Content supplied by Rabobank*

Average farmgate milk prices in China in mid-September hovered around CNY 3.43/kg. This was down from CNY 3.54/kg (-3) at the beginning of 2017. However. with the renminbi appreciating against the US dollar (by 5.6% YTD), average milk prices in US dollar terms have increased by 2.2% to USD 0.53/kg.

Milk prices for large farms have also started to recover. Heat stress from a hot summer has impacted production volumes leading to shorter supply. However, for the large farms surveyed, average milk prices still remain 6% below levels of a year ago.

Latest milk production data from the provinces of Inner Mongolia, Hebei, and Henan - which account for 43% of national production - indicates a 0.4% drop in China's total milk production. The decline is attributable to continuous farm exits by small- to medium-sized operators due to a lack of profitability. Rabobank has subsequently revised down milk production expectations for 1H 2017 - to flat growth (previously 1.0%).

Rabobank has also revised down the 2H 2017 production forecast to 0.5% (previously 1.5%) due to lingering impacts of the very hot summer. Overall, this leads to a full-year production forecast on 0.2% for 2017, down from the 1.2% previously forecast. Looking ahead to 2018, Rabobank maintains a forecast of 1.5% growth in milk production in 2018.

Financial performance announcements by listed Chinese processors indicate better-than-expected revenue growth - a proxy for consumption growth.

While 1H 2017 reports confirmed a continuing trend of product mix premiumisation as consumers trade up to higher value products, the top two players also promoted heavily during the period, partially offsetting the price impact of premiumisation. Based on Rabobank analysis, this implies that 1H 2017 volume growth rose above 5% for the top two players, up from low single-digit rates in the recent past. However, the strong result was also supported by expanding market share. Nevertheless, 1H 2017 consumption growth was stronger than expected and a key contributor to a better balance in the Chinese market.

Rabobank estimated consumption to grow 2% YOY in 1H 2017. However, further upside to consumption expectations is limited given the ability for local dairy companies to continue heavy promotion. Rising costs of goods sold an higher packaging costs are key impediments and, as such, Rabobank is maintaining consumption growth of 1% in 2H 2017 and 1.5% growth in 2018.

Participants in the Chinese infant milk formula (IMF) market are finally receiving some clarity, with the Chinese government steadily announcing approved brands and formulas since the start of August. Distributors have been maintaining low inventory levels to mitigate risk from the pending product registration, but approval announcements will trigger a restocking of successful brands.

Chinese dairy import volumes have been very strong in recent months. June an July import volumes surged by 45% and 34%, respectively. This brings year-to-date volumes 13% higher and this trend is expected to continue for the remainder of 2017.

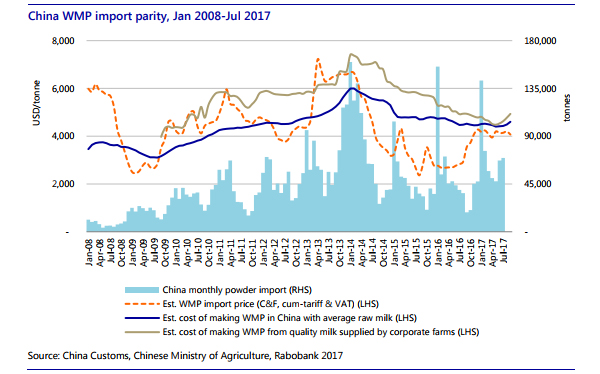

Base on Rabobank's WMP parity analysis, the discount of the Oceania product price is widening again, now at 12% to the domestic average milk price and 18% to the corporate farm milk price, as domestic milk prices respond to some tightening in production and a much stronger renminbi.

Rabobank has maintained its forecast for import volumes in 2H 2017 to grow by 35% YOY. This is due to a combination of a weaker milk production forecast and consumption expectations. Rabobank also anticipates inventory levels to fall further (with one month of inventory to be carried into 2018). This is in contrast to the recent highs when inventory carry averaged 2.2 months of usage,

For 2018, production growth will accelerate slightly - assuming normal weather and some yield improvement - making the Chinese market more balanced in 2017, requiring only 7% import growth.

This story is an extract from the RaboResearch Dairy Quarterly Q3 2017, September 2017.

5 Comments

Chinese propagandists are using pseudo-scientific testing to undermine consumers' confidence in foreign infant formula.

http://dimsums.blogspot.co.nz/2017/09/chinas-attack-on-imported-infant-…

Andrewj, I think this has a parallel in a link that I've posted before regarding a Chinese ratings agency called Dagong, and its rating of Chinese debt as on average much higher than overseas debt (http://www.baldingsworld.com/2014/04/01/credit-ratings-in-china-and-the…). It's about protection of Chinese businesses over international ones, and although the methods are unscientific and flawed, in a way you can't help but feel a little admiration for the economic nationalism, a China-first strategy, at work here.

Have I got this right: China's farmgate price is NZ$0.21 and our farmgate price is NZ$6.75. Doesn't sound like a good market for NZ to me. Perhaps that's why they're buying NZ farms: to bypass our labour costs and Fonterra getting what they see as milk at a reasonable price.

Slight correction: 0.21 is the exchange rate with the NZ$. Their farm gate price is a paltry NZ$0.73.

You are getting confused between the price of millk and the price of milksolids (fat plus protein). In NZ our pricing is based on a term called 'milksolids' which is actually the fat plus protein but not inclduing other solids.

The Chinese milk will typically have about 6.5% -7% milksolids (fat plus protein), and so the farm gate price equates to about $NZ10 to $11 per kg MS - considerably more than NZ farmers get. Their costs are also high.

NZ milksolids are typically about 8% to 9% of the liquid milk, depending on breed and stage of lactation. So on a per litre basis, NZ farmers get paid about 55c per litre for their mlik.

This comparison I have provided is actually a simplification, as payment systems are complex, but it captures the broad picture of the comparison; i.e., on an exchange-rate basis farm gate prices are higher in China than NZ, and have been for a long time.

Keith W

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.