Content supplied by Rabobank.

Cattle prices in key production regions around the world are increasing or remain near record highs as global beef supply starts to tighten.

And with further contraction expected in 2026, the outlook for beef prices remains strong, according to Rabobank’s Q4 Global Beef Quarterly report.

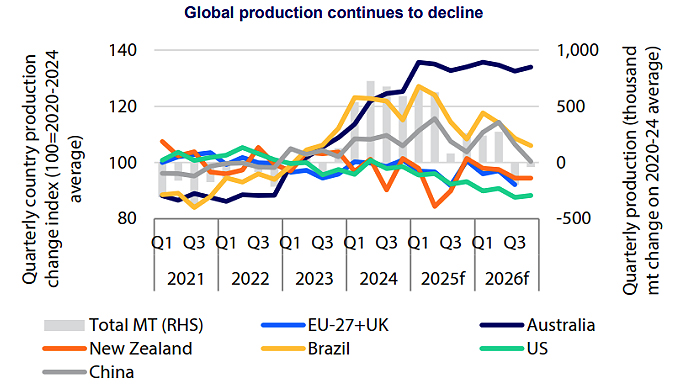

With only a short runway to the end of the year, the report says global beef production is expected to contract by 0.8% year-on-year in 2025, led by a significant dip in US volumes.

“The US, with its large production base, is expected to see the largest drop in volume, falling almost 500,000 metric tons (down 4% from 2024), while the EU27+UK and Canada are also expected to register lower production with decreases of 225,00 metric tonnes (down 3%) and 50,000 metric tons (down 3.9%) respectively,” RaboResearch senior animal proteins analyst Jen Corkran said.

“New Zealand will also contribute to the decrease with production tipped to drop by 34,000 metric tons or around 5%.”

Against the backdrop of lower production, the report says, cattle prices in New Zealand and other southern hemisphere countries – with the exception of Argentina – edged higher through September and October as southern cattle supplies are being drawn on to supply northern hemisphere markets.

“US and Canadian prices did fall slightly through this period, however, they remain at near record highs and well above those of their southern hemisphere counterparts,” Ms Corkran said.

Looking ahead to next year, the report says, global beef production is expected to continue falling with a further contraction of 3.1% forecast.

“Key regions where production is expected to decline in 2026 include Brazil, the US, and Canada,” Ms Corkran said. “And, as a result, we expect to see beef prices continuing to hold high in the short to medium term.

New Zealand update

The report says New Zealand farmgate prices have been setting records across all cohorts of cattle, with North Island bull prices holding above $9.00/kg over spring.

“Prices are $2.00/kg higher than a year ago, up 29 to 40% year-on-year and as much as 50% above the five-year average,” Ms Corkran said.

“While prices remain elevated, a typical seasonal decline may emerge in the coming weeks, particularly if drier conditions in eastern regions prompt earlier offloading.”

Ms Corkran said the expected 5% fall in New Zealand beef production volumes this year had somewhat limited the ability of beef producers to fully capitalise on higher export prices.

“However, approximately 160,000 additional bobby calves are being reared in 2025, signalling optimism for future beef supply and a shift in market dynamic for 2026 and 2027 as these calves enter the beef supply pipeline,” she said.

The report said export demand for Kiwi beef remains robust, with the US market taking 41% of New Zealand’s beef exports in the calendar year through to the end of September, despite overall export volumes being lower.

“Stronger US demand and higher import prices have driven export values to the second-highest level on record, just over $3.8 billion, even as volumes trail the record-high 2022 by 7%.

China’s share of exports dropped to 26%, while Canada and the UK have seen modest gain from low levels,” she said.

P2 Steer

Select chart tabs

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.