Dairy giant Fonterra has cut its milk price forecast for the second time in little more than a month and is now forecasting a price for its farmer suppliers that's some $1.20 lower than forecasts made earlier in the current season.

A series of downgrades have been made by the Fonterra co-operative since the latter part of 2022 in response to sagging global dairy prices. Although prices have been in US dollar terms fairly flat since the start of this year, prices in the GlobalDairyTrade auctions are overall about a third lower now than they were 12 months ago.

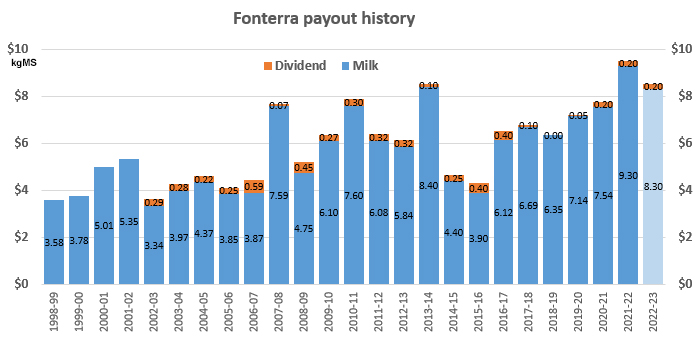

Having started the current season with an implied pick for the milk price of $9 per kilogram of milk solids, then actually increasing it to $9.50, Fonterra's subsequently reduced it four times, the latest forecast by 20c, which follows a 50c reduction in late February.

The term 'implied' is used here because Fonterra's policy is to announce the milk price forecast in a price 'range', and the implied price is the 'mid-point' of the range.

On Monday Fonterra said it had trimmed the range from $8.20 - $8.80 per kgMS (as of the late February forecast) to $8.00 - $8.60 per kgMS.

This reduces the midpoint of the range by 20 cents from $8.50 to $8.30 per kgMS.

Last season Fonterra's actual milk price payout was a record $9.30 per kgMS.

Fonterra's chief executive Miles Hurrell said the latest reduction was due to short-term demand for products "that inform the co-op’s farmgate milk price" being "softer than expected".

"Since our last update in February, prices for our products on Global Dairy Trade have either declined or remained flat.

"Skim milk powder prices have fallen 7% since February, and whole milk powder prices have not lifted to the levels assumed in the previous forecast."

Hurrell said there were "two main drivers" behind this trend. The first was that demand from China for whole milk powder has not yet returned to expected levels. The second is Northern Hemisphere milk production, and therefore skim milk powder stocks, are increasing "as they head into their Spring flush".

"With these factors weighing on demand, prices have not increased to the levels required to sustain a higher forecast Farmgate Milk Price for this season," Hurrell said.

"We recognise this change has an impact on our farmers’ businesses, at a time when many are facing increasing costs."

Hurrell said to assist on-farm cash flow, Fonterra was adjusting the Advance Rate schedule, which is the proportion of the season’s farmgate milk price paid to farmers each month, to get cash to its farmers earlier.

"We have increased the March paid April payment and plan to hold payments at that level until June.

"We are able to do this because of the strength of the co-op’s balance sheet, which is further supported by our strong full year earnings forecast."

Hurrell said Fonterra's full year forecast normalised earnings of 55-75 cents per share remains unchanged.

"We remain positive about the outlook for next season and will share our opening 2023/24 farmgate milk price forecast in May."

Dairy prices

Select chart tabs

4 Comments

I see a worrying trend with Fonterra recently where their announcements seem designed to achieve their outcomes rather than keep us farmers informed.

A businessperson would say they are strategic, a cynic like me would say they are designed to keep us peasants quiet and are about protecting the board and senior management.

Example one. Announcement of POTENTIAL capital repayment of 50c per share week before the new share structure begins and a huge overhang of shares become able to be sold.

Example two. They are making this month's monthly check significantly larger thereby reducing anger at the reducing payout.that is going to seriously hurt our cashflows for the winter coming so quickly after the last downgrade. But our monthly checks after this month are going to hardly cover running costs until September.

Your cynicism is well founded Wilco

Gets tiring being asked to keep producing as it going be better next year !

On point Wilco.

In regards to Example 2 the space between the April payment and the forecast final payment is pretty slim now. Based on the futures there still is downward pressure and if it ended up at $8.00 it might be an even colder winter. The board might have decided that the psychological play was more important than the Advance Rate Guidelines.

April advance rate as a % of forecast final payment as at:

- Opening ? (don't have / $9.00)

- 23 June 22 73% ($6.90 / $9.50)

- 26 Aug 22 72% ($6.70 / $9.25)

- 8 Dec 22 72% ($6.50 / $9.00)

- 24 Feb 23 74% ($6.30 / $8.50)

- 3 April 23 81% ($6.70 / $8.30)

It looks like the guidelines have a target of 70-75% for April when followed? I hope their generosity in departing from them doesn't backfire on us.

-ODM

They are keeping us informed....with the same old story of unforeseen geopolitical events suppressing demand coupled with buoyant offshore supply.

I wonder if the new domestically focused strategy will nullify those old chestnuts for excuses...eventually.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.