This week’s livestock schedule updates led to a bit of head scratching and even an email back to one of the processors to make sure there hadn’t been a misprint. We have had the unusual situation where the same category of livestock has gone in opposite directions, even for the same company.

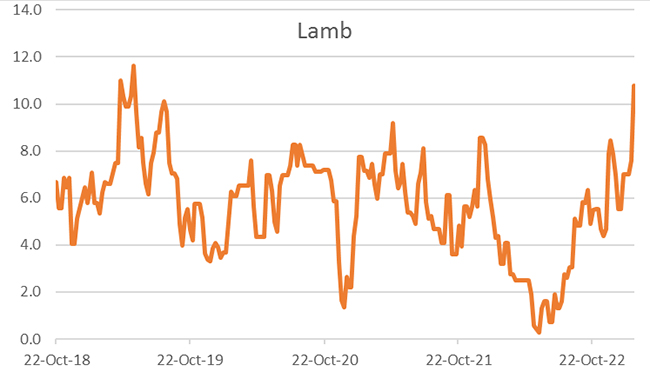

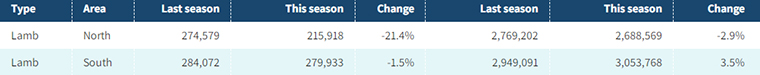

The most pronounced has occurred with lamb where in the North Island it rose by +30 cents per kg while at the same time dropped by -10 cents in the South Island.

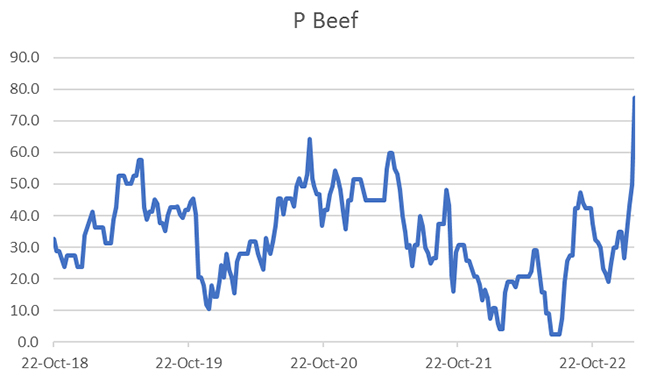

The prime beef schedule, although over a couple of weeks rather than the same as with the lamb, has also ended up having the same trend.

Trying to make sense of the logic behind this has left me somewhat baffled. I tried matching rainfall and soil moisture reports with the schedules to see if the gap between the Islands schedule widened when one was more dry than the other (as with this year when the N.I. has had an over abundance of rain while the S.I. has been lacking), it certainly could explain this years schedule setting. But unfortunately looking back over the last 5 years no real pattern has emerged (except that for beef, September is when the widest divergence seems to occur). As the two graphs below show, this year’s gaps are at the higher end although not the highest. That is, 0.0 on graph means both Islands are on par with each other and when in positive territory (as in all cases) it shows the additional cents per kg of carcass weight on the N.I. animals.

Source: interest.co.nz data.

It is perhaps also worth noting that both lamb and P Beef have similar ‘profiles’ despite having different markets. The data does come from a limited group of processors and there is no weighting of livestock throughput so a statistician could drive a truck through the results, but I doubt the trend would alter a great deal. One thing that may be influencing current prices is that the N.I. towards the end of January was considerably behind (-21%) what was being processed at same time last year. The same trend was occurring with the steer beef kill as well, likely the benefit of increased soil moisture.

Source: NZ Meatboard.

I don’t know how often S.I. animals are sent to the N.I. but the difference in schedule price which also flows through to sale yard prices should mean that there is a margin for finishers to be made. Bearing in mind:

“Animals should be unloaded at appropriate intervals, to allow them to rest. For mature animals this is no longer than 24 hours. For unweaned animals, this is no longer than 12 hours. Where this is not possible (e.g. on long sea journeys), provision should be made for animals to rest while on the conveyance.”

The Meat Industry Association released their summary for the 2022 calendar year. For the whole year red meat exports hit $11.4 billion in exports. Another record year up +9% on 2021 (which was also up 9% on 2020). Again, a large contribution the NZ economy. Unfortunately, they highlighted the declining returns for December. There was a -9% drop on the same period in 2012 (less $966 million). The regions with the largest drops were the UK with a drop by -53% and China -22%

MIA chief executive Sirma Karapeeva said the red meat sector’s global markets had softened with high inflation eroding consumers’ purchasing power. “Some consumers in our key markets are trading down to cheaper proteins and dining out less in restaurants. For beef, we are seeing record imports of beef into China from Brazil. The relaxation of China’s COVID-19 policy has also created some uncertainty in the market.”

Overall, exports for 2022 increased by +13% compared to 2021. China remained the major market, with a total of $4.3 billion, an increase of +5% on 2021. Exports to the United States were up by +7% to $2.3 billion, Japan increased by +20% to $561 million and the United Kingdom by +11% to $464 million.

Sheepmeat export volumes fell by -5% to 375,716 tonnes for the year but the value increased by +6% to $4.3 billion. The average free on board (FoB) value of sheepmeat exports in 2022 was $11.56/kg compared to $10.37/kg in 2021.

The volume of beef exports was also down by -5%, to 482,875 tonnes, but the value increased by +20% to $4.9 billion. The average FoB value of beef exports in 2022 was $10.07/kg, up from $8.02/kg in 2021.

China was the largest market for beef during the year, with the volume up +4% to 219,340 tonnes and the value up +34% to $2.1 billion.

There was a decrease in exports to the other major beef market, the United States, with the volume dropping -22% to 126,177 tonnes and the value by -5% to $1.3 billion. MIA said a significant factor had been the high levels of drought-driven domestic production in the United States last year.

Switching to dairy, we had a GDT auction last week that went almost unnoticed with the shortened week. It has reversed the recent trend being up +3.2% overall with Butter +6.6%, Cheddar +2.3%, SMP unchanged, and WMP +3.8%.

China got the credit for the dairy price rebound and hopefully a sign of things to come.

Y Lamb

Select chart tabs

P2 Steer

Select chart tabs

Dairy prices

Select chart tabs

2 Comments

No animals should be sent across Cooks Strait to be slaughtered. Just ridiculous.

Hear we are trying to sort out animal welfare issues and not to mention our carbon profile.

It is bad enough that we truck thousands of animals to dusty sale yards only to be sent to another farm, sometimes close to where they came from.

Time to modernize and get stock agents to do some real work by getting breeders and finishers incorporated.

Surely there must be a better way to work out stock price apart from standing and shouting in a yard somewhere. For the sake of the animals and our carbon foot print.

I think back many years and was bemused by the fact that all my hard work and investment came down to someone screaming over my stock on a Friday. How can anyone base a business venture on something so tenuous.

I think the cost of transport is rapidly peeling back the attendance at saleyards. Perhaps the aggregation of saleyards 20 to 30 years ago needs to change again. Have more local yards. There is certainly stupidity in sending stock on an hours journey just to return to a property close to where the day started. Yet it would be sad. I do enjoy seeing real live humans once a week or fortnight.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.