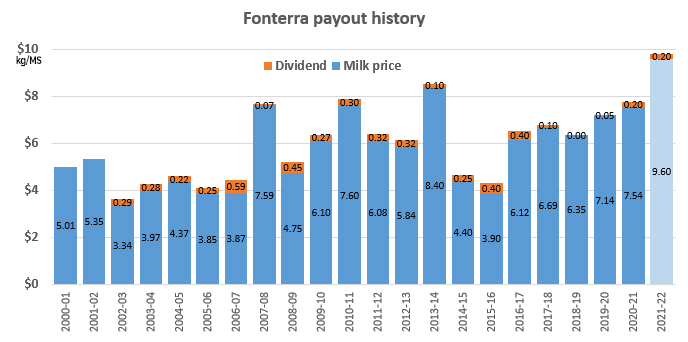

Fonterra has announced yet another rise in their 2021/2022 season payout forecast.

This is the fourth upward revision since they originally set the season forecast on September 23, 2021 at $8.00ks/MS midpoint.

And interestingly, this latest forecast is above all the current forecasts by the major analysts.

But their already-modest dividend is unlikely to get a boost as they pay farmers more.

Its latest 2021/22 forecast Farmgate Milk Price range has been raised to NZ$9.30 - $9.90 per kgMS, up from NZ$8.90 - $9.50 per kgMS in their January 25 revision.

This increases the midpoint of the range, which farmers are paid off, by 40 cents to NZ$9.60 per kgMS.

Fonterra CEO Miles Hurrell says the lift in the forecast reflects the increase in global dairy prices and good levels of ongoing global demand for dairy.

“Since we last revised our forecast, average Whole Milk Powder prices on GDT have increased 10.3%, while Skim Milk Powder has increased 8.4%. Both products are key drivers of our milk price.

“Global demand for dairy remains firm, while global milk supply growth continues to track below average levels. These demand and supply dynamics are supporting the increase in prices.

“Milk production in the EU and US continues to be impacted by the high cost of feed and this is not expected to change in the coming months.

“Here at home, ongoing challenging weather conditions have continued to impact grass growing conditions. As a result, the Co-op has revised its 2021/22 New Zealand milk collections forecast to 1,480 million kgMS, down 3.8% compared to last season, noting that last season generally benefitted from much better growing conditions.

“This reduction in supply reinforces our strategic focus on ensuring our milk is going into the highest value products.

“The forecast midpoint of NZ$9.60 per kgMS represents a cash injection of over $14 billion into New Zealand’s economy through milk price payments alone, and will be welcome news for farmers who are facing rising costs on farm, including from inflation and rising interest rates.

“Analysis by Statistics New Zealand shows a number of key farm inputs have experienced significant inflation pressure over the past two years, for example electricity costs are up 21%, while stock grazing costs are up 36.9%.”

Hurrell says while the higher forecast Farmgate Milk Price puts pressure on the Co-op’s margins in Consumer and Foodservice, prices in its ingredients business remain favourable for milk price and earnings at this stage.

“As a result, our current 2021/22 earnings guidance of 25-35 cents per share remains unchanged.”

"Earnings guidance" isn't the same as the likely dividend payment.

Fonterra share price

Select chart tabs

13 Comments

My quick 'back of the envelope' calculations indicate that total dairy exports, after allowing for milk supplied to non Fonterra companies, plus the value-add from processing, should bring the total dairy-export figure deriving from the 2021/22 dairy season to between $22 and $23 billion. Dairy-cow beef is additional.

KeithW

Wow 14 billion... how much is the cost and how much are the profits?

Still milk price is OTT in this country.

Lucky i got a farmer friend and he gives me full cream milk delivered for $1.50 litre. Rather than whatever the fonteraa anchor is on the market shelves.

The price of milk is a crime really.

Depends on where you buy it. Fonterra milk can be bought at our local BP for around $1.60/L if you buy 4 litres.

I hope that you return the favour to your farmer friend. By my calcs 1.50 per liter is less than what he would get from Fonterra. Then there is Tatua which pays farmers more than fonterra.

20 years after Fonterra was formed we are very close to getting the $10 they promised within 5 years. After some shocking weather and cost blow outs, I'm starting to feel good about life again.

3.8% down over all, some places are down 50% but this is good news for everyone.

T'would be Interesting to see what this means when set against farm input costs (the 3 F's, feed, fert, fencing, etc). Might be a wash.....

The really interesting thing is the failure of the Fonterra dividend to be a meaningful contributor to farmer returns, let alone increase, over the past 20 years. Mismanagement and perhaps an element of cross subsidisation can be blamed for this. NZ is just a dairy commodity producer it seems. The "value add" opportunity has been lost. Witness the lacklustre share price performance of the FSF shares.

It was never meant to be a significant revenue stream. It's a co-operative, which means all farmers own the assets and therefore all farmers need to pay for those assets. The way those assets are paid for is when each farmer owns share equal to production. A co-operative isn't just a free ride. Some of the money from sale of shares was used to produce value added products and the dividend comes from the 'profits' from that. Without Fonterra as a co-operative NZ dairy farmers would have to sell to a company obligated and committed to paying the minimum possible price for raw milk and selling it's products for the maximum possible price.

There has been much muted talk of the value add lately because that is the low margin high risk end and hence Fonterra is/has extracting itself from misplaced capital. The share price only matters to the rentier economy which is the opposite of the co-operative mandate. Even so, the share price is undervalued compared to any other stock giving an equal dividend.

I have always said to dairy farmers; never ever ever ever let non dairy farmers own shares in Fonterra. There are 2 ways for Fonterra to distribute profits. Back to the producers of the product they sell, and to the shareholders. If they are one and the same it is irrelevant how they do it. The actual share price is also irrelevant if the producers income is totally based on their production. But non producing shareholders will always put their interests ahead of the producers of the product they sell. Ask the Kenyan coffee farmers how not owning the means of production works for them. The foreign owned dairy producers in NZ are always having financial trouble. The only time this happened to Fonterra was when their Danish CEO with a CV of favouring private enterprise over Co-ops tried to run them into the ground. As soon as he was gone they were away again.

I'm really pleased to see this, Farmers have hardly had the best of economic times through what's otherwise been a boom, good that they'll see a period of outsized earnings to help them re-build buffers.

Nice job farmers. And good job Fonterra. Finally. I'm a city boy but know which side my toast is buttered. You work for it. You deserve it. Enjoy it.

but make sure to pass a bit on to the teat swingers

I swing the cups but point noted! I have been thinking about a pay rise for staff.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.