By Alex Tarrant

The government has blocked the bid by Natural Dairy to buy the 16 Crafar farms on 'good character' grounds, as well as blocking a retrospective bid by sister company UBNZ Assets Holdings, which bought four other Crafar farms in February this year.

The Crafar farms group was put into receivership in October 2009 owing about NZ$216 million to its lenders Westpac, Rabobank and PGG Wrightson Finance after interest.co.nz revealed animal welfare issues at the farms.

To see the original animal welfare story see here.

Receiver KordaMentha had signed a sale and purchase agreement with the Chinese backed Natural Dairy/UBNZ group led by businesswoman May Wang, which was conditional on Overseas Investment Office approval and thought to be worth about NZ$213 million.

Banks and farmers had hoped the deal would go through, given it used elevated late 2008 prices. If put onto the open market many fear prices will fall 40% plus, forcing banks and farmers to revalue their loans and equity for similar properties.

Earlier this month Bayleys real estate agent Mike Fraser-Jones said investors looking to buy farms in New Zealand were waiting for the OIO's decision on the Crafar bid.

Under old foreign investment rules

A spokesman for the Overseas Investment Office (OIO), which recommended to the government the bids be rejected, said the decision was made under old overseas investment rules. In September this year the government moved to give itself more flexibility to reject sales of 'sensitive land' to foreigners, although the new rules apply for applications made after December.

The OIO had originally said it would not make an announcement on the bid until the Serious Fraud Office had completed its current investigation. However the OIO spokesman said Natural Dairy/UBNZ had asked for the decision to be made ahead of the SFO completing its investigation.

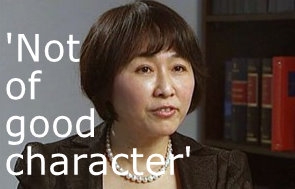

Frontwoman Wang just bankrupted, no longer fronting bid

May Wang, who fronted the Natural Dairy/UBNZ bid for the Crafar farms, was bankrupted earlier this month over a NZ$22 million debt she owed from a prior business failure. However Crafar receiver KordaMentha had said the sale agreement for the farms still had the green light.

On Monday this week a spokesman for Natural Dairy said Wang would no longer front the bid after she withdrew an application to have her bankruptcy suspended.

"This would mean that May Wang would be withdrawn from the Overseas Investment Office application and the companies [Wang-associated UBNZ], I presume, would have new management. That will require some work from Natural Dairy now to just press on on its own," spokesman Bill Ralston told the Dom Post's Nick Krause on Monday.

'Govt got lucky; Odd timing just before Christmas'

Green Party co-leader Russel Norman said the Greens welcomed the decision but that the government had got lucky in the way it was able to decline the bid.

"Our approach is that we want to retain New Zealand land and New Zealand ownership as much as possible so we welcome the decision," Norman said.

"But clearly this isn’t the best way to make these decisions. We got a bit of a lucky break in a way because it was made on the good character component of the application. It was declined on that basis whereas we think there should be strong rules in place to make it clear that New Zealand farm land stays in New Zealand ownership," he said.

It seemed strange the government released the decision in the days before Christmas, Norman said. "Just after five o'clock. It's as if they wanted to dump it and hide it when most New Zealanders are obviously focussed on other things."

See the release below from Kate Wilkinson

Hon Maurice Williamson and Hon Kate Wilkinson have today declined consent to Natural Dairy (NZ) Holdings Limited to acquire the Crafar farms.

The Ministers’ decision covers the applications by Natural Dairy (NZ) Holdings Limited to acquire UBNZ Assets Holdings Limited and 16 of the Crafar farms.

The Ministers also declined consent to UBNZ Assets Holdings Limited’s retrospective application to acquire the four Crafar farms it purchased in February 2010.

“We concur with the Overseas Investment Office’s recommendation that consent should be declined,” the Ministers said.

“We will not be commenting further on our decision.”

Enquiries relating to the Ministers’ decision should be directed to the Overseas Investment Office.

