulturalists, however, had declined in the latest survey and there were now more growers expecting the performance of their own business to worsen than those expecting it to improve. “Labour shortages have been flagged as a major concern by growers in recent quarters and the impact of these shortages has really started to bite over recent months as we’ve moved through the peak of the harvest season. Rising input costs and the lingering impacts of Covid-19 are further factors weighing down confidence in the sector,” he said.

“As a result of these concerns, sentiment among horticulture sector participants has trended lower over recent quarters with pessimism in growers’ farm business performance now increasingly prominent following several years dominated by optimistic outlooks.”

Farm Investment

The survey found farm business investment intentions were marginally higher than in the last quarter with 25 per cent of farmers now planning to increase investment over the next year and only 12 per cent expecting investment to decrease.

“Dairy farmers recorded the most notable jump in investment intentions with three in 10 now looking to increase investment, while there was also a small lift in investment intentions among sheep and beef farmers,” Mr Charteris said.

“While growers’ investment intentions fell from the previous survey, horticulturalists continue to hold the strongest investment plans of all sector groups with a more than a third looking to increase investment in the next 12 months.”

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.