Content supplied by Rabobank

Sentiment remains low among New Zealand farmers, weighed down by a negative outlook among dairy producers.

But a glimmer of optimism looks to be returning to the agricultural sector, with the latest Rabobank Rural Confidence Survey registering a small uptick in farmer confidence.

The survey – while taken in late August and early September during the period when the GlobalDairyTrade auctions had registered two price rises after 10 consecutive falls – showed dairy producers had not yet started to feel optimistic about a price recovery impacting the current season.

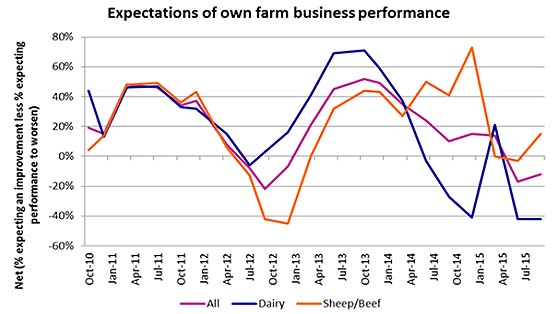

While overall confidence remained downbeat among both dairy farmers and the sector generally – beef and sheep producers did express a more optimistic outlook for the performance of their own farm businesses in the 12 months ahead.

The survey also revealed that over the next two years, more than half of the country's farmers (55 per cent) are looking to change their farm management system – with this figure increasing to 64 per cent in dairy – as current conditions dictate the need for productivity gains.

Overall, the latest Rabobank survey found the majority of New Zealand farmers expected conditions in the rural economy to deteriorate rather than improve, resulting in a negative net confidence reading of -39 per cent, a slight improvement from -45 per cent in the previous survey.

More than half of the country’s farmers (53 per cent) held the view that conditions would worsen over the coming year, however this was down from 56 per cent with that view in the previous survey.

The percentage of farmers expecting an improvement in the agricultural economy increased slightly to 14 per cent, up from 11 per cent, while 32 per cent of surveyed farmers expected similar conditions to the previous 12 months.

While the dairy sector was still languishing, the survey showed sheep and beef farmers, were increasingly positive about their own businesses, with 27 per cent now having an optimistic outlook for their business performance in the 12 months ahead, up from the 22 per cent with that view last quarter. Just 12 per cent of sheep and beef producers surveyed expected business performance to worsen, down from 25 per cent previously.

Rabobank General Manager Country Banking New Zealand Hayley Moynihan said beef and sheep farmers posted a large increase in the intended level of their investment, with 90 per cent looking to either increase (18 per cent) or maintain (72 per cent) their on-farm investment.

“Increased confidence in this sector is largely attributable to the strong upswing in beef prices, with bull beef prices around 33 per cent higher than what was reached this time last year,” she said.

Ms Moynihan said the latest survey continued to reflect the two consecutive seasons of low dairy prices that were weighing not only on sentiment in the dairy industry, but right across the wider New Zealand economy.

“With dairy representing nearly 30 per cent of the value of all New Zealand exports, the farmgate milk price is not only having a huge impact on export revenue, but on the wider economy as farmers reduce their spending,” she said. This situation had profoundly impacted dairy sector sentiment Ms Moynihan said, despite some buffering from lower interest rates and the weaker New Zealand dollar.

Dairy sector confidence would, however, be expected to further improve, she said, off the back of this week’s additional large jump (of 16.5 per cent) in the GDT index.

“The increase in the GDT price index is warmly welcomed by dairy producers, and is more representative of current global market fundamentals following the over-correction” Ms Moynihan said. “However, there is still a way yet to go until we see prices returning towards a more sustainable level.”

She said this concurred with Rabobank’s view that a significant recovery in dairy prices was expected to be underway by mid-2016.

Ms Moynihan said a drop in New Zealand milk production would be one of the key drivers to lead to a supply adjustment in global export markets that would trigger longer-term price recovery. And the survey supported anecdotal reports that total New Zealand milk production could be down by between five and 10 per cent this season, finding 36 per cent of dairy farmers were expecting their production to fall in the 2015/16 season.

“This is largely reflective of a decrease in herd numbers or a lower reliance on feed inputs, with 71 per cent of dairy farmers expecting their management system to become less intensive over the next two years,” she said.

Also indicating resilience in the dairy sector, Ms Moynihan said, the survey showed 51 per cent of dairy farmers were expecting their working capital requirements to decrease over the 2015/16 season, while a further 26 per cent were expecting them to stay the same.

"This is again reflective of how farmers are coping with the current conditions" Ms Moynihan said, "and how they are reining in expenses and investment to 'ride out the storm'."

Across all agricultural industries, commodity prices remained the key factor subduing sentiment this quarter, with 79 per cent of surveyed farmers expecting conditions in the agricultural economy to worsen on the back of prices – similar to last quarter’s reading of 78 per cent. Meanwhile seasonal conditions were only deemed a negative factor by six per cent of respondents, however beef and sheep farmers were particularly anxious about the season – nominated by 14 per cent of farmers in that sector.

“The strengthening El Nino weather pattern is being carefully monitored by drystock farmers, as they hope their feed availability is not diminished over summer,” Ms Moynihan said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.