With another decrease in the weighted value of dairy prices at the Global Dairy Trade auction earlier this week the threatened slowdown of the Chinese economy impacting upon commodities prices seems to be coming to fruition. This is the third drop in succession and while it is going to have little impact on the current season it must provide a bit of nervousness about the next season.

Global Dairy Trade Event 306 concluded with the GDT Price Index down -3.6%

Key Results

- Butter index down -3.7%, average price US$6,640/MT

- Cheddar index down -3.9%, average price US$6,185/MT

- SMP index down -4.2%, average price US$4,408/MT

- WMP index down -4.4%, average price US$4,207/MT

The obvious driver of this slowdown is the current Omicron outbreak in Shanghai and its impact upon the distribution of products throughout China. Some experts have said its impact could reduce the monthly Chinese GDP by up to -3%.

That report estimates that truck flows connected to the city decreased by -54%.

Within China there have been calls from senior academics for China to vaccine-boost the population with “vaccines of different technologies”. Presumably this means the western developed vaccines. However, the health minister has reinforced the view that there will be no relaxation ahead and the country must stick to the “dynamic zero-Covid” policy. There has been some development to improve the ‘local’ vaccines with the mixing of vaccines to improve immunity.

Despite the impact of the latest lockdowns which began at the start of March, China still experienced a +4.8% increase in GDP, ahead of the +4% growth expected. However, the next quarters results may not be as rosy and already China’s unemployment rate is on the increase. Across 31 major Chinese cities rose from 5.4% in February to 6% in March - the highest on record according to official data going back to 2018. With China not appearing to have a ‘Plan B’ for controlling the Covid virus it looks like even if Shanghai can ride out the latest outbreak it is likely to get worse elsewhere.

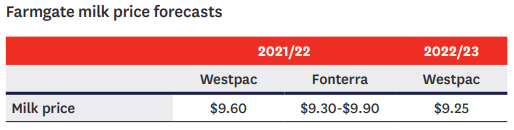

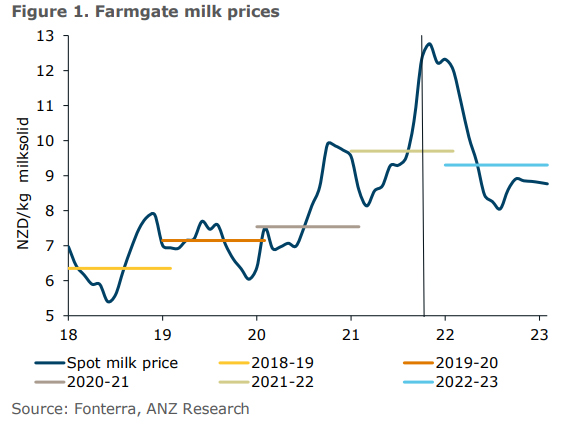

How much this is going to impact New Zealand exports to China will be a bit of a guessing game but at best it is creating more uncertainty and may create real logistical problems leading to a reduction in demand for products as they cannot get to consumers. Despite these apparent headwinds banks are still remaining bullish (See Westpac’s and ANZ’s below) in their predictions for next season and given the speed of change currently being experienced globally who would know.

Rabobank appear to be a little more circumspect with their predictions but based upon their Australian releases still see a $9.20 farmgate price possible. As they point out, the fundamentals are still strong; that is: world supply and demand. One thing all are in agreement with is the increase in costs.

Dairy prices

Select chart tabs

3 Comments

Time to sell some Interest Rate Hedging products then.......

Good article. Has anyone got a long-term consumption forecast? I'm wondering if per capita consumer growth can out-run population decline in China over the next 30 to 40 years. I guess if population halves then per capita consumption will have to double just to stand still.

Double is trivial - does that get them up to Taiwan? A fairly sensible govt will have China doubling GDP per capita without difficulty. They have size, education, determination and culture on their side. All the CCP can do is mess things up - which they may or may not do. It is the quadrupling that will be interesting - can they actually catch up and overtake Singapore without invading it first? Will they be able to achieve it before the world runs out of resources?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.