At Wharf Gate (AWG) prices for unpruned sawlogs delivered to ports around New Zealand in October increased by $6 to $7 per JASm3 depending upon location, log grade, and log length. The lower grade KIS logs increased by up to $11 per JASm3. The AWG prices for pruned logs increased by about $10/JASm3.

These increases were predominantly due to an increase in the CFR selling price of on average 3-4 USD per JASm3. The depreciation of the NZ dollar against the USD added about 1 NZD to the AWG prices.

Ocean freight costs were consistent although recent increases of up to 2 USD per JASm3 will likely impact November AWG prices. Ocean freight costs and exchange rates will likely have the biggest impact on AWG prices over the next couple of months.

There is very little change in domestic demand for both logs and sawn timber. Log prices for Quarter 4 are mostly unchanged. When the export log prices dropped substantially in August, log buyers were anticipating lower log prices in Quarter 4. However, the swift rebound in export log prices and relatively positive market meant this didn’t happen.

Domestic sales of all sawn timber grades are steady and - apart from structural timber - slightly above last year’s levels. Export sales are also virtually unchanged from last month.

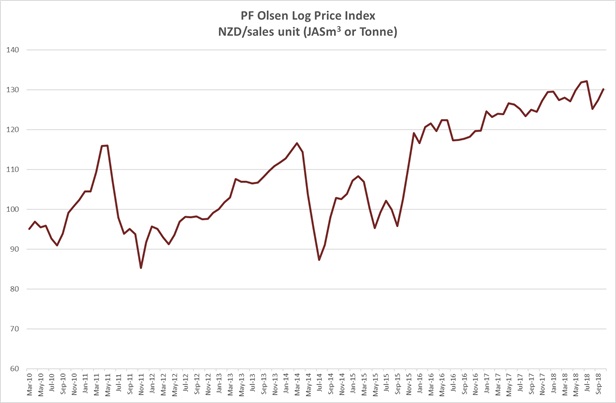

Due to the increase in AWG sale prices the PF Olsen Log Price Index increased $3 to $130 for October. The index is currently $4 above the two-year average, $6 above the three-year average, and $15 higher than the five-year average.

Domestic Log Market

Log Supply and Pricing

There has been very little movement in log prices for Quarter 4 supply agreements. Many mills report plenty of logs as some export supply has switched to domestic supply. There wasn’t the usual reduction in supply through winter this year. It appears many of the smaller forest owners are now investing in sufficient engineering infrastructure to ensure year round harvesting. This is a function of improved economic returns from harvesting, and forest owners realising they need good infrastructure to attract harvesting crews.

Sawn Timber Demand

All mills report steady demand for their product. Many mills have indicated they will increase production in October and November to build stocks for the Christmas break when mills shut and hopefully experience the usual pre-Christmas rush from New Zealanders to finish their DIY construction jobs.

There is also very little change in export markets for New Zealand sawn timber. This demand generally mirrors log demand and pricing, although mills report that sawn timber prices to Asia that also dropped when log prices dropped, have yet to rebound. If the export log price recovery continues then there should be increases in sawn timber prices.

Export Log Markets

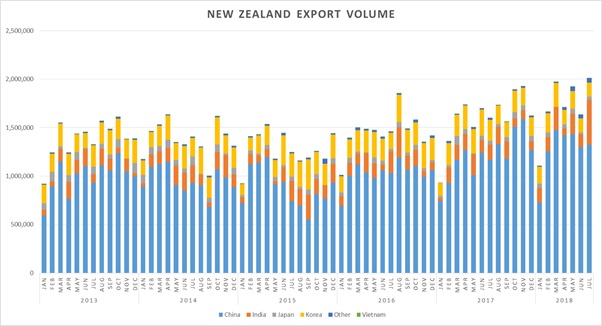

Log exports from New Zealand reached a monthly high of 2 million m3 in July. This high winter export volume also matches what we hear from domestic mills about good log supply through winter.

Courtesy: Pacific Forest Products (PFP)

China

The increase in price for pruned logs is not because of any fundamental improvement in the pruned market. With the cooling of temperatures in China there is less sap-stain colouring the logs. The CFR prices for non-pruned logs increased on average 3-4 USD.

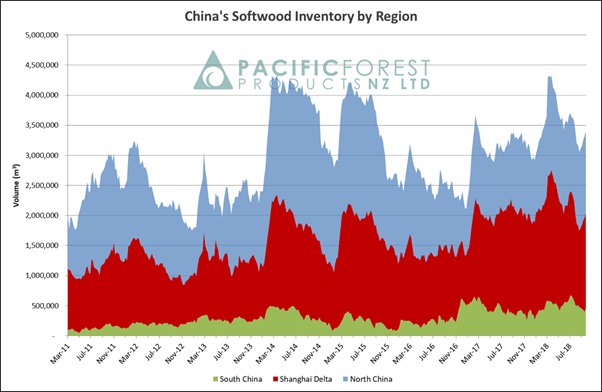

Total softwood logs stocks in China has risen to about 3.4 million m3. Demand is slightly subdued and daily port off-take has reduced to around 70,000 m3/day. This increase in inventory is not of immediate concern. It is likely that log stocks in China will also increase over the ‘Golden Week’ holiday period in early October. The inventory by region is displayed in the chart below.

