The benefits of living in New Zealand have been never better illustrated than the Russian attacks on Ukraine. Covid 19 and even climate change doesn’t seem to have the same bite down in our quiet corner.

However, that is not to say we are not affected, it just often takes the effects a bit longer to reach here.

New Zealand agricultural exports are probably not going to impacted for some time, but it is highly unlikely that they will be unscathed. One thing the world has an insatiable appetite for is grain and energy. Ukraine has been called the bread bowl of Europe and Russia is also a large producer of arable crops.

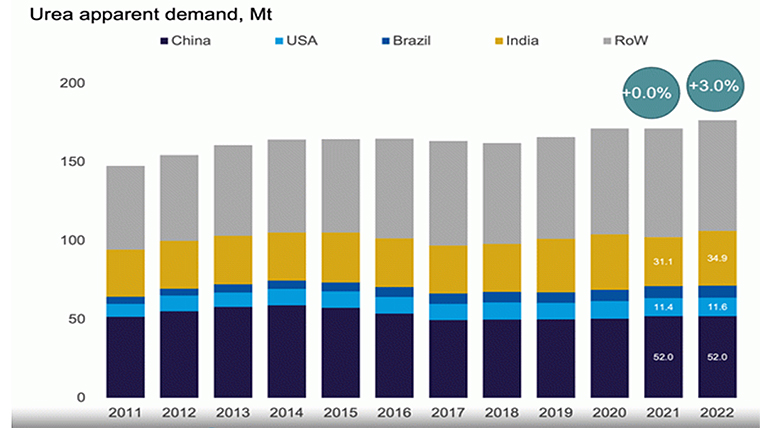

In addition to the disruption of the balance of world feed crops, Russia with its large reserves of natural gas is a major producers of Urea fertiliser.

Just a whiff of the looming troubles sent petroleum products prices soaring several weeks back and the realities of the war are looking to be greater than imagined and with wide ranging sanctions being applied to Russia (and likely Belarus) there is little likelihood of any form of normality returning for a year or two.

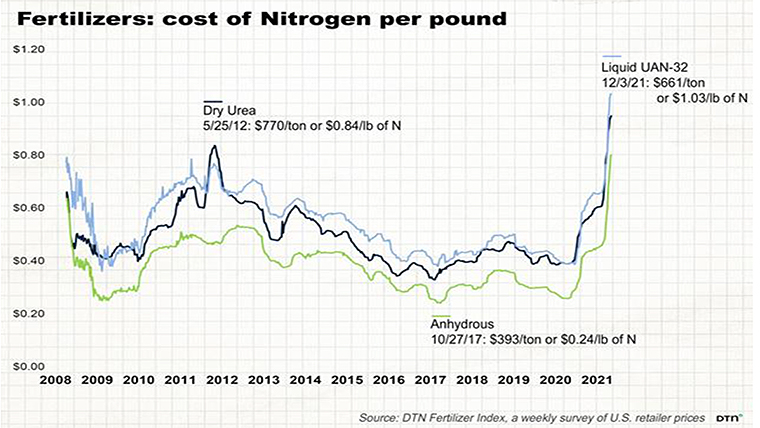

The two graphs below show the increase in urea global demand over time followed by price increases below that. So, urea is going to continue to increase in price. The price graph has not yet caught up to the latest events, that is still to come. Some, commentators are laying at least part of the reason for the steep increases shown (pre-Ukraine events) on the ability of farmers to pay with strong prices being paid for primary goods.

New Zealand imports about 2/3’s of the urea used. Potash supplies are also likely to be negatively impacted with both Russia and normally Belarus major exporters.

Grain exports from the region are likely to have a major reduction which could upset the balance of supply. Russia is (was?) the world’s largest wheat exporter with an estimated 38.5million mt sold in the 2020-21 year. Belarus while normally able to export wheat last year due to widespread drought had a ban put upon exports for six months.

