This article has been supplied by Rabobank.

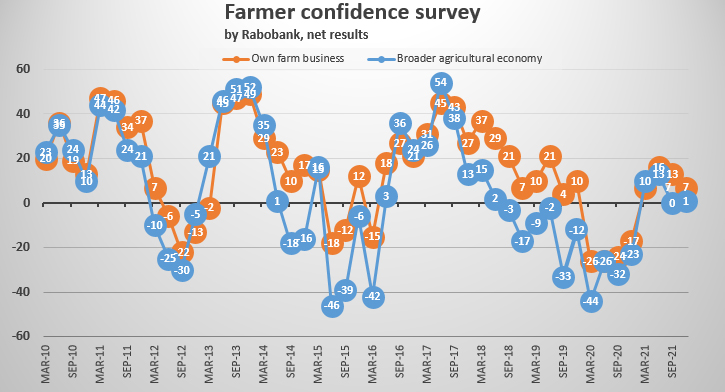

New Zealand farmer confidence continues to ‘hang in the balance’ as 2021 concludes, with an even split of farmers expecting the performance of the agricultural economy to improve in the year ahead and those expecting it to worsen.

The fourth and final Rabobank Rural Confidence Survey of the year — completed late last month — found net farmer confidence relatively unchanged from last quarter, inching fractionally higher to + one per cent, up from the net zero reading recorded in September.

The survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had risen to 28 per cent (up from 23 per cent last quarter) while there were also more farmers expecting conditions to worsen (27 per cent from 23 per cent previously). The number of farmers expecting the performance of the agricultural economy to stay the same fell to 43 per cent (from 52 per cent previously).

Rabobank New Zealand CEO Todd Charteris said the lack of movement in the overall confidence reading masked sizeable swings in sentiment within New Zealand’s key sector groupings.

“In this survey we’ve seen dairy farmer confidence about the broader agri economy rebound strongly after a drop in quarter three, however, this has been offset by reduced confidence among both sheep and beef farmers and horticulturalists,” he said.

The survey found dairy farmer confidence in the economy was up to a net reading of +12 per cent (- three per cent previously) while sheep and beef farmers fell to a net reading of - 1 per cent (+ seven percent last quarter) and growers to – 10 per cent (+ two per cent previously).

“Dairy farmer confidence has lifted off the back of the upward pricing trend at recent Global Dairy Trade (GDT) events which has seen global dairy commodity prices reach levels not seen 2014,” Mr Charteris said.

“The recent lift in the Fonterra milk price forecast came outside the survey period — and is therefore not reflected in the results — however this will only have further buoyed sentiment among dairy farmers who are now looking at a record high milk price for the current season.”

While pricing for New Zealand’s red meat and horticulture products remains robust, Mr Charteris said confidence among sheep and beef farmers and growers was being dragged lower due to a range of farmer concerns.

“The lower sentiment among sheep and beef farmers is being driven by concerns over government policy — with this cited by 85 per cent of dry stock farmers with a negative outlook — while horticulturalists are now less positive due to a host of issues including rising input costs, labour shortages and supply chain disruption.”

Own farm business performance

The survey found farmers’ confidence in their own farm business performance was marginally down with 28 per cent of farmers now expecting the performance of their own farm business to improve (unchanged), 22 per cent expecting business conditions to worsen (17 per cent previously) and 49 per cent expecting conditions to stay the same (down from 54 per cent).

In line with the survey results for the broader agri economy, dairy farmers were significantly more confident about the prospects for their own farm performance over the next 12 months, while dry stock farmers and growers were less positive.

“Dairy farmers are now the most positive on this measure of all the sector groups with more than one-third expecting their own farm business performance to improve in the year ahead, and only one in ten now expecting it to worsen,” Mr Charteris said.

“On the flip side, sheep and beef farmer confidence in their own operations drifted lower, however they remain at net positive levels on this measure overall. Grower confidence fell more markedly and, with the net reading on this measure slumping to - 30 per cent, growers’ confidence in the performance of their own businesses is now at the lowest level recorded at any stage over the last decade.”

Labour challenges

Mr Charteris said the latest survey included additional questions related to labour shortages and the level of impact these were having on farmers businesses.

“We last asked these questions in quarter two and the results from our most recent survey confirm labour shortages continue to be key challenge for the sector as they were six months ago,” Mr Charteris said.

“Forty percent of farmers said they have been affected by labour shortages or expect they will be in the coming year and, of these, more than a third said they expected the impact on their business to be significant.”

The survey found horticulturalist were the most severely impacted by this issue with close to two-thirds saying labour shortages had already affected their business or were expected to over coming months.

Farm Investment

The survey found farm business investment intentions were marginally higher than in the last quarter with 27 per cent of farmers now planning to increase investment over the next year and only nine per cent expecting investment to decrease.

“Sheep and beef farmers continue to hold the strongest investment intentions of all sector groups with close to a third looking to increase investment in the year ahead,” Mr Charteris said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

8 Comments

Record dairy payout and only 33% of dairy farmers think business performance will improve, I suspect this is because costs are rising just as quickly as the payout.

Not sure what they're worried about. The cost Inflation is only transitory. ;)

Ha Ha Ha Ha

.

The word "transitory" is no longer part of the economists vernacular. That's yesterdays prophecy. It's quietly been swept under the magic carpet, hiding in the mists of the crystal ball.

How much do horticultural workers get paid these days? When my uncle did it in the late 60s he was getting the equivalent of $28 an hour plus free bunk room accommodation. He was the leader of a crew of five.

Our pickers are supplied by the packhouse we use. New pickers (5buckets/hr) currently earning $35/hr and faster pickers (8buckets/hr) $56/hr in our orchard. Had quite a bit of rain here in Central in last few days which could potentially significantly impact cherry crop.

Edit supervisors etc are paid an hourly rate. Potential to earn more is to be a picker. ;-)

+ 51 % to - 46 % in march 14 - march 15, these farmers are a fickle lot .

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.