Content supplied by Rabobank

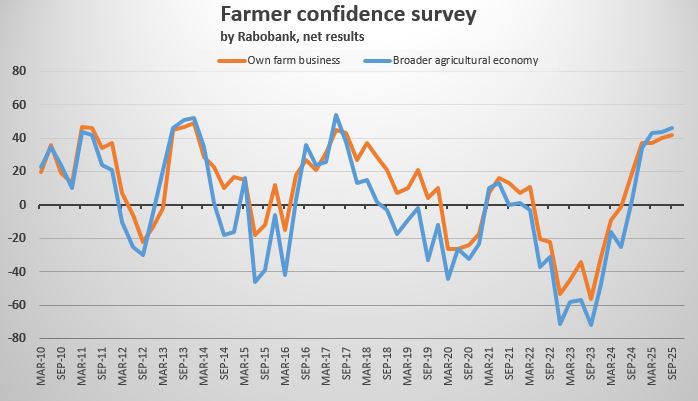

Farmer confidence in the broader agricultural economy has inched higher and is now at its second highest reading at any stage across the last decade, the latest Rabobank Rural Confidence Survey has found.

Following net readings of +44% in the last two quarters, farmer confidence in the broader agricultural economy crept marginally higher to a net reading of +46%. The latest net confidence reading has only been bettered once across the last 10 years (+54% in quarter two, 2017) and marked the fourth successive quarter of elevated farmer sentiment.

The latest survey — completed early this month — found 51% of New Zealand farmers were now expecting the performance of the broader agri economy to improve in the year ahead (up from 48% in the previous quarter), while the number expecting conditions to worsen had also risen to 5% (from 4% previously). The remaining 43% of farmers expected conditions to stay the same (44% previously).

Rabobank Chief Executive Officer Todd Charteris said it was fantastic to see strong farmer confidence extending into a fourth successive quarter.

“The cyclical nature of farming means it’s rare for farmer sentiment to stay elevated for such an extended period. And if we look back across the history of the survey, we have to go all the way back to the 2013/14 season for the last time we had four consecutive quarters where confidence was at such lofty heights,” he said.

As was the case in 2013/14, Mr Charteris said, a record milk price has been the catalyst for the latest extended spell of strong farmer sentiment.

“Since our last survey in June, we’ve seen Fonterra maintain its milk price forecast of $10.00/kgMS for the 2025/26 season, and we’ve also seen them raise their forecast for 2024/25 season to $10.15/kgMS,” he said.

“On top of this, the co-operative recently announced they’ve agreed to sell their consumer and associated businesses to Lactilis and, if approved, this could bring a tax-free capital return of $2.00 per share for their farmer shareholders.

“All this news has been warmly welcomed by sector participants and has helped keep dairy farmer sentiment high.”

Mr Charteris said red meat sector confidence was also soaring off the back of an ongoing wave of high commodity pricing for beef and sheepmeat.

“Led by the US, global demand for New Zealand beef remains strong and this has flowed through to record-breaking prices for cattle over recent months,” he said.

“Farmgate lamb prices are also at historical highs and a combination of tight domestic supply and strong overseas demand is expected to ensure pricing stays elevated over the remainder of 2025.”

Unsurprisingly, the survey found farmers with an optimistic view on the broader agri economy cited ‘rising commodity prices’ (67%) as the main reason for their optimism.

‘Increasing demand’ (20%) and ‘falling interest rates’ (17%) were the next most-frequently cited reasons for positive sentiment. Among the 5% of farmers expecting conditions in the agri economy to deteriorate, ‘government policy/ intervention’ (43%) ‘rising input prices’ (30%) and overseas markets/ economies (29%) were the major reasons given for pessimism.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were also marginally higher than last quarter, with the net reading rising to +42% (from +40%).

The readings for dairy farmers and sheep/beef farmers rose to +54% and +53% respectively, however growers were less optimistic than three months ago, falling to a net reading of +1% from +20% three months ago.

“While prices for key New Zealand horticultural products like kiwifruit and apples remain healthy, they haven’t quite reached the record-breaking heights that we’ve seen in the dairy and red meat sectors,” Mr Charteris said.

“And growers were split on the prospects for their own businesses in the year ahead with 31% expecting performance to improve, 30% expecting it to worsen and 34% expecting it to remain the same.”

Investment intentions

The survey found New Zealand farmers’ investment intentions were largely unchanged from last quarter with the net reading falling to +24% from +25% previously.

“Dairy farmers continue to have the strongest investment intentions and their net reading on this measure rose to +43% with close to half (46%) expecting to increase investment and only 3% expecting investment will reduce,” Mr Charteris said.

“Sheep and beef farmers and horticulturalists investment intentions were weaker than those of their dairy counterparts, but positive overall at net readings of +17% and +5% respectively.”

