Most, if not all farmers involved in the production of products that are primarily sold off-shore will understand that New Zealand’s dollar value against our trading partners has a major impact on the returns and costs involved in farming.

Nowhere is this more obvious than in the weekly dairy commodities updates.

Traded in US$ and then converted back to NZ$’s to illustrate the potential value back to producers, returns can defy gravity by ‘increasing in value’ in NZ$ terms when at the same time losing value at the GDT auction or the total reverse. The same occurs with red meat and other traded goods although generally less obvious.

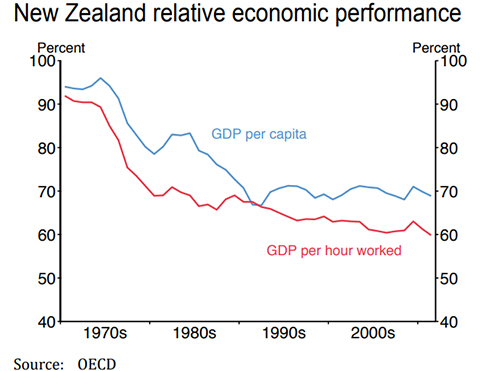

The NZ$ is said to be the 10th most traded currency internationally and this fact along with our relatively small size (50th largest economy) means that the NZ$ is one of the more volatile currencies within the OECD. In recent times there have been multiple factors influencing the NZ$ value which must be making the decision making of values for those brave souls who sell our products particularly difficult.

Fortunately, most agricultural products have been moving in the right direction and it is only recently that we are seeing a softening in prices. It is yet to be confirmed whether or not these downward prices are permanent or not. Factors which have played with the NZ$ value in the last couple of years are the quantitative easing policies (‘money printing’) designed to stimulate the economy from the scourge of the pandemic and the lack of tourists coming into the country and the lowering of interest rates to allow freer borrowing and then the recent lifting of the OCR and interest rates.

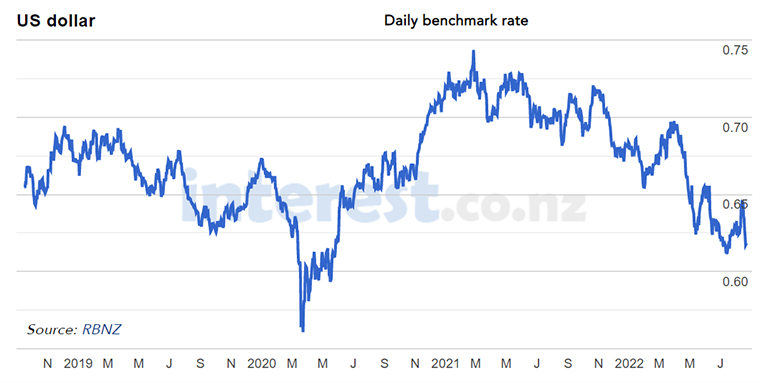

When it comes to the NZ$ value (in relation to the US$) some of the volatility is taken out because the US Federal Reserve is also practicing similar policies. However, in times of uncertainty there is a general ‘flight to safety’ principle and most investors see the US$ as ‘safe’ or relatively so. The deep trough shown below in the March-April 2020 period (down to 56 UScents) was in the midst of the pandemic when all sorts of dire predictions were circulating. It illustrates the lowest point of the NZ$ since 2009 when the world was undergoing the trials of the GFC. Conversely, the peak in February is a reflection that the NZ economy was performing better than expected, especially against the US$.

Source: interest.co.nz

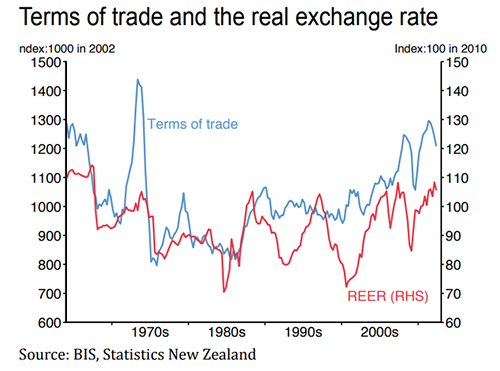

Another influence on the value of the NZ$ is how well the New Zealand economy is performing. Often when investors perceive our economy to be weak i.e. poor returns for commodities, the NZ$ weakens. From a farming perspective this is a bit of a safety valve as the falling NZ$ can buffer farmgate returns from the worst of the reduction in the international price. Of course, the flip side is imports (oil, fertiliser and offshore travel) become more expensive.

Those charged with selling our hard earnt products do have some tools with which they can reduce the risk of the volatile currency. The main one being selling forward i.e. future contracts, so setting a price for future supply (or purchase for those buying in commodities). However, while risks are reduced nobody has a crystal ball and so there is still risk.

At the moment with our Reserve Bank increasing the cost of borrowing through lifting the OCR, it makes investing in the NZ$ potentially more profitable than investing in other countries banks where their OCR may be lower. This provides some upward impetus on the NZ$ value although when the reason is to try and combat inflation there are some counter forces there as well, hence the difficulty along with a multitude of other influences why it is difficult to predict.

The simplest rule of thumb is a strong economy equates to a strong dollar, relative to how other countries are doing.

With the banks predicting that the OCR may rise to 4% by 2023 and given the economy is in reasonable shape (low unemployment, exports sector still strong) it is not surprising that they generally are forecasting an increase in the NZ$ over the US$ towards the end of 2022. Westpac are forecasting the Kiwi dollar to rise to 69 US cents against the US$ while ING are even more bullish with a 74 US cent prediction. A lot will depend upon how well the US$ performs as the NZ$ is only half of the equation.

Livestock prices

When it comes to livestock predictions it seems the local availability of supply is the major driver at least over the winter and early spring months. In the South Island, despite less processing companies operating there appears to be more volatility in the saleyards.

Last week, prime lambs achieved $300 per head at the local saleyards (Coalgate central Canterbury) and prime steers achieved $3.70 per kilogram liveweight.

I don’t believe these levels have been beaten before although heavy Mutton achieved high prices last year driven in part by the pork shortage in China.

At these prices saleyards appear to be achieving a premium over what the works are paying, or at least advertising in their schedules. This takes us back to the age-old problem of why farmers do not commit more to forward contracts. The same issue is why at least a few meat companies (notable AFCO) do not like to publicise their ‘official schedules’. Life can get complicated.

Saleyard Prime Steer

Select chart tabs

1 Comments

Remember all the Japanese money that flooded into NZ where they could earn more interest than they were paying to borrow it. It played merry hell with our currency and made it next to impossible for exporters. We had currency swings from under 50 US cents per dollar to over 90 cents. Profit margins simply cannot tolerate this and it destroyed good Kiwi companies, e.g. F&P Appliances.

We need something like a Toben Tax on all financial transactions to discourage outsiders playing around with our currency. This would be small enough to be irrelevant for normal foreign business transactions, but significant in the world of highly leveraged currency traders.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.