Courtesy: Pacific Forest Products (PFP)

Supply from both South America and the US has reduced significantly. New Zealand log exporters however, are unsure of the actual quantities as China’s General Administration of Customs has stopped releasing data. Officially they are ‘updating software’, but they may not want to share this information with the trade war ongoing.

The increased CFR prices in China are unlikely to see an increase in supply from these regions. The US housing market is strong with August housing starts up 9.4% year on year. There had been some concerns when housing starts dropped to a nine-month low in June, but housing starts increased in July. The monthly data is volatile though due to a shortage of housing supply and the lack of available land and labour. (Sounds similar to New Zealand). The US volume also faces tariffs and phytosanitary delays mentioned in the last two monthly reports.

The South America supply will face increased ocean freight costs as the harvest of the winter cereal has started. While summer grain yields had been down in some parts of South America due to drought (Uruguay 2018 cereal production 20% below average), recent conditions have improved. This demand for ocean freight capacity will impact significantly upon the availability of bulk vessels for logs from South America.

India

The Indian log market is slowly adjusting to a new exchange rate of Rs 73 to 1 USD.

Two of the main New Zealand log exporters to India decided to not ship logs for October and this will help deplete unsold inventory. However, some of the more determined NZ exporters continue to ship without respite, putting immense LC pressure on the buyers. Many buyers have had to use third party LC opening agencies to stay afloat in terms of cash flow.

The Indian market for New Zealand logs closely follows the China market dynamics and an increase in the log price in China in should lift the morale of importers and spur renewed activity. Log exporters feel a turnaround in demand and pricing should occur in Dec/Jan. However, this is contingent on stability of the INR against the USD, and no more surprises on the trade war situation between China and USA.

The NZ pine inventory in Kandla sawmills is not very high (20-25 days stock) but there are recent arrivals of NZ cargo being discharged in the port where sales have been agreed, but LCs not received. Furthermore, there is more than 30,000 JAS m3 unsold stock being moved into the custom bonded area in Port of Kandla. This will be cleared from Custom Bonded Zone only when LCs are received.

Though sales of NZ Pine Lumber continue in Kandla at Rs481/CFT, there is a broad consensus to increase the sales price by Rs20/CFT. We expect this to happen over the next 1-2 weeks. New Zealand pine sawn timber prices in South India are expected to move up to Rs510/CFT+ levels. Increased fuel prices have adversely affected cartage cost from mills to customers.

Tuticorin had a stock shortage situation but that prompted two vessels to be shipped from NZ at different price points. These should provide enough stock to keep the South market well supplied until December.

Indian Banks continue with a generally cautious approach and LCs in USD are hard to obtain across different import categories in the country. The merger of Bank of Baroda, Vijaya Bank and Dena Bank- to cover up large quantum of Non-Performing Assets (NPAs or bad debts)- has not changed sentiments for Public Sector Banks. The need for good governance in the Indian banking sector has become paramount.

Exchange rates

The NZD has continued to depreciate against the USD. At the end of September when AWG prices were set for October the NZD was worth 0.66168 USD. This was a significant drop from 0.66662 at the end of August when September AWG prices were set. Over the last 30 days the NZD:USD exchange rate has been in the range 0.66859 to 0.65145.

NZD:USD

The Chinese Yuan (CNY) continued to stabilise against the USD through September. This has provided some confidence to log buyers.

CNY:USD

Ocean Freight

As you can see in the chart below the recent increase in oil price has seen pressure on the bunker price. The general consensus from economists is that oil prices will continue to increase. This will likely see ocean freight cost increase.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

The graph below shows the recent BDI rises. We reported last month that the rises through the New Zealand winter had stabilised and dropped in September.

Source: Lloyds

PF Olsen Log Price Index - October 2018

Due to the increase in AWG sale prices the PF Olsen Log Price Index increased $3 to $130 for October. The index is currently $4 above the two-year average, $6 above the three-year average, and $15 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – October 2018

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Oct-18 | Sep-18 | Aug-18 | Jul-18 | Jun-18 | Oct-18 | Sep-18 | Aug-18 | Jul-18 | Jun-18 | |

| Pruned (P40) | 170-195 | 170-195 | 175-195 | 175-195 | 175-195 | 176 | 176 | 176 | 194 | 195 |

| Structural (S30) | 130 | 130 | 130 | 130 | 128 | |||||

| Structural (S20) | 114 | 114 | 114 | 114 | 112 | |||||

| Export A | 145 | 139 | 136 | 147 | 147 | |||||

| Export K | 138 | 131 | 128 | 140 | 140 | |||||

| Export KI | 130 | 123 | 114 | 132 | 133 | |||||

| Export KIS | 122 | 111 | ||||||||

| Pulp | 50 | 50 | 50 | 50 | 49 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

A longer series of these prices is available here.

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.