Here is the release from the Overseas Investment Office

Hon Maurice Williamson and Hon Kate Wilkinson have today declined consent to the application by Natural Dairy (NZ) Holdings Limited (Natural Dairy) to acquire the Crafar farms.

Annelies McClure, Manager of the Overseas Investment Office (OIO), said the Ministers concurred with the OIO’s recommendation that consent should be declined.

Under the Overseas Investment Act 2005, decision-making Ministers must decline consent if they are not satisfied that all of the relevant criteria for consent under the Act have been met.

“One of the criteria for consent is that Ministers must be satisfied that all of the individuals with control of an overseas person are of good character,” said Ms McClure.

“The Ministers were not satisfied that all of the individuals with control of Natural Dairy were of good character. Accordingly, consent was declined.”

A summary of the decision can be found at www.linz.govt.nz.

Here is a Question and answer sheet from the OIO:

Questions and answers

Which Ministers made the decision?

The deciding Ministers were Hon Maurice Williamson, the Minister for Land Information, and Hon Kate Wilkinson, acting for the Minister of Finance.

When was the decision made?

Hon Maurice Williamson and Hon Kate Wilkinson made their decision on 22 December 2010.

What did the OIO recommend to the Ministers?

The OIO recommended to Ministers that they decline consent.

What led the OIO to its recommendation to the Ministers?

Under the Overseas Investment Act 2005, decision-making Ministers must decline consent if they are not satisfied that all of the relevant criteria for consent under the Act have been met. One of those criteria for consent is that Ministers must be satisfied that all of the individuals with control of the overseas persons are of good character.

For the purposes of assessing good character, decision-making Ministers must decide who the relevant individuals exercising control over the relevant overseas person are.

In relation to the purchase of 16 dairy farms by UBNZ Assets Holdings Limited, and the purchase of 80 percent of the shares in UBNZ Assets Holdings Limited by Natural Dairy (NZ) Holdings Limited (from UBNZ Trustee Limited), the OIO recommended to the Ministers that they determine the directors of Natural Dairy (NZ) Holdings Limited to be the relevant individuals with control.

The OIO believed that the directors’ good character could be affected by ongoing investigations into transactions associated with its applications for consent.

In relation to the retrospective application for consent, the OIO considered that both the UBNZ Trust and Natural Dairy (NZ) Holdings Limited were the relevant overseas persons. The OIO recommended to the Ministers that they determine May Wang to be the individual in control of the UBNZ Trust.

The OIO considered that the charges Ms Wang currently faces and the possibility of further charges cast doubt on her good character. In addition, her reported conduct in the context of her bankruptcy proceeding raised further concerns.

What did Natural Dairy (NZ) Holdings Limited, UBNZ Assets Holdings Limited and UBNZ Trustee Limited apply for consent for?

Consent was sought under the Overseas Investment Act 2005 for the following transactions:

- The purchase of 16 dairy farms by UBNZ Assets Holdings Limited.

- The purchase of 80 percent of the shares in UBNZ Assets Holdings Limited by Natural Dairy (NZ) Holdings Limited from UBNZ Trustee Limited.

In addition, retrospective consent was sought for the following transactions:

1. The purchase of four dairy farms in February 2010 by UBNZ Funds Management Limited.

2. The subsequent purchase, also in February 2010, of the four dairy farms by UBNZ Assets Holdings Limited from UBNZ Funds Management Limited.

3. The purchase, also in February 2010, of 20 percent of the shares in UBNZ Assets Holdings Limited by Natural Dairy (NZ) Holdings Limited from UBNZ Trustee Limited. Note, consent was required because, as a result of the transaction, Natural Dairy (NZ) Holdings Limited and its associate UBNZ Trustee Limited held a 25 percent or more control interest in UBNZ Assets Holdings Limited.

4. A mortgage granted in May 2010 by UBNZ Assets Holdings Limited to UBNZ Trustee Limited. The mortgage was secured over the four dairy farms purchased by UBNZ Assets Holdings Limited.

Why did Natural Dairy (NZ) Holdings Limited and UBNZ Assets Holdings Limited, UBNZ Funds Management Limited and UBNZ Trustee Limited need consent in the first place?