Mixed level of concern over US tariff rate hike

Mr Charteris said farmers who participated in the most recent survey were asked to rate their level of concern on a scale from 1-10 about the recent increase in the US tariff rate on New Zealand goods from 10% to 15%.

“While we are yet to see any major drop off in US demand for New Zealand’s agricultural products, the recent increase – announced on July 31 – to a 15% tariff does put us at a competitive disadvantage to countries like Australia which remained at a tariff of 10%,” he said.

“The level of farmer concern over this tariff increase was variable with farmer responses at either end of the scale and the average score sitting at 5.5 out of 10.”

“The full impact of the increased US tariff rates on New Zealand, and on other countries like Brazil, has yet to be fully felt. And New Zealand farmers and growers will be keeping a close watch on how these tariffs impact global agri commodity trade over the months ahead.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.

23 Comments

“While prices for key New Zealand horticultural products like kiwifruit and apples remain healthy, they haven’t quite reached the record-breaking heights that we’ve seen in the dairy and red meat sectors,”

We now have an oversupply of the Rockit apple (cross-bred Gala and Splendor varieties). Massive supply with little demand growth in Asia mkts. In reality, there is only so much opportunity to sell 4 miniature apples in a plastic tube at prices north of NZD12.

Good. Any knock back on a product that adds plastic waste is a good thing.

All part of the contradiction in the brand narrative. Zespri is another who goes for plastic packaging in Asia mkts, but will pump their sustainability creds.

I would be very interested to know the evidence for a Rockit over-supply. If correct, this would be very bad news for T&G.I can not find any online evidence for an over-supply.

KeithW

Anecdotal Keith and take it at face value. May not even be true, but I did hear it from a horse's mouth.

Rockit Global is actively raising funds in 2025, having already sought $20 million from shareholders and signaling a larger capital raise later in the year to help recover from recent challenges and to drive growth. Apparently this boost is for its financial position following a period of "difficult grower payouts" and operational complexity.

T&G owns the plant variety rights for Rockit apples. T&G's ultimate owner is the German company BayWa with a 74% share-holding. Those shares are currently for sale. All very interesting. Correction: T&G is involved in the marketing of Rockit apples but the plant variety rights are owned by Rockit Global.

KeithW

T&G is involved in the marketing of Rockit apples but the plant variety rights are owned by Rockit Global.

As you're probably aware, Rockit (and Zespri) have followed an FMCG model in terms of route to market and brand proposition. And arguably they're recognized as pioneers in that regard. Interesting to note that Dole tried to transform into an FMCG-modelled business in recent years. Even though they have product that fits more with FMCG (canned product), they wanted a focus on innovation and best practices that Unilever, etc might use. It hasn't gone particularly well. It appeared that in the APAC mkts, the leaders at Dole where hiring all their mates as opposed to perhaps the most competent people.

Energy input and food output: The energy imbalance across regional agrifood systems - PMC

Farmers are not told that they produce less calories than they consume. Then, having not told them, we report their optimism as?

Not fact, for sure.

Few economists are giving enough weight to the influence of our farmers in helping propel our economy out of this funk we're currently in. 2026 is going to be a blinder from a GDP expansion perspective.

Few economists are giving enough weight to the influence of our farmers in helping propel our economy out of this funk we're currently in. 2026 is going to be a blinder from a GDP expansion perspective.

Are you privy to some demand forecasting or is this just a hunch?

This is a hunch, purely based on the low value of our dollar vs our main trading partners. For example, vs the GBP, it's the weakest it's been since 2009 (with the exception of a brief period at the beginning of Covid). It's a similar situation with the Euro. Vs the USD, it hasn't often been this weak since 2003. This has obvious benefits for our exporters.

Gotcha. Don't forget RMB/CNY and NZD/USD. I think there is a case for NZD strengthening against these currencies going forward.

Possibly, but not in the short term IMO.

The current high prices for livestock prices (meat and dairy) have been largely driven by global short-term supply issues. The fundamentals of demand have not changed. Beware!

KeithW

Maybe more people are catching on to the many benefits of meat consumption. Prices are a bit painful at the moment though. $70 for a leg of lamb! Luckily I am on a calorie restricted diet these days after putting too much full cream in my coffee for too long. Man that stuff has a lot of calories.

Docked 17 lambs and missed 3 lambs, bloody things are feral and breed like rabbits, Wilshire sheep so no shearing, any with a limp get eaton. Local butcher selling for $300 a sheep packaged. Great for bartering.

Big league

yep just a lifestyle.... $70 legs of lamb for the cost of a bullet and a few hours with a knife... life is good.

I guess that's about $15 a kg?

The best cure for high prices is high prices. Be careful at prices well above long term average.

My plan is to pay the bills and pocket the surplus. Good times like these never last.

Yes , surprising the forecast is for 5% less beef production in NZ next year....

And a surplus in 2.5 years probably. Lots of calves being kept. Not sure how the milk powder shortage will workout.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.