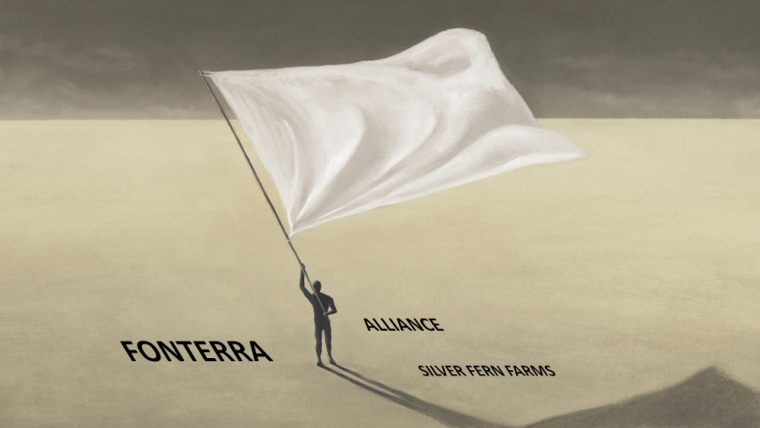

Assuming shareholders vote in favour, the sale of 65% of Alliance and 100% of Fonterra’s brand business to overseas buyers are just the latest in the depressing trend towards losing the ability or desire to retain control of our national assets.

The two cases are somewhat different – Alliance has no obvious alternative, whereas Fonterra has made a conscious decision to concentrate on a lower part of the value chain.

The unavoidable conclusion from both sales is that the buyer sees more unlocked value in the assets than potential New Zealand investors do, otherwise there would have been greater competition than appears to be the case.

Lactalis clearly sees opportunities to build on the strength that rests particularly in the Anchor and Mainland brands, built up by the New Zealand dairy industry over many years and dating from well before Fonterra’s formation in 2002. The price of more than $4.2 billion will include the value of licences for Australian company Bega, but 90% of the value relates to the New Zealand assets.

About 15 years ago Fonterra’s then chairman, Sir Henry van der Heyden, tried to convince shareholders to retain majority control of the brand business, but put the balance up for sale. This would have resulted in the establishment of a separate company with the capital, governance and management necessary to be a successful consumer goods marketer. Shareholders voted against this proposal which seemed a shame at the time and in retrospect even more so.

The Alliance sale is due to a totally different set of circumstances. The problems faced by the meat industry have been glaringly obvious for many years – excess capacity because of declining livestock numbers, removal of subsidies, anaemic profitability leading to land use change, volatile market prices, and more recently the artificial effects of the ETS.

But the fact remains some meat processor/exporters have remained profitable throughout, while others have struggled to be consistently profitable and have at times posted huge annual losses. The 1990s when I worked in the meat industry was a decade of massive change with too much capacity paying too much for livestock, leading to the collapse of Weddel in the North Island and Fortex in the South Island.

But the two cooperatives, PPCS and Alliance, were both well run operations with the ability to keep tight control of their margins, hence Fortex’s failure to reinvent the industry model. It wasn’t until PPCS’s acrimonious takeover of Hawkes Bay based Richmond Meats that its difficulties started, culminating in the need to recapitalise by means of Shanghai Maling’s 50% purchase in 2016.

AFFCO narrowly escaped the same fate in 1994 through the tolerance of its bankers, an initially successful stock market float and some improvement in its performance, but its eventual acquisition by Talley’s was the real turning point. Today AFFCO has a highly efficient plant network, low overhead structure and a lean marketing operation. Greenlea, Auckland Meat Processors and the Progressive Meats group are other New Zealand owned private companies and all are believed to be consistently profitable.

ANZCO is now 100% Japanese owned and in recent years has dramatically improved its overhead structure, systems and profit performance, although it will be interesting to see how robust this remains, as times get harder.

The fate of the two cooperatives remains in the balance, although with their large foreign ownership stakes, they both have a fighting chance. It no longer appears viable for a 100% cooperative structure in the meat industry, because of the conflict between paying shareholders too much vs. reinvesting in the business.

This is a much easier conflict to resolve in private ownership. Equally it can’t be a coincidence that the privately owned companies can afford to reward suppliers competitively as well as make a profit, suggesting their plants are well maintained and efficient, their sales and marketing effective and their overhead structures under control.

Silver Fern Farms and Alliance have both performed very poorly for the last two years and it will be intriguing to see how successfully Alliance has reduced its processing costs and overheads during the current year which closes at the end of this month. The capital injection from Dawn Meats, if approved, will cut finance costs by about $16 million, but it will be essential to reduce operating costs to the point where there is a profit margin, even in a bad year.

SFF has unfortunately squandered the gains from its Chinese joint owner, allowing overheads to surge in pursuit of the holy grail of added value. This year is guaranteed to be profitable, as market conditions will deliver a once in a decade bonanza for both processor and farmer. But the employment of swathes of people at the head offices in Dunedin and Christchurch and in markets like China will ensure the profits will erode when times get tough

Value adding is a noble but expensive activity. Fonterra intends to reduce its exposure by selling the Mainland Group, suggesting our meat companies should also curb their ambitions and focus on the basics.

3 Comments

Extreme lack of capital in this country, NZ is a young country so we're not necessarily to blame for needing the CASH

If someone offered you the value of a Ferrari for your Ford the decision is plain to see. Then use that money better. Have cake and eat it

SFF is running into the same issues any large processor in NZ faces. Are you are high volume, low cost operator or a niche market, high margin operator. The Fonterra board have made their decision.

At the last SFF annual meeting it was obvious head office led by the CEO was trying to do both, however the energy and man power was focussed on the value added prime beef and lamb, and cow and bull beef were just a commodity product. This strategy looks good in glossy brochures and Power Point presentations however in the context of NZ processor scale is doomed to failure.

It is no secret the meat processors consistently making money are running tightly managed cost structures with a focus on plant efficiency - not fancy overseas marketing trips.

It is very tricky processing and packing to ready retail when as distant from the market(s) as NZ. Risky too, in terms of shelf life if shipping is disrupted. The more you further process any product the greater the cost and the greater the risk. NZ’s sheep meat industry grew on the back of the commodity market. Quick frozen carcasses, bulk stowed and shipped feeding the hoi polloi in the UK, the home country. Couldn’t last and didn’t. The understandable reaction to switch to further processing eventuated in an excellent chilled lamb product but for which the comparative market was relatively diminutive. Doesn’t help either that only about a third of the carcass provides the suitable cuts and the by products , offals, slipe wool and pelts, largely unwanted.

It seems to me the milk and meat industry are quite different.

Fonterra has a choice and have decided ingredients are the way to go over brands and have something to sell in the brands. Dairy farmer shareholders can decide and I’m sure they will think carefully but overall the key is they have sufficient income to make the farmers profitable plus Fonterra retain sufficient capital to prosper.

The meat industry dosnt have this luxury as it seems there’s not enough income to let both parties be profitable. Over the past decades we have seen farmers struggle to make meaningful profit on average, some will be doing ok, while the meat companies have also struggled in many cases. Wool obviously has a big part of this on the sheep side.

Even this year beef and lamb are forecasting a “profit” of around $135k - before drawings, tax and principal repayment in a time of very high meat prices. It maybe higher but will the processor then make money? Will it be sustained?

This total gross income issue is the real problem - then you have costs attacked by inflation over the last 5 years.

Even if Dawn meats takes over Alliance it still dosnt answer the rationalisation of capacity issue. That will be interesting to watch.

I hope they find a way as with a rapidly ageing farmer ownership structure we urgently need to find a reason and financial pathway for passing the farm on.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.