Natural Dairy (NZ) Holdings Limited is defined as an overseas person by the Overseas Investment Act 2005, as it is incorporated in the Cayman Islands.

The OIO considers that UBNZ Assets Holdings Limited, UBNZ Funds Management Limited and UBNZ Trustee Limited are associates of Natural Dairy (NZ) Holdings Limited. Associates of overseas persons are also required under the Overseas Investment Act 2005 to apply for consent to acquire an interest in sensitive New Zealand assets.

Why did the OIO make its recommendation ahead of the findings of the Serious Fraud Office’s Part 1 investigation?

The applicants had sought a decision ahead of the completion of the Serious Fraud Office’s Part 1 investigation.

Did news reports that May Wang would no longer be fronting Natural Dairy (NZ) Holdings Limited’s bid for the farms affect the OIO’s recommendation to the Ministers?

No. The applications and applicants on which the OIO based its recommendation to the Ministers did not change.

What will now happen with the four Crafar farms purchased by UBNZ Funds Management Limited and UBNZ Assets Holdings Limited?

The OIO will consider its options in relation to the four farms. One option is for the OIO to apply to the High Court to have the farms sold.

What happens to the OIO’s investigation into the acquisition of the four Crafar farms?

As consent was declined for the acquisition of the four farms, the OIO will now conclude its investigation.

What was the focus of the OIO’s investigation?

The purpose of the OIO’s investigation was to determine whether or not each of UBNZ Assets Holdings Limited, UBNZ Funds Management Limited and UBNZ Trustee Limited was an associate of an overseas person (Natural Dairy (NZ) Holdings Limited).

The OIO considers that each company is an associate of Natural Dairy (NZ) Holdings Limited, and therefore consent was required to acquire the four farms and the mortgage over the properties.

When did the OIO receive the applications?

The OIO received the application for consent for the purchase of 16 dairy farms by UBNZ Assets Holdings Limited, and the purchase of 80 percent of the shares in UBNZ Assets Holdings Limited by Natural Dairy (NZ) Holdings Limited from UBNZ Trustee Limited, on7 July 2010. The retrospective application for consent was received on 10 August 2010.

Later on Wednesday evening Federated Farmers put out this release:

Federated Farmers wonders if Natural Dairy (NZ) Holdings bid to secure the 16 former Crafar Farms is at a dead-end, with Ministers, the Hon Maurice Williamson and Hon Kate Wilkinson, backing an Overseas Investment Office (OIO) recommendation to decline the application.

“Some very colourful personalities have clouded what ought to have been a straight forward exercise,” says Don Nicolson, Federated Farmers President.

“We must respect that Natural Dairy may have legal options open to it, not to mention the status of the four farms previously purchased by UBNZ.

“At times a tragi-comedy, at least we’ll seemingly be able to start the slate clean once these legal hoops have been cleared. Federated Farmers believes open market forces must then apply.

“We hope KordaMentha will be receptive to people wishing to acquire individual farms instead of all 16.

“I must say that some commentators have become so fixated with the CraFarms they’ve taken on a life of their own, as a supposed rural market barometer.

“Since Natural Dairy announced its plans to buy the former CraFarms in March, there have been around 88 dairy farms sold throughout New Zealand.

“The rural farm market is in fact trade exposed, unlike a residential sector underpinned by Government spending and welfare programmes.

“By comparison, 14 dairy farms sold in the three-months to November 2010 and that was two-thirds less than the number of dairy farms sold in November 2008. This tells me the market is doing its job of self-correction.

“It’s not good or bad, it’s just the market doing what a functioning market does.

“With Natural Dairy, I must say that Federated Farmers was concerned at the unnatural number of board departures in recent months.

“For a company with such a healthy name, ‘health reasons’ have been cited for three departures, including the former chairman and company secretary. Only two weeks ago two more directors went, this time after being pushed but it included the vice-chairman.

“It doesn’t instil much confidence in the board and you have to wonder if the bid is at a dead-end,” Mr Nicolson concluded.

(Updated with comment from Fed Farmers, Greens)

13 Comments

Good. Anyone know how she financed the purchase of the first 4 farms.