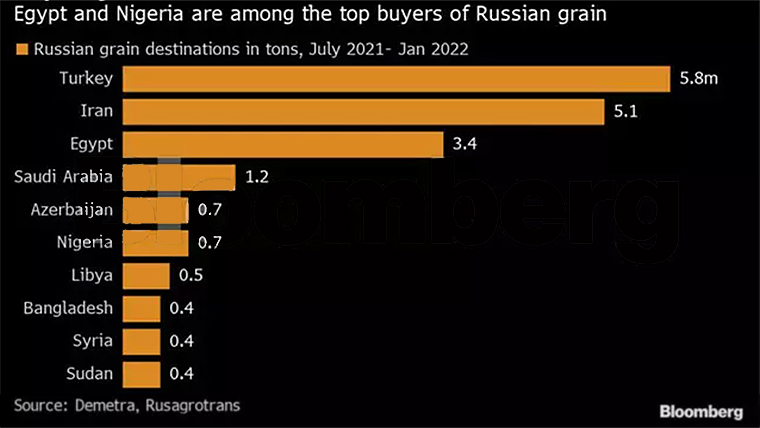

Some of the Russia and Belarusian surpluses go the other countries in the Eurasian Economic Union (these include Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan) a partial reply to the EU in the West. But larger portions go to countries in the Middle East and Africa. The Ukraine accounts for 12% of global wheat exports, 16% of corn and around 18% for barley and rapeseed. While there are currently no sanctions on Ukraine, what the future holds with its ability to export is anyone’s guess but disruptions to both exporters is highly likely.

What this means to Western countries is minimal with their supplies coming from the unaffected countries although the price of bread is likely to increase on top of the current inflation pressures.

However, for countries like Egypt and Turkey the issues are far more pressing. Egypt, a top wheat importer, had scheduled a tender on Thursday (day 1 of invasion) but cancelled it after only receiving one offer -- of French wheat. Turkey which is the number one recipient of Russian wheat has closed the Bosphorus Straits to warships, plus it is a member of Nato so is unlikely to receive any grain from Russia even if it was available.

With the war coming towards the end of the northern winter (although at least 6 cold weeks ahead) much of last season’s grains have already been exported, Rabobank estimated 2/3’s of the Ukraine wheat and barley crop has already been exported but only 1/3 of the maize crop. They predict, with wide-ranging sanctions, later this year, the price of wheat could double, and the price of maize could rise 30%. Only by mid-2023 could the wheat market rebalance somewhat. And, there depends upon how the conflict gets resolved.

Reduced supplies of corn and soybean, largely used as animal feeds, may have a greater impact on Western farmers than wheat.

With most livestock systems in the northern hemisphere reliant upon grains in some form or fashion to feed to animals this may be where the impacts filter back to the likes of New Zealand and Australia. The USA farmers trend, for example, tends to be as feed prices increase finishers off load stock at lower weights but in greater numbers to reduce costs and dairy farmers cull milking cows earlier. This is likely to make beef schedules more uncertain in the near future with increasing downward pressures.

Of course, for everyone fuel prices are going to increase. The other great unknown is how China will respond. To date its response has been muted. The West is applying pressure for China to join in with sanctions against Russia.

China has enjoyed good trade relations with both the Ukraine and Russia with the Ukraine in the past being a major supplier of corn. There are reports of many large Chinese companies ceasing to trade with China, no doubt driven by the risk of upsetting their trade with the EU (which is far more lucrative than either Russia or the Ukraine). On balance it is the Chinese dependence upon the West for trade that is likely to keep them sitting on the fence.

If they are seen to be siding with Putin this would be the worse possible outcome for New Zealand (apart from a full out war). This would lead to the EU and NATO to include China in the sanctions being applied to Russia and block New Zealand from its most lucrative trading partner. China finds Russia useful to give it support against pressures from Western democracies and so looking forward does not want to cut off its relationship with Russia, however, its actions will depend upon at what cost this support comes at.

New Zealand has little power to influence any of the different scenarios but can only wait and watch (disapprovingly) from the sidelines.

P2 Steer

Select chart tabs

4 Comments

The convienent thing now is that the government can move on from blaming inflation on Covid and now blame it on the war. IT's DiSRupTiNg SuPpLY ChAInS!

What do you think global inflation is being caused by?

as you say,living on an island has its benefits.having a big bully for a neighbour is bad enough but at least we dont share a border with them.

Nuclear free might suddenly be a big selling point again .

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.