Content supplied by Rabobank.

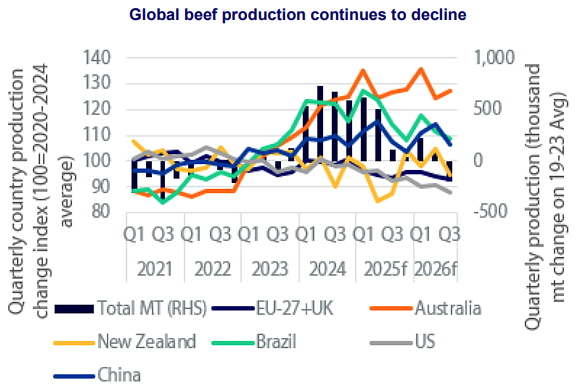

With production volumes contracting in most major beef-producing regions, global cattle prices have continued to rise across recent months, according to Rabobank’s latest Global Beef Quarterly report.

In the recently-released Q3 report, RaboResearch says reductions in production volumes in Europe, New Zealand, Brazil and the US have contributed to a fall in global beef production of 2% for the first half of 2025.

“Australia and China have bucked this trend recording beef production increases of 10% and 4% for the first half of the year respectively, but the overall global trend is one of contraction and RaboResearch expects global production to reduce by 3% for 2025,” RaboResearch senior agricultural analyst Jen Corkran said.

The report says lower global production helped contribute to rising global cattle prices through quarter two. “Northern hemisphere countries continue to stand out at record prices, but US and Canada prices have moderated in recent weeks, suggesting some of the heat is slightly reducing in this market,” Ms Corkran said.

“Meanwhile, prices in southern hemisphere countries continue to increase. The reduced volumes of beef in the North American market, plus what appears to be a slight improvement in the Chinese market, have generated stronger demand for southern hemisphere beef suppliers.

“And we’re continuing to see this strong demand flow through to cattle prices.”

US tariffs and the impacts on the Brazilian beef market

The latest round of US tariffs – announced on July 31 – brings the total tariffs on Brazilian beef imports into the US to 76.4%.

Ms Corkran said Brazilian beef exports to the US through to July 2025 were vastly higher than the same period last year, lifting by 94%. “The one-week delay in the implementation of the tariffs – which were pushed to August 6 – supported ongoing high volumes into August as it appeared Brazilian exporters tried to frontload before the deadline,” she said.

The report says nearly a month after the US began applying further import tariffs on Brazilian beef, shipments remain strong in a year-over-year comparison through to the fourth week of August 2025.

“According to processors, shipments to the US have remained relatively stable even after the tariffs have taken effect. Projections of rising live cattle prices in Brazil for the second half of 2025 may explain the current appetite from American importers for Brazilian beef,” Ms Corkran said.

“It’s our view that the volume the US imports from Brazil may drop an estimated 10,000 metric tonnes (mt) to 15,000mt per month as we progress through the remainder of the year. Coincidentally, or not, the tariffs came into effect at the end of the US domestic peak consumption period, which seasonally runs from May to August. This timing may also see reduced demand from US buyers of Brazilian exports.”

NZ export values climb despite volume dip

After a stable start to the year, the report says, New Zealand’s beef production saw a notable fall in quarter two. “Total production volume dropped 16.6% year-on-year to 177,000mt, following what was a steady quarter one performance,” the report said.

Ms Corkran said the decline aligns with expectations, given the limited cattle availability across the country.

“According to NZ Meat Board data, national cattle slaughter fell 15% in head count year-on-year, totalling just over 700,000 head compared to more than 840,000 head in quarter two, 2024. The breakdown reveals a 14% drop in bull beef, a 15% decline in cull cow numbers, and a significant 20% reduction in steer slaughter,” she said.

Looking ahead, Ms Corkran said, quarter three production is forecast to reach just under 118,000mt, representing a further approximate 5% decline.

“RaboResearch maintains its full-year outlook of a 4% to 5% year-on-year drop in total beef slaughter numbers,” she said.

“Final production volumes will hinge on pasture conditions through spring and average carcass weights during the lower-volume quarter period. Additionally, New Zealand is expected to process fewer bobby calves this year, which will increase beef production in two years’ time."

In line with reduced production, the report says, New Zealand’s total beef export volume fell 11% year-on-year in quarter two, 2025, to 129,670 metric tons.

“Despite this being the case, export values for the quarter were actually up by 7% to $1.432 billion, driven by strong global demand and firmer pricing,” Ms Corkran said.

“The quarter also included a new record average export value of $11.17/kg Free On Board (FOB), with this hit in April.”

“And since then, we’ve seen a further new record in July 2025 at $11.20/kg FOB. The report said the US remained New Zealand’s leading market, absorbing 40% of total volume, while China accounted for 24%."

“Notably, Canada saw a sharp 54% second quarter year-on-year increase in volume to 11,345mt. While still a smaller destination, this jump reflects the demand for lean trim in this market as well,” Ms Corkran said.

“Early August saw the announcement of a 15% tariff on NZ beef entering the US. This poses a competitive challenge, especially as Australian beef continues to face only a 10% tariff. Nonetheless, strong US demand for NZ lean trimmings supports a positive outlook for farmgate prices in the second half of 2025.”

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.