Good job this is one of our major industries we don't need idiots like her involved in it to that kind of an extent.

What's up these idiot receivers? why do they still seem to insist it's all sold as one parcel, it's just ridiculous and out pricing most Kiwis, it's no surprise KordaMentha is an aussie company.

Easy earned brownie points for the Government!

I wonder how Rabobank and Westpac are feeling right now having spurned local purchasers on the off chance that a bulk deal to off-shore investors would deliver less losses..

My calculation is that there will have been around $15m of additional losses accrued in trying to sell off shore (assuming that the venture was so highly geared that it can't meet all costs on an annual basis).

Good job I say...

I am not a Green supporter , but I am 100% behind the Government on this one for 2 simple reasons

Firstly , we have allowed too many strategic assets to fall into foreign ownership and now we risk becoming tenants in our own country .

Secondly , the one-sided free trade agreements with China , and other low wage economies have destroyed all manufacturing capacity in New Zealand , having a detremental effect on employment levels in smaller rural towns in New Zealand . Now we not ony dont have these factories , but these folk are on the benefit, or many of these folk now work mowing lawns as "small enterprises "

We need to be a little more hard-nosed in proteting National Interests.

Australia has limits on foreign ownership of land. Foreigners need a dispensation to buy farm land , even if they farm it themselves .

South Africa has onerous laws that restrict foreigners borrowing on the local market to buy any property . You cannot use thinly capitalised companies to buy SA Assets and you cannot raise a Mortgage in SA if you are a foreign purchaser of SA property .

In Germany , companies like Volkswagen have to maintain 75% German ownership, no way any one can buy strategic assets there .

We DO have national interests and its time we protected them and nurtured them for future generations. After the foreign investor had plundered the asset , taken advantage of loose trade policies, they will leave us with run down assets and sitting unemployed ....and he is on the next avaialable fight out of here

Personally I think it's shown that MMP can work well.

If we had FPP the government probably wouldn't have done anything about it, but as soon as they could see other parties getting serious traction on this, they knew that had to get serious about it.

Will Pansy Wong organise something now?

I think that could be the reason that she resigned as an MP. However would she pass the good character test after rorting the MP airfare policy?

It's good to see that the correct decision was made and for the right reasons. It will be interesting to see now whether or not the Editor of the Royal New Zealand Herald, and Bill Ralston, will come out and lambast all involved for being xenophobic racist halfwits and rednecks picking on the Chinese and leading the country to penniless ruin. Which can also be read as the sour grapes of those who got it wrong and who were wrong.

They will just make another bid now but without Wang.

Like Russell Norman said, the legislation needs to be toughened up.

I think it should be changed to prevent massive parcels of land to be bundled up like this and sold together, it guarantees that only very big organizations can afford them.

Is that the way we want our farming industry to go?

KordaMentha in NZ is really Michael Stiassny, used to be Ferrier Hodgson. Selling those farms individually would take forever in the current market, e.g. none of the Rank Group CHH farms have been sold and they have been on the market for a couple of years now. I don't think the Crafer farms are strategic, some of them are on pretty marginal land.

I still don't understand why people object to farms being sold overseas when it is OK to sell profitable businesses, banks, and forests to overseas interests.

With May Wang fronting this bid was it ever really going to go ahead - I don't think so.

SimonP: I stand to be corrected, but I understood that the CHH farms do not have individual titles therefore they need to be sold as one.

The Crafar farms are geographically spread and some of them would make profitable farms with the right management. Some of them however are 'dogs' and always will be. The receivers would be able to realise a sale on the farms on the better country e.g. Reporoa and you would think that some sales would be better than nothing. Some of the others are only going to be good for reverting back to sheep and beef.

Absolutely the right call.. Wang's a total flake. Does nothing for other credible investors, particularly ex China wanting to invest in NZ. AND they should be allowed.. if not welcomed, based on merit. Ralston and Kinght are damaged by association.. but hey, as fee gabbers this is probably a very secondary consideration for them. Westpac and the others deserve all that's coming to them.. ALWAYS fair-weather sailors !!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.