Content supplied by Rabobank.

Global beef production is expected to contract through the remainder of the year supporting strong farmgate beef pricing in New Zealand and in other key production regions across the globe, according to a new report by food and agribusiness banking specialist Rabobank.

In its recently-released Q2 Global Beef Quarterly report, Rabobank says while global beef production was up by 1% in Q1 on 2024 volumes, an overall contraction of 2% is projected for the full calendar year.

“The largest production contractions are expected in Brazil (down 5%) and New Zealand (down 4%), with more modest falls also likely in Europe, the UK, the US and China,” report co-author RaboResearch senior agricultural analyst Jen Corkran said.

“Beef pricing has trended higher in the first half of 2025 across all major beef suppliers, and this expected dip in global supply should help keep pricing at healthy levels over coming months,” she said.

The report says disease and pests are emerging as a key restraint on global beef production.

“In Europe, and now in the UK, Blue Tongue virus continues to affect the herd. Meanwhile New World Screw Worm in Mexico has caused US authorities to close the border to the importation of Mexican cattle, and the risk of potential infestation in the United States continues to increase,” Ms Corkran said.

“In both cases, these health threats are challenging production in markets where cattle supplies are already historically low, likely supporting already elevated cattle prices.”

Off the back the global uncertainty initiated by President Trump’s ‘Liberation Day’ announcement on 5 April, the report says, we are now starting to see some redistribution of beef trade volumes around the world.

“Liberation Day saw the introduction of tariffs for many countries exporting beef into the United States. Additional reciprocal tariffs for identified countries are currently on hold until early July and the US-China tariff escalation has also been put on hold until early August,” Ms Corkran said.

“While negotiations are ongoing, we’re now seeing the uncertainty start to impact on trade flows with reports emerging that Chinese buyers are looking more toward Australian, New Zealand and South American beef suppliers as US beef becomes more expensive.”

New Zealand update

The report says New Zealand’s total beef production in Q1 of 2025 was up by 1% on the previous year, reaching just under 200,000 tonnes.

“This uptick defied earlier forecasts predicting a 5% decline in the first three months of the year, with the higher slaughter volumes in the North Island likely influenced by dry on-farm conditions over summer,” Ms Corkran said.

That said, the report says, RaboResearch is still forecasting a 4% decline in total NZ production volumes for the 2025 calendar year.

“Slaughter numbers nationally from January 1 to late April 2025 are down by 3.3% compared to the same period in 2024,” Ms Corkran said.

“And we expect slaughter numbers will continue to be lower than 2024 throughout the rest of the year, with production volumes influenced by slaughter weight.”

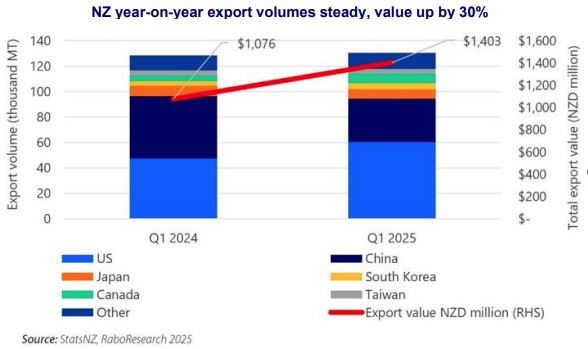

The report says Q1 beef export volumes have been steady while values have risen strongly.

“Beef exports were basically flat for Q1 versus 2024, at close to 129,000 tonnes,” Ms Corkran said.

“However, over the same period, the value of beef exports surged by 30% driven by robust demand and a weaker New Zealand dollar.”

“The United States continues to be a key market, accounting for 51% of export volumes and 46% of total value in Q1, 2025. Conversely, exports to China have further declined, with volumes now making up 31% of overall beef exports.”

Ms Corkran said the higher export returns were driving record farmgate prices across all cattle cohorts.

“Prices are now surging above five-year averages and this may indicate a structural shift upward in New Zealand beef pricing,” she said.

“The April-June export data will be crucial in observing changes in trade flows and values, particularly given the implementation of US tariffs.”

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.