Dairy giant Fonterra has made a late, late cut to its milk price forecast with just days to run in the current season - as well as having a go at its first forecast for the season that will start in June 2023. Additionally, an $800 million capital return is being brought forward.

And Fonterra also says it has lifted its forecast "normalised" earnings to 65-80 cents per share from 55-75 cents per share and says it remains on track "for a strong full year dividend".

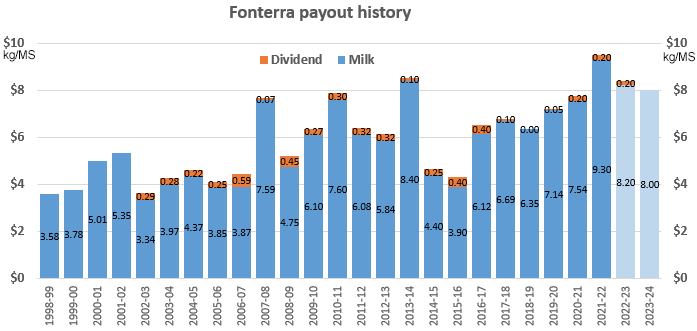

The Fonterra co-operative is now forecasting an implied price for its supplier/shareholder farmers of $8.20 per kilogram of milk solids for the season that is about to end, down from $8.30.

This is the third cut that's been made to the forecast since the start of the year and means that the implied price to farmers is actually now some $1.30 lower than the very high forecast made earlier in the season.

At $8.20, the price would still be the third-best in Fonterra's history, albeit well down on the record $9.30 paid last year.

The downgrades in forecast prices from Fonterra have come amid a backdrop of falling dairy prices globally.

As for the new season that's about to start, Fonterra's first forecast implies a price to farmers of $8 per kilogram of milk solids.

The term 'implied' is used here because for several years now Fonterra has expressed its forecasts as a range - and the implied figure is the midpoint of that range.

The new forecast range for the season that's about to end is $8.10 - $8.30 per kgMS.

As is typical at the start of a season, Fonterra's forecast range for the season that starts next month is a wide one - $7.25 to $8.75 per kgMS, with a midpoint of $8.00 per kgMS.

Last year Fonterra announced it had sold its Soprole business in Chile and was planning to return capital.

Now it is bringing forward that capital return. It says the payment date of the proposed return of around 50 cents per share and unit, will be moved from October 2023 to August 2023.

The co-operative says implementation of the capital return, remains subject to a Scheme of Arrangement being voted on by shareholders, and approval by the High Court.

Fonterra chief executive Miles Hurrell says while the forecast farmgate milk price for this season has been impacted by reduced demand, particularly from China, the co-op remains on track for a strong full year dividend.

"Global Dairy Trade prices have not recovered to the levels required to hold the previous [milk price forecast] midpoint for this season," Hurrell said.

He said the opening forecast price for next season "reflects an expectation that China’s demand for whole milk powder will lift over the medium-term".

"We expect demand to gradually strengthen over the course of FY24 as China’s economy continues to recover from Covid-19.

"However, the timing and extent of this remains uncertain, with China’s in-market whole milk powder stocks estimated to be above normal levels following increased domestic production. This is reflected in our wide opening forecast range for the season."

He said he recognised the pressure farmers are under and Fonterra has designed a new Advance Rate guideline to get cash to farmers earlier in the season.

"Our strong balance sheet allows us to make these changes and we will be using this new Advance Rate guideline going forward, starting with the season about to commence.

Meanwhile, Fonterra has reported a profit after tax of $1,326 million, equivalent to 81 cents per share, for the third quarter of the 2023 financial year. This is up $854 million on the same period last year and includes the gain on sale from Soprole of $260 million.

"Excluding the net gain from divestments, our normalised profit after tax improved on last year, up $606 million to $1,078 million, equivalent to 65 cents per share," Hurrell said.

"This is due to strong performance in our Ingredients channel, with continued higher margins in our cheese and protein portfolio, particularly casein and caseinate.

"These favourable price relatives have continued longer than expected, and we’re also seeing improved performance coming through in our Foodservice and Consumer channels, in particular in Global Markets.

"As a result, we have lifted our FY23 full year forecast normalised earnings to 65-80 cents per share from 55-75 cents per share and remain on track for a strong full year dividend.

"Total Group normalised operating expenses are up in part due to the impact of impairments reported in our FY23 Interim Results in March, as well as ongoing inflationary pressures," Hurrell said.

Dairy prices

Select chart tabs

14 Comments

That's a long way from the $10 gaurenteed payment of 12 months ago.

Equally the dividend is up a long way and is light-years from what was on offer pre Miles Hurrel.

Does the drop in price have much impact on our trade deficit AKA worsen it?

Probably.

"...reduced demand, particularly from China..."

Will this mean the astronomical price of milk in NZ, where we the taxpayer subsidise the cleanup, will reduce?

Another grand standing GreenPiece type statement Sobotka! Please explain how taxpayers are paying to clean up anything in the diary industry.

Note the lowered milk payout and strong dividend. If all the shareholders are dairy farmers that doesn't matter. But the farmers are being put under intense pressure to let non farmer shareholders in. Ask the Kenyan coffee farmers how much fun it is getting no share of the production profit.

My understanding is farmers break even price is about $8.50

Just as well for the strong dividend

Around 4500/1/3rd farms are sharemilked by mostly non shareholding independent contractors plus an unknown number of others such as contract milkers who receive an extra percentage (i.e 10% of anything over $7 payout).

So a large number of farmers are not shareholders, unless of course it's considered such persons are not infact dairy farmers.

Non farmers share holders is about 7%. 1500 million milk solids backed shares. 100 million fund shares.

I think redcows was talking about non share holding dairy farmers not non farming shareholders.

Fonterra's focus is on keeping the share price steady now farmers can unload up to two thirds of their holdings, especially if under pressure from the bank.

I admit I got wrong footed with all today's positive news for the shares.

By nonfarmer shareholders, I mean the usual investors looking for a profit. If it is at the expense of fellow shareholders who actually produce the products that create the profit, they don't care.

On a related topic, if Fonterra says that selling their Chinese assets creates a capital return situation, then that tells us all that they don't need that capital. That tells us that they never needed that capital. Which of course tells us that Fonterra never needed nonfarmer shareholders in the first place. As a lot of people suspected, it was all a setup by that Danish CEO, Theo Speiring, with a CV packed full of anti co-op, pro usual suspect multinational businesses history, to try to weaken Fonterra, as his Fonterra Chinese division showed.

Now the majority farmer shareholders have to flex their muscles, and force Fonterra to look after them instead of their competitors, the investor shareholders. Personally, I don't think they have the intestinal fortitude for the fight. They certainly didn't have it when opposing the introduction of nonproductive shareholders in the first place. But I am happy to be wrong.

You're quite wrong about Theo. Only in pointing at him personally. It was actually the likes of Vanderheeden ,Wilson and Norgates, the intention was always to head towards non farmer shareholding from way before Fonterras formation I'd even presume.

The rest well basically you only need that capital when you're mantra is growth for growths sake so need another new massive powder drier each year.

Dropping the payout this late in the season is a great way to p*ss your suppliers off. We were already on reduced payments for the next 3 months, this is just another kick in the guts.

The $8.00 midpoint for next season is a joke. It's a nice round number to keep undecided farmers supplying and banks lending. Again like this season's opening price so much depends on MAYBE. But if not then $7 something here we come.

Then watch the farms and herds come on the market for sale.

If you follow what's happening in markets then this should not be a surprise. Forecasting is a joke. It's just a forecast based on the current situation. It could end up with a 9$. Good luck for the new season.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.