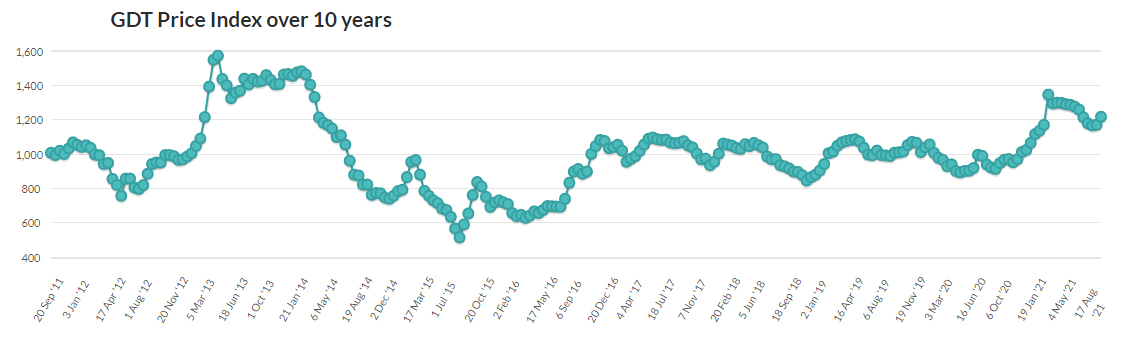

The latest Global Dairy Trade dairy product auction took place in the early hours and the current trend of decline has fortunately been arrested and reversed. All categories of product Fonterra puts up have shown increases:

SMP lead the way with a +7.7% increase, and WMP rose +3.3%. Butter and Cheddar rose by +3.7% and +3.6% respectively.

According to the Westpac update, the SMP rise indicates a reduction in supplies coming out of Europe.

This is the first appreciable rise since March this year (there was a +0.3% increase in April). Back in early August the feeling was that Chinese domestic production was starting to dampen their demand on the international market. So, while ‘one swallow’ etc does not mean the trend has reversed, it has at least provided hope that as the northern hemisphere heads towards winter perhaps there is more demand for Oceania product.

On that note, it will be interesting to see in the next decade or so whether the growing number of ‘super herds’ in housed systems largely in the northern hemisphere impacts upon New Zealand sourced product. At the moment judging by last 10-year trends there is no discernible pattern I can pick out.

Staying with China a moment, it appears that New Zealand, Taiwan, and China are the only countries that are still sticking to an elimination policy for Covid, at least for the medium term until all those that want to are vaccinated.

The same countries apart from also having relatively lower deaths from Covid also have better economic performances than those countries that have succumbed to ‘living’ with the virus.

The latest round of lockdowns in New Zealand are certainly going to have an impact on domestic GDP however, exports are able to continue with some degree of normality.

The exception may be horticulture which of all sectors keeps hitting hurdles when it comes to getting seasonal labour in and getting product offshore. If the Pacific Island’s can remain Covid free and the government allows meaningful numbers of RSE in there may be time to catch up on past maintenance and be in time for summer harvesting.

At the moment there are supposedly still 7,000 RSE workers in New Zealand although many of these are likely to have been here for some time and looking forward to getting back home. Peak numbers are around 10,000. However, this number is normally supplemented by large numbers of international travellers who make a meaningful contribution to the seasonal workforce. These also are largely absent contributing to the labour shortage. Prior to the lockdown the government was aiming on letting in 150 workers every 16 days or so, starting in September. The date has now been pushed out at least until October, presumably because there is an added risk of spreading the virus?

An update on Synlait's situation

Synlait’s year has been punctuated by less than good news. Since it went to the public (last November) to get another $200 million in through shares it has seen a steady decline in its share value. In November shares had a short-term peak of $5.93, even that was well down from the glory days of $13.00 back in 2018 and this week the price sits at around $3.20

Source: NZX

Adding to the gloom, is news that the company is aiming to reduce staffing by 15% in a bid to decrease the salary bill by between $10-15million.

Back in March Synlait reported their half -year profit was down by 76% on the previous year. Despite the fall in profit revenue was up by 19% indicating that something was out of balance.

Chief executive John Penno said "This is not just a cost out exercise, it is a complete reset of how we operate as a business". The company appears to have been hit harder by the impact of Covid-19 disruptions than the likes of Fonterra. This has largely been due to the reduction in its profitable infant formula sales. These are likely to be restored post Covid but the belt tightening shows there has been a bit of fat accumulating in the business over the years.

Dairy prices

Select chart tabs

3 Comments

Were the volumes on offer restricted as per some previous auctions ? We are still a way off peak season so it will be interesting to see how prices go in the next few months .

Just my personal opinion, I think dairying has a great future. Milking sheep and goats will also enhance this industry.

Reading into the carefully constructed comments by Hurrell a significantly greater volume of product has been contracted outside the auction system than previous years while at the same time there is limited upside in local supply.

With constraints and delays with shipping this could be an effort by buyers to protect security of delivery which suggests a degree of stock piling and from past experience once the supply chain corrects itself there will be a sudden fall in forward buying.

Or (and my preferred hope) in these times of uncertainty NZ's quality assurance programs including certainty of delivery are generating a genuine premium in the market place.

Also reading into Fonterra's responses to date they are holding firm on the $8.00 mid point for this season because, unlike us, they know what those contracted sales were priced at, whereas many commentators base their commentary around the auction results.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.