Content supplied by Rabobank.

Results at a glance

• Farmer confidence in the broader agri economy remains elevated with primary producers across all sectors looking favourably at the 12 months ahead.

• Among farmers holding a positive outlook on the agri economy, higher commodity prices (62%) was cited as the major source of optimism, while ‘improved marketing’ (16%) and ‘overseas markets/ economies’ (14%) were other key reasons for optimism.

• Farmers’ expectations of their own farm business performance over the next 12 months were marginally up from last quarter and remain strong overall. Growers were markedly more positive about the prospects for their own businesses than last quarter while dairy farmers and sheep and beef farmers were largely unchanged on this measure.

• Farmer investment intentions rose from last quarter and are at their strongest since mid-2018.

• The number of farmers self-assessing their own farm business as ‘unviable’ fell to 3% (from 5% previously) while there was also a lift in the number of farmers assessing their own operation as ‘easily viable’ or ‘viable’ (70% from 66% last quarter).

Farmer confidence in the broader agri economy remains at a near-record high with the country’s farmers across all sectors looking favourably at the 12 months ahead, the quarter two Rabobank Rural Confidence Survey has found.

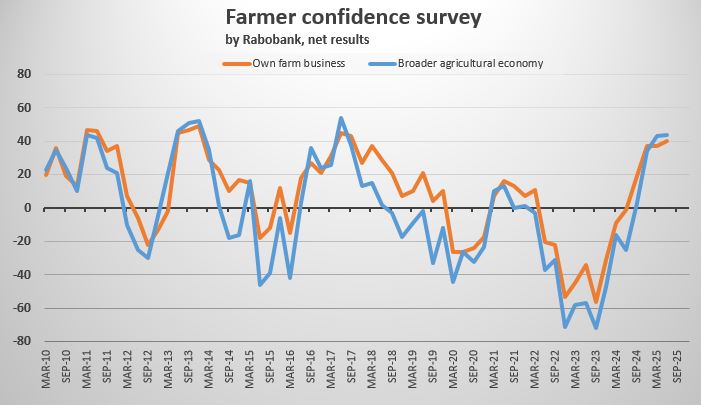

Following consecutive lifts in the previous three quarters, farmer confidence in the broader agri economy was unchanged at a net reading of +44%. Alongside last quarter, this is the second-highest net reading recorded across the past decade, with only quarter two 2017 higher (at +52%).

The latest survey — completed early this month — found 48% of farmers were now expecting the performance of the broader agri economy to improve in the year ahead (down from 52% in the previous quarter), while the number expecting conditions to worsen had also fallen to 4% (from 8%). The remaining 44% of farmers expected conditions to stay the same (36% previously).

Rabobank Chief Executive Officer Todd Charteris said sentiment was high among producers across all of New Zealand’s major agri sectors.

“This broad-based positivity is largely being driven by strong commodity prices for our key agri exports,” he said.

“Since our last survey in March, we’ve seen Fonterra announce a record opening farmgate milk price forecast of $10kg/MS for the 2025/26 season, while prices for beef and sheepmeat products have also surged.

“On top of this, prices for horticulture products and export revenues have also been on the up and, at last week’s Fieldays event in Mystery Creek, we saw the Ministry for Primary Industries release a new report forecasting horticulture export revenues to increase by 19% in the year to June 30, 2025.

“And, with all this positive pricing news coming in over recent months, it wasn’t a surprise to see close to two-thirds of farmers and growers in our quarter two survey citing rising commodity prices as a key reason for their upbeat view on the outlook for the agri economy.”

The survey found ‘improved marketing’ (16%) and ‘overseas markets/ economies’ (14%) were other key reasons identified for optimism among farmers.

Among the 4% of farmers expecting conditions in the agri economy to deteriorate, ‘falling commodity prices’ (66%) and ‘rising input prices’ (46%) were the major factors cited.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were marginally higher than last quarter, with the net reading rising to +40% (from +37%).

Mr Charteris said dairy farmers and sheep and beef farmers confidence in their own businesses remained strong and was relatively unchanged from March, while horticulturalists were now much more upbeat.

“In our March survey, we actually saw horticulturalists dip into negative territory on this measure, but confidence has come roaring back this quarter and growers are now up to a net reading of +21%,” he said.

“This upwards shift comes off the back of recent strong export revenues and elevated prices for a host of key horticultural products including kiwifruit, apples, pears, and vegetables.”

Investment intentions stronger

The survey found New Zealand farmers’ investment intentions were stronger this quarter and are now at their highest level since mid-2018.

“Close to a third of farmers are now looking to increase investment, with only one in 20 looking to invest less, and this lifted the net reading on this measure to +25% from +16% previously,” Mr Charteris said.

“This growing investment intent is fantastic to see, and I’ve no doubt that one of the factors that has helped push this up is the government’s recent introduction of the Investment Boost Tax incentive, which was announced as part of the budget and which means businesses can now claim a 20% tax deduction on new assets purchases.”

The survey found dairy farmers now have the strongest investment intentions (net reading of +37%), while sheep and beef farmers (+21%) and horticulturalists (+3%) were also up on the previous quarter.

Farm viability

Rounding off the positive results, Mr Charteris said, the survey also found farmers’ perceptions of the viability of their own operations had strengthened.

“The number of farmers assessing their own operations as ‘unviable’ was down to 3% from 5% last quarter, while we also saw a change at the other end with 70% of farmers now viewing their operations as ‘easily viable’ or ‘viable’ from 66% three months ago,” he said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.